Aluminum Packaging Cans

Aluminum Packaging CansAluminum Packaging Cans XX CAGR Growth Outlook 2025-2033

Aluminum Packaging Cans by Application (Chemicals, Beverage, Food, Pharmaceuticals), by Type (Below 50mm, 50-100mm, Above 100mm), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global aluminum packaging cans market is experiencing robust growth, driven by the increasing demand for lightweight, recyclable, and sustainable packaging solutions across various industries. The market's expansion is fueled by several key factors, including the rising consumption of beverages and food products, the growing preference for convenient and portable packaging formats, and the stringent regulations aimed at reducing plastic waste. The food and beverage sectors, specifically, are major contributors to market growth, with significant demand for cans in the production of soft drinks, beer, energy drinks, and processed foods. Further segmentation by can size (below 50mm, 50-100mm, above 100mm) highlights diverse applications, reflecting the versatility of aluminum cans for various product formats. Major players like Ball Corporation, Amcor, and Crown Holdings are driving innovation through advancements in can design, manufacturing processes, and sustainable materials, leading to a competitive landscape characterized by mergers and acquisitions, technological advancements, and a focus on expanding geographic reach. While certain regional markets might experience fluctuations due to economic factors or regulatory changes, the overall long-term growth trajectory remains positive.

The market is projected to continue its expansion throughout the forecast period (2025-2033), albeit at a potentially moderating CAGR compared to previous years. This moderation could be attributed to factors like fluctuating raw material prices (aluminum), evolving consumer preferences, and the emergence of alternative packaging materials. However, ongoing efforts to improve recycling infrastructure and the growing awareness of environmental sustainability are expected to counterbalance these potential restraints. Geographic expansion, particularly in developing economies with rising disposable incomes and increasing consumer demand, represents a significant opportunity for market players. Innovation in materials science and design, including the development of lighter and more durable cans, will remain crucial for maintaining market competitiveness and driving further growth. The market's future hinges on successfully balancing economic viability, environmental sustainability, and consumer preferences.

Aluminum Packaging Cans Trends

The global aluminum packaging cans market exhibited robust growth throughout the historical period (2019-2024), driven primarily by increasing demand from the food and beverage sectors. The market's expansion is fueled by the inherent advantages of aluminum – its lightweight nature, recyclability, and ability to preserve product quality and extend shelf life. The estimated market value in 2025 signifies a significant milestone, reflecting continued consumer preference for convenient and sustainable packaging solutions. The forecast period (2025-2033) anticipates sustained growth, propelled by burgeoning global populations and rising disposable incomes, especially in developing economies, leading to increased consumption of packaged goods. Innovation within the aluminum packaging industry, including the development of more sustainable production methods and advancements in can design for enhanced functionality and aesthetics, further contributes to market expansion. The competitive landscape is characterized by several major players, engaging in strategic acquisitions, capacity expansions, and product diversification to maintain their market share. The shift toward eco-conscious consumption patterns globally is a key trend bolstering the market's sustained growth trajectory, with consumers actively seeking recyclable and easily disposable packaging options. This preference is driving significant investment in recycling infrastructure and promoting the circular economy, fostering long-term growth opportunities for the aluminum packaging cans market. Furthermore, the increasing adoption of aluminum cans in new applications beyond traditional beverage and food segments, such as pharmaceuticals and chemicals, is contributing to diversification and market expansion. This diversification is especially prevalent in regions experiencing rapid economic growth and urbanization. Overall, the market presents a positive outlook for the forecast period, with substantial growth expected across various segments and geographical regions. The millions of units sold are a clear indicator of this expansion and the market's significant role in the global packaging industry. Market segmentation, encompassing various can sizes and applications, reveals diverse growth rates and opportunities.

Driving Forces: What's Propelling the Aluminum Packaging Cans Market?

