Automation as a Service

Automation as a ServiceAutomation as a Service 2025-2033 Analysis: Trends, Competitor Dynamics, and Growth Opportunities

Automation as a Service by Type (Rule-based Automation, Knowledge-based Automation), by Application (BFSI, Telecom and IT, Retail and Consumer goods, Healthcare and Life Sciences, Manufacturing, Government and Defense, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The Automation as a Service (AaaS) market is experiencing explosive growth, projected to reach $3348.2 million in 2025 and maintain a robust Compound Annual Growth Rate (CAGR) of 25.6% from 2025 to 2033. This surge is driven by several key factors. Firstly, businesses across diverse sectors, including BFSI (Banking, Financial Services, and Insurance), Telecom and IT, Retail, Healthcare, Manufacturing, and Government, are increasingly adopting AaaS solutions to streamline operations, enhance efficiency, and reduce operational costs. The shift towards cloud-based infrastructure, coupled with the rising need for improved customer experience and increased agility, fuels this adoption. Furthermore, advancements in artificial intelligence (AI) and machine learning (ML) are empowering more sophisticated automation capabilities, further boosting market expansion. The market segmentation reveals significant opportunities across various application areas, with BFSI and Telecom & IT currently leading in adoption, yet significant potential remains untapped in Healthcare and Manufacturing. The competitive landscape comprises established players like Automation Anywhere, UiPath, and Blue Prism, alongside technology giants like IBM and Microsoft, fostering innovation and driving market maturation.

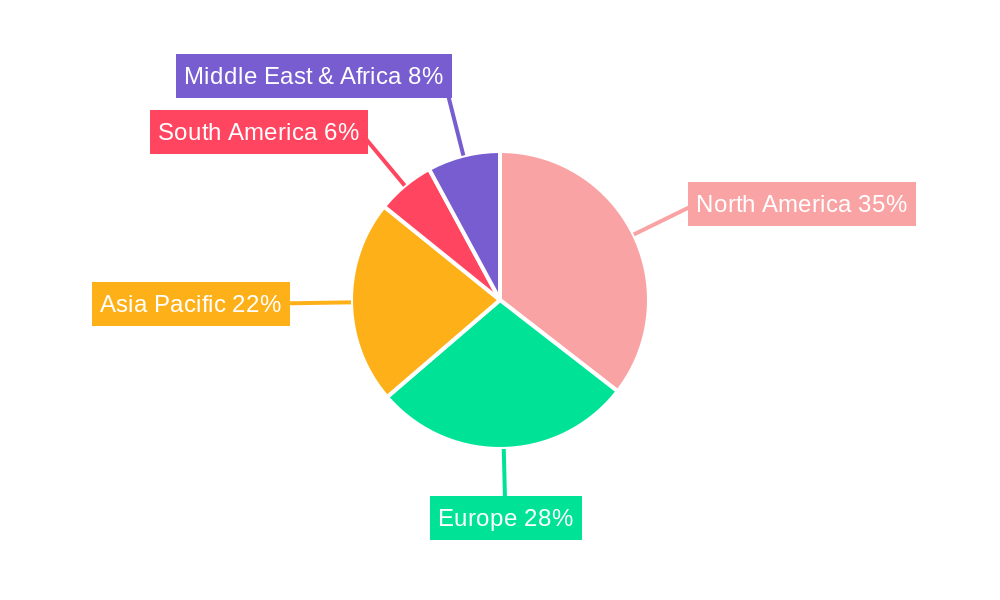

Looking ahead, the AaaS market is poised for continued expansion. The increasing prevalence of big data analytics and the growing demand for robotic process automation (RPA) are expected to significantly influence the market trajectory. However, challenges such as data security concerns, the need for skilled professionals to manage and implement AaaS solutions, and the initial investment required for implementation could potentially act as restraints. Nevertheless, the substantial benefits offered by AaaS, including cost optimization, improved productivity, and enhanced operational resilience, are likely to outweigh these challenges, ensuring sustained market growth throughout the forecast period. Regional analysis suggests North America currently dominates the market, followed by Europe and Asia-Pacific, with developing economies in Asia-Pacific exhibiting significant growth potential. The market's continued expansion hinges on the successful navigation of technological advancements and the strategic adoption of AaaS solutions by businesses across various industries and geographical locations.

