Blood Alcohol Test Service

Blood Alcohol Test ServiceBlood Alcohol Test Service Navigating Dynamics Comprehensive Analysis and Forecasts 2025-2033

Blood Alcohol Test Service by Type (Based On Infrared Based Devices, Based On Semiconductor Equipment, Based On Chromatographic Equipment, Based On Immunoassay Equipment, Other), by Application (Hospitals, Laboratories, Rehabilitation Centres, Federal Agencies, Criminal Justice), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

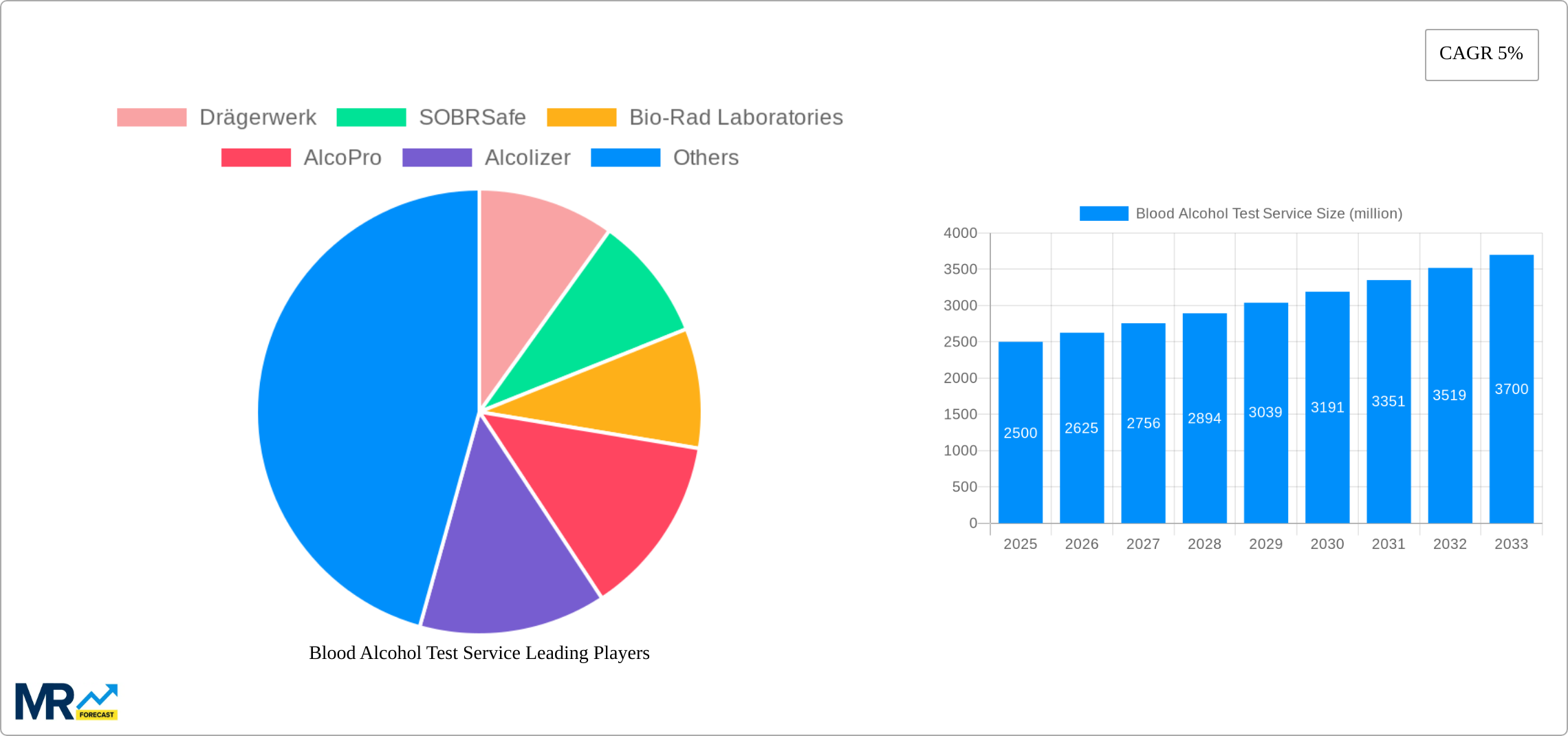

The global blood alcohol test (BAT) service market is experiencing steady growth, driven by increasing concerns about drunk driving and workplace safety, coupled with advancements in testing technologies. The market, estimated at $2.5 billion in 2025, is projected to grow at a compound annual growth rate (CAGR) of 5% from 2025 to 2033, reaching approximately $3.7 billion by 2033. This growth is fueled by several factors, including the rising prevalence of alcohol-related accidents and the increasing demand for accurate and rapid BAT services from hospitals, law enforcement agencies, and rehabilitation centers. The development of more sophisticated and portable devices, such as breathalyzers and blood alcohol content (BAC) testing kits, is also contributing to market expansion. Furthermore, stringent regulations concerning driving under the influence (DUI) and the increasing adoption of point-of-care testing are further bolstering market demand. The market segmentation reveals a diverse landscape, with significant contributions from infrared-based devices, semiconductor equipment, and chromatographic equipment, as well as substantial applications across hospitals, laboratories, and legal sectors.

The market faces certain restraints, primarily the high cost of advanced testing equipment and the potential for inaccurate results due to factors like operator error or environmental conditions. However, ongoing technological advancements, such as the development of non-invasive testing methods, and the increasing adoption of telehealth and remote monitoring technologies, are likely to mitigate these challenges in the coming years. The regional market is characterized by significant contributions from North America and Europe, driven by well-established healthcare infrastructure and stringent regulations. However, emerging economies in Asia Pacific are expected to witness substantial growth due to rising disposable incomes and increasing awareness about the dangers of alcohol abuse. The competitive landscape is dominated by a mix of established players and emerging companies, each striving to offer innovative solutions and cater to the evolving needs of the market.

Blood Alcohol Test Service Trends

The global blood alcohol test service market is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. Driven by increasing road accidents, stringent regulations regarding drunk driving, and a rising awareness of alcohol's detrimental effects on health, the demand for accurate and reliable blood alcohol testing is surging. The market's expansion is further fueled by technological advancements in testing equipment, leading to more portable, efficient, and accurate devices. This trend is particularly evident in the increasing adoption of infrared-based and semiconductor-based devices due to their speed and ease of use. The historical period (2019-2024) showcased steady growth, and the estimated year (2025) indicates a significant market value. The forecast period (2025-2033) anticipates sustained expansion, propelled by factors discussed further below. The market is witnessing a shift towards point-of-care testing, reducing turnaround times and enabling immediate intervention in critical