4D Imaging Radar for Autonomous Driving

4D Imaging Radar for Autonomous Driving4D Imaging Radar for Autonomous Driving Analysis Report 2025: Market to Grow by a CAGR of XX to 2033, Driven by Government Incentives, Popularity of Virtual Assistants, and Strategic Partnerships

4D Imaging Radar for Autonomous Driving by Type (Less Than 100 Meters, 100-500 Meters, More Than 500 Meters), by Application (L1/L2+ Driving Automation, L3 Driving Automation, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

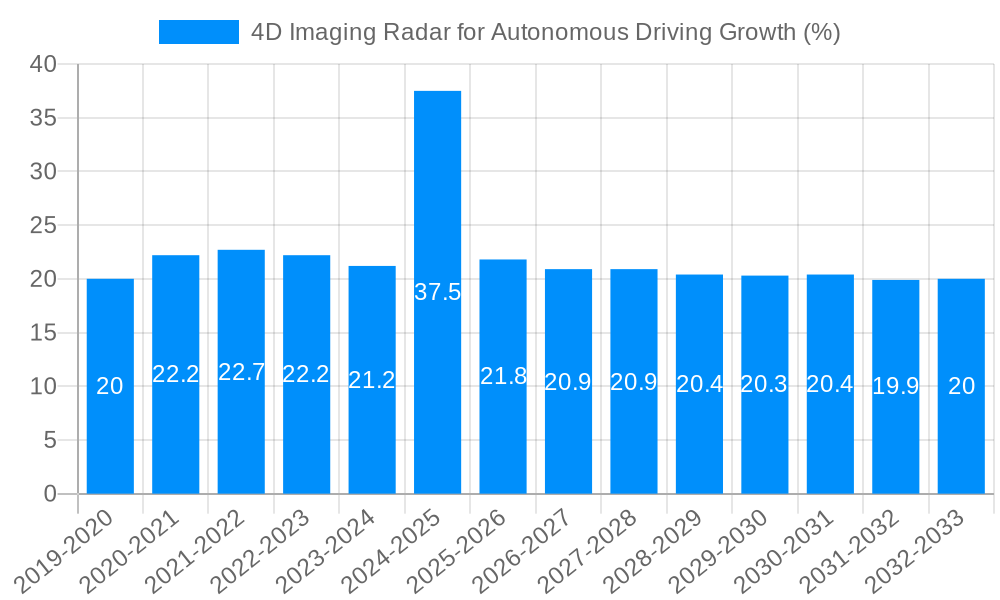

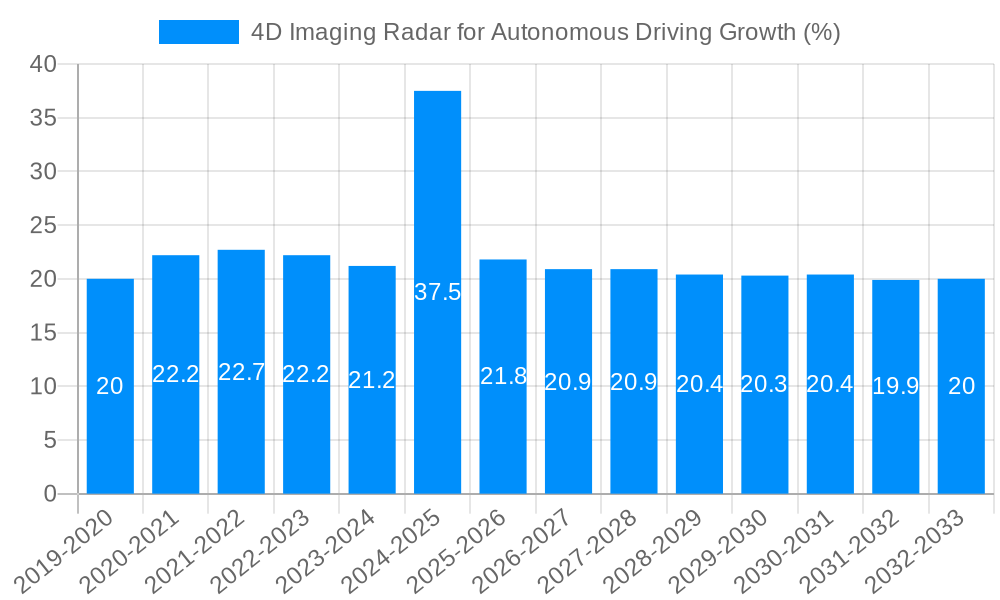

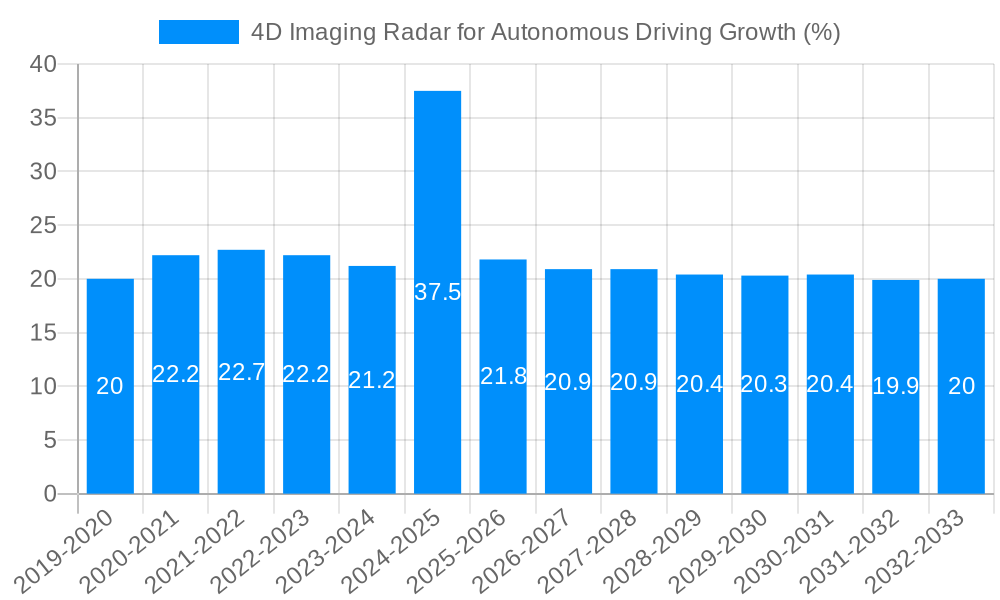

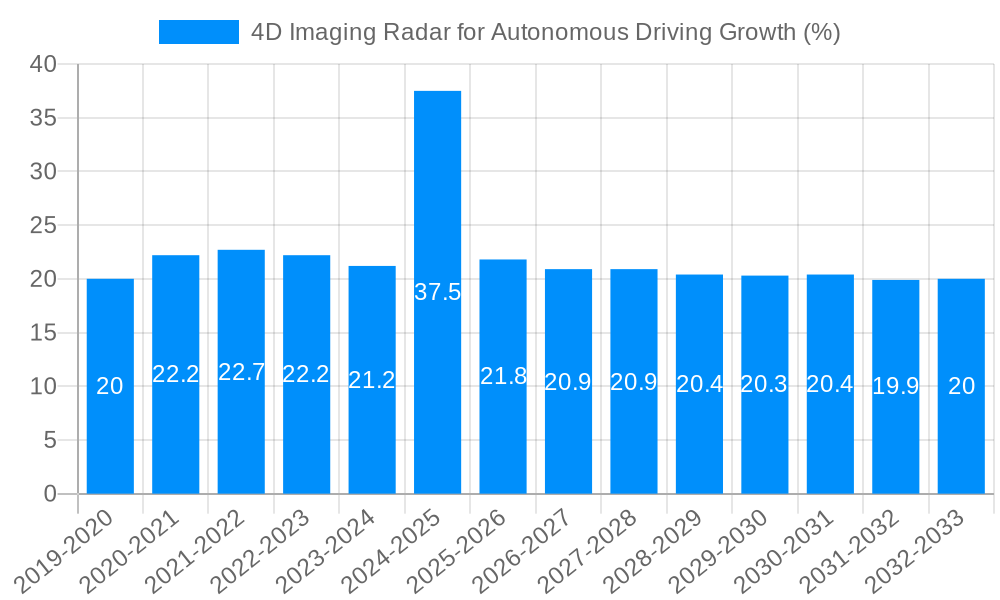

The 4D Imaging Radar market for autonomous driving is experiencing rapid growth, driven by the increasing demand for safer and more efficient autonomous vehicles. The market, currently valued at approximately $2 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 25% from 2025 to 2033, reaching an estimated $15 billion by 2033. This significant expansion is fueled by several key factors. Advancements in sensor technology are leading to improved accuracy and range, enabling more reliable object detection and classification in challenging conditions like low light or inclement weather. Furthermore, the rising adoption of higher levels of autonomous driving (L3 and beyond) necessitates more sophisticated sensor fusion systems, where 4D imaging radar plays a crucial role in providing comprehensive environmental awareness. The market is segmented by range (less than 100 meters, 100-500 meters, more than 500 meters) and application (L1/L2+ driving automation, L3 driving automation, other), reflecting the diverse needs of the autonomous driving ecosystem. North America and Europe currently hold the largest market shares, driven by robust technological advancements and early adoption of autonomous vehicle technologies. However, the Asia-Pacific region is anticipated to witness significant growth in the coming years due to increasing investments in infrastructure and the growing popularity of electric vehicles.

Despite its promising prospects, the market faces certain challenges. High initial investment costs for 4D imaging radar systems can hinder adoption, especially for smaller companies. Furthermore, the development of robust data processing and fusion algorithms remains a crucial area of development, requiring further research and development investments. Competition among established automotive suppliers and emerging technology companies is also intensifying, shaping the competitive landscape. However, the long-term benefits of enhanced safety and efficiency for autonomous driving are expected to outweigh these challenges, driving further market penetration. The key players in this space, including Continental AG, Arbe Robotics, and Bosch, are continuously innovating to enhance the performance, affordability, and reliability of their products, fostering further market expansion.

