3PL Healthcare Logistics

3PL Healthcare Logistics3PL Healthcare Logistics Unlocking Growth Opportunities: Analysis and Forecast 2025-2033

3PL Healthcare Logistics by Type (Transportation, Warehousing, Value Added Services), by Application (Pharmaceutical Manufacturers, Pharmaceutical Distributors, Hospital), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global 3PL Healthcare Logistics market is experiencing robust growth, driven by increasing demand for efficient and reliable pharmaceutical and medical supply chain management. The market's compound annual growth rate (CAGR) of 5% from 2019-2024 suggests a continuously expanding market, projected to reach approximately $150 billion in 2025, based on reasonable estimations considering industry growth trends and existing market size information. Key drivers include the rising prevalence of chronic diseases necessitating extensive medication distribution, the growing e-commerce penetration in healthcare, stringent regulatory compliance requirements, and the increasing adoption of advanced technologies like temperature-controlled transportation and real-time tracking systems. The pharmaceutical manufacturing and distribution segments constitute major portions of market demand. Growth is also spurred by the increasing outsourcing of logistics operations by healthcare providers to reduce costs and improve efficiency, allowing them to focus on core competencies. Geographic expansion and strategic partnerships among 3PL providers and pharmaceutical companies are also contributing factors.

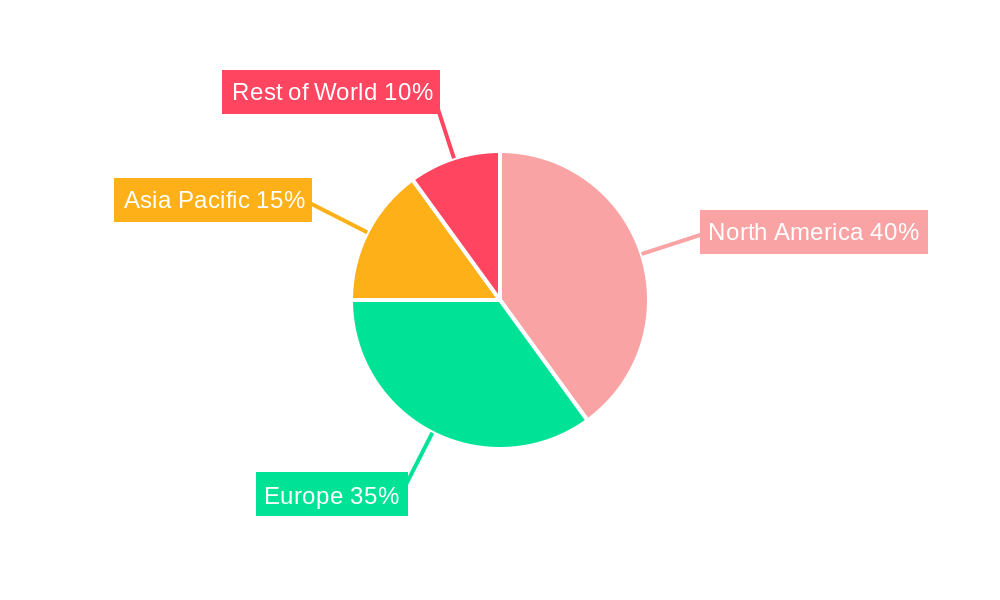

Despite the promising growth trajectory, the market faces challenges. These include maintaining stringent quality control and regulatory compliance across diverse geographical regions, the high investment costs associated with advanced logistics technologies, and the risks associated with temperature-sensitive pharmaceutical products. The market is segmented by type (transportation, warehousing, value-added services) and application (pharmaceutical manufacturers, distributors, hospitals). Major players include DHL, Kuehne + Nagel, Nippon Express, DB Schenker, and others, engaging in intense competition to offer superior services, optimized technology, and global reach. Regional variations exist, with North America and Europe currently holding significant market shares, while Asia-Pacific is expected to show substantial growth fueled by rising healthcare spending and infrastructure development in emerging economies. This competitive landscape necessitates continuous innovation and strategic adaptation to maintain a leading position in this dynamic sector.

