Biometrics Technology

Biometrics TechnologyBiometrics Technology Future-proof Strategies: Trends, Competitor Dynamics, and Opportunities 2025-2033

Biometrics Technology by Type (Face Recognition, Fingerprint Recognition, Iris Recognition, Palm Print/Hand Recognition, Hand Geometry Recognition), by Application (Security, Military & Defense, Healthcare System, Banking & Finance), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

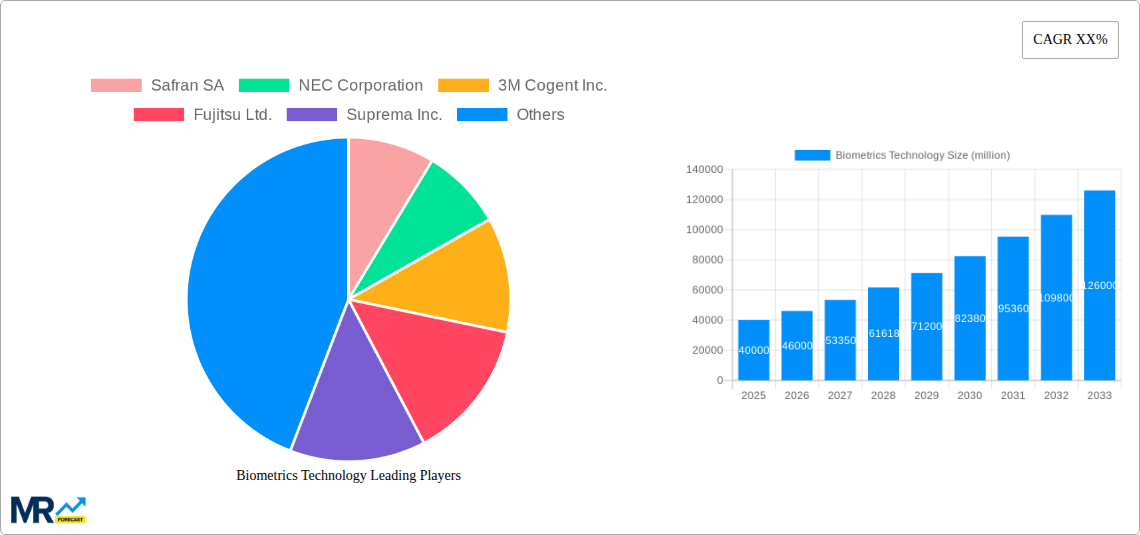

The global biometrics technology market is experiencing robust growth, driven by increasing security concerns across various sectors and the rising adoption of advanced authentication methods. The market, encompassing technologies like facial, fingerprint, iris, and palm recognition, is projected to reach a substantial size, with a Compound Annual Growth Rate (CAGR) fueling expansion. This growth is largely attributed to the rising demand for secure access control systems in government, commercial, and residential settings. Furthermore, the integration of biometrics into mobile devices and other consumer electronics is further accelerating market penetration. The healthcare sector is also a significant contributor, leveraging biometric authentication for patient identification and access control to sensitive medical records, improving efficiency and security. The military and defense sectors utilize biometric technologies for soldier identification, access control to sensitive information, and enhanced security at critical infrastructure sites. While data privacy concerns and the potential for misuse pose challenges, technological advancements are continuously addressing these issues, creating more secure and reliable biometric systems. Market segmentation by application (security, military & defense, healthcare, banking & finance) and by type (facial, fingerprint, iris, palm print/hand recognition, hand geometry recognition) reveals significant opportunities within each segment, with facial recognition currently dominating due to its ease of use and widespread adoption. Geographic expansion, particularly in developing economies with rapidly growing populations, provides further impetus for market growth. Competition among key players, including Safran SA, NEC Corporation, and others, fuels innovation and drives the development of more advanced, cost-effective, and user-friendly biometric technologies.