4D Imaging Radar for Autonomous Driving Trends

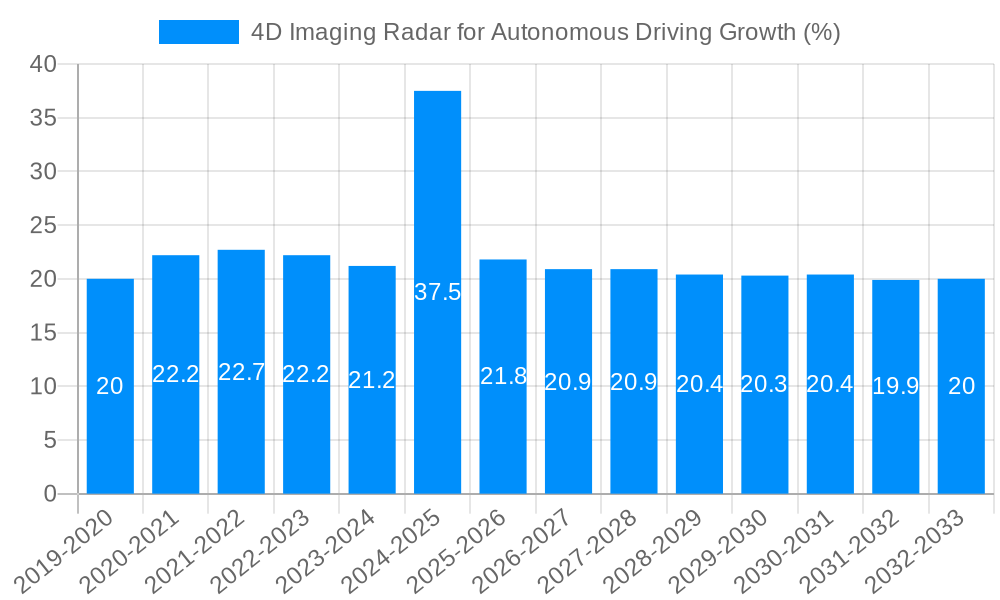

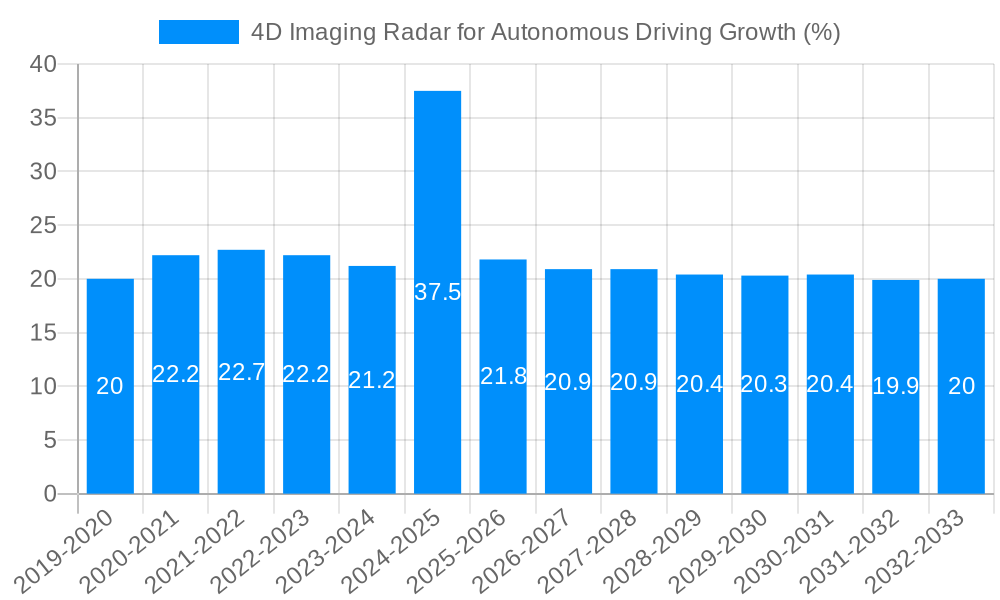

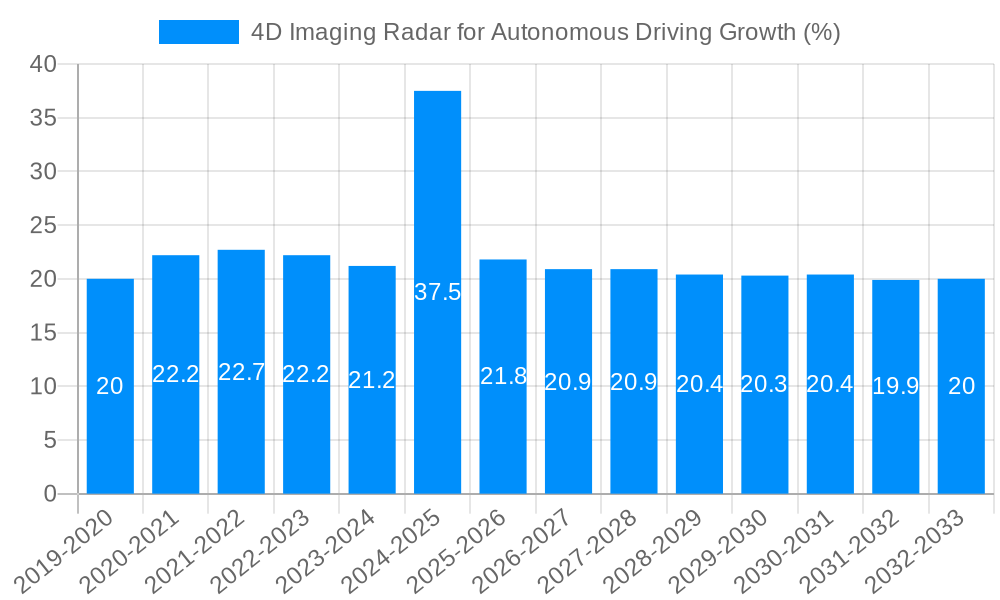

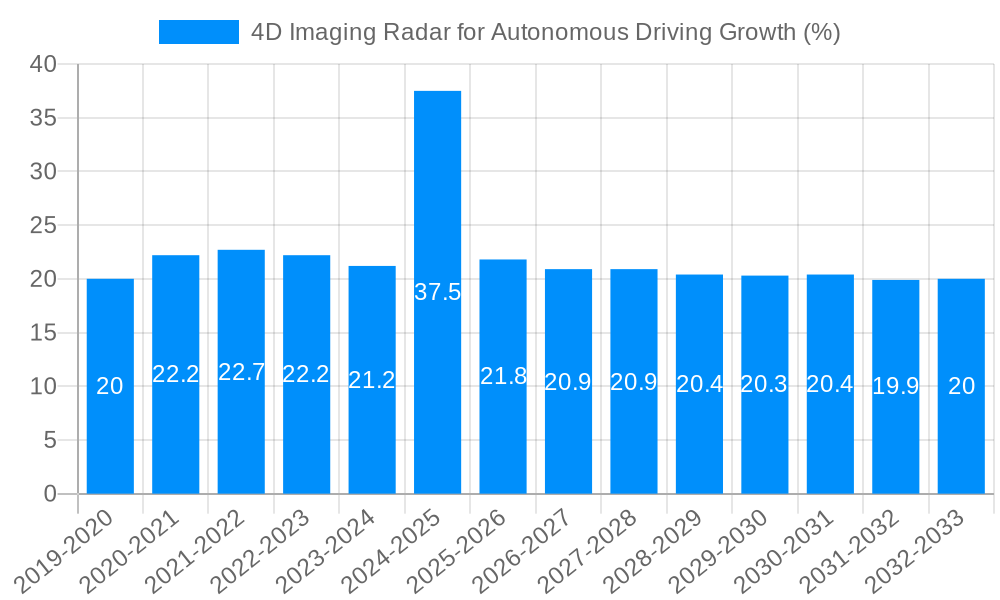

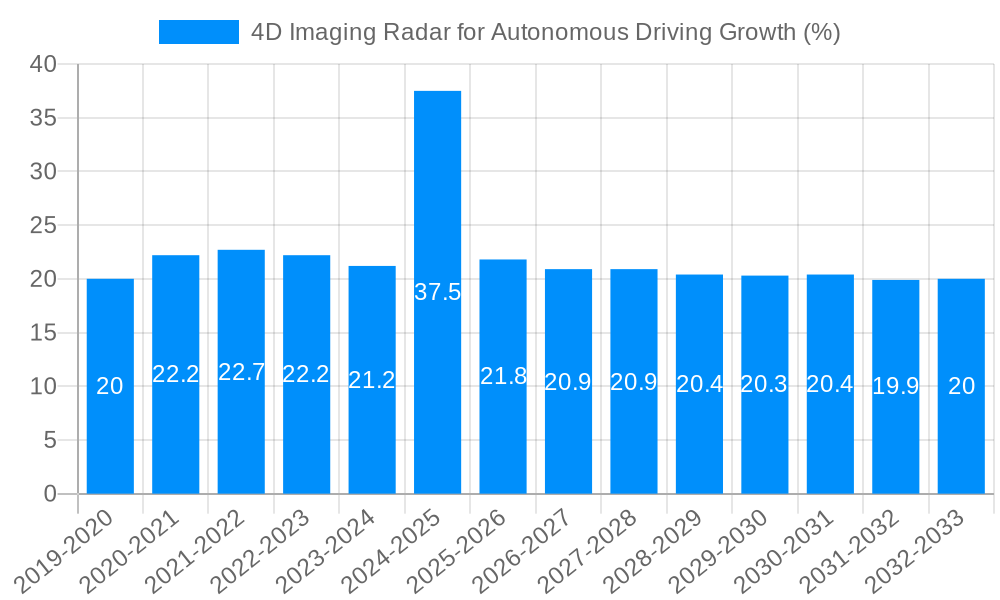

The global 4D imaging radar market for autonomous driving is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Driven by the increasing demand for safer and more efficient autonomous vehicles, the market is witnessing significant technological advancements and intense competition amongst key players. The historical period (2019-2024) showcased a steady rise in adoption, particularly in L1/L2+ automated driving systems. The estimated year (2025) shows a clear inflection point, with a massive surge expected during the forecast period (2025-2033). This expansion is fueled by several factors including improved sensor resolution, wider detection ranges, and decreasing production costs. The market is segmented by detection range (less than 100 meters, 100-500 meters, more than 500 meters) and application (L1/L2+ driving automation, L3 driving automation, other). While shorter-range radars currently hold a larger market share due to widespread adoption in existing ADAS systems, longer-range sensors are poised for significant growth as L3 and higher levels of automation become more prevalent. The integration of 4D imaging radar with other sensor technologies, such as LiDAR and cameras, is also a major trend, improving overall system robustness and reliability. This synergistic approach allows for a more comprehensive understanding of the driving environment, enhancing the safety and performance of autonomous vehicles. The market is characterized by a diverse range of players, from established automotive suppliers to innovative technology startups, each contributing to the rapid evolution of this crucial technology. The overall market size, though currently in the hundreds of millions of units, is projected to reach figures in the billions within the next decade, making it a highly attractive and competitive sector.

