Cloud Security Monitoring and Analytics Tool

Cloud Security Monitoring and Analytics ToolCloud Security Monitoring and Analytics Tool 2025-2033 Analysis: Trends, Competitor Dynamics, and Growth Opportunities

Cloud Security Monitoring and Analytics Tool by Type (Cloud -Based, Web-based), by Application (Large EnterPrises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The Cloud Security Monitoring and Analytics Tool market is experiencing robust growth, driven by the increasing adoption of cloud technologies and the rising need for enhanced cybersecurity measures. The market's expansion is fueled by several key factors, including the proliferation of cloud-based applications and services across various industries, a surge in sophisticated cyberattacks targeting cloud environments, and stringent regulatory compliance requirements demanding robust security monitoring. The market is segmented by deployment type (cloud-based and web-based) and by target user (large enterprises and SMEs). Cloud-based solutions dominate the market due to their scalability, flexibility, and ease of integration with existing cloud infrastructures. Large enterprises are the primary consumers, given their extensive cloud deployments and higher budgets for security investments. However, the SME segment is showing significant growth potential as cloud adoption increases within these organizations.

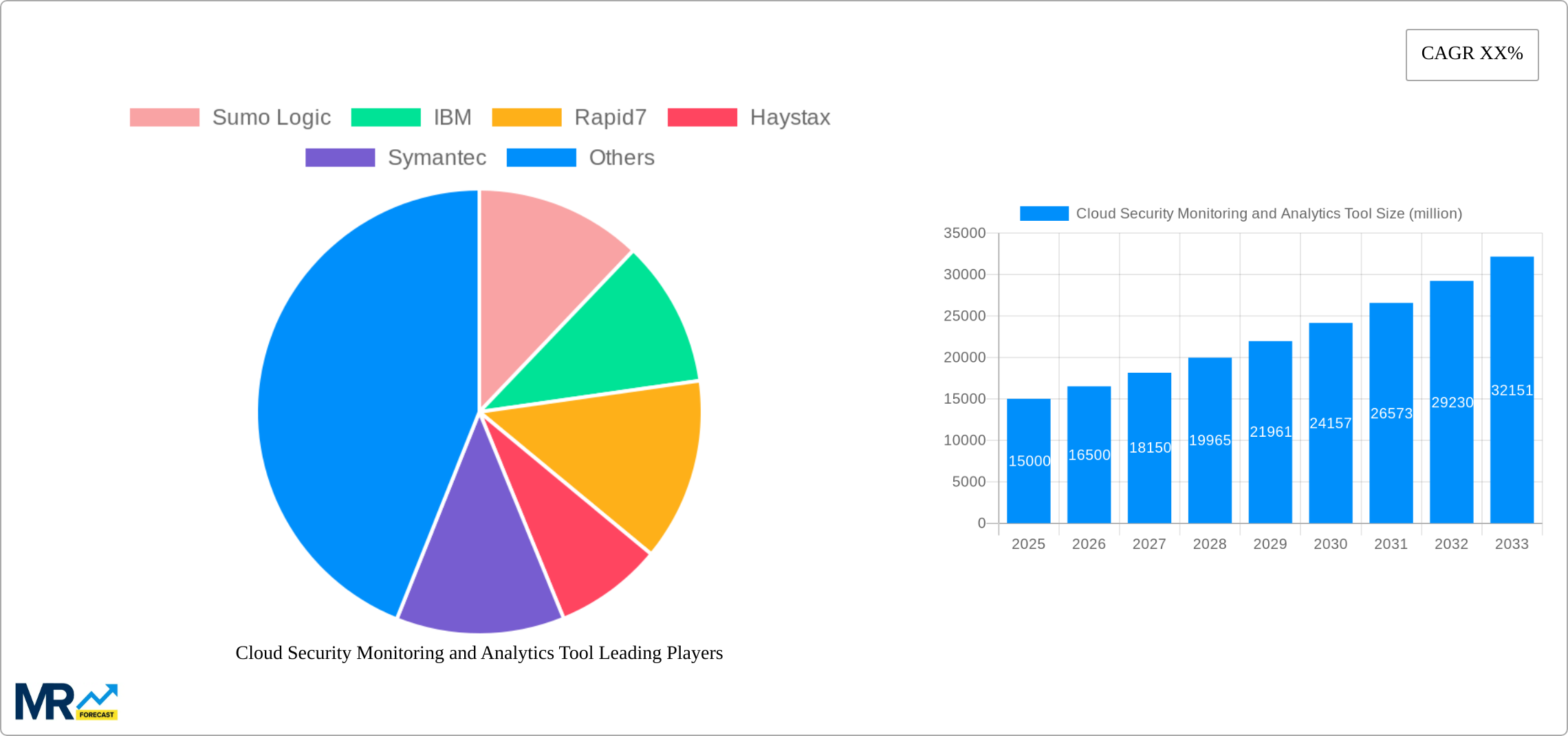

Competitive dynamics are intense, with a range of established players and emerging vendors vying for market share. Major players like IBM, Symantec, and McAfee leverage their existing security expertise and extensive customer base to maintain a leading position. However, agile startups and specialized vendors are also making significant inroads, particularly in niche areas like threat detection and response. Geographic distribution reveals that North America currently holds the largest market share, due to high cloud adoption rates and a robust cybersecurity infrastructure. However, regions like Asia Pacific and Europe are exhibiting strong growth trajectories, driven by increasing digitalization and government initiatives promoting cybersecurity awareness and regulation. Future growth will be influenced by continued technological advancements in areas such as artificial intelligence (AI) and machine learning (ML) for threat detection, and the rising adoption of cloud-native security solutions. The market is expected to witness sustained growth over the forecast period (2025-2033) due to these ongoing trends.

Cloud Security Monitoring and Analytics Tool Trends