Automation as a Service Trends

The Automation as a Service (AaaS) market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Our study, covering the period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, reveals a consistently upward trajectory. The historical period (2019-2024) showed significant adoption across various sectors, driven by the increasing need for operational efficiency and cost reduction. The forecast period (2025-2033) anticipates even more substantial growth, fueled by advancements in artificial intelligence (AI), machine learning (ML), and the expanding capabilities of robotic process automation (RPA). Key market insights indicate a strong preference for cloud-based AaaS solutions, enabling scalability and accessibility. The demand for knowledge-based automation, capable of handling complex tasks requiring cognitive capabilities, is surging, surpassing the growth of rule-based automation. This is particularly evident in sectors like BFSI (Banking, Financial Services, and Insurance), Telecom and IT, and Healthcare and Life Sciences, where complex processes and large datasets necessitate intelligent automation solutions. The market is characterized by intense competition among established players and emerging startups, fostering innovation and driving prices down, making AaaS accessible to a wider range of businesses, regardless of their size. The increasing availability of pre-built automation modules is another significant trend, simplifying deployment and reducing implementation time. Overall, the AaaS market presents a compelling investment opportunity, offering substantial returns in the coming decade. The market is expected to surpass several million units in terms of deployment across various industries and segments.

Driving Forces: What's Propelling the Automation as a Service Market?

Several factors are converging to propel the rapid expansion of the AaaS market. The ever-increasing pressure on businesses to reduce operational costs and improve efficiency is a primary driver. AaaS solutions offer a cost-effective alternative to traditional, on-premise automation systems, eliminating the need for significant upfront investments in hardware and software. Moreover, the flexibility and scalability of cloud-based AaaS platforms allow businesses to easily adapt their automation solutions to changing needs. The rise of AI and ML is another key factor, enabling the development of more sophisticated and intelligent automation solutions capable of handling complex tasks. This is particularly important for knowledge-based automation, which is rapidly gaining traction across diverse sectors. The growing availability of skilled workforce for implementation and maintenance also contributes to market growth. Finally, the increasing adoption of cloud computing is creating a more conducive environment for the deployment and management of AaaS solutions. Cloud-based platforms offer superior scalability, flexibility, and accessibility, making them an attractive option for businesses of all sizes.

Challenges and Restraints in Automation as a Service

Despite its immense potential, the AaaS market faces certain challenges and restraints. Security concerns remain a significant hurdle, particularly regarding the protection of sensitive data processed by AaaS platforms. Businesses are understandably hesitant to entrust their critical operations to cloud-based systems unless robust security measures are in place. Another major concern is the lack of skilled professionals capable of designing, implementing, and maintaining complex AaaS solutions. The demand for skilled RPA developers and AI/ML experts far outstrips the supply, creating a bottleneck for market growth. Integration with legacy systems can also prove challenging, requiring significant effort and expertise to ensure seamless interoperability. Furthermore, vendor lock-in is a potential concern, as businesses may become reliant on a particular AaaS provider, making it difficult to switch to an alternative solution. Finally, the high initial investment in some AaaS implementation projects may deter smaller businesses from adopting these solutions, even though the long-term cost savings are significant.

Key Region or Country & Segment to Dominate the Market

The BFSI segment is poised to dominate the AaaS market.

- High Adoption Rate: BFSI organizations are early adopters of automation technologies due to the high volume of repetitive tasks and the need for increased efficiency and accuracy in processing financial transactions, customer data, and regulatory compliance.

- Significant ROI Potential: Automation can significantly reduce operational costs in banking, insurance, and financial services, leading to a substantial return on investment.

- Complex Processes: The complex nature of many BFSI processes makes AaaS solutions particularly well-suited to streamlining operations.

- Stringent Regulations: The strict regulatory environment in BFSI necessitates high levels of accuracy and compliance, which automation excels at providing.

- Data-Driven Decision Making: AaaS facilitates data-driven decision-making by automating data collection, analysis, and reporting processes.

North America and Western Europe are expected to lead the regional market due to high technology adoption rates, substantial investments in digital transformation, and the presence of major AaaS providers. These regions boast strong infrastructure and mature IT sectors, creating an ideal environment for the growth of AaaS. However, Asia-Pacific is expected to experience rapid growth, driven by the increasing digitalization of businesses and the expanding adoption of cloud technologies across various industries. The significant cost advantages of AaaS solutions are particularly attractive to businesses in rapidly developing economies within the Asia-Pacific region.

Rule-based automation currently holds a larger market share than knowledge-based automation, but the latter is experiencing faster growth. This trend is expected to continue as AI and ML technologies mature, making knowledge-based automation more accessible and affordable.

Growth Catalysts in the Automation as a Service Industry

The convergence of several factors fuels the Automation as a Service (AaaS) market's rapid expansion. These include the pressing need for businesses to optimize operational efficiency and reduce costs, the rise of increasingly sophisticated AI and ML-powered automation solutions, the expanding availability of skilled professionals, the ubiquitous nature of cloud computing, and an increasing focus on digital transformation strategies across various industries. These catalysts are creating a favorable environment for the continued adoption and growth of AaaS solutions globally.

Leading Players in the Automation as a Service Market

- Automation Anywhere

- Blue Prism

- IBM

- Microsoft

- UiPath

- HCL Technologies

- HPE

- Kofax

- Nice Ltd.

