Coating Inspection Service

Coating Inspection ServiceCoating Inspection Service Navigating Dynamics Comprehensive Analysis and Forecasts 2025-2033

Coating Inspection Service by Type (Non-destructive Testing (NDT), Destructive Testing), by Application (Infrastructure, Transportation, Industrial Structure, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

Market Overview

The global coating inspection service market is estimated to reach a value of XXX million by 2033, growing at a CAGR of XX% from 2025 to 2033. The market is driven by the increasing demand for quality control and assurance in various industries, including infrastructure, transportation, industrial structures, and others. Key market trends include the adoption of advanced non-destructive testing (NDT) methods, the growing use of destructive testing for detailed analysis, and the emergence of digital inspection solutions.

Market Segments and Competitive Landscape

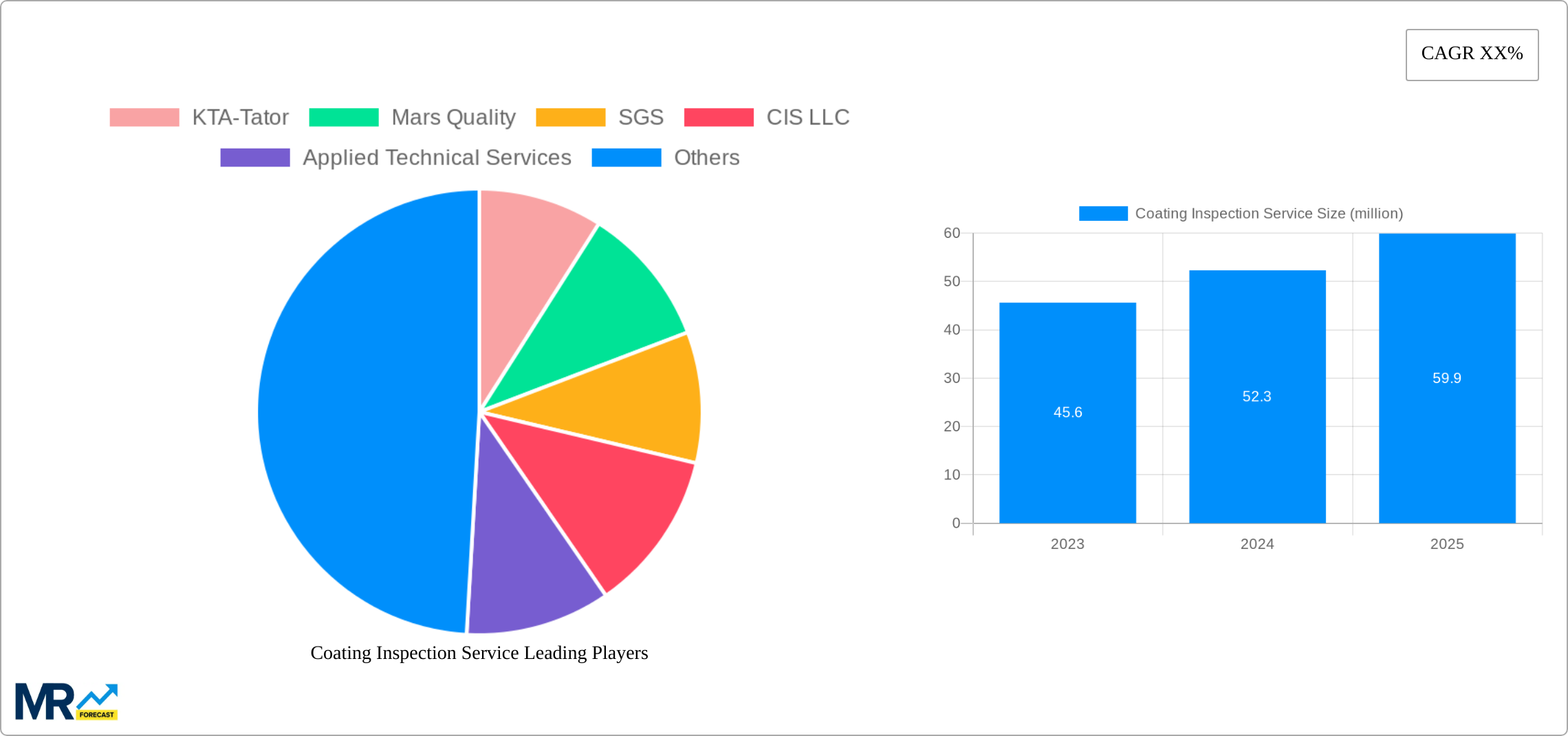

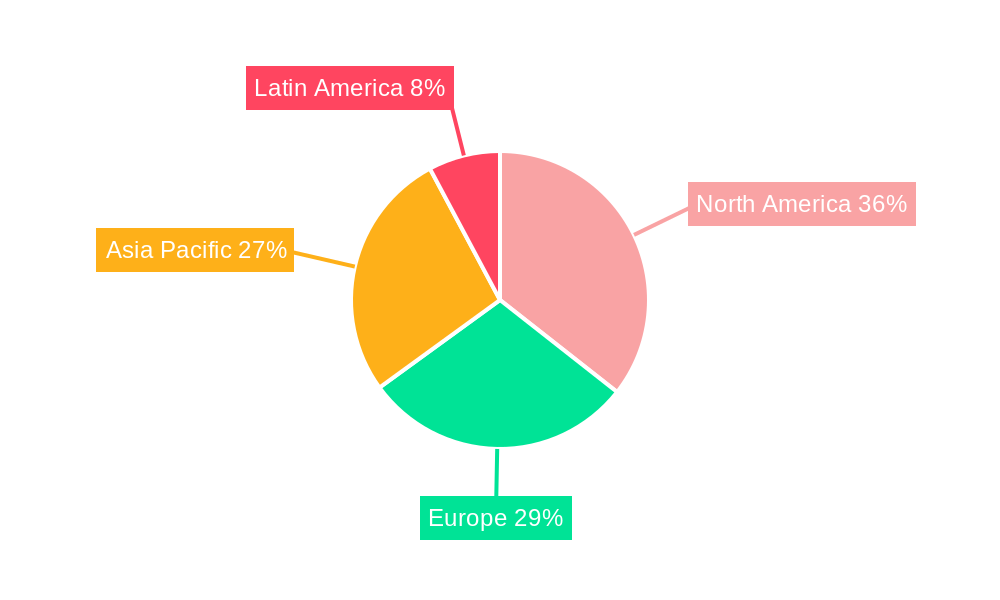

The market is segmented based on type (NDT, destructive testing), application (infrastructure, transportation, industrial structures), and region. Major market players include KTA-Tator, Mars Quality, SGS, CIS LLC, Applied Technical Services, Paint Inspection, True Inspection Services, Inspeks Coating, Coating Inspector, Quinn, Pro QC International, Dexon, Braun Intertec, Corrocoat, Site Map, Tcorr Inspection, Corrsafe, A. Morton Thomas and Associates, Inspexion, and Industry Painting. North America holds the largest market share, followed by Europe and Asia Pacific.

**Coating Inspection Service Trends**

The global coating inspection service market has been witnessing a steady rise in demand, with the market size projected to reach $5.2 billion by 2028, expanding at a CAGR of 6.1%. The increasing focus on maintaining and extending the lifespan of infrastructure and industrial structures has fueled the growth of this market. Moreover, advancements in coating technologies and the adoption of non-destructive testing methods have further propelled the demand for coating inspection services.

Key market insights include:

- Growing awareness of coating failure consequences: Recognizing the severe implications of coating failures, such as corrosion and premature deterioration, has heightened the need for regular coating inspections to ensure the integrity and performance of critical assets.

- Rising construction and infrastructure development: The booming construction and infrastructure sectors have led to increased demand for coating inspections to verify the quality and durability of protective coatings applied to structures, bridges, pipelines, and other infrastructure components.

- Stringent regulations and quality standards: Governments and regulatory bodies are enforcing stricter regulations and quality standards to ensure the safety and longevity of public infrastructure and industrial facilities. This has created a greater emphasis on coating inspection services to meet compliance requirements.

- Technological advancements in inspection techniques: The adoption of advanced non-destructive testing methods, such as ultrasonic and radiographic testing, has enhanced the accuracy and efficiency of coating inspections, allowing for early detection of defects and timely maintenance.

**Driving Forces: What's Propelling the Coating Inspection Service**

The primary driving forces fueling the growth of the coating inspection service market include:

- Rising infrastructure investment: Governments and private entities are investing heavily in infrastructure development and maintenance projects, which has created a significant demand for coating inspection services to ensure the durability and performance of newly constructed and existing structures.