3PL Healthcare Logistics Trends

The global 3PL healthcare logistics market is experiencing robust growth, driven by the increasing complexity of healthcare supply chains and the rising demand for efficient and reliable logistics solutions. The market size, valued at XXX million units in 2025, is projected to reach XXX million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X% during the forecast period (2025-2033). This growth is fueled by several key factors, including the expanding pharmaceutical and biotechnology industries, the growing adoption of temperature-sensitive drug shipments, and the increasing need for specialized warehousing and transportation solutions to maintain product integrity and patient safety. The historical period (2019-2024) showed a steady increase in market size, laying a strong foundation for the projected future growth. Key market insights reveal a significant shift towards integrated logistics solutions, with 3PL providers offering a comprehensive suite of services encompassing transportation, warehousing, and value-added services tailored to the specific needs of pharmaceutical manufacturers, distributors, and hospitals. This trend is further amplified by the increasing adoption of advanced technologies such as blockchain, AI, and IoT, enhancing transparency, traceability, and efficiency across the supply chain. The market is also witnessing a rise in demand for specialized services like cold chain logistics and reverse logistics, catering to the unique requirements of handling temperature-sensitive pharmaceuticals and managing returns or recalls effectively. This comprehensive approach to healthcare logistics is critical for maintaining product quality, ensuring regulatory compliance, and ultimately, improving patient outcomes. The competitive landscape is marked by the presence of both large multinational 3PL providers and specialized niche players, leading to continuous innovation and service enhancement within the sector.

Driving Forces: What's Propelling the 3PL Healthcare Logistics Market?

Several key factors are propelling the growth of the 3PL healthcare logistics market. The increasing globalization of healthcare supply chains necessitates efficient and reliable logistics partners capable of navigating complex international regulations and managing diverse transportation modes. The stringent regulatory requirements surrounding the handling and transportation of pharmaceuticals, including stringent temperature control and traceability mandates, are driving the demand for specialized 3PL providers with expertise in compliance and risk management. The rising prevalence of chronic diseases and the consequent increase in demand for pharmaceutical products are further fueling the market's expansion. Simultaneously, technological advancements are playing a critical role, with innovations in cold chain technologies, tracking systems, and data analytics enhancing efficiency, visibility, and security throughout the supply chain. The growing adoption of e-commerce in healthcare, with online pharmacies and direct-to-patient delivery models becoming more prevalent, is creating new opportunities for 3PL providers to offer customized solutions. Finally, the increasing focus on cost optimization and supply chain resilience within the healthcare sector is compelling organizations to outsource their logistics operations to specialized 3PL providers who can offer economies of scale and expertise in managing risk and disruptions.

Challenges and Restraints in 3PL Healthcare Logistics

Despite the significant growth potential, the 3PL healthcare logistics market faces several challenges and restraints. Maintaining strict temperature control and ensuring product integrity during transportation and storage presents a significant hurdle, requiring specialized equipment and rigorous monitoring systems. The complex regulatory landscape varies across different countries and jurisdictions, requiring 3PL providers to maintain a high level of compliance expertise and adapt to changing regulations. Securing and managing sensitive patient data throughout the supply chain necessitates robust security measures and compliance with data privacy regulations. Capacity constraints and the availability of skilled labor, especially in specialized areas like cold chain logistics, can hinder the growth of the market. Furthermore, managing the inherent risks associated with pharmaceutical transportation, such as product damage, theft, and counterfeiting, requires significant investment in security and risk management strategies. Lastly, the need for continuous investment in advanced technologies and infrastructure to maintain competitiveness and meet evolving customer demands represents a significant ongoing challenge for 3PL providers in this sector.

Key Region or Country & Segment to Dominate the Market

The North American and European regions are currently dominating the 3PL healthcare logistics market, driven by the high concentration of pharmaceutical manufacturers, distributors, and hospitals in these regions. However, the Asia-Pacific region is experiencing rapid growth, fueled by increasing healthcare expenditure and the expansion of the pharmaceutical and biotechnology industries. Within the segments, pharmaceutical manufacturers represent a significant portion of the market due to their large-scale production and distribution needs. This segment is expected to maintain its dominance due to the increasing demand for innovative pharmaceuticals and biologics.