situations. Furthermore, the growing prevalence of alcohol-related health issues is bolstering demand, particularly within hospitals, rehabilitation centers, and laboratories. The criminal justice sector also represents a significant portion of the market, necessitating robust and reliable testing methodologies for legal proceedings. The market's growth is not uniform across all geographical regions, with developed nations leading the way in adoption and technological advancements. However, developing economies are showing promising growth potential as awareness and regulatory frameworks evolve. Overall, the market showcases a dynamic interplay of technological advancements, increasing social awareness, and stricter legal frameworks, promising substantial future growth.

Driving Forces: What's Propelling the Blood Alcohol Test Service

Several key factors are driving the expansion of the blood alcohol test service market. Stringent government regulations worldwide to curb drunk driving are a major catalyst. Increased penalties and public awareness campaigns emphasizing the dangers of driving under the influence are significantly impacting demand for accurate testing. The rising number of alcohol-related accidents and fatalities fuels the need for efficient and reliable blood alcohol testing services to ensure public safety. Technological advancements are playing a crucial role, with the development of portable, rapid, and accurate testing devices simplifying the testing process and making it more accessible. The growing prevalence of alcohol abuse and alcohol-related health issues are also pushing demand for blood alcohol testing in hospitals, rehabilitation centers, and other healthcare settings for diagnosis, monitoring, and treatment. Furthermore, the increasing use of blood alcohol testing in workplace settings for safety and compliance reasons contributes to market expansion. The need for accurate and reliable data in legal contexts, such as criminal investigations and DUI cases, creates a constant demand for these services. Finally, the ongoing research and development efforts focused on improving the accuracy, speed, and cost-effectiveness of blood alcohol testing technologies continually expand market possibilities.

Challenges and Restraints in Blood Alcohol Test Service

Despite significant growth potential, the blood alcohol test service market faces several challenges. High costs associated with acquiring and maintaining sophisticated testing equipment can pose a barrier, particularly for smaller clinics or organizations in developing countries. The need for skilled and trained personnel to operate and interpret test results adds to operational expenses. Furthermore, the accuracy and reliability of the test results are crucial, and any inaccuracies can have severe legal and ethical implications. Maintaining the quality control and ensuring standardization across testing procedures and equipment is therefore paramount. Ethical concerns surrounding privacy and data security related to test results are also significant factors. The development and implementation of robust data protection measures are essential to build trust and ensure compliance with regulations. The presence of alternative testing methods, such as breathalyzers, although less accurate in some instances, poses competitive pressure. Finally, fluctuating government regulations and varying legal frameworks across different jurisdictions can create uncertainty and complexity in the market. Addressing these challenges requires collaborative efforts from industry stakeholders, regulatory bodies, and healthcare professionals to ensure the responsible and ethical growth of the blood alcohol testing service industry.