- Increasing corrosion concerns: The corrosive effects of harsh environmental conditions, industrial pollutants, and chemicals pose a major threat to metal structures and other industrial assets. Coating inspections play a crucial role in identifying and mitigating corrosion risks through timely repair and maintenance measures.

- Technological advancements: The continuous advancements in coating technologies and inspection techniques have led to improved accuracy, efficiency, and reliability of coating inspections. This has made these services more effective and accessible for various industries.

- Growing awareness of coating performance: Industries are becoming increasingly aware of the importance of maintaining optimal coating performance to extend asset lifespan, prevent failures, and maximize return on investment. This has led to the increased adoption of coating inspection services.

**Challenges and Restraints in Coating Inspection Service**

Despite the promising growth prospects, the coating inspection service market faces certain challenges and restraints:

- Skilled labor shortage: The need for highly skilled and certified coating inspectors is a significant challenge for the industry. The shortage of qualified professionals can limit the availability and quality of coating inspection services.

- Accessibility and cost considerations: Accessing remote or complex structures for coating inspections can be challenging and costly. This can make it difficult for organizations to maintain regular inspection schedules and can lead to delayed maintenance or undetected coating failures.

- Environmental regulations: The use of certain coating materials and inspection techniques may be subject to stringent environmental regulations. This can add complexity and increase the cost of coating inspection services.

- Industry fluctuations: The coating inspection service market is closely tied to the construction and industrial sectors. Economic downturns or fluctuations in construction activity can impact the demand for these services.

**Key Region or Country & Segment to Dominate the Market**

The Asia-Pacific region is projected to dominate the coating inspection service market, with a market share of over 40% by 2028. Rapid industrialization, infrastructure development, and the presence of major manufacturing hubs in countries like China, India, and South Korea are contributing to this dominance.

Within the market, the non-destructive testing segment is expected to hold the largest share due to the increasing adoption of advanced non-destructive methods for coating inspections. These methods offer accurate and efficient evaluation of coating thickness, adhesion, and other parameters without damaging the coating or the underlying substrate.

**Growth Catalysts in Coating Inspection Service Industry**

Several factors are anticipated to fuel the continued growth of the coating inspection service industry:

- Government initiatives and regulations aimed at ensuring infrastructure safety and quality will stimulate demand for coating inspections.

- Technological advancements in coating materials and inspection techniques will further enhance the accuracy, efficiency, and affordability of coating inspection services.

- Increased awareness of the benefits of proactive coating maintenance and the consequences of coating failures will drive market growth.

- Emerging markets in developing economies present significant opportunities for coating inspection service providers as infrastructure and industrial development accelerate in these regions.

**Leading Players in the Coating Inspection Service**

The global coating inspection service market is highly fragmented, with a large number of small and medium-sized businesses operating alongside a few established players. Some notable companies in the industry include:

- KTA-Tator

- Mars Quality

- SGS

- CIS LLC

- Applied Technical Services

- Paint Inspection

- True Inspection Services

- Inspeks Coating

- 涂层检验员

- Coating Inspector

- Quinn

- Pro QC International

- Dexon

- Braun Intertec

- Corrocoat

- Tcorr Inspection

- Corrsafe

- A. Morton Thomas and Associates

- Inspexion

- Industry Painting

**Significant Developments in Coating Inspection Service Sector**

The coating inspection service sector has witnessed significant developments and advancements:

- Development of portable and handheld coating inspection devices: The introduction of portable and handheld devices has enhanced the ease and accessibility of coating inspections, allowing inspectors to perform on-site evaluations more efficiently and effectively.

- Integration of AI and data analytics: The integration of artificial intelligence (AI) and data analytics into coating inspection services is improving accuracy, efficiency, and the ability to detect defects and anomalies that may not be visible to the human eye.

- Advancements in coating technology: The development of new coating materials and technologies, such as self-healing coatings and bio-based coatings, is driving the demand for specialized coating inspection services to evaluate their performance and effectiveness.

- Increased focus on sustainability: Growing environmental concerns have led to an increased focus on sustainability in the coating industry. This has created a demand for coating inspection services that can assess the environmental impact of coatings and ensure compliance with sustainability regulations.

