Anxiety Disorder and Depression Treatment

Anxiety Disorder and Depression TreatmentAnxiety Disorder and Depression Treatment Future-proof Strategies: Trends, Competitor Dynamics, and Opportunities 2025-2033

Anxiety Disorder and Depression Treatment by Type (Drugs, Devices), by Application (Hospitals, Mental Healthcare Centers, NGOs, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

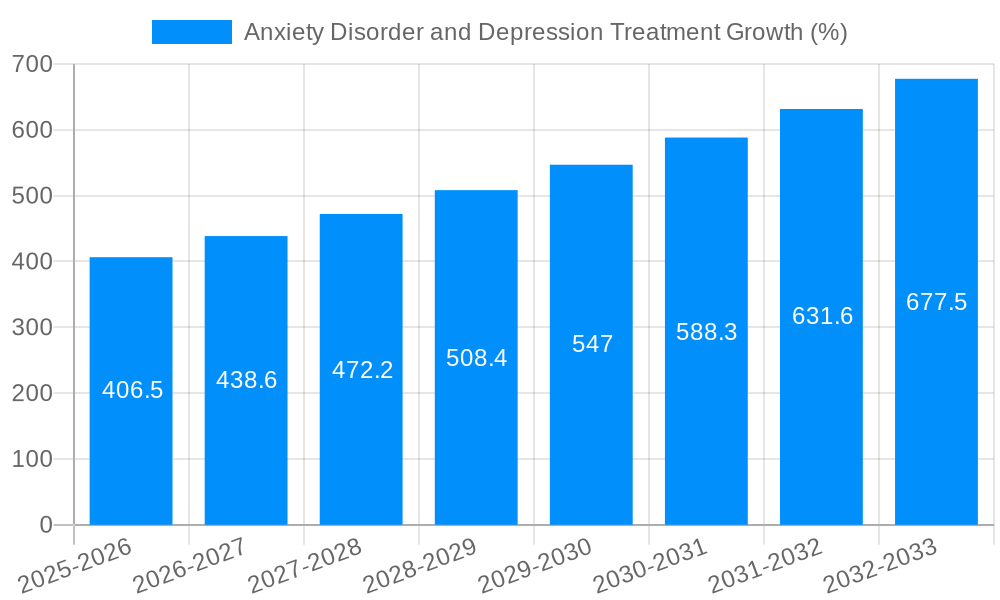

The global market for anxiety disorder and depression treatment is a substantial and rapidly growing sector, projected to reach \$6827.1 million in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 5.7% from 2025 to 2033. This growth is fueled by several key factors. The rising prevalence of anxiety and depression disorders globally, driven by factors such as increased stress levels, changing lifestyles, and societal pressures, is a primary driver. Furthermore, advancements in pharmaceutical research and development are leading to the introduction of more effective and targeted treatments, including novel antidepressants and anxiolytics. Increased awareness and reduced stigma surrounding mental health are also contributing to higher diagnosis rates and greater access to treatment options. The market is segmented by drug types (antidepressants, anxiolytics, others), treatment devices (including therapies like TMS and rTMS), and application settings (hospitals, mental healthcare centers, NGOs, and others). The significant investment in research and development within the pharmaceutical industry, coupled with supportive government initiatives and insurance coverage expansions for mental healthcare, further propel market growth.

The market's geographical distribution reflects global disparities in mental health awareness and access to care. North America, particularly the United States, is expected to hold a significant market share, owing to high healthcare expenditure and advanced healthcare infrastructure. Europe also represents a considerable market, driven by similar factors. However, significant growth opportunities exist in emerging markets within Asia-Pacific and other regions, where increasing healthcare awareness, growing middle classes, and rising disposable incomes are creating demand for better mental healthcare services. While the market exhibits strong growth potential, challenges remain, including the high cost of treatment, the need for improved access to care in underserved populations, and the ongoing development of more effective and tolerable treatments to address treatment resistance and side effects. Competition among pharmaceutical companies is fierce, driving innovation and potentially impacting pricing strategies.

