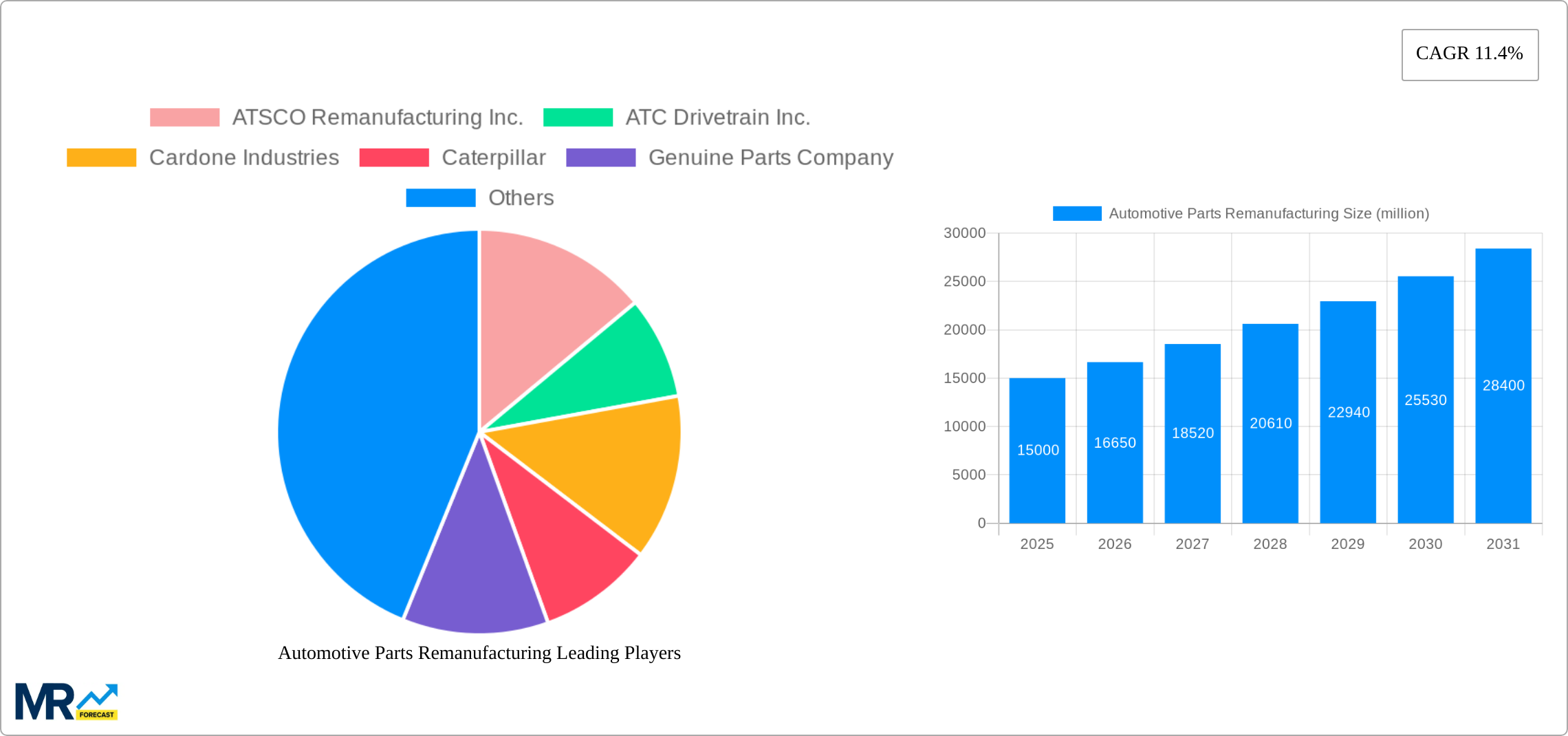

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Parts Remanufacturing?

The projected CAGR is approximately 11.4%.