- Pegasystems

Significant Developments in the Automation as a Service Sector

- 2020: Significant investments by major players in AI and ML capabilities for AaaS platforms.

- 2021: Increased focus on developing solutions for specific industry verticals (e.g., healthcare, finance).

- 2022: Launch of several low-code/no-code AaaS platforms, making automation more accessible to non-technical users.

- 2023: Growing adoption of hyperautomation strategies, combining RPA with other automation technologies.

- 2024: Increased emphasis on security and compliance in AaaS solutions.

Comprehensive Coverage Automation as a Service Report

This report provides a comprehensive analysis of the Automation as a Service market, offering valuable insights into market trends, driving forces, challenges, key players, and future growth prospects. The detailed segmentation and regional analysis allow for a granular understanding of the market dynamics, providing a robust foundation for strategic decision-making for investors, businesses, and technology providers within the AaaS ecosystem. The report's forecast extends to 2033, offering a long-term perspective on the market's trajectory.

Automation as a Service Segmentation

-

1. Type

- 1.1. Rule-based Automation

- 1.2. Knowledge-based Automation

-

2. Application

- 2.1. BFSI

- 2.2. Telecom and IT

- 2.3. Retail and Consumer goods

- 2.4. Healthcare and Life Sciences

- 2.5. Manufacturing

- 2.6. Government and Defense

- 2.7. Others

Automation as a Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automation as a Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.6% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automation as a Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Rule-based Automation

- 5.1.2. Knowledge-based Automation

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. BFSI

- 5.2.2. Telecom and IT

- 5.2.3. Retail and Consumer goods

- 5.2.4. Healthcare and Life Sciences

- 5.2.5. Manufacturing

- 5.2.6. Government and Defense

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automation as a Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Rule-based Automation

- 6.1.2. Knowledge-based Automation

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. BFSI

- 6.2.2. Telecom and IT

- 6.2.3. Retail and Consumer goods

- 6.2.4. Healthcare and Life Sciences

- 6.2.5. Manufacturing

- 6.2.6. Government and Defense

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Automation as a Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Rule-based Automation

- 7.1.2. Knowledge-based Automation

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. BFSI

- 7.2.2. Telecom and IT

- 7.2.3. Retail and Consumer goods

- 7.2.4. Healthcare and Life Sciences

- 7.2.5. Manufacturing

- 7.2.6. Government and Defense

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Automation as a Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Rule-based Automation

- 8.1.2. Knowledge-based Automation

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. BFSI

- 8.2.2. Telecom and IT

- 8.2.3. Retail and Consumer goods

- 8.2.4. Healthcare and Life Sciences

- 8.2.5. Manufacturing

- 8.2.6. Government and Defense

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Automation as a Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Rule-based Automation

- 9.1.2. Knowledge-based Automation

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. BFSI

- 9.2.2. Telecom and IT

- 9.2.3. Retail and Consumer goods

- 9.2.4. Healthcare and Life Sciences

- 9.2.5. Manufacturing

- 9.2.6. Government and Defense

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Automation as a Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Rule-based Automation

- 10.1.2. Knowledge-based Automation

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. BFSI

- 10.2.2. Telecom and IT

- 10.2.3. Retail and Consumer goods

- 10.2.4. Healthcare and Life Sciences

- 10.2.5. Manufacturing

- 10.2.6. Government and Defense

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Automation Anywhere

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Blue Prism

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Microsoft

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Uipath

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HCL Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HPE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kofax

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nice Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pegasystems

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Automation Anywhere

- Figure 1: Global Automation as a Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automation as a Service Revenue (million), by Type 2024 & 2032

- Figure 3: North America Automation as a Service Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Automation as a Service Revenue (million), by Application 2024 & 2032

- Figure 5: North America Automation as a Service Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Automation as a Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automation as a Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automation as a Service Revenue (million), by Type 2024 & 2032

- Figure 9: South America Automation as a Service Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Automation as a Service Revenue (million), by Application 2024 & 2032

- Figure 11: South America Automation as a Service Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Automation as a Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automation as a Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automation as a Service Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Automation as a Service Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Automation as a Service Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Automation as a Service Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Automation as a Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automation as a Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automation as a Service Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Automation as a Service Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Automation as a Service Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Automation as a Service Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Automation as a Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automation as a Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automation as a Service Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Automation as a Service Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Automation as a Service Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Automation as a Service Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Automation as a Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automation as a Service Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Automation as a Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automation as a Service Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Automation as a Service Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Automation as a Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automation as a Service Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Automation as a Service Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Automation as a Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automation as a Service Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Automation as a Service Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Automation as a Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automation as a Service Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Automation as a Service Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Automation as a Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automation as a Service Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Automation as a Service Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Automation as a Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automation as a Service Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Automation as a Service Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Automation as a Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automation as a Service Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.