The forecast period (2025-2033) anticipates sustained growth, propelled by the ongoing integration of biometrics into Internet of Things (IoT) devices and the increasing emphasis on contactless authentication solutions in a post-pandemic world. Government regulations and initiatives promoting digital identity management are also positively impacting market development. However, the market is subject to certain restraints, including the relatively high initial investment costs for implementing biometric systems, the potential for vulnerabilities and security breaches, and ongoing concerns regarding data privacy. Despite these challenges, the overall outlook remains positive, suggesting continued expansion and diversification of the biometrics technology market across diverse applications and geographic regions. Technological advancements, particularly in areas such as AI-powered biometric recognition and improved sensor technologies, are expected to mitigate some of the existing limitations and further fuel market growth.

Biometrics Technology Trends

The global biometrics technology market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Driven by increasing security concerns, advancements in technology, and the rising adoption of biometric authentication across various sectors, the market shows a strong upward trajectory. The historical period (2019-2024) witnessed significant adoption of fingerprint and face recognition technologies, primarily in security and access control applications. However, the forecast period (2025-2033) anticipates a diversification of biometric modalities, with iris recognition, palm print recognition, and hand geometry recognition gaining traction. This diversification is fueled by the demand for more secure and accurate authentication methods, particularly in sensitive applications like banking and finance, healthcare, and military & defense. The market's evolution also includes the integration of biometrics with other technologies, like AI and cloud computing, to enhance performance and scalability. The estimated market value for 2025 suggests a substantial leap from previous years, indicating a tipping point in widespread biometric adoption. This growth is not uniform across all regions, with North America and Asia-Pacific leading the charge, followed by Europe and other regions. Key players are strategically investing in research and development to improve the accuracy, speed, and affordability of biometric systems, creating a dynamic and competitive landscape. The increasing prevalence of mobile biometrics and the growing demand for contactless authentication are further propelling market expansion. The shift towards cloud-based biometric solutions also adds another layer of scalability and accessibility, benefiting both businesses and consumers alike.

Driving Forces: What's Propelling the Biometrics Technology

Several factors are fueling the rapid expansion of the biometrics technology market. The paramount driver is the escalating need for robust and reliable security solutions across diverse sectors. Governments and organizations are increasingly adopting biometrics to enhance security measures, combating identity theft and fraud. The rising adoption of smartphones and other mobile devices equipped with biometric sensors is significantly contributing to the market's growth. The convenience and enhanced security offered by biometric authentication in mobile banking, access control, and various other applications are proving highly attractive to users. Technological advancements, particularly in areas like AI and machine learning, are improving the accuracy, speed, and reliability of biometric systems. These improvements are leading to wider acceptance and deployment of these technologies. Furthermore, the decreasing cost of biometric sensors and software is making these solutions more accessible to a broader range of organizations and individuals. Government initiatives and regulations mandating biometric authentication in certain sectors are also acting as significant catalysts for market expansion. Finally, the increasing demand for contactless and touchless solutions in a post-pandemic world has further boosted the adoption of biometrics, highlighting their crucial role in a safer and more hygienic environment.

Challenges and Restraints in Biometrics Technology

Despite its rapid growth, the biometrics technology market faces several challenges. Privacy concerns surrounding the collection and storage of sensitive biometric data remain a significant hurdle. Regulations like GDPR and CCPA are increasingly stringent, necessitating robust data protection measures and transparency to maintain user trust. The accuracy and reliability of biometric systems can vary depending on factors like environmental conditions and the quality of the biometric data. False acceptance rates (FAR) and false rejection rates (FRR) need to be minimized to ensure consistent performance. The integration of biometric systems with existing infrastructure can be complex and expensive, particularly for older systems. This can be a significant barrier to adoption for some organizations. Furthermore, ensuring interoperability between different biometric systems from various vendors remains a challenge. The potential for spoofing and attacks on biometric systems is a serious concern, demanding continuous improvements in security protocols and countermeasures. Finally, ensuring equitable access to biometric technologies and avoiding biases in algorithms are crucial for ethical and inclusive deployment. Addressing these challenges is key to unlocking the full potential of biometrics and gaining widespread public acceptance.

Key Region or Country & Segment to Dominate the Market

The North American market is currently leading the biometrics technology sector, driven by significant investments in security infrastructure and the presence of major technology companies. However, the Asia-Pacific region is projected to witness the fastest growth rate in the coming years, fueled by rising population, expanding economies, and increasing government initiatives promoting digital transformation. Within the biometric modalities, fingerprint recognition holds the largest market share due to its maturity, affordability, and widespread adoption. Its established presence in access control and mobile devices contributes significantly to this dominance. However, face recognition is quickly gaining ground, driven by its ease of use and suitability for contactless applications.