Key Region or Country & Segment to Dominate the Market

The North American market, particularly the United States, is expected to dominate the blood alcohol test service market due to stringent DUI laws, high rates of alcohol-related incidents, and widespread adoption of advanced testing technologies. Europe also holds significant market share due to similar factors. Within the segment breakdown, the Hospitals and Laboratories application sector is projected to remain a major driver, fueled by the increasing demand for accurate blood alcohol testing for diagnostic and monitoring purposes. Further, Infrared-based devices are likely to dominate the "Type" segment due to their accuracy, speed, and ease of use compared to other technologies.

- North America (USA): High incidence of alcohol-related accidents and stringent legal frameworks contribute to strong demand. The availability of advanced technologies and substantial healthcare infrastructure further supports market growth.

- Europe: Similar to North America, Europe has robust regulations and a high prevalence of alcohol-related issues. Well-established healthcare systems and access to technology also contribute to the market's strength.

- Asia Pacific: While showing promising growth, this region lags behind North America and Europe due to variations in regulatory frameworks and healthcare infrastructure. However, rising awareness and growing adoption of advanced testing are creating opportunities.

- Hospitals and Laboratories: This segment is dominant due to the high volume of alcohol-related cases requiring accurate testing for diagnosis, treatment, and legal purposes.

- Infrared-Based Devices: These devices are favored for their speed, ease of use, and reliability compared to other testing technologies, contributing to their market dominance.

- Government Agencies (Federal Agencies & Criminal Justice): The need for accurate and admissible evidence in legal proceedings significantly contributes to the demand for this segment.

Growth Catalysts in Blood Alcohol Test Service Industry

The blood alcohol test service industry's growth is further fueled by technological advancements that are constantly improving test accuracy and speed. Point-of-care testing is becoming increasingly popular, enabling faster results and facilitating immediate intervention. Furthermore, rising public awareness of alcohol's detrimental effects on health and society, coupled with proactive government initiatives to combat drunk driving, contributes significantly to the market's expansion.

Leading Players in the Blood Alcohol Test Service

- Drägerwerk

- SOBRSafe

- Bio-Rad Laboratories

- AlcoPro

- Alcolizer

- Abbott Laboratories

- Quest Diagnostics

- Roche Diagnostics

- Lifeloc Technologies

- MPD

- BACtrack

- LabCorp

- OraSure Technologies

- Alfa Scientific Designs

- Thermo Fisher Scientific

- Omega Laboratories

- Premier Biotech

- Psychemedics

- Shimadzu

- Siemens Healthineers

Significant Developments in Blood Alcohol Test Service Sector

- 2020: Several companies launched new, more portable blood alcohol testing devices.

- 2021: Increased adoption of point-of-care testing in hospitals and emergency rooms.

- 2022: New regulations in several countries tightened DUI laws and increased demand for blood alcohol testing services.

- 2023: Several technological advancements in testing methodologies improved accuracy and speed.

Comprehensive Coverage Blood Alcohol Test Service Report

This report provides a comprehensive overview of the blood alcohol test service market, including detailed analysis of market trends, drivers, challenges, key players, and regional performance. The report highlights the significant growth potential of the market, driven by increased awareness, regulatory changes, and technological advancements. The detailed segmentation analysis enables informed decision-making for stakeholders within the industry. The long-term forecast provides a clear outlook of the market's trajectory, enabling businesses to strategize effectively for sustainable growth.

Blood Alcohol Test Service Segmentation

-

1. Type

- 1.1. Based On Infrared Based Devices

- 1.2. Based On Semiconductor Equipment

- 1.3. Based On Chromatographic Equipment

- 1.4. Based On Immunoassay Equipment

- 1.5. Other

-

2. Application

- 2.1. Hospitals

- 2.2. Laboratories

- 2.3. Rehabilitation Centres

- 2.4. Federal Agencies

- 2.5. Criminal Justice

Blood Alcohol Test Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Blood Alcohol Test Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blood Alcohol Test Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Based On Infrared Based Devices

