Cocoa Liquid Extract

Cocoa Liquid ExtractCocoa Liquid Extract Analysis Report 2025: Market to Grow by a CAGR of 3.7 to 2033, Driven by Government Incentives, Popularity of Virtual Assistants, and Strategic Partnerships

Cocoa Liquid Extract by Type (White Cocoa Liquid Extract, Milk Cocoa Liquid Extract, Dark Cocoa Liquid Extract), by Application (Supermarket, Convenience Store, Online Sales, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

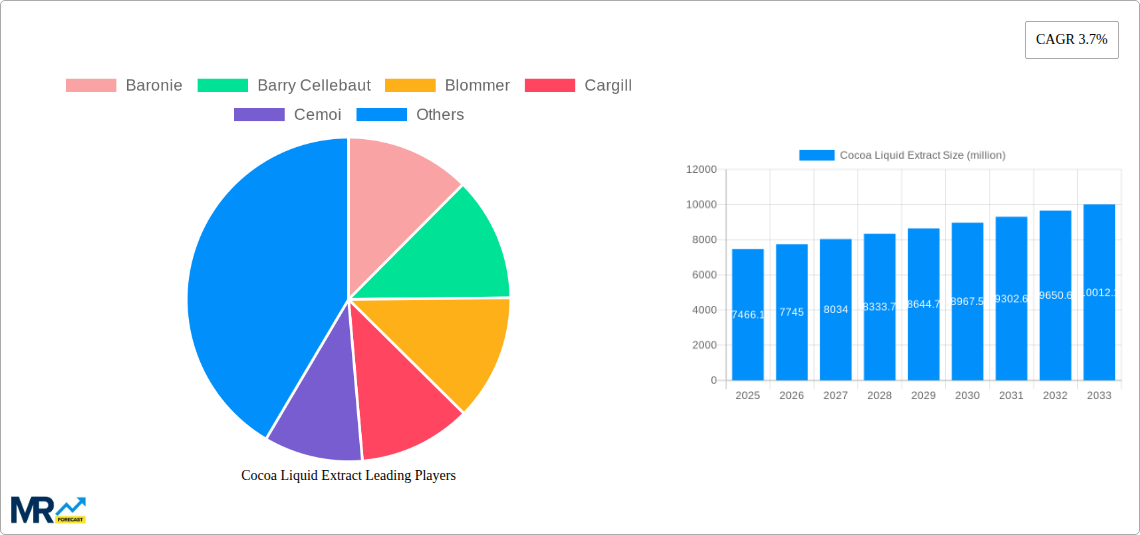

The global cocoa liquid extract market, valued at $7,466.1 million in 2025, is projected to experience steady growth, driven by increasing demand from the food and beverage industry. The compound annual growth rate (CAGR) of 3.7% from 2025 to 2033 indicates a consistent expansion, fueled by several key factors. The rising popularity of chocolate-flavored products in confectionery, bakery, and dairy applications is a major driver. Furthermore, the growing consumer preference for natural and clean-label ingredients is boosting demand for cocoa liquid extracts as a natural flavoring and coloring agent. The convenience of using liquid extracts compared to cocoa powder or other forms also contributes to market growth. Different product types such as white, milk, and dark cocoa liquid extracts cater to diverse applications and consumer preferences, enhancing market diversity. The market is segmented geographically with North America and Europe currently holding significant market share, but the Asia-Pacific region is expected to witness robust growth due to rising disposable incomes and changing consumption patterns. Distribution channels include supermarkets, convenience stores, and increasingly, online sales, reflecting modern consumer purchasing habits. Competitive rivalry amongst major players like Barry Callebaut, Cargill, and others further stimulates innovation and product development.

While the market shows strong potential, certain challenges exist. Fluctuations in cocoa bean prices, a key raw material, can impact production costs and profitability. Sustainable sourcing initiatives are also gaining importance, with consumers demanding ethically produced cocoa products. Companies are increasingly adopting sustainable practices to address these concerns and maintain a positive brand image. Maintaining quality and consistency in the liquid extract, considering variations in cocoa bean quality from different origins, remains an operational challenge. However, technological advancements in extraction and processing techniques are helping to mitigate these challenges, supporting sustained growth in the cocoa liquid extract market. The continued evolution of product offerings, including functional and organic versions, will further fuel expansion in the years to come.