Anxiety Disorder and Depression Treatment Trends

The global anxiety disorder and depression treatment market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. From 2019 to 2024 (historical period), the market witnessed significant expansion fueled by rising prevalence rates of these disorders, increased awareness, and advancements in therapeutic approaches. The estimated market value in 2025 sits at several million dollars, representing a substantial leap from previous years. This upward trajectory is expected to continue throughout the forecast period (2025-2033), driven by factors such as improved access to healthcare, the development of novel medications, and a growing acceptance of mental health treatment. The base year for our analysis is 2025, providing a crucial benchmark for projecting future market performance. Key market insights reveal a strong preference for pharmaceutical interventions, particularly in developed nations with robust healthcare infrastructure. However, the market is also seeing growth in non-pharmaceutical treatments, including therapy and digital health solutions, highlighting a shift towards holistic care models. The significant investments made by major pharmaceutical companies like Pfizer, Johnson & Johnson, and Eli Lilly further underscore the market’s potential and the ongoing efforts to develop more effective and accessible treatments. This comprehensive market report analyzes the market dynamics, identifying key trends and drivers to provide a thorough understanding of this rapidly evolving sector. Competition among established players is fierce, with companies continually striving to improve the efficacy and safety profiles of existing drugs and introduce innovative therapeutic options. The increasing use of telemedicine and digital therapeutics is also gaining traction, further expanding market access and improving patient engagement.

Driving Forces: What's Propelling the Anxiety Disorder and Depression Treatment Market?

Several key factors contribute to the rapid expansion of the anxiety disorder and depression treatment market. The escalating prevalence of these conditions globally is a primary driver. Stressful lifestyles, societal changes, and increased awareness are leading to more people seeking professional help. Advancements in pharmacological treatments, including the development of novel antidepressants and anxiolytics with improved efficacy and fewer side effects, are significantly boosting market growth. Growing acceptance of mental healthcare is also playing a crucial role, as societal stigma surrounding mental illness gradually diminishes. More people are now comfortable seeking treatment, leading to increased demand for services. Furthermore, the rising adoption of digital health technologies, such as telehealth platforms and mobile apps, enhances access to care, especially in underserved areas. Increased healthcare expenditure, particularly in developed countries, fuels investments in research and development, leading to the introduction of innovative treatments and therapies. Governments and healthcare organizations are also increasingly recognizing the economic burden of untreated mental illness and investing more in mental health services, which also contributes to market growth.

Challenges and Restraints in Anxiety Disorder and Depression Treatment

Despite the considerable growth potential, several challenges hinder the market's expansion. High treatment costs remain a significant barrier, particularly for patients in low- and middle-income countries. The complexity of mental illnesses and the lack of effective treatment for certain patients pose additional hurdles. Furthermore, the side effects associated with some medications can lead to treatment discontinuation and hinder the overall effectiveness of therapy. Another challenge is the limited availability of qualified mental healthcare professionals, especially in rural and underserved communities. This shortage often results in long wait times for appointments and limits access to appropriate care. The development of effective treatments for specific types of anxiety and depression is another area that needs improvement. Lastly, the stigma associated with mental health remains a substantial barrier, preventing many individuals from seeking help and delaying treatment initiation.

Key Region or Country & Segment to Dominate the Market

Segments Dominating the Market:

Drugs: This segment currently holds the largest market share, due to the widespread use of antidepressants, anxiolytics, and other psychotropic medications in managing these conditions. The continuous innovation and development within pharmaceutical companies, like Pfizer and Eli Lilly, constantly push advancements within this segment, further strengthening its dominance. Millions of dollars are invested annually in R&D for new drug development and improving existing medications.

Hospitals: Hospitals serve as primary treatment centers for severe cases of anxiety and depression, providing comprehensive care, including inpatient treatment, medication management, and therapy. They cater to a broad patient spectrum, contributing to their significant market share. The high concentration of specialized professionals within hospital settings ensures higher quality of care, leading to more patients seeking treatment within this setting.

Key Regions:

North America: This region holds a significant market share due to high healthcare expenditure, increased awareness of mental health issues, and the availability of advanced treatment options. The prevalence of anxiety and depression is high in this region, further adding to the strong market growth. The region’s robust healthcare infrastructure and significant investment in research and development lead to constant advancement in this field.

Europe: The high per-capita expenditure on healthcare and a well-established mental healthcare infrastructure contribute to Europe’s considerable market share. The presence of numerous pharmaceutical giants and research institutions supports continuous improvement and advancements in treatment methodologies within the European market.

Paragraph Summary: The North American and European markets currently represent the largest segments within the anxiety and depression treatment landscape, largely due to factors such as high healthcare spending, robust research and development, and advanced healthcare infrastructure. Within these regions, pharmaceutical drugs are the most widely utilized form of treatment within hospital settings. This trend is set to continue in the forecast period with further growth fueled by innovative treatments, growing awareness, and increasing healthcare spending.

