Air Lost Baggage Claim Service

Air Lost Baggage Claim ServiceAir Lost Baggage Claim Service 2025-2033 Overview: Trends, Competitor Dynamics, and Opportunities

Air Lost Baggage Claim Service by Type (Legal Services, Third-Party Claims Management Company, Others), by Application (Personal, Family), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The air lost baggage claim service market is experiencing robust growth, driven by increasing air travel, stricter airline liability regulations, and a rising demand for convenient and efficient claim processing solutions. The market, estimated at $2 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching an estimated market value of $6 billion by 2033. This growth is fueled by several factors. First, the rising number of air travelers globally directly increases the probability of lost or delayed baggage, generating a higher volume of claims. Second, more stringent regulations regarding airline liability for lost baggage incentivize passengers to pursue claims, boosting market demand. Third, the emergence of specialized third-party claim management companies, such as Refundmore and AirHelp, simplifies the claims process, attracting a wider range of consumers who might otherwise forgo pursuing compensation. These companies offer streamlined online platforms and experienced professionals to navigate the complexities of airline claims, leading to increased market penetration.

However, the market faces certain restraints. The inconsistent application of international baggage liability conventions across airlines and jurisdictions can create challenges for claim processing and resolution. Furthermore, the time-consuming nature of traditional claim procedures and the difficulty in obtaining sufficient documentation can deter some passengers from filing claims. Despite these challenges, technological advancements, such as improved baggage tracking systems and AI-powered claim processing tools, are expected to mitigate these issues and further drive market expansion. The market segmentation reveals a strong demand from both personal and family travelers, indicating a broad appeal across consumer demographics. The presence of numerous players, including both dedicated claim management companies and legal service providers, suggests a competitive yet dynamic market landscape.

Air Lost Baggage Claim Service Trends

The global air lost baggage claim service market is experiencing robust growth, projected to reach multi-million unit figures by 2033. Driven by increasing air travel, stricter passenger rights regulations, and the rise of technology-enabled claim assistance services, the market witnessed significant expansion during the historical period (2019-2024). The base year 2025 marks a crucial juncture, with the market exhibiting a substantial value and poised for continued expansion during the forecast period (2025-2033). Key market insights reveal a shift towards the utilization of third-party claim management companies, driven by their efficiency and expertise in navigating complex airline claim procedures. The personal application segment dominates the market, reflecting the individual traveler's need for assistance in recovering lost baggage expenses. However, the family and industry segments show promising growth potential, indicating a broader market appeal and a rising need for dedicated claim management in the corporate travel sector. Furthermore, the increasing awareness of passenger rights and the availability of user-friendly online platforms are streamlining the claim process, contributing to market growth. The legal services segment also plays a significant role, providing legal counsel for complex or disputed cases. The market's evolution reflects a growing demand for efficient and reliable solutions to the inconvenience and financial losses associated with lost baggage, underscoring the necessity and value of specialized claim services. This trend is expected to continue, driven by the ongoing expansion of the global aviation industry and the increasing sophistication of these services. The market is characterized by both established players and emerging tech-driven businesses, indicating a dynamic and competitive landscape.

Driving Forces: What's Propelling the Air Lost Baggage Claim Service

Several factors contribute to the expansion of the air lost baggage claim service market. The escalating number of air passengers globally directly correlates with a higher incidence of lost or delayed baggage. Stricter regulations concerning passenger rights, particularly in regions like the EU, mandate airlines to compensate passengers for lost baggage, creating a demand for services that facilitate the claim process. The growing awareness among passengers of their rights and available compensation options further fuels the market. Technological advancements have simplified claim filing through user-friendly online platforms and mobile applications, making the process more accessible and convenient. The emergence of specialized third-party claim management companies offering expertise in navigating complex airline procedures and maximizing compensation significantly improves the efficiency and success rates of claims. These companies often leverage technology to streamline the process, reducing the administrative burden on the passenger. Furthermore, the increasing integration of these services with travel insurance policies is adding another layer of convenience and assurance for travelers. These combined factors drive substantial market growth by making the claim process more accessible and successful for a larger population of air travelers.

Challenges and Restraints in Air Lost Baggage Claim Service

Despite the positive market trends, several challenges hinder the growth of the air lost baggage claim service market. One significant challenge is the varying and often complex regulations regarding passenger rights across different jurisdictions. Navigating these legal nuances requires specialized knowledge and expertise, adding a layer of complexity to the claim process. The airline industry’s occasional resistance to promptly processing or accepting claims, including disputes over liability and compensation amounts, can significantly delay and complicate matters. Another significant challenge is ensuring data privacy and security, as these services handle sensitive passenger information during the claim process. Maintaining the trust of customers in protecting this information is crucial for the credibility and success of these services. Competition among existing players and the constant emergence of new entrants in the market add further pressure to maintain competitive pricing and service excellence. Finally, the often unpredictable nature of baggage handling disruptions, including those caused by unforeseen circumstances such as extreme weather, poses a challenge in accurately forecasting market demand and ensuring consistent service delivery.