Several key factors propel the growth of the aluminum packaging cans market. The rising demand for convenient and portable packaging solutions across numerous sectors, especially in the food and beverage industries, is a primary driver. Consumers increasingly favor ready-to-consume products, fueling the demand for aluminum cans due to their lightweight, easy-to-open design and effective product preservation capabilities. Aluminum's inherent properties contribute significantly – its recyclability addresses growing environmental concerns, attracting environmentally conscious consumers and aligning with the broader sustainable packaging movement. The superior ability of aluminum cans to protect products from light, oxygen, and moisture contributes to extended shelf life, reducing food waste and ensuring product quality. The increasing adoption of aluminum cans in emerging markets experiencing rapid economic growth and urbanization further contributes to market expansion. Furthermore, technological advancements in can manufacturing, such as improved printing techniques and innovative designs, enhance product appeal and market competitiveness. Finally, the increasing investments in recycling infrastructure worldwide, combined with governmental regulations promoting sustainable packaging, create a positive feedback loop, reinforcing the demand for recyclable aluminum cans. These factors cumulatively drive significant market expansion, projecting substantial growth in the coming years, measured in millions of units sold annually.

Challenges and Restraints in Aluminum Packaging Cans

Despite the positive outlook, the aluminum packaging cans market faces certain challenges. Fluctuations in aluminum prices, a critical raw material, significantly impact production costs and profitability. Geopolitical instability and supply chain disruptions can also lead to price volatility and potential shortages. Competition from alternative packaging materials, such as plastic and glass, presents a continuous challenge, although aluminum's superior properties often outweigh these alternatives. Environmental concerns related to the energy-intensive manufacturing process of aluminum cans remain a consideration, although ongoing efforts to improve manufacturing efficiency and increase recycling rates are mitigating these concerns. Furthermore, regulations pertaining to packaging waste management and recycling differ significantly across geographical regions, potentially creating complexities for manufacturers operating globally. These regulatory variations necessitate strategic adaptations and compliance efforts to ensure successful market operation. Finally, the ever-evolving consumer preferences and the emergence of new packaging innovations necessitate continuous product development and adaptation to maintain market relevance and competitiveness. These challenges require manufacturers to adopt innovative strategies, optimize supply chains, and proactively address sustainability concerns to ensure sustained growth in the aluminum packaging cans market.

Key Region or Country & Segment to Dominate the Market

The beverage segment is projected to dominate the aluminum packaging cans market throughout the forecast period. This is largely due to the widespread consumption of carbonated soft drinks, juices, and alcoholic beverages packaged in aluminum cans. The segment's substantial growth is primarily driven by the increasing demand for convenient, portable, and shelf-stable beverages. Within the beverage segment, the 50-100mm can size is predicted to experience significant market share growth due to its widespread application across various beverage types. This size offers a balance between portability and sufficient beverage volume for individual consumption.

- Beverage Segment Dominance: The sheer volume of beverages packaged in aluminum cans makes this segment a major contributor to the overall market size in millions of units.

- 50-100mm Can Size: This size range offers a compelling combination of convenience, affordability, and volume, contributing to its widespread adoption across various beverages.

