Cloud Native Container Service

Cloud Native Container ServiceCloud Native Container Service Unlocking Growth Potential: Analysis and Forecasts 2025-2033

Cloud Native Container Service by Application (Financial Industry, Manufacturing, Business Services, Retail, Science And Technology, Other), by Type (Container Orchestration Service, Container Instance Service, Container Security Service, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Base Year: 2024

128 Pages

Key Insights

The cloud native container service market is experiencing robust growth, driven by the increasing adoption of microservices architecture, the need for enhanced application portability and scalability, and the imperative to optimize DevOps processes. The market, estimated at $15 billion in 2025, is projected to expand significantly over the next decade, fueled by a Compound Annual Growth Rate (CAGR) of 25% from 2025 to 2033. This growth is underpinned by several key factors: the rising popularity of container orchestration platforms like Kubernetes, which streamline container management and deployment; the surge in demand for container security services to mitigate vulnerabilities and protect sensitive data within containerized environments; and the expanding adoption of cloud-native technologies across diverse industries, including finance, manufacturing, and retail. Companies are increasingly migrating their applications to cloud-native architectures to leverage the benefits of agility, cost efficiency, and improved resource utilization.

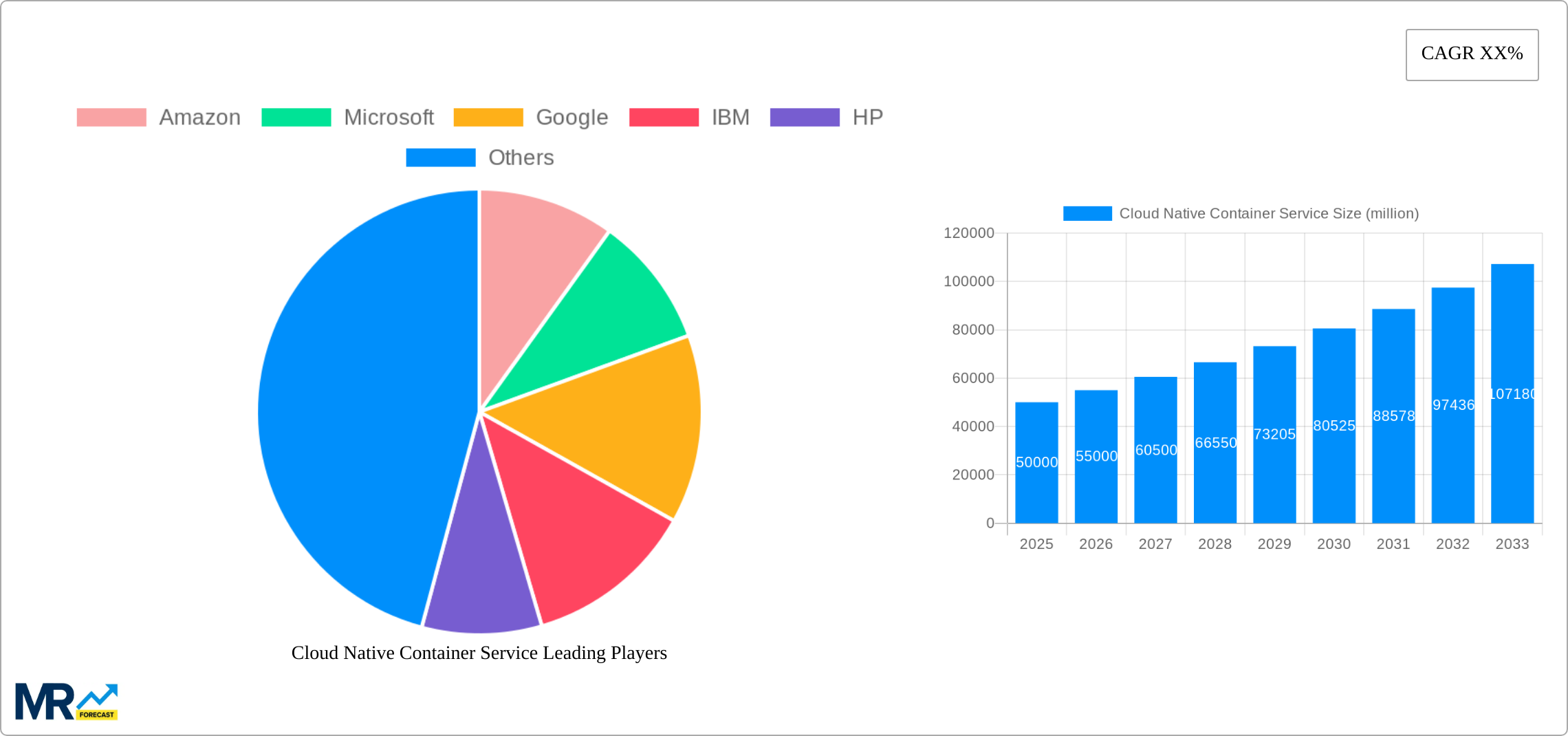

The market segmentation reveals a diverse landscape. Container orchestration services currently dominate the market, reflecting the critical role these platforms play in managing complex containerized deployments. However, the container instance and security service segments are also exhibiting strong growth, driven by the increasing focus on application security and the need for efficient, isolated container execution environments. Geographically, North America and Europe currently hold the largest market shares, though the Asia-Pacific region is expected to witness the fastest growth rate, driven by the rapid digital transformation underway in countries like China and India. Key players in this competitive market include established cloud providers like Amazon, Microsoft, and Google, along with specialized container technology vendors like Docker and Red Hat. These companies are continuously innovating to offer advanced solutions that address the evolving needs of businesses embracing cloud-native technologies. Future growth will be shaped by advancements in serverless computing, edge computing, and AI-powered container management tools.

Cloud Native Container Service Trends