The global cloud security monitoring and analytics tool market is experiencing explosive growth, projected to reach several billion dollars by 2033. The study period from 2019 to 2033 reveals a consistent upward trajectory, with significant acceleration expected during the forecast period (2025-2033). The base year of 2025 marks a critical juncture, representing a substantial market size already in the multi-million dollar range. This growth is fueled by the increasing adoption of cloud computing across various industries, coupled with escalating cyber threats and stringent regulatory compliance requirements. Enterprises, both large and small, are increasingly recognizing the need for robust security solutions to protect their sensitive data and applications residing in the cloud. The market is characterized by intense competition among a diverse range of vendors, each offering unique features and functionalities. This competitive landscape fosters innovation, driving the development of sophisticated tools capable of detecting, analyzing, and responding to sophisticated cyber threats in real-time. The shift towards cloud-native security solutions is prominent, with a growing preference for cloud-based and web-based tools offering seamless integration and scalability. Furthermore, the market is witnessing a surge in demand for AI-powered security analytics to enhance threat detection and response capabilities. The estimated market value for 2025 signals a significant milestone, highlighting the market’s maturity and potential for further expansion in the coming years. The historical period (2019-2024) shows a steady climb, setting the stage for the impressive growth predicted in the years ahead.

Driving Forces: What's Propelling the Cloud Security Monitoring and Analytics Tool

Several key factors are propelling the growth of the cloud security monitoring and analytics tool market. The exponential rise in cloud adoption across all sectors is a primary driver, as organizations increasingly migrate their infrastructure and applications to the cloud. This transition brings with it inherent security challenges, making robust monitoring and analytics tools indispensable. The increasing sophistication and frequency of cyberattacks further fuel demand for advanced security solutions capable of detecting and responding to threats in real-time. The growing volume and complexity of data generated by cloud environments necessitate advanced analytics capabilities to effectively identify anomalies and potential security breaches. Regulatory compliance mandates, such as GDPR and CCPA, impose strict requirements on data security and privacy, compelling organizations to implement comprehensive security measures, including robust monitoring and analytics tools. Furthermore, the increasing adoption of DevOps and agile methodologies necessitates integrated security solutions that can adapt to rapidly changing environments. The cost-effectiveness of cloud-based security solutions compared to traditional on-premises systems also contributes to market growth, as organizations seek to optimize their IT budgets. Finally, the rising awareness of cybersecurity risks among businesses and consumers is driving demand for sophisticated security solutions.