Automotive Parts Remanufacturing

Automotive Parts RemanufacturingAutomotive Parts Remanufacturing by Type (Transmission, Engine, Gear), by Application (Compact Vehicle, Mid-Sized Vehicle, Premium Vehicle, Luxury Vehicle, Commercial Vehicles, SUV), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The automotive parts remanufacturing market is experiencing robust growth, projected to reach $20.31 billion by 2031, exhibiting a Compound Annual Growth Rate (CAGR) of 11.4%. This expansion is fueled by several key factors. Increasing environmental concerns are driving demand for sustainable alternatives to new part manufacturing, highlighting the reduced environmental impact of remanufacturing. Furthermore, the rising cost of new automotive parts, coupled with the increasing age of vehicles on the road, is making remanufactured components a more economically viable option for both consumers and businesses. The growing popularity of vehicle maintenance and repair services further contributes to market growth. Technological advancements in remanufacturing processes are improving the quality and reliability of remanufactured parts, erasing any lingering perceptions of inferior quality compared to new parts. This market is segmented by part type (transmission, engine, gear, etc.) and vehicle application (compact, mid-sized, premium, luxury, commercial, SUV). The geographic distribution shows significant market presence across North America, Europe, and Asia Pacific, with considerable growth potential in emerging economies.

Competitive dynamics are shaped by a mix of established players like Caterpillar, Genuine Parts Company, and Cardone Industries, alongside specialized remanufacturers such as ATSCO Remanufacturing and Jasper Engines. These companies are employing various strategies to maintain their market share, including investments in advanced technologies, expansion into new geographical markets, and strategic partnerships to enhance their supply chains and distribution networks. The market faces some challenges, primarily the need for robust quality control and certification processes to build consumer trust and overcome perceptions of lower quality compared to new parts. However, the long-term outlook remains positive, driven by sustained demand for cost-effective and environmentally friendly solutions in the automotive aftermarket.

The automotive parts remanufacturing market is experiencing robust growth, driven by a confluence of factors including increasing environmental awareness, stringent regulations on waste disposal, and the escalating cost of new parts. The global market size, estimated at USD XX billion in 2025, is projected to reach USD YY billion by 2033, exhibiting a CAGR of Z%. This surge is fueled by the rising demand for cost-effective alternatives to original equipment manufacturer (OEM) parts, particularly within the commercial vehicle and SUV segments. The historical period (2019-2024) witnessed significant adoption of remanufactured components, primarily driven by the economic benefits offered to both consumers and businesses. The forecast period (2025-2033) promises even more pronounced growth as technological advancements enhance the quality and reliability of remanufactured parts. Furthermore, the increasing focus on the circular economy and sustainable practices is bolstering the market's expansion. Key trends observed include the growing adoption of advanced remanufacturing techniques, the rise of specialized remanufacturing companies focusing on specific parts (like transmissions or engines), and the increasing integration of digital technologies across the value chain, optimizing processes and enhancing traceability. The market's expansion is also influenced by evolving consumer preferences and the increasing availability of certified remanufactured parts, thus diminishing the stigma associated with used components. The shift toward electric vehicles, while presenting new challenges, also opens opportunities for remanufacturing specific components within these vehicles. Overall, the automotive parts remanufacturing sector presents a significant growth trajectory, offering compelling economic and environmental benefits to stakeholders across the automotive ecosystem.

Several key factors are accelerating the growth of the automotive parts remanufacturing market. Firstly, the increasing cost of new automotive parts is prompting both individual consumers and businesses to seek more affordable alternatives. Remanufactured parts provide significant cost savings, often ranging from 30% to 70% less than new parts, making them an attractive option. Secondly, the growing environmental consciousness is pushing for sustainable practices within the automotive industry. Remanufacturing significantly reduces waste and resource consumption, aligning perfectly with the global push for circular economy principles and reducing the environmental footprint of the automotive sector. Thirdly, stringent government regulations on waste disposal and environmental protection are incentivizing the adoption of remanufacturing as a means to comply with these regulations while mitigating potential fines and penalties. The increasing demand for automotive parts, particularly in developing economies, also fuels market expansion. This rising demand can be partially met by remanufacturing existing parts, thus mitigating supply chain pressure. Lastly, advancements in remanufacturing technologies and processes are improving the quality and reliability of remanufactured components, making them increasingly comparable to new parts, and even surpassing OEM components in some instances, bolstering consumer confidence and industry adoption.