Driving Forces: What's Propelling the 4D Imaging Radar for Autonomous Driving

Several key factors are accelerating the adoption of 4D imaging radar in autonomous driving systems. Firstly, the increasing demand for enhanced safety features in vehicles is a primary driver. 4D imaging radar offers superior object detection and classification capabilities compared to traditional radar systems, enabling autonomous vehicles to react more effectively to various scenarios, including adverse weather conditions. Secondly, the continuous advancements in radar technology, including higher resolution, improved range, and enhanced processing power, are making 4D imaging radar more cost-effective and reliable. The decrease in production costs is crucial for widespread adoption in mass-market vehicles. Thirdly, stringent government regulations and safety standards worldwide are pushing automakers to integrate advanced driver-assistance systems (ADAS) and autonomous driving capabilities into their vehicles, directly boosting demand for 4D imaging radar. Furthermore, the growing investment in research and development by both established automotive players and technology startups is accelerating innovation and pushing the boundaries of 4D imaging radar technology. The rising investments are translating into better performance, improved accuracy, and reduced latency in real-world driving scenarios. Finally, the increasing consumer demand for autonomous features and the overall growth in the automotive industry are creating a favorable market environment for 4D imaging radar technology to thrive. These combined factors create a powerful synergy, driving the rapid expansion of the market.

Challenges and Restraints in 4D Imaging Radar for Autonomous Driving

Despite the significant potential of 4D imaging radar, several challenges and restraints hinder its widespread adoption. One major obstacle is the relatively high cost of 4D imaging radar sensors compared to other sensor technologies, such as traditional 2D radar. This price disparity can limit accessibility, especially for lower-cost vehicle segments. Another challenge is the complexity of data processing and algorithm development. Extracting meaningful information from the high-resolution data generated by 4D imaging radar requires sophisticated algorithms and significant computational power, increasing the overall system complexity and cost. Furthermore, the accuracy and reliability of 4D imaging radar can be affected by environmental factors such as heavy rain, fog, and snow. Addressing these challenges necessitates ongoing research and development efforts to improve sensor robustness and develop more efficient data processing techniques. The regulatory landscape surrounding autonomous driving is also evolving rapidly, creating uncertainties for manufacturers and potentially hindering investment. The need for robust safety standards and certification processes adds complexity to the deployment process. Finally, the cybersecurity implications of connected autonomous vehicles are a growing concern, requiring robust security measures to prevent malicious attacks and ensure the integrity of sensor data.

Key Region or Country & Segment to Dominate the Market

The North American and European markets are currently leading the adoption of 4D imaging radar for autonomous driving, driven by stringent safety regulations, supportive government policies, and high consumer demand for advanced automotive features. However, the Asia-Pacific region, particularly China, is expected to witness significant growth in the coming years, fueled by rapid industrialization, a large automotive market, and increasing investment in autonomous vehicle technologies.

Key Segment: L1/L2+ Driving Automation: This segment currently dominates the market due to the widespread adoption of advanced driver-assistance systems (ADAS) in modern vehicles. Features such as adaptive cruise control, lane-keeping assist, and automatic emergency braking are becoming increasingly common, driving demand for shorter-range 4D imaging radars. These systems are comparatively easier to integrate and require less sophisticated processing power, thus reducing the entry barrier for manufacturers.

Geographic Dominance: North America’s early adoption of advanced driving assistance systems (ADAS) and its strong automotive industry provide a firm market foothold. Europe follows closely, driven by regulatory pressures toward enhanced vehicle safety and autonomous capabilities. China’s rapidly growing automotive sector and significant government investment are positioned to make it a major player in the coming decade.

The high initial cost of 4D imaging radar technologies remains a barrier, but its importance in safety and autonomy is pushing the industry towards solutions that reduce these costs through technological improvements and economies of scale. The transition from L1/L2+ to higher automation levels will fuel increasing demand for longer-range 4D imaging radars, leading to more significant market growth in the future. As autonomous driving technology matures, the demand for high-accuracy, long-range sensors will steadily increase, transforming the market landscape.

Growth Catalysts in 4D Imaging Radar for Autonomous Driving Industry

Several factors are accelerating the growth of the 4D imaging radar market for autonomous driving. The most significant is the continuous improvement in sensor technology leading to improved accuracy, range, and resolution at reduced costs. Coupled with this is the increasing demand for advanced driver-assistance systems (ADAS) and autonomous driving features from consumers. Government regulations promoting safer vehicles further accelerate the adoption of this critical technology.