**Comprehensive Coverage Coating Inspection Service Report**

This report provides a comprehensive analysis of the global coating inspection service market, addressing its current trends, driving forces, challenges, and future growth prospects. It includes detailed market segmentation, regional market analysis, industry dynamics, and key company profiles. This report is a valuable resource for coating manufacturers, inspection service providers, industry professionals, and investors seeking to gain insights into the coating inspection service industry.

Coating Inspection Service Segmentation

-

1. Type

- 1.1. Non-destructive Testing (NDT)

- 1.2. Destructive Testing

-

2. Application

- 2.1. Infrastructure

- 2.2. Transportation

- 2.3. Industrial Structure

- 2.4. Others

Coating Inspection Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Coating Inspection Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

What are the notable trends driving market growth?

.

How can I stay updated on further developments or reports in the Coating Inspection Service?

To stay informed about further developments, trends, and reports in the Coating Inspection Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

What are the main segments of the Coating Inspection Service?

The market segments include

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million .

Are there any restraints impacting market growth?

.

Which companies are prominent players in the Coating Inspection Service?

Key companies in the market include KTA-Tator,Mars Quality,SGS,CIS LLC,Applied Technical Services,Paint Inspection,True Inspection Services,Inspeks Coating,涂层检验员,Coating Inspector,Quinn,Pro QC International,Dexon,Braun Intertec,Corrocoat,Site Map,Tcorr Inspection,Corrsafe,A. Morton Thomas and Associates,Inspexion,Industry Painting

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

What is the projected Compound Annual Growth Rate (CAGR) of the Coating Inspection Service ?

The projected CAGR is approximately XX%.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coating Inspection Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Non-destructive Testing (NDT)

- 5.1.2. Destructive Testing

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infrastructure

- 5.2.2. Transportation

- 5.2.3. Industrial Structure

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Coating Inspection Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Non-destructive Testing (NDT)

- 6.1.2. Destructive Testing

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infrastructure

- 6.2.2. Transportation

- 6.2.3. Industrial Structure

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Coating Inspection Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Non-destructive Testing (NDT)

- 7.1.2. Destructive Testing

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infrastructure

- 7.2.2. Transportation

- 7.2.3. Industrial Structure

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Coating Inspection Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Non-destructive Testing (NDT)

- 8.1.2. Destructive Testing

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infrastructure

- 8.2.2. Transportation

- 8.2.3. Industrial Structure

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Coating Inspection Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Non-destructive Testing (NDT)

- 9.1.2. Destructive Testing

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Infrastructure

- 9.2.2. Transportation

- 9.2.3. Industrial Structure

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Coating Inspection Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Non-destructive Testing (NDT)

- 10.1.2. Destructive Testing

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Infrastructure

- 10.2.2. Transportation

- 10.2.3. Industrial Structure

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 KTA-Tator

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mars Quality

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SGS

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CIS LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Applied Technical Services

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Paint Inspection

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 True Inspection Services

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Inspeks Coating

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 涂层检验员

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Coating Inspector

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Quinn

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pro QC International

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Dexon

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Braun Intertec

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Corrocoat

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Site Map

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Tcorr Inspection

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Corrsafe

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 A. Morton Thomas and Associates

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Inspexion

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Industry Painting

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 KTA-Tator

- Figure 1: Global Coating Inspection Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Coating Inspection Service Revenue (million), by Type 2024 & 2032

- Figure 3: North America Coating Inspection Service Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Coating Inspection Service Revenue (million), by Application 2024 & 2032

- Figure 5: North America Coating Inspection Service Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Coating Inspection Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Coating Inspection Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Coating Inspection Service Revenue (million), by Type 2024 & 2032

- Figure 9: South America Coating Inspection Service Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Coating Inspection Service Revenue (million), by Application 2024 & 2032

- Figure 11: South America Coating Inspection Service Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Coating Inspection Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Coating Inspection Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Coating Inspection Service Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Coating Inspection Service Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Coating Inspection Service Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Coating Inspection Service Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Coating Inspection Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Coating Inspection Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Coating Inspection Service Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Coating Inspection Service Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Coating Inspection Service Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Coating Inspection Service Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Coating Inspection Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Coating Inspection Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Coating Inspection Service Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Coating Inspection Service Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Coating Inspection Service Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Coating Inspection Service Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Coating Inspection Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Coating Inspection Service Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Coating Inspection Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Coating Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Coating Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Coating Inspection Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Coating Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Coating Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Coating Inspection Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Coating Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Coating Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Coating Inspection Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Coating Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Coating Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Coating Inspection Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Coating Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Coating Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Coating Inspection Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Coating Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Coating Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Coating Inspection Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Coating Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.