Cocoa Liquid Extract Trends

The global cocoa liquid extract market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. The study period (2019-2033), encompassing historical (2019-2024), base (2025), and forecast (2025-2033) years, reveals a consistently upward trajectory. This growth is fueled by several factors, including the increasing demand for convenient and ready-to-use ingredients in the food and beverage industry. Consumers are increasingly opting for products with natural and clean-label ingredients, driving demand for cocoa liquid extracts as a natural flavoring and coloring agent. The versatility of cocoa liquid extract, applicable across diverse food and beverage products such as chocolates, confectionery, baked goods, and beverages, contributes significantly to its market expansion. Furthermore, the growing popularity of cocoa-based products due to their perceived health benefits, such as antioxidants, further fuels market growth. This trend is particularly pronounced in regions with established chocolate consumption and developing economies witnessing rising disposable incomes and a shift towards westernized diets. The market also benefits from continuous innovation in product offerings, with manufacturers introducing new variations like organic and fair-trade cocoa liquid extracts to cater to specific consumer demands. This competitive landscape, characterized by both established players and emerging businesses, drives innovation and product diversification, thereby boosting overall market growth. The estimated market value for 2025 indicates a significant milestone, setting the stage for substantial expansion in the coming years. The market's dynamism is evident in the continual introduction of new products and the strategic partnerships and acquisitions among key players. The market shows a strong potential for further growth, driven by continued innovation, expanding applications, and a growing consumer preference for natural and convenient ingredients.

Driving Forces: What's Propelling the Cocoa Liquid Extract Market?

Several key factors are propelling the growth of the cocoa liquid extract market. The rising popularity of chocolate and cocoa-based products globally is a primary driver. Consumers are increasingly seeking convenient and ready-to-use ingredients, and cocoa liquid extract offers a simple and efficient way to incorporate cocoa flavor and color into various food and beverage applications. The health and wellness trend is also contributing significantly. Consumers are increasingly aware of the health benefits associated with cocoa, particularly its antioxidant properties. This growing health consciousness is driving demand for cocoa-based products, including those containing cocoa liquid extract. Furthermore, the increasing demand for natural and clean-label ingredients is a major factor. Cocoa liquid extract is viewed as a natural and less processed alternative to artificial flavorings and colorings, aligning perfectly with the clean-label trend. The expansion of the food and beverage industry itself, particularly in developing economies, creates further opportunities for the cocoa liquid extract market. The increasing disposable incomes in these regions are leading to higher spending on processed foods and beverages, boosting the demand for convenient ingredients like cocoa liquid extracts. Finally, continuous innovation in product development, with manufacturers introducing new variations and applications for cocoa liquid extract, keeps the market dynamic and vibrant, further driving its growth.

Challenges and Restraints in the Cocoa Liquid Extract Market

Despite its robust growth, the cocoa liquid extract market faces certain challenges. Fluctuations in cocoa bean prices are a significant concern. The price of cocoa beans is subject to various factors, including weather patterns, global supply and demand, and political instability in cocoa-producing regions. These fluctuations can directly impact the cost of production for cocoa liquid extract manufacturers, potentially leading to price volatility and impacting market stability. Another challenge is the intense competition among numerous manufacturers. The market is populated by both established multinational corporations and smaller specialized players. This intense competition can put pressure on profit margins and necessitate constant innovation and strategic maneuvering to maintain market share. Furthermore, maintaining consistent product quality and complying with stringent food safety regulations across different regions is a key operational challenge. Meeting diverse regulatory requirements and maintaining quality control throughout the supply chain requires significant investment and meticulous operational management. Lastly, concerns regarding sustainability and ethical sourcing of cocoa beans are increasingly impacting consumer choices. The market is witnessing a growing demand for sustainably sourced and ethically produced cocoa products. Manufacturers must address these concerns by implementing transparent and traceable supply chains to ensure their products align with consumer expectations. Addressing these challenges effectively is crucial for the continued sustainable growth of the cocoa liquid extract market.

Key Region or Country & Segment to Dominate the Market

The Dark Cocoa Liquid Extract segment is poised to dominate the market due to its rich flavor profile and versatility in applications. Consumers are increasingly seeking intense cocoa flavors, leading to a higher demand for dark cocoa liquid extract in premium chocolate products, desserts, and beverages.

North America and Europe are expected to continue as leading regions due to high per capita consumption of chocolate and cocoa-based products, established food and beverage industries, and strong consumer preference for convenient, natural ingredients.

Asia-Pacific presents significant growth potential due to a rapidly expanding middle class with increasing disposable incomes and a growing preference for Western-style desserts and confectionery. This is fostering higher demand for premium cocoa products including dark cocoa liquid extracts.

Within the application segments:

Supermarkets represent a significant distribution channel due to their wide reach and accessibility to a vast consumer base. The convenience of readily available cocoa products drives strong sales within this segment.

Online sales are witnessing rapid growth, driven by the ease of online shopping and increasing popularity of e-commerce platforms specializing in food and beverages. The delivery of premium cocoa liquid extracts directly to consumers fuels expansion in this area.

