Building Ceramic Floor Tiles

Building Ceramic Floor TilesBuilding Ceramic Floor Tiles 2025-2033 Analysis: Trends, Competitor Dynamics, and Growth Opportunities

Building Ceramic Floor Tiles by Type (Overview: Global Building Ceramic Floor Tiles Consumption Value, Dry Pressing, Extrusion), by Application (Overview: Global Building Ceramic Floor Tiles Consumption Value, Building Ground, Structure Ground, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

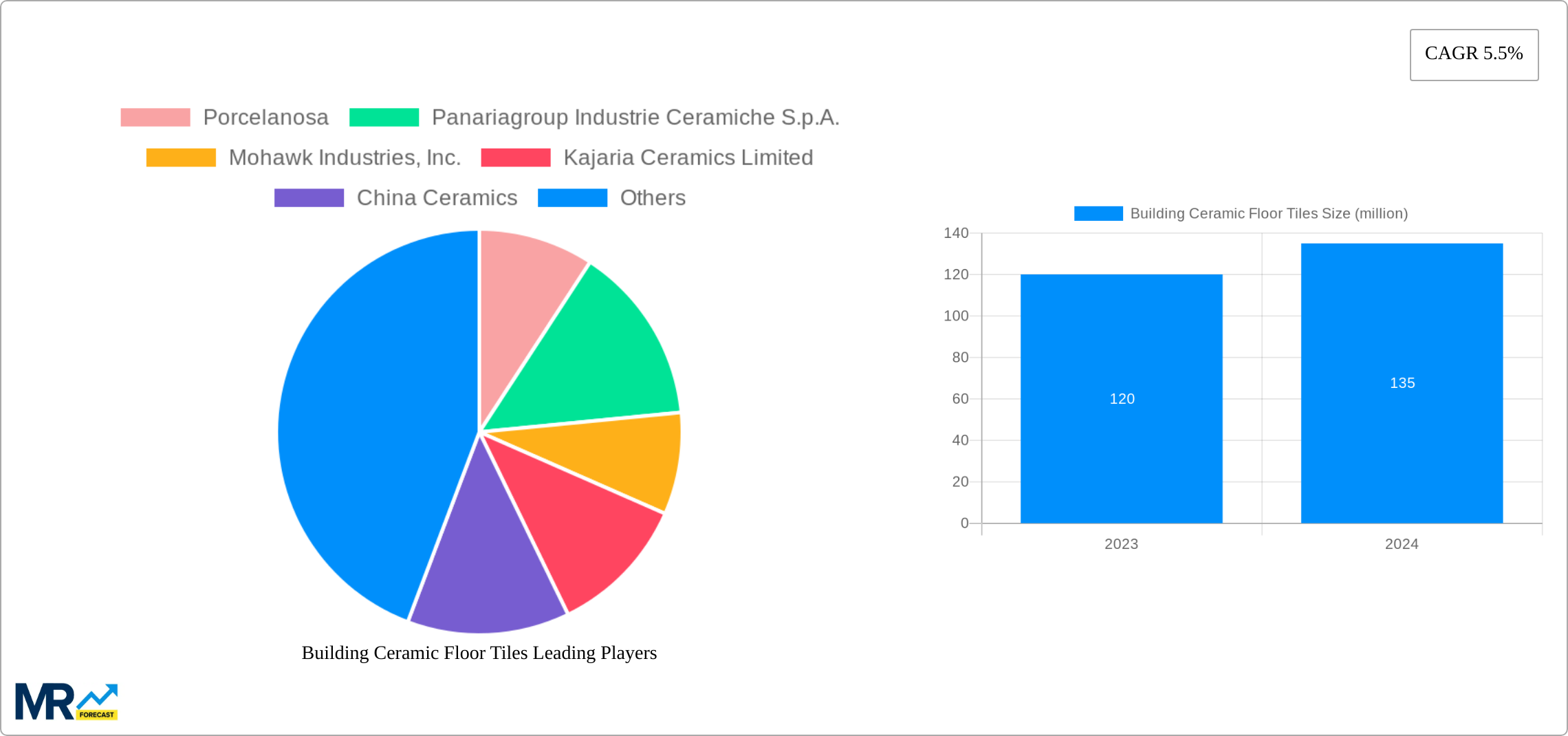

The global building ceramic floor tiles market is expected to grow at a CAGR of 5.5% during the forecast period 2025-2033, reaching a value of $67400 million by 2033. The growth of the market is attributed to the increasing demand for ceramic floor tiles in residential and commercial construction projects. Ceramic floor tiles are durable, easy to clean, and available in a wide range of colors and styles, making them a popular choice for both indoor and outdoor applications. The market is segmented by type into dry pressing and extrusion, and by application into building ground, structure ground, and other. The dry pressing segment is expected to account for the largest share of the market during the forecast period, due to the high demand for dry-pressed ceramic floor tiles in residential construction projects. The building ground segment is expected to account for the largest share of the market during the forecast period, due to the high demand for ceramic floor tiles in new construction projects.

The major drivers of the global building ceramic floor tiles market include the increasing demand for ceramic floor tiles in residential and commercial construction projects, the rising disposable income of consumers, and the growing popularity of ceramic floor tiles in developing countries. The market is also benefiting from the increasing availability of ceramic floor tiles in a wide range of colors and styles, as well as the growing awareness of the benefits of ceramic floor tiles, such as their durability and ease of cleaning. However, the market is also facing some challenges, such as the increasing competition from other flooring materials, such as vinyl and laminate, and the rising costs of raw materials.

Building Ceramic Floor Tiles Trends

The building ceramic floor tiles market is projected to garner revenues of around $46.6 billion by the end of 2031, with a CAGR of about 6% during the forecast period of 2023 to 2031. The market upgrowth is attributed to rising investments in the construction sector, increasing disposable incomes, and the growing popularity of ceramic floor tiles due to their durability and aesthetic appeal.