Leading Players in the 4D Imaging Radar for Autonomous Driving

- Continental AG [Continental AG]

- Arbe Robotics [Arbe Robotics]

- Muniu Tech

- WHST

- Smart Radar System

- Aptiv [Aptiv]

- Smartmicro

- ZF Friedrichshafen AG [ZF Friedrichshafen AG]

- CubTEK

- HUAWEI [HUAWEI]

- BOSCH [BOSCH]

- Oculii

Significant Developments in 4D Imaging Radar for Autonomous Driving Sector

- 2020: Several companies announce breakthroughs in 4D imaging radar technology, focusing on improved resolution and detection range.

- 2021: Increased investments in R&D from major automotive players and startups.

- 2022: First mass-production deployments of 4D imaging radar in high-end autonomous vehicles.

- 2023: Growing partnerships between automotive manufacturers and technology providers.

- 2024: Development of new algorithms for enhanced object classification and tracking.

- 2025: Significant reduction in sensor costs due to economies of scale.

Comprehensive Coverage 4D Imaging Radar for Autonomous Driving Report

This report provides a comprehensive analysis of the 4D imaging radar market for autonomous driving, encompassing market size estimations, segment-wise analysis, key player profiles, and future growth projections from 2019 to 2033. The report considers various factors influencing market dynamics, including technological advancements, regulatory changes, and economic conditions. It identifies key growth opportunities and challenges, offering valuable insights for businesses and stakeholders interested in this rapidly expanding market. The in-depth analysis of the competitive landscape and technological developments provides a crucial resource for informed decision-making in this dynamic sector.

4D Imaging Radar for Autonomous Driving Segmentation

-

1. Type

- 1.1. Less Than 100 Meters

- 1.2. 100-500 Meters

- 1.3. More Than 500 Meters

-

2. Application

- 2.1. L1/L2+ Driving Automation

- 2.2. L3 Driving Automation

- 2.3. Other

4D Imaging Radar for Autonomous Driving Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

4D Imaging Radar for Autonomous Driving REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 4D Imaging Radar for Autonomous Driving Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Less Than 100 Meters

- 5.1.2. 100-500 Meters

- 5.1.3. More Than 500 Meters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. L1/L2+ Driving Automation

- 5.2.2. L3 Driving Automation

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America 4D Imaging Radar for Autonomous Driving Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Less Than 100 Meters

- 6.1.2. 100-500 Meters

- 6.1.3. More Than 500 Meters

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. L1/L2+ Driving Automation

- 6.2.2. L3 Driving Automation

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America 4D Imaging Radar for Autonomous Driving Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Less Than 100 Meters

- 7.1.2. 100-500 Meters

- 7.1.3. More Than 500 Meters

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. L1/L2+ Driving Automation

- 7.2.2. L3 Driving Automation

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe 4D Imaging Radar for Autonomous Driving Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Less Than 100 Meters

- 8.1.2. 100-500 Meters

- 8.1.3. More Than 500 Meters

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. L1/L2+ Driving Automation

- 8.2.2. L3 Driving Automation

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa 4D Imaging Radar for Autonomous Driving Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Less Than 100 Meters

- 9.1.2. 100-500 Meters

- 9.1.3. More Than 500 Meters

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. L1/L2+ Driving Automation

- 9.2.2. L3 Driving Automation

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific 4D Imaging Radar for Autonomous Driving Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Less Than 100 Meters

- 10.1.2. 100-500 Meters

- 10.1.3. More Than 500 Meters

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. L1/L2+ Driving Automation

- 10.2.2. L3 Driving Automation

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Continental AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arbe Robotics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Muniu Tech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 WHST

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smart Radar System

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aptiv

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Smartmicro

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ZF Friedrichshafen AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CubTEK

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HUAWEI

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BOSCH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Oculii

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Continental AG

- Figure 1: Global 4D Imaging Radar for Autonomous Driving Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global 4D Imaging Radar for Autonomous Driving Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America 4D Imaging Radar for Autonomous Driving Revenue (million), by Type 2024 & 2032

- Figure 4: North America 4D Imaging Radar for Autonomous Driving Volume (K), by Type 2024 & 2032

- Figure 5: North America 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America 4D Imaging Radar for Autonomous Driving Volume Share (%), by Type 2024 & 2032

- Figure 7: North America 4D Imaging Radar for Autonomous Driving Revenue (million), by Application 2024 & 2032

- Figure 8: North America 4D Imaging Radar for Autonomous Driving Volume (K), by Application 2024 & 2032

- Figure 9: North America 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America 4D Imaging Radar for Autonomous Driving Volume Share (%), by Application 2024 & 2032