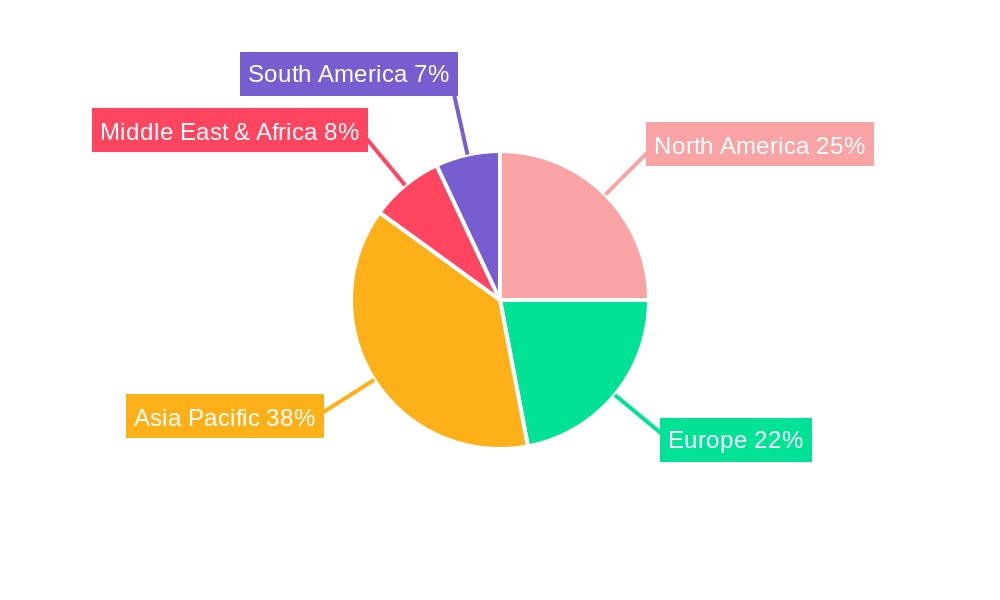

- Developed Economies as Key Markets: North America and Europe, with their established beverage industries and high per capita consumption rates, are expected to maintain substantial market shares.

- Emerging Markets' Growth Potential: Developing economies in Asia-Pacific and Latin America present significant growth potential, fueled by rising incomes and increasing demand for packaged beverages.

- Regional Variations in Consumption Patterns: Consumption patterns for different beverage types vary across regions, leading to diverse market dynamics. For example, certain regions might exhibit higher demand for energy drinks or specific types of alcoholic beverages, influencing the size and type of aluminum cans in demand.

- Strategic Investments in Manufacturing Capacity: Major players in the market are strategically investing in production capacities in high-growth regions to meet the rising demand.

Geographically, North America and Europe currently hold significant market share due to high per capita consumption of packaged beverages and established manufacturing bases. However, Asia-Pacific is projected to exhibit the most significant growth rate during the forecast period, driven by rapid economic expansion and rising demand for packaged goods in rapidly urbanizing populations.

Growth Catalysts in Aluminum Packaging Cans Industry

The aluminum packaging cans industry is poised for robust growth due to several key catalysts. Increased consumer preference for sustainable and recyclable packaging materials, coupled with growing environmental awareness, significantly boosts demand. Advancements in manufacturing technologies, leading to enhanced efficiency and reduced costs, are crucial. Expanding beverage consumption globally and the introduction of innovative designs and features for aluminum cans continually drive market growth. Finally, strategic investments in recycling infrastructure enhance the circularity of aluminum, promoting sustainable packaging practices and reinforcing market appeal.

Leading Players in the Aluminum Packaging Cans Market

- Ball Corporation www.ball.com

- ORG Packaging

- Shengxing Group

- Toyo Seikan Co. www.toyo-seikan.co.jp/english/

- Crown Holdings, Inc. www.crowncork.com

- Amcor plc www.amcor.com

- CPMC

- Great China Metal Industry Company

- EXAL

Significant Developments in Aluminum Packaging Cans Sector

- 2021: Ball Corporation announces expansion of its aluminum can production capacity in North America.

- 2022: Amcor launches a new range of sustainable aluminum cans with improved recyclability.

- 2023: Crown Holdings invests in advanced can manufacturing technologies to enhance efficiency and reduce environmental impact.

- 2024: Several major players announce partnerships to improve aluminum can recycling infrastructure globally.