Additionally, the expansion of residential and commercial construction activities and the increasing utilization of ceramic floor tiles in commercial applications such as offices, retail stores, and hospitality venues also contribute to market expansion. Emerging economies' substantial growth in the construction sector and urbanization are attractive prospects for the building ceramic floor tiles industry.

Driving Forces: What's Propelling the Building Ceramic Floor Tiles

Several factors drive the building ceramic floor tiles market. These include:

Increased demand for ceramic floor tiles from residential and commercial sectors: Ceramic floor tiles are gaining prominence in residential and commercial sectors due to their durability, ease of maintenance, and availability of attractive designs, catering to consumer preferences for aesthetically pleasing and long-lasting flooring solutions.

Expansion of the construction industry in developing economies: The construction industry's sustained expansion in emerging economies, particularly in the Asia-Pacific region, has increased the demand for building materials, including ceramic floor tiles.

Rising disposable incomes and changing lifestyles: As disposable incomes rise, consumers spend more on home improvement and remodeling projects, including flooring upgrades. Ceramic floor tiles are a popular choice due to their value for money and durability.

Government investment in infrastructure: Governments worldwide continue to invest heavily in infrastructure projects such as roads, bridges, and public buildings, driving the demand for ceramic floor tiles as a preferred flooring solution in commercial and public spaces.

Increasing consumer preference for sustainable building materials: Consumers are becoming more conscious of the environmental impact of their purchasing decisions, leading to a growing preference for sustainable building materials like ceramic floor tiles, which are durable, easy to maintain, and contribute to energy efficiency in buildings.

Challenges and Restraints in Building Ceramic Floor Tiles

Despite the positive market drivers, the building ceramic floor tiles market also faces some challenges and restraints:

Fluctuating raw material costs: Ceramic floor tiles are manufactured using various raw materials like clay, feldspar, and quartz, whose prices can fluctuate due to factors such as supply and demand dynamics, geopolitical issues, and natural calamities.