The global cloud native container service market exhibited robust growth during the historical period (2019-2024), exceeding USD 100 million in revenue by 2024. This upward trajectory is projected to continue throughout the forecast period (2025-2033), with estimations indicating market value surpassing USD 500 million by 2033. Key market insights reveal a strong preference for container orchestration services, driven by the increasing complexity of microservices-based applications and the need for efficient management of containerized workloads. The financial industry and the science and technology sectors are leading adopters, leveraging cloud-native container services to enhance agility, scalability, and security. However, the market also faces challenges, including security concerns, the need for skilled professionals, and the complexity of integrating cloud-native technologies into existing infrastructure. The growth is further fueled by the continuous innovation in container technologies, the expanding ecosystem of tools and services, and the rising adoption of hybrid and multi-cloud strategies. Major players are aggressively investing in research and development, expanding their service offerings, and forming strategic partnerships to maintain a competitive edge in this rapidly evolving market. Geographic expansion, particularly in Asia-Pacific regions experiencing high growth rates, represents a major driver of overall market value. The rise of serverless computing and edge computing is expected to significantly impact the future development and adoption of cloud-native container services, shaping their application across various industry segments.

Driving Forces: What's Propelling the Cloud Native Container Service

Several factors are fueling the rapid growth of the cloud native container service market. The increasing adoption of microservices architecture, which allows for faster development cycles and easier scaling, is a key driver. Organizations are seeking improved application deployment speed and efficiency, leading to a greater reliance on containerization technologies. The inherent scalability and flexibility of cloud-native environments allow businesses to efficiently handle fluctuating workloads and reduce infrastructure costs. The rise of DevOps practices and CI/CD pipelines further contributes to this trend, as containerization seamlessly integrates with these processes. Enhanced security features offered by container platforms, including image scanning, access control, and network security, are also attracting organizations seeking to improve their security posture. Furthermore, the growing availability of managed container services from major cloud providers simplifies deployment and management, making it more accessible to a wider range of businesses. This combined effect of technological advancements, operational efficiencies, and improved security is significantly contributing to the market's rapid expansion.