The dominance of dark cocoa liquid extract is attributed to its growing consumer preference, reflecting a shift towards bolder and more intense flavors within the premium segment of the market. The leading geographical regions reflect established chocolate consumption cultures and emerging markets with rapidly increasing purchasing power. The application segment dominance highlights the ease and convenience of supermarket channels and the rising popularity of e-commerce for purchasing specialty food items. The combined factors solidify the projections for significant market growth across these key segments.

Growth Catalysts in the Cocoa Liquid Extract Industry

Several factors are driving the growth of the cocoa liquid extract industry. The rising demand for convenient and ready-to-use ingredients in the food and beverage sector is a primary driver. This, coupled with increasing consumer awareness of the health benefits of cocoa, such as its antioxidant properties, boosts demand. Additionally, the growing preference for natural and clean-label ingredients is a significant factor pushing manufacturers to utilize cocoa liquid extracts as a healthier alternative. These combined factors are projected to accelerate market growth throughout the forecast period.

Leading Players in the Cocoa Liquid Extract Market

- Baronie

- Barry Callebaut (Barry Callebaut)

- Blommer Chocolate Company

- Cargill (Cargill)

- Cemoi

- Frutarom (now part of IFF)

- Haldin International

- Horner International

- Irca

- Kerry Group (Kerry Group)

- Natra

- Olam International (Olam International)

- Puratos (Puratos)

Significant Developments in the Cocoa Liquid Extract Sector

- 2020: Barry Callebaut launches a new range of sustainable cocoa liquid extracts.

- 2021: Cargill invests in expanding its cocoa processing facilities to meet growing demand.

- 2022: Puratos introduces a line of organic cocoa liquid extracts.

- 2023: Several key players announce partnerships focusing on ethical sourcing and sustainable cocoa farming practices.

Comprehensive Coverage Cocoa Liquid Extract Report

The cocoa liquid extract market exhibits strong growth potential driven by several key factors. Increased demand for convenience, health consciousness, and clean-label products all contribute to the market's expansion. The report comprehensively covers market trends, driving forces, challenges, and key players, providing a detailed outlook for the forecast period. The focus on specific segments and leading regions further illuminates the market's dynamics and growth opportunities.

Cocoa Liquid Extract Segmentation

-

1. Type

- 1.1. White Cocoa Liquid Extract

- 1.2. Milk Cocoa Liquid Extract

- 1.3. Dark Cocoa Liquid Extract

-

2. Application

- 2.1. Supermarket

- 2.2. Convenience Store

- 2.3. Online Sales

- 2.4. Others

Cocoa Liquid Extract Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cocoa Liquid Extract REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.7% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cocoa Liquid Extract Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. White Cocoa Liquid Extract

- 5.1.2. Milk Cocoa Liquid Extract

- 5.1.3. Dark Cocoa Liquid Extract

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Supermarket

- 5.2.2. Convenience Store

- 5.2.3. Online Sales

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Cocoa Liquid Extract Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. White Cocoa Liquid Extract

- 6.1.2. Milk Cocoa Liquid Extract

- 6.1.3. Dark Cocoa Liquid Extract

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Supermarket

- 6.2.2. Convenience Store

- 6.2.3. Online Sales

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Cocoa Liquid Extract Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. White Cocoa Liquid Extract

- 7.1.2. Milk Cocoa Liquid Extract

- 7.1.3. Dark Cocoa Liquid Extract

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Supermarket

- 7.2.2. Convenience Store

- 7.2.3. Online Sales

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Cocoa Liquid Extract Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. White Cocoa Liquid Extract

- 8.1.2. Milk Cocoa Liquid Extract

- 8.1.3. Dark Cocoa Liquid Extract

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Supermarket

- 8.2.2. Convenience Store

- 8.2.3. Online Sales

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Cocoa Liquid Extract Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. White Cocoa Liquid Extract

- 9.1.2. Milk Cocoa Liquid Extract

- 9.1.3. Dark Cocoa Liquid Extract

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Supermarket

- 9.2.2. Convenience Store

- 9.2.3. Online Sales

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Cocoa Liquid Extract Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. White Cocoa Liquid Extract

- 10.1.2. Milk Cocoa Liquid Extract

- 10.1.3. Dark Cocoa Liquid Extract

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Supermarket

- 10.2.2. Convenience Store

- 10.2.3. Online Sales

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Baronie

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Barry Cellebaut

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Blommer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cargill

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cemoi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Frutarom

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Haldin International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Horner International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Irca

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kerry Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Natra

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Olam

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Puratos

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Baronie

- Figure 1: Global Cocoa Liquid Extract Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Cocoa Liquid Extract Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Cocoa Liquid Extract Revenue (million), by Type 2024 & 2032