Despite the considerable growth potential, the automotive parts remanufacturing market faces certain challenges. One significant hurdle is the persistent perception that remanufactured parts are inferior in quality to their new counterparts. Overcoming this perception and fostering consumer trust requires focused marketing campaigns highlighting the improved quality and reliability of modern remanufacturing techniques. Another challenge is the complex logistics involved in collecting, disassembling, remanufacturing, and distributing parts. Efficient reverse logistics systems are crucial for cost-effective operations and require significant investment in infrastructure and technology. The lack of standardized quality control processes and certification across the industry also presents a challenge. Establishing robust industry standards would improve consumer confidence and facilitate fair competition. Furthermore, the availability of skilled labor for disassembly, inspection, and remanufacturing processes is sometimes limited. The industry needs to invest in training and development programs to address this skills gap. Finally, the rapid technological advancements in the automotive sector, specifically the transition towards electric and autonomous vehicles, present new challenges and opportunities. Remanufacturing processes need to adapt to these changes to remain relevant. Addressing these challenges is vital for the sustained and robust growth of the automotive parts remanufacturing market.

The automotive parts remanufacturing market is geographically diverse, with significant growth potential across various regions. However, North America and Europe are expected to remain dominant markets throughout the forecast period (2025-2033) due to high vehicle density, established remanufacturing infrastructure, and strong environmental regulations. Within these regions, the commercial vehicle segment is poised for substantial growth, outpacing the passenger vehicle segment, driven by high operating costs and the need for cost-effective maintenance solutions in fleet operations. Within the commercial vehicle segment, the remanufacturing of engines and transmissions represents a significant opportunity, accounting for a major share of the market.

North America: High vehicle ownership, strong environmental regulations, and a well-established aftermarket network contribute to this region's leading position. The focus on reducing operational costs among commercial fleets further fuels the demand for remanufactured parts.

Europe: Similar to North America, Europe has a mature automotive market, a well-developed remanufacturing industry, and stringent environmental norms pushing for sustainable solutions. The higher penetration of diesel vehicles in certain European markets also drives the demand for remanufactured engine and transmission components.

Asia Pacific: While currently smaller compared to North America and Europe, the Asia Pacific region is showing promising growth potential, driven by increasing vehicle ownership and the development of a larger aftermarket network. The rapid industrialization and economic growth in many Asian countries are creating an increasing demand for cost-effective maintenance and repair solutions.

The commercial vehicle segment's dominance stems from the significant cost savings achievable through remanufacturing compared to purchasing new parts, especially given the heavy-duty nature of these vehicles and their intensive use. The higher frequency of repairs and maintenance further boosts the demand for remanufactured components in this sector. Furthermore, the long lifespan and higher repair costs of commercial vehicle parts make remanufacturing a particularly economically viable solution for fleet operators.

The automotive parts remanufacturing industry is poised for significant growth fueled by several key factors. The increasing focus on sustainability and the circular economy is driving demand for environmentally friendly alternatives to new parts manufacturing. Technological advancements in remanufacturing processes are leading to improved part quality and reliability, thus enhancing consumer confidence. Simultaneously, stringent government regulations promoting environmentally conscious practices further incentivize the adoption of remanufacturing, providing a regulatory framework for growth. Finally, cost savings offered by remanufactured parts, often significantly lower than those of new parts, present a compelling economic incentive for both individual consumers and large-scale fleet operators. These combined factors create a positive feedback loop, accelerating the adoption of remanufacturing and fostering the industry's continued expansion.

This report provides a comprehensive analysis of the automotive parts remanufacturing market, encompassing historical data (2019-2024), current estimates (2025), and future projections (2025-2033). The report details market trends, driving forces, challenges, and key players, offering valuable insights into the industry's growth trajectory. It provides in-depth segment analyses, focusing on key regions, component types (engine, transmission, gear), and vehicle applications (compact, mid-sized, premium, luxury, commercial, SUV). The report helps stakeholders make strategic decisions, capitalize on growth opportunities, and effectively navigate the challenges within this dynamic market. The data presented is backed by rigorous research and analysis, providing valuable insights for investors, manufacturers, and other industry participants.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.4%.

Key companies in the market include ATSCO Remanufacturing Inc., ATC Drivetrain Inc., Cardone Industries, Caterpillar, Genuine Parts Company, Jasper Engines and Transmissions, Marshall Engines Inc., Motorcar Parts of America, Remy Power Products, Standard Motor Products Inc., strategyr, .

The market segments include Type, Application.

The market size is estimated to be USD 20310 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Parts Remanufacturing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Parts Remanufacturing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.