Check Cashing Service

Check Cashing ServiceCheck Cashing Service Decade Long Trends, Analysis and Forecast 2025-2033

Check Cashing Service by Type (Pre-Printed Check, Payroll Check, Government Check, Others), by Application (Personal, Company), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Base Year: 2024

109 Pages

Key Insights

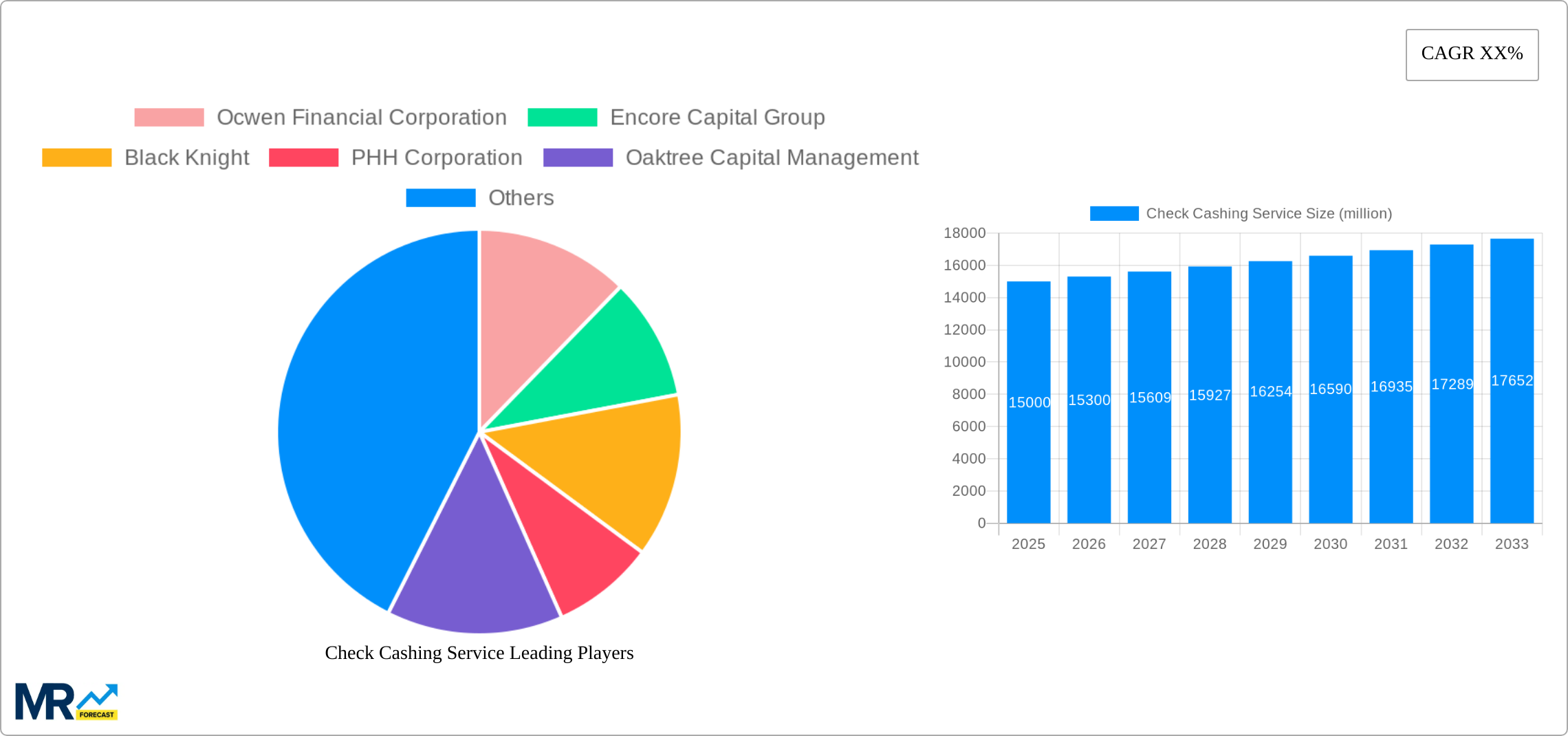

The check cashing service market, while experiencing a gradual decline in recent years due to the rise of digital payment methods, maintains a significant presence, particularly in underserved communities. The market, estimated at $15 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 2% from 2025 to 2033. This modest growth reflects the ongoing shift toward digital banking and mobile payment solutions. However, factors such as the persistent need for cash transactions among lower-income segments, the lack of access to traditional banking services in certain regions, and the convenience of immediate cash access continue to fuel demand. The pre-printed check segment holds a considerable share, driven by established business practices and government regulations in specific sectors. The personal application segment remains larger than the company segment, but the latter is expected to see faster growth driven by payroll processing services for small and medium-sized enterprises (SMEs) lacking sophisticated digital payroll systems. Key players in the market, including Ocwen Financial Corporation and Encore Capital Group, are adapting to changing consumer habits by integrating technology and offering more diverse financial services. Geographic distribution shows a higher concentration of market share in North America and Europe, with emerging markets in Asia-Pacific exhibiting gradual but noticeable growth. Regulatory changes and technological innovations will be crucial in shaping the future landscape of this sector.