Key Region or Country & Segment to Dominate the Market

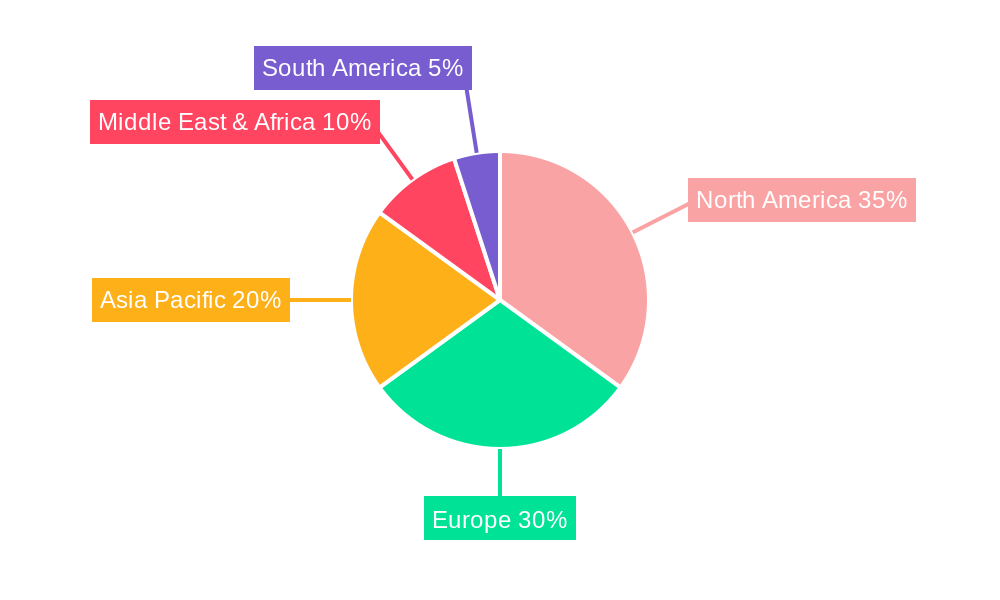

The market for air lost baggage claim services exhibits significant regional variations, with key regions experiencing substantial growth. North America and Europe are currently the leading markets, driven by high air passenger traffic and well-established legal frameworks concerning passenger rights. However, the Asia-Pacific region is expected to witness robust growth in the coming years, fueled by rising air travel and increasing passenger awareness of their rights.

Segments: The Third-Party Claims Management Company segment is poised to dominate the market. These companies provide specialized expertise, efficient processes, and technology-driven solutions, surpassing individual efforts in claim success rates and securing faster compensation. This segment's market share is projected to increase significantly during the forecast period.

Application: The Personal application segment currently holds the largest market share, reflecting the high number of individual travelers utilizing these services. However, the Family segment is demonstrating strong growth potential, indicating a rising trend of families utilizing these services for collective claim management, particularly in cases involving multiple lost bags. This represents a significant untapped market segment with potential for high growth in the coming years.

The success of third-party claim management companies stems from several factors: Their ability to streamline the often complex and bureaucratic claim processes, their knowledge of relevant regulations and airline policies, their use of sophisticated technology and tools to track claims, gather evidence, and manage communication effectively, and their ability to negotiate favorable settlements with airlines. The personalized service they provide to clients, coupled with transparent communication and clear pricing structures, significantly enhances customer satisfaction and trust.

Growth Catalysts in Air Lost Baggage Claim Service Industry

The air lost baggage claim service industry is experiencing rapid growth due to several key catalysts. Increased air travel globally fuels demand for efficient claim management services. Stricter passenger rights regulations and growing awareness among passengers of their rights also significantly boost the market. Technological advancements, such as user-friendly online platforms and mobile applications, enhance accessibility and convenience. The rise of specialized third-party claim management companies offering expertise in navigating complex airline procedures further drives market expansion.

Leading Players in the Air Lost Baggage Claim Service

- Refundmore

- Flight Delay

- Resolver

- MYFLYRIGHT

- airlawyer

- Skycop

- AirHelp

- ClaimCompass

- Flight-Delayed

- ClaimFlights

- FlightRight

- FairPlane

- FlightClaimEU

- Claimair

Significant Developments in Air Lost Baggage Claim Service Sector

- 2020: Several companies launched improved mobile applications for streamlined claim submissions.

- 2021: Increased partnerships between claim service providers and travel insurance companies were observed.

- 2022: Several legislative changes in various countries impacted claim processing procedures.

- 2023: The use of AI and machine learning in claim processing started gaining traction.

