Cloud Security Monitoring and Analytics Tool

Cloud Security Monitoring and Analytics ToolCloud Security Monitoring and Analytics Tool 2025-2033 Trends: Unveiling Growth Opportunities and Competitor Dynamics

Cloud Security Monitoring and Analytics Tool by Type (Cloud -Based, Web-based), by Application (Large EnterPrises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

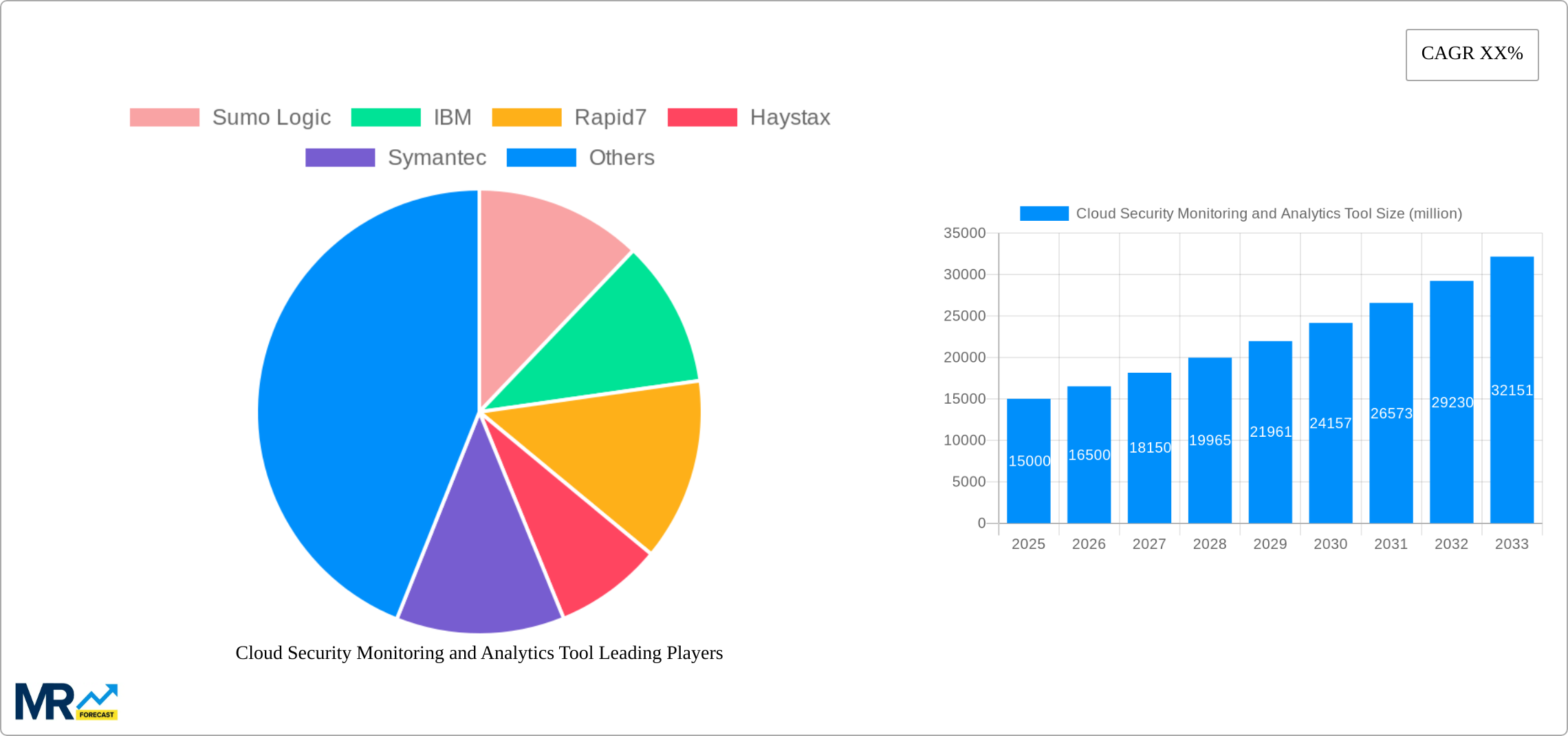

The Cloud Security Monitoring and Analytics Tool market is experiencing robust growth, driven by the increasing adoption of cloud computing and the rising need for robust security solutions to mitigate escalating cyber threats. The market, estimated at $15 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching approximately $45 billion by 2033. This expansion is fueled by several key factors, including the proliferation of sophisticated cyberattacks targeting cloud environments, stringent government regulations demanding enhanced data security, and the growing preference for cloud-based security solutions offering scalability and cost-effectiveness. The market is segmented by deployment type (cloud-based and web-based) and target user (large enterprises and SMEs), with cloud-based solutions dominating due to their inherent flexibility and accessibility. Large enterprises are currently the primary adopters, but increasing cyber awareness and digital transformation initiatives are driving significant growth amongst SMEs. Geographical distribution shows a strong concentration in North America, followed by Europe and Asia Pacific, reflecting the higher adoption rates of cloud technologies in these regions. However, emerging economies in Asia Pacific and Middle East & Africa are presenting significant untapped potential. Restraints to market growth include the complexity of implementing and managing these tools, the shortage of skilled cybersecurity professionals, and concerns about data privacy and compliance.