Challenges and Restraints in Cloud Native Container Service

Despite its rapid growth, the cloud native container service market faces certain challenges. Security remains a major concern, with potential vulnerabilities in container images and the orchestration layer posing risks. The need for skilled professionals with expertise in containerization and cloud-native technologies presents a significant hurdle for many organizations. Integrating cloud-native services with existing legacy systems can be complex and costly, requiring substantial effort and planning. The operational complexity of managing containerized environments, particularly at scale, can be overwhelming for some businesses. Furthermore, vendor lock-in is a potential concern, as organizations might become dependent on a specific cloud provider's services. Cost optimization, balancing the benefits of cloud-native technologies with cost-effective solutions, is another significant challenge. Finally, regulatory compliance requirements in specific industries may impact the adoption of certain cloud-native practices. Overcoming these challenges will be crucial for sustained market growth.

Key Region or Country & Segment to Dominate the Market

The North American region is expected to maintain its dominant position in the cloud native container service market throughout the forecast period, driven by high technology adoption rates, robust cloud infrastructure, and a large number of early adopters among enterprises. However, the Asia-Pacific region is poised for significant growth, fueled by the increasing adoption of cloud technologies in rapidly developing economies like China and India.

Dominant Segments:

Container Orchestration Service: This segment is projected to hold the largest market share throughout the forecast period due to the increasing demand for efficient management and scaling of containerized applications. The need for robust tools to manage complex deployments drives demand in this space. The ease of scaling applications and increased operational efficiency provided by orchestration systems are key drivers of growth. Kubernetes, in particular, is a dominant force within this segment, given its open-source nature and broad industry adoption.

Financial Industry Application: This sector is witnessing rapid adoption due to its need for high scalability, reliability, and security. Financial institutions are increasingly embracing microservices architecture and containerization to improve their applications' speed, efficiency, and resilience, leading to significant investment in cloud native container services. The need for robust security measures further drives the adoption in this critical sector.

Science and Technology: This sector consistently pushes boundaries in technology adoption, making cloud-native container services a crucial enabler for their rapid development cycles and flexible infrastructure needs. Research and development projects, data analytics initiatives, and AI/ML applications significantly contribute to the demand within this segment.

The combined influence of these factors—geographic concentration, technological preference, and specific industry needs—shapes the overall dynamics of the cloud native container service market, leading to substantial market growth in specific areas while driving the need for adaptation and innovation.

Growth Catalysts in Cloud Native Container Service Industry

The market's expansion is fueled by several key factors, including the increasing adoption of microservices architectures, which promotes agility and scalability. The rise of DevOps practices and CI/CD pipelines simplifies deployment and management. Growing demand for improved application security and enhanced cost efficiency further accelerates market growth. The expanding ecosystem of tools and services supporting cloud-native container solutions provides businesses with more options and flexibility.

Leading Players in the Cloud Native Container Service

- Amazon

- Microsoft

- IBM

- HP

- Accenture

- Cisco Systems

- Vmware

- Docker

- Pivotal

- Red Hat

- Baidu

- Huawei

- Tencent

- Alibaba

- JD

- Ucloud

Significant Developments in Cloud Native Container Service Sector

- 2020: Kubernetes 1.18 released with enhanced security and scalability features.

- 2021: Increased adoption of serverless container platforms.

- 2022: Major cloud providers announce new managed container services with improved security and cost optimization capabilities.

- 2023: Focus on integrating AI/ML capabilities within container platforms.

- 2024: Growing adoption of container security solutions to address vulnerabilities and compliance requirements.

Comprehensive Coverage Cloud Native Container Service Report

This report provides a comprehensive overview of the cloud native container service market, encompassing historical data, current market trends, and future projections. It analyzes key market drivers, challenges, and growth opportunities, along with detailed segment analysis and competitive landscape information. The report offers valuable insights for businesses, investors, and industry professionals seeking to understand and participate in this dynamic market.