Comprehensive Coverage Aluminum Packaging Cans Report

This report provides a detailed analysis of the aluminum packaging cans market, encompassing historical data, current market estimations, and future projections. It thoroughly examines market trends, driving factors, challenges, key players, and significant developments, offering a comprehensive understanding of this dynamic industry. The report delves into various segments, including applications (beverages, food, pharmaceuticals, chemicals) and can sizes, providing granular insights into market dynamics across different categories. The geographical segmentation provides regional perspectives, highlighting key markets and growth opportunities in different parts of the world. The analysis also features projections for the upcoming years, enabling stakeholders to make informed business decisions. The millions of units sold are consistently factored into the projections, offering a clear quantitative understanding of the market's size and growth potential.

Aluminum Packaging Cans Segmentation

-

1. Application

- 1.1. Chemicals

- 1.2. Beverage

- 1.3. Food

- 1.4. Pharmaceuticals

-

2. Type

- 2.1. Below 50mm

- 2.2. 50-100mm

- 2.3. Above 100mm

Aluminum Packaging Cans Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aluminum Packaging Cans REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aluminum Packaging Cans Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Chemicals

- 5.1.2. Beverage

- 5.1.3. Food

- 5.1.4. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Below 50mm

- 5.2.2. 50-100mm

- 5.2.3. Above 100mm

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aluminum Packaging Cans Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Chemicals

- 6.1.2. Beverage

- 6.1.3. Food

- 6.1.4. Pharmaceuticals

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Below 50mm

- 6.2.2. 50-100mm

- 6.2.3. Above 100mm

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Aluminum Packaging Cans Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Chemicals

- 7.1.2. Beverage

- 7.1.3. Food

- 7.1.4. Pharmaceuticals

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Below 50mm

- 7.2.2. 50-100mm

- 7.2.3. Above 100mm

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Aluminum Packaging Cans Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Chemicals

- 8.1.2. Beverage

- 8.1.3. Food

- 8.1.4. Pharmaceuticals

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Below 50mm

- 8.2.2. 50-100mm

- 8.2.3. Above 100mm

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Aluminum Packaging Cans Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Chemicals

- 9.1.2. Beverage

- 9.1.3. Food

- 9.1.4. Pharmaceuticals

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Below 50mm

- 9.2.2. 50-100mm

- 9.2.3. Above 100mm

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Aluminum Packaging Cans Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Chemicals

- 10.1.2. Beverage

- 10.1.3. Food

- 10.1.4. Pharmaceuticals

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Below 50mm

- 10.2.2. 50-100mm

- 10.2.3. Above 100mm

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ball Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ORG Packaging

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shengxing Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toyo Seikan Co.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Crown

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Amcor

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CPMC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Great China Metal Industry Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EXAL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ball Corporation

- Figure 1: Global Aluminum Packaging Cans Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Aluminum Packaging Cans Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Aluminum Packaging Cans Revenue (million), by Application 2024 & 2032

- Figure 4: North America Aluminum Packaging Cans Volume (K), by Application 2024 & 2032

- Figure 5: North America Aluminum Packaging Cans Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Aluminum Packaging Cans Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Aluminum Packaging Cans Revenue (million), by Type 2024 & 2032

- Figure 8: North America Aluminum Packaging Cans Volume (K), by Type 2024 & 2032

- Figure 9: North America Aluminum Packaging Cans Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Aluminum Packaging Cans Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Aluminum Packaging Cans Revenue (million), by Country 2024 & 2032

- Figure 12: North America Aluminum Packaging Cans Volume (K), by Country 2024 & 2032

- Figure 13: North America Aluminum Packaging Cans Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Aluminum Packaging Cans Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Aluminum Packaging Cans Revenue (million), by Application 2024 & 2032

- Figure 16: South America Aluminum Packaging Cans Volume (K), by Application 2024 & 2032

- Figure 17: South America Aluminum Packaging Cans Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Aluminum Packaging Cans Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Aluminum Packaging Cans Revenue (million), by Type 2024 & 2032

- Figure 20: South America Aluminum Packaging Cans Volume (K), by Type 2024 & 2032