Competitive landscape analysis reveals a mix of established players like IBM, Symantec, and McAfee, alongside emerging specialized vendors such as Sumo Logic, Rapid7, and Securonix. The market is characterized by continuous innovation, with vendors focusing on enhancing their offerings through advanced threat detection capabilities, AI-powered analytics, and improved integration with existing security infrastructure. Future growth will likely be shaped by the increasing adoption of cloud-native security solutions, the rise of serverless computing, and the expanding use of security orchestration, automation, and response (SOAR) technologies. The market's evolution will necessitate vendors to adapt to evolving threat landscapes, prioritize user-friendliness, and offer cost-effective and scalable solutions to cater to the diverse needs of various organizations.

Cloud Security Monitoring and Analytics Tool Trends

The global cloud security monitoring and analytics tool market is experiencing explosive growth, projected to reach multi-billion-dollar valuations by 2033. This surge is driven by the accelerating adoption of cloud computing across all industry sectors, from small and medium-sized enterprises (SMEs) to large enterprises. The historical period (2019-2024) witnessed a steady increase in market size, laying the foundation for the significant expansion predicted during the forecast period (2025-2033). The estimated market value for 2025 signifies a crucial milestone, showcasing the market's maturity and the increasing sophistication of security solutions demanded by organizations. Key market insights reveal a strong preference for cloud-based solutions, offering scalability and ease of management. The demand for integrated platforms that combine monitoring, analytics, and threat response capabilities is also significant. Furthermore, the increasing complexity of cyber threats and the growing regulatory pressures surrounding data security are fueling the demand for robust and comprehensive cloud security monitoring and analytics tools. The market is seeing a shift towards artificial intelligence (AI) and machine learning (ML)-powered solutions that can automate threat detection and response, improving efficiency and reducing the burden on security teams. This is driving significant innovation within the market, leading to the emergence of specialized tools addressing specific cloud environments and security concerns. The competitive landscape is dynamic, with established players and new entrants vying for market share. This competition is ultimately beneficial for end-users, leading to improved product offerings and more competitive pricing. The market’s evolution is also marked by a growing awareness among organizations regarding the importance of proactive security measures, transitioning from reactive approaches to a more predictive and preventive security posture.

Driving Forces: What's Propelling the Cloud Security Monitoring and Analytics Tool Market?

Several factors are propelling the growth of the cloud security monitoring and analytics tool market. The ever-increasing sophistication and frequency of cyberattacks are a primary driver. Organizations are increasingly reliant on cloud services, making them vulnerable to a wider range of threats. This necessitates the adoption of sophisticated tools capable of detecting and responding to these threats in real-time. Furthermore, the stringent regulatory compliance requirements, such as GDPR and CCPA, are forcing organizations to invest heavily in robust security measures to protect sensitive data and avoid hefty penalties. The growing adoption of cloud-native applications and microservices architectures also contributes to the demand for specialized monitoring and analytics tools. These architectures introduce new security challenges that require dedicated solutions. The rise of cloud-based infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS) offerings is another key driver, as organizations need tools to secure their diverse cloud deployments effectively. Finally, the increasing adoption of DevOps and Agile methodologies is driving the need for integrated security solutions that can seamlessly integrate with development workflows. This trend demands automated security monitoring and continuous integration/continuous deployment (CI/CD) pipeline security.

Challenges and Restraints in Cloud Security Monitoring and Analytics Tool Market

Despite the significant growth potential, the cloud security monitoring and analytics tool market faces several challenges. The complexity of cloud environments presents a significant hurdle, as organizations often struggle to gain a holistic view of their security posture across multiple cloud platforms. Integrating security tools across different cloud environments can be difficult and time-consuming, requiring specialized expertise. The sheer volume of data generated by cloud environments necessitates efficient data processing and analysis capabilities, posing a significant technological challenge. Furthermore, the skills gap in cybersecurity remains a major constraint, limiting the ability of organizations to effectively manage and interpret security data. Finding and retaining skilled cybersecurity professionals to manage and interpret the insights generated by these tools is often difficult and expensive. The cost of implementing and maintaining these sophisticated tools can also be prohibitive for some organizations, particularly SMEs. Finally, the constant evolution of cyber threats necessitates continuous updates and improvements to security tools, leading to ongoing costs and potential disruptions.

Key Region or Country & Segment to Dominate the Market

The North American market is expected to dominate the cloud security monitoring and analytics tool market throughout the forecast period (2025-2033), driven by high cloud adoption rates, robust technological infrastructure, and a significant concentration of large enterprises. Europe is also anticipated to experience substantial growth, fueled by stringent data privacy regulations like GDPR and the increasing digitalization of businesses. Asia-Pacific is projected to witness significant growth, primarily driven by countries like China and India, characterized by rapidly expanding cloud adoption and digital transformation initiatives.