- North America: Strong government spending on defense and security, coupled with a thriving private sector driving adoption in banking and healthcare, positions this region at the forefront.

- Asia-Pacific: A burgeoning middle class, rapid technological advancements, and growing urbanization are pushing the demand for secure identity management solutions, making this region a key growth driver.

- Europe: Stringent data privacy regulations are shaping the market, promoting responsible development and usage of biometric technologies.

- Fingerprint Recognition: Its established infrastructure and cost-effectiveness makes it the most widely deployed biometric modality.

- Face Recognition: Growing popularity in mobile devices, security systems, and law enforcement applications is driving its rapid market expansion.

- Security Applications: This segment benefits most from heightened global security concerns and the adoption of biometric authentication in critical infrastructure and access control systems.

- Banking & Finance: Biometric authentication is increasingly adopted for secure online transactions and access to financial accounts, bolstering this sector's growth.

The paragraph above explains why these segments and regions dominate the market, supported by the points listed.

Growth Catalysts in Biometrics Technology Industry

The biometrics technology industry is experiencing robust growth fueled by several key catalysts. Increasing government investments in national security and identity management initiatives are a primary driver. Simultaneously, the surging demand for secure and convenient authentication methods across various sectors, such as banking, healthcare, and law enforcement, continues to accelerate adoption. The ongoing development of advanced biometric technologies, including improved algorithms and sophisticated sensor technologies, enhances accuracy and reliability, further boosting market expansion. Furthermore, the decreasing cost of hardware and software makes biometric solutions more accessible to a wider range of users and organizations.

Leading Players in the Biometrics Technology

- Safran SA

- NEC Corporation

- 3M Cogent Inc.

- Fujitsu Ltd.

- Suprema Inc.

- Cross Match Technologies

- Fulcrum Biometrics

- Thales SA

- Bio-Key International Inc.

- Precise Biometrics AB

- Secunet Security Networks AF

Significant Developments in Biometrics Technology Sector

- 2020: Increased adoption of contactless biometrics due to the COVID-19 pandemic.

- 2021: Significant advancements in AI-powered biometric authentication systems improving accuracy and speed.

- 2022: Growing integration of biometrics with cloud-based security platforms.

- 2023: Expansion of regulations concerning data privacy and security related to biometric data.

- 2024: Rising investment in multi-modal biometric systems, combining various biometric traits for improved security.

Comprehensive Coverage Biometrics Technology Report

This report provides a comprehensive overview of the biometrics technology market, covering market size, growth drivers, challenges, key players, and future trends. The analysis spans the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering a complete understanding of the market dynamics and potential for future growth. The report segments the market by type of biometric technology, application, and geographic region, providing detailed insights into each segment's performance and growth prospects. Furthermore, the competitive landscape is thoroughly analyzed, highlighting the strengths and weaknesses of key players and their strategic initiatives. This report serves as a valuable resource for businesses, investors, and researchers seeking a complete understanding of this rapidly evolving market.

Biometrics Technology Segmentation

-

1. Type

- 1.1. Face Recognition

- 1.2. Fingerprint Recognition

- 1.3. Iris Recognition

- 1.4. Palm Print/Hand Recognition

- 1.5. Hand Geometry Recognition

-

2. Application

- 2.1. Security

- 2.2. Military & Defense

- 2.3. Healthcare System

- 2.4. Banking & Finance

Biometrics Technology Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Biometrics Technology REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biometrics Technology Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Face Recognition

- 5.1.2. Fingerprint Recognition

- 5.1.3. Iris Recognition

- 5.1.4. Palm Print/Hand Recognition

- 5.1.5. Hand Geometry Recognition

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Security

- 5.2.2. Military & Defense

- 5.2.3. Healthcare System

- 5.2.4. Banking & Finance

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Biometrics Technology Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Face Recognition