Growth Catalysts in Anxiety Disorder and Depression Treatment Industry

The anxiety and depression treatment market is experiencing substantial growth fueled by several key catalysts. Rising awareness and decreasing stigma surrounding mental health encourage individuals to seek professional help, driving demand for treatment services. Technological advancements, such as telemedicine and digital therapeutics, are expanding access to care, especially for those in remote areas. Increased investment in research and development is resulting in more effective and tolerable medications, further fueling market expansion. Government initiatives and healthcare policies are promoting mental health awareness and integrating mental healthcare services into broader healthcare systems. These factors synergistically contribute to the market’s robust growth.

Leading Players in the Anxiety Disorder and Depression Treatment Market

Significant Developments in Anxiety Disorder and Depression Treatment Sector

- 2020: FDA approves a new antidepressant with a novel mechanism of action.

- 2021: Several telehealth platforms launch services specializing in mental health treatment.

- 2022: A major pharmaceutical company announces a significant investment in research and development for new treatments.

- 2023: New guidelines are published for the diagnosis and treatment of anxiety and depression.

- 2024: Several studies highlight the effectiveness of certain digital therapeutics in managing anxiety and depression.

Comprehensive Coverage Anxiety Disorder and Depression Treatment Report

This report provides a comprehensive overview of the anxiety disorder and depression treatment market, analyzing current trends, driving forces, challenges, and growth opportunities. It offers detailed market sizing and forecasting across key segments and geographical regions, providing invaluable insights for stakeholders. The report’s rigorous methodology ensures accurate and reliable market data, allowing informed decision-making for strategic planning and business development in this rapidly expanding sector.

Anxiety Disorder and Depression Treatment Segmentation

-

1. Type

- 1.1. Drugs

- 1.2. Devices

-

2. Application

- 2.1. Hospitals

- 2.2. Mental Healthcare Centers

- 2.3. NGOs

- 2.4. Other

Anxiety Disorder and Depression Treatment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Anxiety Disorder and Depression Treatment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.7% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anxiety Disorder and Depression Treatment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Drugs

- 5.1.2. Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Hospitals

- 5.2.2. Mental Healthcare Centers

- 5.2.3. NGOs

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Anxiety Disorder and Depression Treatment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Drugs

- 6.1.2. Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Hospitals

- 6.2.2. Mental Healthcare Centers

- 6.2.3. NGOs

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Anxiety Disorder and Depression Treatment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Drugs

- 7.1.2. Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Hospitals

- 7.2.2. Mental Healthcare Centers

- 7.2.3. NGOs

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Anxiety Disorder and Depression Treatment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Drugs

- 8.1.2. Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Hospitals

- 8.2.2. Mental Healthcare Centers

- 8.2.3. NGOs

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Anxiety Disorder and Depression Treatment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Drugs

- 9.1.2. Devices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Hospitals

- 9.2.2. Mental Healthcare Centers

- 9.2.3. NGOs

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Anxiety Disorder and Depression Treatment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Drugs

- 10.1.2. Devices

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Hospitals

- 10.2.2. Mental Healthcare Centers

- 10.2.3. NGOs

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pfizer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Johnson & Johnson

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lundbeck

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GSK

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eli Lilly

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AstraZeneca

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Pfizer

- Figure 1: Global Anxiety Disorder and Depression Treatment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Anxiety Disorder and Depression Treatment Revenue (million), by Type 2024 & 2032

- Figure 3: North America Anxiety Disorder and Depression Treatment Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Anxiety Disorder and Depression Treatment Revenue (million), by Application 2024 & 2032

- Figure 5: North America Anxiety Disorder and Depression Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Anxiety Disorder and Depression Treatment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Anxiety Disorder and Depression Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Anxiety Disorder and Depression Treatment Revenue (million), by Type 2024 & 2032

- Figure 9: South America Anxiety Disorder and Depression Treatment Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Anxiety Disorder and Depression Treatment Revenue (million), by Application 2024 & 2032

- Figure 11: South America Anxiety Disorder and Depression Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Anxiety Disorder and Depression Treatment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Anxiety Disorder and Depression Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Anxiety Disorder and Depression Treatment Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Anxiety Disorder and Depression Treatment Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Anxiety Disorder and Depression Treatment Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Anxiety Disorder and Depression Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Anxiety Disorder and Depression Treatment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Anxiety Disorder and Depression Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Anxiety Disorder and Depression Treatment Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Anxiety Disorder and Depression Treatment Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Anxiety Disorder and Depression Treatment Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Anxiety Disorder and Depression Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Anxiety Disorder and Depression Treatment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Anxiety Disorder and Depression Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Anxiety Disorder and Depression Treatment Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Anxiety Disorder and Depression Treatment Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Anxiety Disorder and Depression Treatment Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Anxiety Disorder and Depression Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Anxiety Disorder and Depression Treatment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Anxiety Disorder and Depression Treatment Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Anxiety Disorder and Depression Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Anxiety Disorder and Depression Treatment Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.