- Figure 11: North America 4D Imaging Radar for Autonomous Driving Revenue (million), by Country 2024 & 2032

- Figure 12: North America 4D Imaging Radar for Autonomous Driving Volume (K), by Country 2024 & 2032

- Figure 13: North America 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America 4D Imaging Radar for Autonomous Driving Volume Share (%), by Country 2024 & 2032

- Figure 15: South America 4D Imaging Radar for Autonomous Driving Revenue (million), by Type 2024 & 2032

- Figure 16: South America 4D Imaging Radar for Autonomous Driving Volume (K), by Type 2024 & 2032

- Figure 17: South America 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America 4D Imaging Radar for Autonomous Driving Volume Share (%), by Type 2024 & 2032

- Figure 19: South America 4D Imaging Radar for Autonomous Driving Revenue (million), by Application 2024 & 2032

- Figure 20: South America 4D Imaging Radar for Autonomous Driving Volume (K), by Application 2024 & 2032

- Figure 21: South America 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America 4D Imaging Radar for Autonomous Driving Volume Share (%), by Application 2024 & 2032

- Figure 23: South America 4D Imaging Radar for Autonomous Driving Revenue (million), by Country 2024 & 2032

- Figure 24: South America 4D Imaging Radar for Autonomous Driving Volume (K), by Country 2024 & 2032

- Figure 25: South America 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America 4D Imaging Radar for Autonomous Driving Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe 4D Imaging Radar for Autonomous Driving Revenue (million), by Type 2024 & 2032

- Figure 28: Europe 4D Imaging Radar for Autonomous Driving Volume (K), by Type 2024 & 2032

- Figure 29: Europe 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe 4D Imaging Radar for Autonomous Driving Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe 4D Imaging Radar for Autonomous Driving Revenue (million), by Application 2024 & 2032

- Figure 32: Europe 4D Imaging Radar for Autonomous Driving Volume (K), by Application 2024 & 2032

- Figure 33: Europe 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe 4D Imaging Radar for Autonomous Driving Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe 4D Imaging Radar for Autonomous Driving Revenue (million), by Country 2024 & 2032

- Figure 36: Europe 4D Imaging Radar for Autonomous Driving Volume (K), by Country 2024 & 2032

- Figure 37: Europe 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe 4D Imaging Radar for Autonomous Driving Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa 4D Imaging Radar for Autonomous Driving Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa 4D Imaging Radar for Autonomous Driving Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa 4D Imaging Radar for Autonomous Driving Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa 4D Imaging Radar for Autonomous Driving Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa 4D Imaging Radar for Autonomous Driving Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa 4D Imaging Radar for Autonomous Driving Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa 4D Imaging Radar for Autonomous Driving Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa 4D Imaging Radar for Autonomous Driving Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa 4D Imaging Radar for Autonomous Driving Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific 4D Imaging Radar for Autonomous Driving Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific 4D Imaging Radar for Autonomous Driving Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific 4D Imaging Radar for Autonomous Driving Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific 4D Imaging Radar for Autonomous Driving Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific 4D Imaging Radar for Autonomous Driving Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific 4D Imaging Radar for Autonomous Driving Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific 4D Imaging Radar for Autonomous Driving Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific 4D Imaging Radar for Autonomous Driving Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific 4D Imaging Radar for Autonomous Driving Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific 4D Imaging Radar for Autonomous Driving Volume Share (%), by Country 2024 & 2032

- Table 1: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Region 2019 & 2032

- Table 3: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Type 2019 & 2032

- Table 5: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Application 2019 & 2032

- Table 7: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Region 2019 & 2032

- Table 9: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Type 2019 & 2032

- Table 11: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Application 2019 & 2032

- Table 13: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Country 2019 & 2032

- Table 15: United States 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Type 2019 & 2032

- Table 23: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Application 2019 & 2032

- Table 25: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Type 2019 & 2032

- Table 35: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Application 2019 & 2032

- Table 37: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Type 2019 & 2032

- Table 59: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Application 2019 & 2032

- Table 61: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Type 2019 & 2032

- Table 77: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Application 2019 & 2032

- Table 79: Global 4D Imaging Radar for Autonomous Driving Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global 4D Imaging Radar for Autonomous Driving Volume K Forecast, by Country 2019 & 2032

- Table 81: China 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific 4D Imaging Radar for Autonomous Driving Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific 4D Imaging Radar for Autonomous Driving Volume (K) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.