Intense competition: Numerous local and global manufacturers compete in the building ceramic floor tiles market, leading to intense price competition and the need for differentiation through product innovation and marketing strategies.

Technological advancements in alternative flooring materials: The market faces competition from other resilient flooring materials like luxury vinyl tiles (LVT) and laminate flooring, which offer competitive aesthetics and ease of installation, challenging the market share of ceramic floor tiles.

Logistics and transportation challenges: The transportation of ceramic floor tiles can be challenging due to their weight and fragility, affecting the overall cost and timely delivery of products to customers.

Key Region or Country & Segment to Dominate the Market

Regions:

- Asia-Pacific: The Asia-Pacific region holds the largest market share in the building ceramic floor tiles market due to the construction boom in China, India, and other developing countries.

Countries:

- China: China is the largest producer and consumer of building ceramic floor tiles globally, driven by its vast construction sector and growing consumer demand.

Segments:

- Type: Dry pressing accounts for the dominant share in the market as it enables the production of larger and more precise tiles with reduced water absorption.

- Application: Building ground holds the largest share, with ceramic floor tiles preferred in residential and commercial constructions for their durability and ease of maintenance.

Growth Catalysts in Building Ceramic Floor Tiles Industry

The building ceramic floor tiles industry's growth is driven by several catalysts:

- Product innovation: Manufacturers are continuously developing innovative products with enhanced designs, textures, and finishes to cater to evolving consumer preferences and aesthetic trends.

- Technological advancements: Technological advancements in production processes, such as digital printing and automation, have increased efficiency and enabled the production of high-quality tiles with intricate designs.

- Government initiatives: Governments are implementing favorable policies, such as tax incentives and energy-efficiency regulations, to promote the adoption of sustainable building materials like ceramic floor tiles.

- Environmental awareness: Consumers are increasingly opting for eco-friendly flooring options, driving the demand for ceramic floor tiles, which are durable, low-maintenance, and contribute to energy savings in buildings.

Leading Players in the Building Ceramic Floor Tiles

- Porcelanosa

- Panariagroup Industrie Ceramiche S.p.A.

- Mohawk Industries, Inc.

- Kajaria Ceramics Limited

- China Ceramics

- Mingyang Tiles

Significant Developments in Building Ceramic Floor Tiles Sector

The building ceramic floor tiles sector has seen some significant developments in recent years:

- Introduction of anti-bacterial and anti-viral ceramic floor tiles: Manufacturers have introduced ceramic floor tiles with anti-bacterial and anti-viral properties, addressing concerns about hygiene and health in both residential and public spaces.

- Growing popularity of large-format tiles: Large-format ceramic floor tiles are gaining traction due to their ability to create seamless and expansive floor surfaces, enhancing aesthetics and reducing grout lines.

- Adoption of digital printing technology: Digital printing technology has enabled the production of ceramic floor tiles with highly realistic designs, intricate patterns, and even photographic images, expanding design possibilities.

- Sustainability initiatives: Manufacturers are focusing on reducing the environmental impact of ceramic floor tile production by optimizing energy consumption, recycling waste materials, and using sustainable raw materials.

Comprehensive Coverage Building Ceramic Floor Tiles Report

This report on the building ceramic floor tiles market provides comprehensive coverage of market dynamics, drivers and challenges, key regions and segments, growth catalysts, leading players, and significant developments. It offers insights into the industry's current and future trends, helping stakeholders make informed decisions and identify potential growth opportunities.

Building Ceramic Floor Tiles Segmentation

-

1. Type

- 1.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 1.2. Dry Pressing

- 1.3. Extrusion

-

2. Application

- 2.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 2.2. Building Ground

- 2.3. Structure Ground

- 2.4. Other

Building Ceramic Floor Tiles Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Building Ceramic Floor Tiles REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.5% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Can you provide examples of recent developments in the market?

undefined

How can I stay updated on further developments or reports in the Building Ceramic Floor Tiles?

To stay informed about further developments, trends, and reports in the Building Ceramic Floor Tiles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

What are some drivers contributing to market growth?