Cloud Native Container Service Segmentation

-

1. Application

- 1.1. Financial Industry

- 1.2. Manufacturing

- 1.3. Business Services

- 1.4. Retail

- 1.5. Science And Technology

- 1.6. Other

-

2. Type

- 2.1. Container Orchestration Service

- 2.2. Container Instance Service

- 2.3. Container Security Service

- 2.4. Other

Cloud Native Container Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cloud Native Container Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Table Of Content

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Native Container Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Financial Industry

- 5.1.2. Manufacturing

- 5.1.3. Business Services

- 5.1.4. Retail

- 5.1.5. Science And Technology

- 5.1.6. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Container Orchestration Service

- 5.2.2. Container Instance Service

- 5.2.3. Container Security Service

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cloud Native Container Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Financial Industry

- 6.1.2. Manufacturing

- 6.1.3. Business Services

- 6.1.4. Retail

- 6.1.5. Science And Technology

- 6.1.6. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Container Orchestration Service

- 6.2.2. Container Instance Service

- 6.2.3. Container Security Service

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cloud Native Container Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Financial Industry

- 7.1.2. Manufacturing

- 7.1.3. Business Services

- 7.1.4. Retail

- 7.1.5. Science And Technology

- 7.1.6. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Container Orchestration Service

- 7.2.2. Container Instance Service

- 7.2.3. Container Security Service

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cloud Native Container Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Financial Industry

- 8.1.2. Manufacturing

- 8.1.3. Business Services

- 8.1.4. Retail

- 8.1.5. Science And Technology

- 8.1.6. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Container Orchestration Service

- 8.2.2. Container Instance Service

- 8.2.3. Container Security Service

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cloud Native Container Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Financial Industry

- 9.1.2. Manufacturing

- 9.1.3. Business Services

- 9.1.4. Retail

- 9.1.5. Science And Technology

- 9.1.6. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Container Orchestration Service

- 9.2.2. Container Instance Service

- 9.2.3. Container Security Service

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cloud Native Container Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Financial Industry

- 10.1.2. Manufacturing

- 10.1.3. Business Services

- 10.1.4. Retail

- 10.1.5. Science And Technology

- 10.1.6. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Container Orchestration Service

- 10.2.2. Container Instance Service

- 10.2.3. Container Security Service

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Amazon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Microsoft

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Google

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HP

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Accenture

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cisco Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vmware

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Docker

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pivotal

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Red Hat

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Baidu

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Huawei

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Tencent

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ali

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 JD

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Ucloud

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Amazon

List of Figures

- Figure 1: Global Cloud Native Container Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cloud Native Container Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cloud Native Container Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cloud Native Container Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Cloud Native Container Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Cloud Native Container Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cloud Native Container Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cloud Native Container Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cloud Native Container Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cloud Native Container Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Cloud Native Container Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Cloud Native Container Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cloud Native Container Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cloud Native Container Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cloud Native Container Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cloud Native Container Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Cloud Native Container Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Cloud Native Container Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cloud Native Container Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cloud Native Container Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cloud Native Container Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cloud Native Container Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Cloud Native Container Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Cloud Native Container Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cloud Native Container Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cloud Native Container Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cloud Native Container Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cloud Native Container Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Cloud Native Container Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Cloud Native Container Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cloud Native Container Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cloud Native Container Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cloud Native Container Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cloud Native Container Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Cloud Native Container Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cloud Native Container Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cloud Native Container Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Cloud Native Container Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cloud Native Container Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cloud Native Container Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Cloud Native Container Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cloud Native Container Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cloud Native Container Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Cloud Native Container Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cloud Native Container Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cloud Native Container Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Cloud Native Container Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cloud Native Container Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cloud Native Container Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Cloud Native Container Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cloud Native Container Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Top-down and bottom-up approaches are used to validate the global market size and estimate the market size for manufactures, regional segemnts, product and application.

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Additionally after gathering mix and scattered data from wide range of sources, data is triangull- ated and correlated to come up with estimated figures which are further validated through primary mediums, or industry experts, opinion leader.

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.