Comprehensive Coverage Air Lost Baggage Claim Service Report

This report provides a comprehensive analysis of the air lost baggage claim service market, covering market trends, driving forces, challenges, key players, and significant developments. It offers valuable insights for stakeholders, including companies operating in the sector, investors, and policymakers, enabling informed decision-making and strategic planning within this rapidly evolving market. The report's detailed segmentation allows for a thorough understanding of the various aspects of the market, revealing areas of highest growth potential.

Air Lost Baggage Claim Service Segmentation

-

1. Type

- 1.1. Legal Services

- 1.2. Third-Party Claims Management Company

- 1.3. Others

-

2. Application

- 2.1. Personal

- 2.2. Family

Air Lost Baggage Claim Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Air Lost Baggage Claim Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) of the Air Lost Baggage Claim Service ?

The projected CAGR is approximately XX%.

What are some drivers contributing to market growth?

.

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00 , USD 5220.00, and USD 6960.00 respectively.

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million .

Which companies are prominent players in the Air Lost Baggage Claim Service?

Key companies in the market include Refundmore,Flight Delay,Resolver,MYFLYRIGHT,airlawyer,Skycop,AirHelp,ClaimCompass,Flight-Delayed,ClaimFlights,FlightRight,FairPlane,FlightClaimEU,Claimair,

How can I stay updated on further developments or reports in the Air Lost Baggage Claim Service?

To stay informed about further developments, trends, and reports in the Air Lost Baggage Claim Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Can you provide examples of recent developments in the market?

undefined

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air Lost Baggage Claim Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Legal Services

- 5.1.2. Third-Party Claims Management Company

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal

- 5.2.2. Family

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Air Lost Baggage Claim Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Legal Services

- 6.1.2. Third-Party Claims Management Company

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Personal

- 6.2.2. Family

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Air Lost Baggage Claim Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Legal Services

- 7.1.2. Third-Party Claims Management Company

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Personal

- 7.2.2. Family

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Air Lost Baggage Claim Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Legal Services

- 8.1.2. Third-Party Claims Management Company

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Personal

- 8.2.2. Family

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Air Lost Baggage Claim Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Legal Services

- 9.1.2. Third-Party Claims Management Company

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Personal

- 9.2.2. Family

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Air Lost Baggage Claim Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Legal Services

- 10.1.2. Third-Party Claims Management Company

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Personal

- 10.2.2. Family

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Refundmore

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flight Delay

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Resolver

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MYFLYRIGHT

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 airlawyer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Skycop

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AirHelp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ClaimCompass

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Flight-Delayed

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ClaimFlights

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FlightRight

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FairPlane

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 FlightClaimEU

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Claimair

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Refundmore

- Figure 1: Global Air Lost Baggage Claim Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Air Lost Baggage Claim Service Revenue (million), by Type 2024 & 2032

- Figure 3: North America Air Lost Baggage Claim Service Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Air Lost Baggage Claim Service Revenue (million), by Application 2024 & 2032

- Figure 5: North America Air Lost Baggage Claim Service Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Air Lost Baggage Claim Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Air Lost Baggage Claim Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Air Lost Baggage Claim Service Revenue (million), by Type 2024 & 2032

- Figure 9: South America Air Lost Baggage Claim Service Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Air Lost Baggage Claim Service Revenue (million), by Application 2024 & 2032

- Figure 11: South America Air Lost Baggage Claim Service Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Air Lost Baggage Claim Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Air Lost Baggage Claim Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Air Lost Baggage Claim Service Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Air Lost Baggage Claim Service Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Air Lost Baggage Claim Service Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Air Lost Baggage Claim Service Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Air Lost Baggage Claim Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Air Lost Baggage Claim Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Air Lost Baggage Claim Service Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Air Lost Baggage Claim Service Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Air Lost Baggage Claim Service Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Air Lost Baggage Claim Service Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Air Lost Baggage Claim Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Air Lost Baggage Claim Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Air Lost Baggage Claim Service Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Air Lost Baggage Claim Service Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Air Lost Baggage Claim Service Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Air Lost Baggage Claim Service Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Air Lost Baggage Claim Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Air Lost Baggage Claim Service Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Air Lost Baggage Claim Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Air Lost Baggage Claim Service Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Air Lost Baggage Claim Service Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Air Lost Baggage Claim Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Air Lost Baggage Claim Service Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Air Lost Baggage Claim Service Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Air Lost Baggage Claim Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Air Lost Baggage Claim Service Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Air Lost Baggage Claim Service Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Air Lost Baggage Claim Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Air Lost Baggage Claim Service Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Air Lost Baggage Claim Service Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Air Lost Baggage Claim Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Air Lost Baggage Claim Service Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Air Lost Baggage Claim Service Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Air Lost Baggage Claim Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Air Lost Baggage Claim Service Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Air Lost Baggage Claim Service Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Air Lost Baggage Claim Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Air Lost Baggage Claim Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.