- North America: Strong regulatory frameworks and high healthcare spending drive market demand.

- Europe: A well-established pharmaceutical industry and robust infrastructure contribute to market leadership.

- Asia-Pacific: Rapid economic growth and increasing healthcare expenditure fuel significant growth potential.

- Pharmaceutical Manufacturers: High volume of shipments and specialized needs make this a dominant application segment.

- Transportation Segment: This segment holds a significant share, requiring specialized fleets for temperature-sensitive goods.

- Warehousing Segment: The need for specialized storage facilities, including cold storage and secure warehousing, fuels substantial market growth.

- Value-Added Services: This segment is growing rapidly as pharmaceutical companies increasingly seek services such as kitting, labeling, and packaging to enhance supply chain efficiency.

The pharmaceutical manufacturers segment is expected to remain a key driver of market growth due to their substantial logistics needs. The transportation segment will likely continue to dominate owing to the large volume of pharmaceutical shipments requiring specialized handling and temperature control. However, the value-added services segment exhibits strong growth potential as pharmaceutical companies increasingly outsource tasks such as labeling, packaging, and kitting to enhance efficiency and reduce costs.

Growth Catalysts in 3PL Healthcare Logistics Industry

Several factors will continue to drive growth in the 3PL healthcare logistics industry. Technological advancements like blockchain for enhanced traceability and AI-powered predictive analytics will optimize supply chain efficiency and reduce risks. The increasing demand for personalized medicine and the resulting need for specialized logistics solutions will create new opportunities. Furthermore, the rise of direct-to-patient delivery models will drive further growth in the market. A greater focus on sustainability and environmentally friendly logistics practices will also impact the industry, encouraging the adoption of green technologies and practices.

Leading Players in the 3PL Healthcare Logistics Market

- DHL Supply Chain & Global Forwarding

- Kuehne + Nagel

- Nippon Express

- DB Schenker Logistics

- C.H. Robinson Worldwide

- DSV Panalpina

- Sinotrans

- XPO Logistics

- UPS Supply Chain Solutions

- J.B. Hunt (JBI, DCS & ICS)

- Expeditors International of Washington

- CEVA Logistics

- Hitachi Transport System

- Dachser

- GEODIS

- Toll Group

Significant Developments in 3PL Healthcare Logistics Sector

- 2020: Increased adoption of digital technologies for enhanced traceability and visibility in cold chain logistics.

- 2021: Several major 3PL providers invested heavily in expanding their cold chain infrastructure to meet growing demand.

- 2022: Focus shifted towards sustainable and environmentally friendly logistics solutions to reduce carbon footprint.

- 2023: Growth in demand for specialized services such as reverse logistics and last-mile delivery.

- 2024: Increased collaboration between 3PL providers and pharmaceutical companies to optimize supply chain efficiency.

Comprehensive Coverage 3PL Healthcare Logistics Report

This report provides a comprehensive analysis of the 3PL healthcare logistics market, covering market trends, driving forces, challenges, key players, and future growth prospects. It offers valuable insights for stakeholders across the healthcare and logistics industries, enabling informed decision-making and strategic planning. The report's detailed segmentation and regional analysis allows for a granular understanding of market dynamics, while the forecast to 2033 provides a long-term perspective on the market's future trajectory. It's a vital resource for companies seeking to understand and navigate the complexities of the ever-evolving 3PL healthcare logistics landscape.