Challenges and Restraints in Cloud Security Monitoring and Analytics Tool

Despite the significant growth potential, the cloud security monitoring and analytics tool market faces several challenges. The complexity of cloud environments, particularly multi-cloud and hybrid cloud deployments, presents difficulties in implementing and managing comprehensive security solutions. Integrating security tools with existing IT infrastructure can be complex and time-consuming, requiring significant expertise and resources. The lack of skilled cybersecurity professionals is a major constraint, hindering the effective deployment and management of these advanced tools. The high cost of implementation and maintenance, particularly for large enterprises, can be a deterrent for some organizations. Keeping up with the rapidly evolving threat landscape necessitates continuous updates and enhancements to security tools, adding to the overall cost. Furthermore, ensuring the accuracy and effectiveness of security analytics can be challenging, as false positives can lead to wasted resources and alert fatigue. The integration of diverse security tools and data sources into a unified platform can also be complex and require significant effort. Finally, concerns about data privacy and security compliance add an extra layer of complexity to the implementation and management of these tools.

Key Region or Country & Segment to Dominate the Market

The North American market is expected to dominate the cloud security monitoring and analytics tool market throughout the forecast period due to high cloud adoption rates and a large number of technology companies. Within this region, the United States will be a significant contributor. Similarly, Europe, driven by strong regulatory compliance mandates (GDPR, etc.) and a significant number of large enterprises, is projected to show substantial growth.

Large Enterprises: Large enterprises are the primary drivers of market growth due to their significant investments in IT infrastructure and their critical need to protect substantial amounts of sensitive data. Their complex environments often require more sophisticated tools and features, contributing to higher spending per organization.

Cloud-Based Tools: This segment is experiencing the most rapid growth due to its inherent advantages: scalability, ease of deployment and management, and seamless integration with cloud environments. The demand for cloud-native security solutions is a dominant force, further increasing this segment’s market share.

The shift towards cloud adoption is universally observed, but the speed of adoption and the level of maturity vary considerably across regions and industries. While North America and Europe currently lead, regions like Asia-Pacific are catching up rapidly, presenting significant future growth opportunities. SMEs are adopting cloud security solutions at an increasing rate, though often at a slower pace than large enterprises, owing to budgetary constraints and a smaller pool of skilled personnel. However, as the cost-effectiveness of cloud-based solutions increases and user-friendly tools emerge, SME adoption is likely to accelerate significantly. The web-based segment complements the cloud-based segment, offering organizations flexibility and accessibility regardless of location. The combined growth of cloud-based and web-based tools is anticipated to drive the overall market expansion.

Growth Catalysts in Cloud Security Monitoring and Analytics Tool Industry

The increasing adoption of cloud-based infrastructure and applications, combined with the growing sophistication and frequency of cyberattacks, is fueling demand for sophisticated security monitoring and analytics tools. Stringent data privacy regulations and the rising awareness of data security are also crucial factors driving market expansion. Furthermore, the integration of artificial intelligence and machine learning into these tools significantly enhances their effectiveness and efficiency, creating further growth opportunities.

Leading Players in the Cloud Security Monitoring and Analytics Tool

- Sumo Logic

- IBM

- Rapid7

- Haystax

- Symantec

- Aviatrix

- McAfee

- Argent

- BMC Software

- Varonis

- Check Point Software Technologies

- Compaas

- Coronet

- Enzoic

- Gurucul

- Hillstone Networks

- Huntsman Security

- Securonix

- Threat Stack

Significant Developments in Cloud Security Monitoring and Analytics Tool Sector

- 2020: Increased focus on cloud security posture management (CSPM) solutions.