.

Can you provide details about the market size?

The market size is estimated to be USD 67400 million as of 2022.

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Building Ceramic Floor Tiles," which aids in identifying and referencing the specific market segment covered.

What are the main segments of the Building Ceramic Floor Tiles?

The market segments include

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00 , USD 5220.00, and USD 6960.00 respectively.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Building Ceramic Floor Tiles Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 5.1.2. Dry Pressing

- 5.1.3. Extrusion

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 5.2.2. Building Ground

- 5.2.3. Structure Ground

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Building Ceramic Floor Tiles Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 6.1.2. Dry Pressing

- 6.1.3. Extrusion

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 6.2.2. Building Ground

- 6.2.3. Structure Ground

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Building Ceramic Floor Tiles Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 7.1.2. Dry Pressing

- 7.1.3. Extrusion

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 7.2.2. Building Ground

- 7.2.3. Structure Ground

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Building Ceramic Floor Tiles Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 8.1.2. Dry Pressing

- 8.1.3. Extrusion

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 8.2.2. Building Ground

- 8.2.3. Structure Ground

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Building Ceramic Floor Tiles Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 9.1.2. Dry Pressing

- 9.1.3. Extrusion

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 9.2.2. Building Ground

- 9.2.3. Structure Ground

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Building Ceramic Floor Tiles Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 10.1.2. Dry Pressing

- 10.1.3. Extrusion

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Overview: Global Building Ceramic Floor Tiles Consumption Value

- 10.2.2. Building Ground

- 10.2.3. Structure Ground

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Porcelanosa

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Panariagroup Industrie Ceramiche S.p.A.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mohawk Industries Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kajaria Ceramics Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Ceramics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mingyang Tiles

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Porcelanosa

- Figure 1: Global Building Ceramic Floor Tiles Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Building Ceramic Floor Tiles Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Building Ceramic Floor Tiles Revenue (million), by Type 2024 & 2032

- Figure 4: North America Building Ceramic Floor Tiles Volume (K), by Type 2024 & 2032

- Figure 5: North America Building Ceramic Floor Tiles Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Building Ceramic Floor Tiles Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Building Ceramic Floor Tiles Revenue (million), by Application 2024 & 2032

- Figure 8: North America Building Ceramic Floor Tiles Volume (K), by Application 2024 & 2032

- Figure 9: North America Building Ceramic Floor Tiles Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Building Ceramic Floor Tiles Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Building Ceramic Floor Tiles Revenue (million), by Country 2024 & 2032

- Figure 12: North America Building Ceramic Floor Tiles Volume (K), by Country 2024 & 2032

- Figure 13: North America Building Ceramic Floor Tiles Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Building Ceramic Floor Tiles Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Building Ceramic Floor Tiles Revenue (million), by Type 2024 & 2032

- Figure 16: South America Building Ceramic Floor Tiles Volume (K), by Type 2024 & 2032

- Figure 17: South America Building Ceramic Floor Tiles Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Building Ceramic Floor Tiles Volume Share (%), by Type 2024 & 2032

- Figure 19: South America Building Ceramic Floor Tiles Revenue (million), by Application 2024 & 2032

- Figure 20: South America Building Ceramic Floor Tiles Volume (K), by Application 2024 & 2032

- Figure 21: South America Building Ceramic Floor Tiles Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Building Ceramic Floor Tiles Volume Share (%), by Application 2024 & 2032

- Figure 23: South America Building Ceramic Floor Tiles Revenue (million), by Country 2024 & 2032

- Figure 24: South America Building Ceramic Floor Tiles Volume (K), by Country 2024 & 2032

- Figure 25: South America Building Ceramic Floor Tiles Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Building Ceramic Floor Tiles Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Building Ceramic Floor Tiles Revenue (million), by Type 2024 & 2032

- Figure 28: Europe Building Ceramic Floor Tiles Volume (K), by Type 2024 & 2032

- Figure 29: Europe Building Ceramic Floor Tiles Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Building Ceramic Floor Tiles Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe Building Ceramic Floor Tiles Revenue (million), by Application 2024 & 2032