3PL Healthcare Logistics Segmentation

-

1. Type

- 1.1. Transportation

- 1.2. Warehousing

- 1.3. Value Added Services

-

2. Application

- 2.1. Pharmaceutical Manufacturers

- 2.2. Pharmaceutical Distributors

- 2.3. Hospital

3PL Healthcare Logistics Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

3PL Healthcare Logistics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3PL Healthcare Logistics Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Transportation

- 5.1.2. Warehousing

- 5.1.3. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Manufacturers

- 5.2.2. Pharmaceutical Distributors

- 5.2.3. Hospital

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America 3PL Healthcare Logistics Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Transportation

- 6.1.2. Warehousing

- 6.1.3. Value Added Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Pharmaceutical Manufacturers

- 6.2.2. Pharmaceutical Distributors

- 6.2.3. Hospital

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America 3PL Healthcare Logistics Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Transportation

- 7.1.2. Warehousing

- 7.1.3. Value Added Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Pharmaceutical Manufacturers

- 7.2.2. Pharmaceutical Distributors

- 7.2.3. Hospital

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe 3PL Healthcare Logistics Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Transportation

- 8.1.2. Warehousing

- 8.1.3. Value Added Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Pharmaceutical Manufacturers

- 8.2.2. Pharmaceutical Distributors

- 8.2.3. Hospital

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa 3PL Healthcare Logistics Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Transportation

- 9.1.2. Warehousing

- 9.1.3. Value Added Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Pharmaceutical Manufacturers

- 9.2.2. Pharmaceutical Distributors

- 9.2.3. Hospital

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific 3PL Healthcare Logistics Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Transportation

- 10.1.2. Warehousing

- 10.1.3. Value Added Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Pharmaceutical Manufacturers

- 10.2.2. Pharmaceutical Distributors

- 10.2.3. Hospital

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DHL Supply Chain & Global Forwarding

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kuehne + Nagel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nippon Express

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DB Schenker Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 C.H. Robinson Worldwide

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DSV Panalpina

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sinotrans

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 XPO Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 UPS Supply Chain Solutions

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 J.B. Hunt (JBI DCS & ICS)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Expeditors International of Washington

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CEVA Logistics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hitachi Transport System

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Dachser

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 GEODIS

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Toll Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 DHL Supply Chain & Global Forwarding

- Figure 1: Global 3PL Healthcare Logistics Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America 3PL Healthcare Logistics Revenue (million), by Type 2024 & 2032

- Figure 3: North America 3PL Healthcare Logistics Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America 3PL Healthcare Logistics Revenue (million), by Application 2024 & 2032

- Figure 5: North America 3PL Healthcare Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America 3PL Healthcare Logistics Revenue (million), by Country 2024 & 2032

- Figure 7: North America 3PL Healthcare Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America 3PL Healthcare Logistics Revenue (million), by Type 2024 & 2032

- Figure 9: South America 3PL Healthcare Logistics Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America 3PL Healthcare Logistics Revenue (million), by Application 2024 & 2032

- Figure 11: South America 3PL Healthcare Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America 3PL Healthcare Logistics Revenue (million), by Country 2024 & 2032

- Figure 13: South America 3PL Healthcare Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe 3PL Healthcare Logistics Revenue (million), by Type 2024 & 2032

- Figure 15: Europe 3PL Healthcare Logistics Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe 3PL Healthcare Logistics Revenue (million), by Application 2024 & 2032

- Figure 17: Europe 3PL Healthcare Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe 3PL Healthcare Logistics Revenue (million), by Country 2024 & 2032

- Figure 19: Europe 3PL Healthcare Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa 3PL Healthcare Logistics Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa 3PL Healthcare Logistics Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa 3PL Healthcare Logistics Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa 3PL Healthcare Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa 3PL Healthcare Logistics Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa 3PL Healthcare Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific 3PL Healthcare Logistics Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific 3PL Healthcare Logistics Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific 3PL Healthcare Logistics Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific 3PL Healthcare Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific 3PL Healthcare Logistics Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific 3PL Healthcare Logistics Revenue Share (%), by Country 2024 & 2032

- Table 1: Global 3PL Healthcare Logistics Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global 3PL Healthcare Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global 3PL Healthcare Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global 3PL Healthcare Logistics Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global 3PL Healthcare Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global 3PL Healthcare Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global 3PL Healthcare Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global 3PL Healthcare Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global 3PL Healthcare Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global 3PL Healthcare Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global 3PL Healthcare Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global 3PL Healthcare Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global 3PL Healthcare Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global 3PL Healthcare Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global 3PL Healthcare Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global 3PL Healthcare Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global 3PL Healthcare Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global 3PL Healthcare Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global 3PL Healthcare Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 41: China 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific 3PL Healthcare Logistics Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.