The market's future trajectory will be significantly influenced by regulatory changes impacting financial inclusion and the continued advancement of fintech solutions. The growth of mobile payment apps and digital wallets directly competes with check cashing, pushing companies to innovate and diversify their service offerings. This includes exploring partnerships with digital platforms and integrating financial literacy programs to cater to evolving consumer needs and enhance market penetration. The increasing adoption of online banking and digital payments among younger demographics presents a major challenge. To counter this, successful businesses will focus on customer loyalty programs, enhanced customer service, and a commitment to financial inclusion to cater to underserved communities who lack access to traditional banking systems. Regional variations in financial inclusion and regulatory frameworks will continue to influence market segmentation and growth patterns. This suggests a need for companies to adapt their strategies to align with local market dynamics.

Check Cashing Service Trends

The check cashing service market, valued at $XXX million in 2025, is projected to experience significant growth throughout the forecast period (2025-2033). This growth is driven by a confluence of factors, including the persistent unbanked and underbanked population segment who rely heavily on these services for accessing their funds. The historical period (2019-2024) saw fluctuating growth rates, largely influenced by macroeconomic conditions and changes in financial regulations. However, the estimated year 2025 reveals a stabilizing trend, indicating a period of sustained expansion. The increasing popularity of mobile check cashing apps and the broader adoption of fintech solutions are also contributing to market expansion. These digital platforms offer convenience and often lower fees compared to traditional brick-and-mortar locations, attracting a wider range of users. However, challenges remain, particularly in terms of regulatory compliance and combating fraudulent activities. The market is characterized by a diverse range of players, from large national chains to smaller, localized businesses. Competition is fierce, pushing providers to innovate and offer value-added services to retain customers. The shift towards digital platforms is reshaping the competitive landscape, requiring traditional businesses to adapt or risk losing market share. The overall trend points towards continued growth, but with a significant focus on technological integration and customer experience to stay competitive and cater to evolving consumer needs. This expansion will particularly benefit those regions with larger proportions of unbanked populations and areas with limited access to traditional banking services.

Driving Forces: What's Propelling the Check Cashing Service

Several key factors are driving the expansion of the check cashing service market. The persistently high number of unbanked and underbanked individuals globally remains a significant driver. These individuals lack access to traditional banking services and rely on check cashing businesses to access their funds. The increasing prevalence of prepaid debit cards, often used in conjunction with check cashing services, further fuels market growth. These cards provide a convenient alternative to traditional bank accounts for managing funds. Furthermore, the growth of the gig economy and the rise of independent contractors have increased the demand for flexible financial solutions, as these individuals often receive payments via checks. The ongoing advancements in technology, particularly the development of mobile check cashing applications, are simplifying the process and enhancing accessibility for consumers. These apps often offer faster processing times, lower fees, and increased convenience compared to traditional methods. Finally, government initiatives aimed at financial inclusion are indirectly supporting the market's growth by encouraging greater access to financial services, even if not through traditional banking channels.

Challenges and Restraints in Check Cashing Service

Despite the market's growth potential, several challenges hinder its expansion. Stringent regulatory compliance requirements, including anti-money laundering (AML) and know-your-customer (KYC) regulations, increase operational costs and complexity for businesses. The high cost of compliance and the risk of penalties for non-compliance can significantly impact profitability. Competition is intense, with both established players and emerging fintech companies vying for market share. This competitive pressure often results in price wars and reduced profit margins. Fraudulent activities, such as check forgery and identity theft, pose a significant risk to both businesses and consumers, requiring robust security measures and increased vigilance. Concerns about high fees charged by some check cashing services continue to be a deterrent for some consumers, particularly those who could potentially access traditional banking services. Finally, the evolving technological landscape requires continuous investment in infrastructure and technology to stay competitive and meet customer expectations.

Key Region or Country & Segment to Dominate the Market

Segment Domination: The Payroll Check segment is poised to dominate the market over the forecast period. The consistent and predictable nature of payroll checks provides a stable revenue stream for check cashing businesses. Furthermore, the widespread use of payroll checks, particularly among lower-income individuals and those employed in sectors with limited access to direct deposit, fuels the high demand within this segment. Growth in the gig economy, where many workers receive payments via check, further strengthens this segment's dominance. The Personal Application segment also holds substantial market share as individuals frequently use check cashing services for personal financial management, especially those without traditional banking accounts.

Regional Domination: Regions with high percentages of the unbanked or underbanked population are predicted to experience the most significant market growth. This could include certain developing nations or underserved areas within developed countries. These areas often lack access to traditional banking services, making check cashing services essential for financial inclusion. Factors such as lower average income levels and limited financial literacy in specific geographic areas further contribute to the concentration of check cashing services. Moreover, government regulations and incentives in certain regions can either stimulate or impede the growth of the check cashing service market.