- 2021: Significant advancements in AI-powered threat detection and response capabilities.

- 2022: Emergence of extended detection and response (XDR) solutions integrating various security data sources.

- 2023: Growing adoption of cloud-native security tools and serverless security solutions.

Comprehensive Coverage Cloud Security Monitoring and Analytics Tool Report

This report provides a comprehensive analysis of the cloud security monitoring and analytics tool market, covering key trends, drivers, challenges, and growth forecasts. It includes detailed profiles of leading vendors and examines significant industry developments, providing insights for businesses and investors seeking to navigate this rapidly evolving market landscape. The report also delves into various market segments, offering detailed analyses of specific regional, application-based, and tool-type market trends.

Cloud Security Monitoring and Analytics Tool Segmentation

-

1. Type

- 1.1. Cloud -Based

- 1.2. Web-based

-

2. Application

- 2.1. Large EnterPrises

- 2.2. SMEs

Cloud Security Monitoring and Analytics Tool Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cloud Security Monitoring and Analytics Tool REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Which companies are prominent players in the Cloud Security Monitoring and Analytics Tool?

Key companies in the market include Sumo Logic,IBM,Rapid7,Haystax,Symantec,Aviatrix,McAfee,Argent,BMC Software,Varonis,Check Point Software Technologies,Compaas,Coronet,Enzoic,Gurucul,Hillstone Networks,Huntsman Security,Securonix,Threat Stack,

What are the main segments of the Cloud Security Monitoring and Analytics Tool?

The market segments include

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

What are the notable trends driving market growth?

.

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

Are there any restraints impacting market growth?

.

How can I stay updated on further developments or reports in the Cloud Security Monitoring and Analytics Tool?

To stay informed about further developments, trends, and reports in the Cloud Security Monitoring and Analytics Tool, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Can you provide examples of recent developments in the market?

undefined

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cloud -Based

- 5.1.2. Web-based

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Large EnterPrises

- 5.2.2. SMEs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cloud -Based

- 6.1.2. Web-based

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Large EnterPrises

- 6.2.2. SMEs

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cloud -Based

- 7.1.2. Web-based

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Large EnterPrises

- 7.2.2. SMEs

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cloud -Based

- 8.1.2. Web-based

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Large EnterPrises

- 8.2.2. SMEs

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cloud -Based

- 9.1.2. Web-based

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Large EnterPrises

- 9.2.2. SMEs

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Cloud Security Monitoring and Analytics Tool Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cloud -Based

- 10.1.2. Web-based

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Large EnterPrises

- 10.2.2. SMEs

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sumo Logic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rapid7

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Haystax

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Symantec

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aviatrix

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 McAfee

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Argent

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BMC Software

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Varonis

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Check Point Software Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Compaas

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Coronet

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Enzoic

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Gurucul

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Hillstone Networks

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Huntsman Security

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Securonix

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Threat Stack

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Sumo Logic

- Figure 1: Global Cloud Security Monitoring and Analytics Tool Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cloud Security Monitoring and Analytics Tool Revenue (million), by Type 2024 & 2032

- Figure 3: North America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Cloud Security Monitoring and Analytics Tool Revenue (million), by Application 2024 & 2032

- Figure 5: North America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Cloud Security Monitoring and Analytics Tool Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cloud Security Monitoring and Analytics Tool Revenue (million), by Type 2024 & 2032

- Figure 9: South America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Cloud Security Monitoring and Analytics Tool Revenue (million), by Application 2024 & 2032

- Figure 11: South America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Cloud Security Monitoring and Analytics Tool Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cloud Security Monitoring and Analytics Tool Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Cloud Security Monitoring and Analytics Tool Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Cloud Security Monitoring and Analytics Tool Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Cloud Security Monitoring and Analytics Tool Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cloud Security Monitoring and Analytics Tool Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.