- Figure 21: South America Aluminum Packaging Cans Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Aluminum Packaging Cans Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Aluminum Packaging Cans Revenue (million), by Country 2024 & 2032

- Figure 24: South America Aluminum Packaging Cans Volume (K), by Country 2024 & 2032

- Figure 25: South America Aluminum Packaging Cans Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Aluminum Packaging Cans Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Aluminum Packaging Cans Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Aluminum Packaging Cans Volume (K), by Application 2024 & 2032

- Figure 29: Europe Aluminum Packaging Cans Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Aluminum Packaging Cans Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Aluminum Packaging Cans Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Aluminum Packaging Cans Volume (K), by Type 2024 & 2032

- Figure 33: Europe Aluminum Packaging Cans Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Aluminum Packaging Cans Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Aluminum Packaging Cans Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Aluminum Packaging Cans Volume (K), by Country 2024 & 2032

- Figure 37: Europe Aluminum Packaging Cans Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Aluminum Packaging Cans Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Aluminum Packaging Cans Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Aluminum Packaging Cans Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Aluminum Packaging Cans Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Aluminum Packaging Cans Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Aluminum Packaging Cans Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Aluminum Packaging Cans Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Aluminum Packaging Cans Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Aluminum Packaging Cans Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Aluminum Packaging Cans Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Aluminum Packaging Cans Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Aluminum Packaging Cans Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Aluminum Packaging Cans Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Aluminum Packaging Cans Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Aluminum Packaging Cans Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Aluminum Packaging Cans Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Aluminum Packaging Cans Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Aluminum Packaging Cans Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Aluminum Packaging Cans Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Aluminum Packaging Cans Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Aluminum Packaging Cans Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Aluminum Packaging Cans Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Aluminum Packaging Cans Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Aluminum Packaging Cans Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Aluminum Packaging Cans Volume Share (%), by Country 2024 & 2032

- Table 1: Global Aluminum Packaging Cans Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Aluminum Packaging Cans Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Aluminum Packaging Cans Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Aluminum Packaging Cans Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Aluminum Packaging Cans Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Aluminum Packaging Cans Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Aluminum Packaging Cans Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Aluminum Packaging Cans Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Aluminum Packaging Cans Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Aluminum Packaging Cans Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Aluminum Packaging Cans Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Aluminum Packaging Cans Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Aluminum Packaging Cans Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Aluminum Packaging Cans Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Aluminum Packaging Cans Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Aluminum Packaging Cans Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Aluminum Packaging Cans Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Aluminum Packaging Cans Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Aluminum Packaging Cans Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Aluminum Packaging Cans Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Aluminum Packaging Cans Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Aluminum Packaging Cans Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Aluminum Packaging Cans Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Aluminum Packaging Cans Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Aluminum Packaging Cans Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Aluminum Packaging Cans Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Aluminum Packaging Cans Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Aluminum Packaging Cans Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Aluminum Packaging Cans Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Aluminum Packaging Cans Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Aluminum Packaging Cans Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Aluminum Packaging Cans Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Aluminum Packaging Cans Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Aluminum Packaging Cans Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Aluminum Packaging Cans Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Aluminum Packaging Cans Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Aluminum Packaging Cans Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Aluminum Packaging Cans Volume K Forecast, by Country 2019 & 2032

- Table 81: China Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Aluminum Packaging Cans Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Aluminum Packaging Cans Volume (K) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) of the Aluminum Packaging Cans ?

The projected CAGR is approximately XX%.

How can I stay updated on further developments or reports in the Aluminum Packaging Cans?

To stay informed about further developments, trends, and reports in the Aluminum Packaging Cans, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Which companies are prominent players in the Aluminum Packaging Cans?

Key companies in the market include Ball Corporation,ORG Packaging,Shengxing Group,Toyo Seikan Co.,Crown,Amcor,CPMC,Great China Metal Industry Company,EXAL,

What are the notable trends driving market growth?

.

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aluminum Packaging Cans," which aids in identifying and referencing the specific market segment covered.

Are there any restraints impacting market growth?

.

Can you provide examples of recent developments in the market?

undefined

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.