- 5.1.2. Based On Semiconductor Equipment

- 5.1.3. Based On Chromatographic Equipment

- 5.1.4. Based On Immunoassay Equipment

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Hospitals

- 5.2.2. Laboratories

- 5.2.3. Rehabilitation Centres

- 5.2.4. Federal Agencies

- 5.2.5. Criminal Justice

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Blood Alcohol Test Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Based On Infrared Based Devices

- 6.1.2. Based On Semiconductor Equipment

- 6.1.3. Based On Chromatographic Equipment

- 6.1.4. Based On Immunoassay Equipment

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Hospitals

- 6.2.2. Laboratories

- 6.2.3. Rehabilitation Centres

- 6.2.4. Federal Agencies

- 6.2.5. Criminal Justice

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Blood Alcohol Test Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Based On Infrared Based Devices

- 7.1.2. Based On Semiconductor Equipment

- 7.1.3. Based On Chromatographic Equipment

- 7.1.4. Based On Immunoassay Equipment

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Hospitals

- 7.2.2. Laboratories

- 7.2.3. Rehabilitation Centres

- 7.2.4. Federal Agencies

- 7.2.5. Criminal Justice

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Blood Alcohol Test Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Based On Infrared Based Devices

- 8.1.2. Based On Semiconductor Equipment

- 8.1.3. Based On Chromatographic Equipment

- 8.1.4. Based On Immunoassay Equipment

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Hospitals

- 8.2.2. Laboratories

- 8.2.3. Rehabilitation Centres

- 8.2.4. Federal Agencies

- 8.2.5. Criminal Justice

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Blood Alcohol Test Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Based On Infrared Based Devices

- 9.1.2. Based On Semiconductor Equipment

- 9.1.3. Based On Chromatographic Equipment

- 9.1.4. Based On Immunoassay Equipment

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Hospitals

- 9.2.2. Laboratories

- 9.2.3. Rehabilitation Centres

- 9.2.4. Federal Agencies

- 9.2.5. Criminal Justice

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Blood Alcohol Test Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Based On Infrared Based Devices

- 10.1.2. Based On Semiconductor Equipment

- 10.1.3. Based On Chromatographic Equipment

- 10.1.4. Based On Immunoassay Equipment

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Hospitals

- 10.2.2. Laboratories

- 10.2.3. Rehabilitation Centres

- 10.2.4. Federal Agencies

- 10.2.5. Criminal Justice

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Drägerwerk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SOBRSafe

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bio-Rad Laboratories

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AlcoPro

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alcolizer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abbott Laboratories

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Quest Diagnostics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Roche Diagnostics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lifeloc Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MPD

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BACtrack

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LabCorp

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 OraSure Technologies

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Alfa Scientific Designs

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Thermo Fisher Scientific

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Omega Laboratories

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Premier Biotech

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Psychemedics

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Shimadzu

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Siemens Healthineers

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Drägerwerk

- Figure 1: Global Blood Alcohol Test Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Blood Alcohol Test Service Revenue (million), by Type 2024 & 2032

- Figure 3: North America Blood Alcohol Test Service Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Blood Alcohol Test Service Revenue (million), by Application 2024 & 2032

- Figure 5: North America Blood Alcohol Test Service Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Blood Alcohol Test Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Blood Alcohol Test Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Blood Alcohol Test Service Revenue (million), by Type 2024 & 2032

- Figure 9: South America Blood Alcohol Test Service Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Blood Alcohol Test Service Revenue (million), by Application 2024 & 2032

- Figure 11: South America Blood Alcohol Test Service Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Blood Alcohol Test Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Blood Alcohol Test Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Blood Alcohol Test Service Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Blood Alcohol Test Service Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Blood Alcohol Test Service Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Blood Alcohol Test Service Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Blood Alcohol Test Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Blood Alcohol Test Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Blood Alcohol Test Service Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Blood Alcohol Test Service Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Blood Alcohol Test Service Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Blood Alcohol Test Service Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Blood Alcohol Test Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Blood Alcohol Test Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Blood Alcohol Test Service Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Blood Alcohol Test Service Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Blood Alcohol Test Service Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Blood Alcohol Test Service Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Blood Alcohol Test Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Blood Alcohol Test Service Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Blood Alcohol Test Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Blood Alcohol Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Blood Alcohol Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Blood Alcohol Test Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Blood Alcohol Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Blood Alcohol Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Blood Alcohol Test Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Blood Alcohol Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Blood Alcohol Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Blood Alcohol Test Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Blood Alcohol Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Blood Alcohol Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Blood Alcohol Test Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Blood Alcohol Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Blood Alcohol Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Blood Alcohol Test Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Blood Alcohol Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Blood Alcohol Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Blood Alcohol Test Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Blood Alcohol Test Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.