Large Enterprises: This segment will dominate due to their higher budgets, greater complexity of IT infrastructure, and increased regulatory compliance requirements. Large organizations often have extensive cloud deployments requiring robust security solutions. They typically invest heavily in sophisticated tools capable of managing and analyzing the vast amount of security data generated across their multiple cloud environments. They often have dedicated security teams with the necessary skills and expertise to manage such systems.

Cloud-Based Solutions: The preference for cloud-based solutions is a dominant trend. This is due to their scalability, ease of deployment, and cost-effectiveness compared to on-premise alternatives. These solutions are highly flexible and can adapt to the changing needs of an organization, ensuring that security measures always remain relevant. Cloud-based tools often integrate seamlessly with other cloud services and can provide a unified security management platform.

The global distribution of cloud computing adoption across various regions and the preference for cloud-based solutions paint a clear picture of market dominance, with the North American market leading the charge and large enterprises spearheading adoption, closely followed by the cloud-based solution segment.

Growth Catalysts in Cloud Security Monitoring and Analytics Tool Industry

The increasing adoption of AI and ML in security analytics is a major growth catalyst. These technologies enable automated threat detection, faster response times, and improved accuracy, making security operations significantly more efficient. The expanding use of hybrid cloud environments is also driving growth, as organizations require tools that can manage security across multiple cloud platforms and on-premise infrastructure. The growing awareness of security risks and regulatory compliance pressures are forcing organizations to invest in better security, fueling market growth.

Leading Players in the Cloud Security Monitoring and Analytics Tool Market

- Sumo Logic

- IBM

- Rapid7

- Haystax

- Symantec (Broadcom)

- Aviatrix

- McAfee

- Argent

- BMC Software

- Varonis

- Check Point Software Technologies

- Compaas

- Coronet

- Enzoic

- Gurucul

- Hillstone Networks

- Huntsman Security

- Securonix

- Threat Stack

Significant Developments in Cloud Security Monitoring and Analytics Tool Sector

- 2020: Increased adoption of cloud-native security solutions.

- 2021: Significant investment in AI and ML-powered security analytics.

- 2022: Growing adoption of extended detection and response (XDR) solutions.

- 2023: Focus on securing multi-cloud environments.

- 2024: Rise of cloud security posture management (CSPM) tools.

Comprehensive Coverage Cloud Security Monitoring and Analytics Tool Report

This report provides a comprehensive overview of the cloud security monitoring and analytics tool market, including detailed analysis of market trends, growth drivers, challenges, and leading players. It offers valuable insights into the key market segments and regions, providing a strategic roadmap for businesses operating within this rapidly evolving sector. The report includes detailed forecasts for the market's future growth, helping stakeholders make informed decisions regarding investment, product development, and market strategy.

Cloud Security Monitoring and Analytics Tool Segmentation

-

1. Type

- 1.1. Cloud -Based

- 1.2. Web-based

-

2. Application

- 2.1. Large EnterPrises

- 2.2. SMEs

Cloud Security Monitoring and Analytics Tool Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cloud Security Monitoring and Analytics Tool REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cloud -Based

- 5.1.2. Web-based

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Large EnterPrises

- 5.2.2. SMEs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cloud -Based

- 6.1.2. Web-based

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Large EnterPrises

- 6.2.2. SMEs

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cloud -Based

- 7.1.2. Web-based

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Large EnterPrises

- 7.2.2. SMEs

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cloud -Based

- 8.1.2. Web-based

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Large EnterPrises

- 8.2.2. SMEs

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cloud -Based

- 9.1.2. Web-based

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Large EnterPrises

- 9.2.2. SMEs

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cloud -Based

- 10.1.2. Web-based

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Large EnterPrises

- 10.2.2. SMEs

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sumo Logic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rapid7

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Haystax

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Symantec

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aviatrix

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 McAfee

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Argent

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BMC Software

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Varonis

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Check Point Software Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Compaas

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Coronet

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Enzoic

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Gurucul

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Hillstone Networks

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Huntsman Security

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Securonix

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Threat Stack

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Sumo Logic

- Figure 1: Global Cloud Security Monitoring and Analytics Tool Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cloud Security Monitoring and Analytics Tool Revenue (million), by Type 2024 & 2032

- Figure 3: North America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Cloud Security Monitoring and Analytics Tool Revenue (million), by Application 2024 & 2032

- Figure 5: North America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Cloud Security Monitoring and Analytics Tool Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cloud Security Monitoring and Analytics Tool Revenue (million), by Type 2024 & 2032

- Figure 9: South America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Cloud Security Monitoring and Analytics Tool Revenue (million), by Application 2024 & 2032

- Figure 11: South America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Cloud Security Monitoring and Analytics Tool Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cloud Security Monitoring and Analytics Tool Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Cloud Security Monitoring and Analytics Tool Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Cloud Security Monitoring and Analytics Tool Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.