The combination of consistent payroll check usage and the significant unbanked/underbanked populations in specific geographical locations creates a synergistic effect, boosting the overall market share of this segment and driving growth in specific regions.

Growth Catalysts in Check Cashing Service Industry

The increasing adoption of mobile check cashing apps, along with government initiatives aimed at promoting financial inclusion, are key catalysts for growth. These digital platforms offer increased convenience, faster processing, and often lower fees compared to traditional methods. Furthermore, initiatives promoting financial literacy and access to banking services, while seemingly contradictory, inadvertently support the check cashing sector by providing a stepping stone to more formal financial management for a segment of the population. This growth also benefits from the continued prevalence of checks as a payment method, particularly in sectors with less access to digital payment systems.

Leading Players in the Check Cashing Service

- Ocwen Financial Corporation

- Encore Capital Group

- Black Knight

- PHH Corporation

- Oaktree Capital Management

- QCHI

- Film Finances

- Currency Exchange International Corp

- Harrison Vickers

- Waterman

Significant Developments in Check Cashing Service Sector

- 2020: Increased adoption of mobile check cashing apps due to the COVID-19 pandemic.

- 2021: Several regulatory changes impacting fee structures and compliance requirements.

- 2022: Expansion of partnerships between check cashing services and fintech companies.

- 2023: Launch of new innovative solutions focusing on customer experience and security.

Comprehensive Coverage Check Cashing Service Report

This report provides a comprehensive analysis of the check cashing service market, covering market size, growth trends, key drivers, challenges, and competitive landscape. It delves into specific segments, analyzing regional variations and highlighting key players. The report also offers valuable insights into future market developments and provides actionable strategies for stakeholders. This detailed examination offers a complete picture of the opportunities and challenges in this dynamic market.

Check Cashing Service Segmentation

-

1. Type

- 1.1. Pre-Printed Check

- 1.2. Payroll Check

- 1.3. Government Check

- 1.4. Others

-

2. Application

- 2.1. Personal

- 2.2. Company

Check Cashing Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Check Cashing Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Table Of Content

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Check Cashing Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pre-Printed Check

- 5.1.2. Payroll Check

- 5.1.3. Government Check

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal

- 5.2.2. Company

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Check Cashing Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pre-Printed Check

- 6.1.2. Payroll Check

- 6.1.3. Government Check

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Personal

- 6.2.2. Company

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Check Cashing Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pre-Printed Check

- 7.1.2. Payroll Check

- 7.1.3. Government Check

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Personal

- 7.2.2. Company

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Check Cashing Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pre-Printed Check

- 8.1.2. Payroll Check

- 8.1.3. Government Check

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Personal

- 8.2.2. Company

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Check Cashing Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pre-Printed Check

- 9.1.2. Payroll Check

- 9.1.3. Government Check

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Personal

- 9.2.2. Company

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Check Cashing Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Pre-Printed Check

- 10.1.2. Payroll Check

- 10.1.3. Government Check

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Personal

- 10.2.2. Company

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ocwen Financial Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Encore Capital Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Black Knight

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PHH Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Oaktree Capital Management

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 QCHI

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Film Finances

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Currency Exchange International Corp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Harrison Vickers

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Waterman

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Ocwen Financial Corporation

List of Figures

- Figure 1: Global Check Cashing Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Check Cashing Service Revenue (million), by Type 2024 & 2032

- Figure 3: North America Check Cashing Service Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Check Cashing Service Revenue (million), by Application 2024 & 2032

- Figure 5: North America Check Cashing Service Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Check Cashing Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Check Cashing Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Check Cashing Service Revenue (million), by Type 2024 & 2032

- Figure 9: South America Check Cashing Service Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Check Cashing Service Revenue (million), by Application 2024 & 2032

- Figure 11: South America Check Cashing Service Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Check Cashing Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Check Cashing Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Check Cashing Service Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Check Cashing Service Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Check Cashing Service Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Check Cashing Service Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Check Cashing Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Check Cashing Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Check Cashing Service Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Check Cashing Service Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Check Cashing Service Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Check Cashing Service Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Check Cashing Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Check Cashing Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Check Cashing Service Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Check Cashing Service Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Check Cashing Service Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Check Cashing Service Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Check Cashing Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Check Cashing Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Check Cashing Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Check Cashing Service Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Check Cashing Service Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Check Cashing Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Check Cashing Service Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Check Cashing Service Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Check Cashing Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Check Cashing Service Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Check Cashing Service Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Check Cashing Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Check Cashing Service Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Check Cashing Service Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Check Cashing Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Check Cashing Service Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Check Cashing Service Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Check Cashing Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Check Cashing Service Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Check Cashing Service Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Check Cashing Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Check Cashing Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Top-down and bottom-up approaches are used to validate the global market size and estimate the market size for manufactures, regional segemnts, product and application.

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Additionally after gathering mix and scattered data from wide range of sources, data is triangull- ated and correlated to come up with estimated figures which are further validated through primary mediums, or industry experts, opinion leader.

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.