- 6.1.2. Fingerprint Recognition

- 6.1.3. Iris Recognition

- 6.1.4. Palm Print/Hand Recognition

- 6.1.5. Hand Geometry Recognition

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Security

- 6.2.2. Military & Defense

- 6.2.3. Healthcare System

- 6.2.4. Banking & Finance

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Biometrics Technology Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Face Recognition

- 7.1.2. Fingerprint Recognition

- 7.1.3. Iris Recognition

- 7.1.4. Palm Print/Hand Recognition

- 7.1.5. Hand Geometry Recognition

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Security

- 7.2.2. Military & Defense

- 7.2.3. Healthcare System

- 7.2.4. Banking & Finance

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Biometrics Technology Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Face Recognition

- 8.1.2. Fingerprint Recognition

- 8.1.3. Iris Recognition

- 8.1.4. Palm Print/Hand Recognition

- 8.1.5. Hand Geometry Recognition

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Security

- 8.2.2. Military & Defense

- 8.2.3. Healthcare System

- 8.2.4. Banking & Finance

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Biometrics Technology Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Face Recognition

- 9.1.2. Fingerprint Recognition

- 9.1.3. Iris Recognition

- 9.1.4. Palm Print/Hand Recognition

- 9.1.5. Hand Geometry Recognition

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Security

- 9.2.2. Military & Defense

- 9.2.3. Healthcare System

- 9.2.4. Banking & Finance

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Biometrics Technology Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Face Recognition

- 10.1.2. Fingerprint Recognition

- 10.1.3. Iris Recognition

- 10.1.4. Palm Print/Hand Recognition

- 10.1.5. Hand Geometry Recognition

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Security

- 10.2.2. Military & Defense

- 10.2.3. Healthcare System

- 10.2.4. Banking & Finance

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Safran SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NEC Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 3M Cogent Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fujitsu Ltd.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Suprema Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cross Match Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fulcrum Biometrics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thales SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bio-Key International Inc.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Precise Biometrics AB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Secunet Security Networks AF

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Safran SA

- Figure 1: Global Biometrics Technology Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Biometrics Technology Revenue (million), by Type 2024 & 2032

- Figure 3: North America Biometrics Technology Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Biometrics Technology Revenue (million), by Application 2024 & 2032

- Figure 5: North America Biometrics Technology Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Biometrics Technology Revenue (million), by Country 2024 & 2032

- Figure 7: North America Biometrics Technology Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Biometrics Technology Revenue (million), by Type 2024 & 2032

- Figure 9: South America Biometrics Technology Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Biometrics Technology Revenue (million), by Application 2024 & 2032

- Figure 11: South America Biometrics Technology Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Biometrics Technology Revenue (million), by Country 2024 & 2032

- Figure 13: South America Biometrics Technology Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Biometrics Technology Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Biometrics Technology Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Biometrics Technology Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Biometrics Technology Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Biometrics Technology Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Biometrics Technology Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Biometrics Technology Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Biometrics Technology Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Biometrics Technology Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Biometrics Technology Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Biometrics Technology Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Biometrics Technology Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Biometrics Technology Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Biometrics Technology Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Biometrics Technology Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Biometrics Technology Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Biometrics Technology Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Biometrics Technology Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Biometrics Technology Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Biometrics Technology Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Biometrics Technology Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Biometrics Technology Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Biometrics Technology Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Biometrics Technology Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Biometrics Technology Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Biometrics Technology Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Biometrics Technology Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Biometrics Technology Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Biometrics Technology Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Biometrics Technology Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Biometrics Technology Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Biometrics Technology Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Biometrics Technology Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Biometrics Technology Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Biometrics Technology Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Biometrics Technology Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Biometrics Technology Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Biometrics Technology Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Are there any restraints impacting market growth?

.

Can you provide examples of recent developments in the market?

undefined

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

What are some drivers contributing to market growth?

.

What are the main segments of the Biometrics Technology?

The market segments include

Which companies are prominent players in the Biometrics Technology?

Key companies in the market include Safran SA,NEC Corporation,3M Cogent Inc.,Fujitsu Ltd.,Suprema Inc.,Cross Match Technologies,Fulcrum Biometrics,Thales SA,Bio-Key International Inc.,Precise Biometrics AB,Secunet Security Networks AF,

What are the notable trends driving market growth?

.

How can I stay updated on further developments or reports in the Biometrics Technology?

To stay informed about further developments, trends, and reports in the Biometrics Technology, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.