- Figure 32: Europe Building Ceramic Floor Tiles Volume (K), by Application 2024 & 2032

- Figure 33: Europe Building Ceramic Floor Tiles Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe Building Ceramic Floor Tiles Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe Building Ceramic Floor Tiles Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Building Ceramic Floor Tiles Volume (K), by Country 2024 & 2032

- Figure 37: Europe Building Ceramic Floor Tiles Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Building Ceramic Floor Tiles Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Building Ceramic Floor Tiles Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa Building Ceramic Floor Tiles Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa Building Ceramic Floor Tiles Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa Building Ceramic Floor Tiles Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa Building Ceramic Floor Tiles Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa Building Ceramic Floor Tiles Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa Building Ceramic Floor Tiles Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa Building Ceramic Floor Tiles Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa Building Ceramic Floor Tiles Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Building Ceramic Floor Tiles Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Building Ceramic Floor Tiles Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Building Ceramic Floor Tiles Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Building Ceramic Floor Tiles Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific Building Ceramic Floor Tiles Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific Building Ceramic Floor Tiles Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific Building Ceramic Floor Tiles Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific Building Ceramic Floor Tiles Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific Building Ceramic Floor Tiles Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific Building Ceramic Floor Tiles Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Building Ceramic Floor Tiles Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Building Ceramic Floor Tiles Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Building Ceramic Floor Tiles Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Building Ceramic Floor Tiles Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Building Ceramic Floor Tiles Volume Share (%), by Country 2024 & 2032

- Table 1: Global Building Ceramic Floor Tiles Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Building Ceramic Floor Tiles Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Building Ceramic Floor Tiles Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Building Ceramic Floor Tiles Volume K Forecast, by Type 2019 & 2032

- Table 5: Global Building Ceramic Floor Tiles Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Building Ceramic Floor Tiles Volume K Forecast, by Application 2019 & 2032

- Table 7: Global Building Ceramic Floor Tiles Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Building Ceramic Floor Tiles Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Building Ceramic Floor Tiles Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Building Ceramic Floor Tiles Volume K Forecast, by Type 2019 & 2032

- Table 11: Global Building Ceramic Floor Tiles Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Building Ceramic Floor Tiles Volume K Forecast, by Application 2019 & 2032

- Table 13: Global Building Ceramic Floor Tiles Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Building Ceramic Floor Tiles Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Building Ceramic Floor Tiles Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global Building Ceramic Floor Tiles Volume K Forecast, by Type 2019 & 2032

- Table 23: Global Building Ceramic Floor Tiles Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global Building Ceramic Floor Tiles Volume K Forecast, by Application 2019 & 2032

- Table 25: Global Building Ceramic Floor Tiles Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Building Ceramic Floor Tiles Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Building Ceramic Floor Tiles Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global Building Ceramic Floor Tiles Volume K Forecast, by Type 2019 & 2032

- Table 35: Global Building Ceramic Floor Tiles Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global Building Ceramic Floor Tiles Volume K Forecast, by Application 2019 & 2032

- Table 37: Global Building Ceramic Floor Tiles Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Building Ceramic Floor Tiles Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Building Ceramic Floor Tiles Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global Building Ceramic Floor Tiles Volume K Forecast, by Type 2019 & 2032

- Table 59: Global Building Ceramic Floor Tiles Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global Building Ceramic Floor Tiles Volume K Forecast, by Application 2019 & 2032

- Table 61: Global Building Ceramic Floor Tiles Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Building Ceramic Floor Tiles Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Building Ceramic Floor Tiles Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global Building Ceramic Floor Tiles Volume K Forecast, by Type 2019 & 2032

- Table 77: Global Building Ceramic Floor Tiles Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global Building Ceramic Floor Tiles Volume K Forecast, by Application 2019 & 2032

- Table 79: Global Building Ceramic Floor Tiles Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Building Ceramic Floor Tiles Volume K Forecast, by Country 2019 & 2032

- Table 81: China Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Building Ceramic Floor Tiles Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Building Ceramic Floor Tiles Volume (K) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.5% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.