- Figure 4: North America Cocoa Liquid Extract Volume (K), by Type 2024 & 2032

- Figure 5: North America Cocoa Liquid Extract Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Cocoa Liquid Extract Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Cocoa Liquid Extract Revenue (million), by Application 2024 & 2032

- Figure 8: North America Cocoa Liquid Extract Volume (K), by Application 2024 & 2032

- Figure 9: North America Cocoa Liquid Extract Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Cocoa Liquid Extract Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Cocoa Liquid Extract Revenue (million), by Country 2024 & 2032

- Figure 12: North America Cocoa Liquid Extract Volume (K), by Country 2024 & 2032

- Figure 13: North America Cocoa Liquid Extract Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Cocoa Liquid Extract Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Cocoa Liquid Extract Revenue (million), by Type 2024 & 2032

- Figure 16: South America Cocoa Liquid Extract Volume (K), by Type 2024 & 2032

- Figure 17: South America Cocoa Liquid Extract Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Cocoa Liquid Extract Volume Share (%), by Type 2024 & 2032

- Figure 19: South America Cocoa Liquid Extract Revenue (million), by Application 2024 & 2032

- Figure 20: South America Cocoa Liquid Extract Volume (K), by Application 2024 & 2032

- Figure 21: South America Cocoa Liquid Extract Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Cocoa Liquid Extract Volume Share (%), by Application 2024 & 2032

- Figure 23: South America Cocoa Liquid Extract Revenue (million), by Country 2024 & 2032

- Figure 24: South America Cocoa Liquid Extract Volume (K), by Country 2024 & 2032

- Figure 25: South America Cocoa Liquid Extract Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Cocoa Liquid Extract Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Cocoa Liquid Extract Revenue (million), by Type 2024 & 2032

- Figure 28: Europe Cocoa Liquid Extract Volume (K), by Type 2024 & 2032

- Figure 29: Europe Cocoa Liquid Extract Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Cocoa Liquid Extract Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe Cocoa Liquid Extract Revenue (million), by Application 2024 & 2032

- Figure 32: Europe Cocoa Liquid Extract Volume (K), by Application 2024 & 2032

- Figure 33: Europe Cocoa Liquid Extract Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe Cocoa Liquid Extract Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe Cocoa Liquid Extract Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Cocoa Liquid Extract Volume (K), by Country 2024 & 2032

- Figure 37: Europe Cocoa Liquid Extract Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Cocoa Liquid Extract Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Cocoa Liquid Extract Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa Cocoa Liquid Extract Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa Cocoa Liquid Extract Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa Cocoa Liquid Extract Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa Cocoa Liquid Extract Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa Cocoa Liquid Extract Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa Cocoa Liquid Extract Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa Cocoa Liquid Extract Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa Cocoa Liquid Extract Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Cocoa Liquid Extract Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Cocoa Liquid Extract Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Cocoa Liquid Extract Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Cocoa Liquid Extract Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific Cocoa Liquid Extract Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific Cocoa Liquid Extract Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific Cocoa Liquid Extract Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific Cocoa Liquid Extract Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific Cocoa Liquid Extract Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific Cocoa Liquid Extract Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Cocoa Liquid Extract Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Cocoa Liquid Extract Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Cocoa Liquid Extract Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Cocoa Liquid Extract Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Cocoa Liquid Extract Volume Share (%), by Country 2024 & 2032

- Table 1: Global Cocoa Liquid Extract Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cocoa Liquid Extract Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Cocoa Liquid Extract Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Cocoa Liquid Extract Volume K Forecast, by Type 2019 & 2032

- Table 5: Global Cocoa Liquid Extract Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cocoa Liquid Extract Volume K Forecast, by Application 2019 & 2032

- Table 7: Global Cocoa Liquid Extract Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Cocoa Liquid Extract Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Cocoa Liquid Extract Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Cocoa Liquid Extract Volume K Forecast, by Type 2019 & 2032

- Table 11: Global Cocoa Liquid Extract Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cocoa Liquid Extract Volume K Forecast, by Application 2019 & 2032

- Table 13: Global Cocoa Liquid Extract Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Cocoa Liquid Extract Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Cocoa Liquid Extract Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global Cocoa Liquid Extract Volume K Forecast, by Type 2019 & 2032

- Table 23: Global Cocoa Liquid Extract Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global Cocoa Liquid Extract Volume K Forecast, by Application 2019 & 2032

- Table 25: Global Cocoa Liquid Extract Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Cocoa Liquid Extract Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Cocoa Liquid Extract Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global Cocoa Liquid Extract Volume K Forecast, by Type 2019 & 2032

- Table 35: Global Cocoa Liquid Extract Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global Cocoa Liquid Extract Volume K Forecast, by Application 2019 & 2032

- Table 37: Global Cocoa Liquid Extract Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Cocoa Liquid Extract Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Cocoa Liquid Extract Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global Cocoa Liquid Extract Volume K Forecast, by Type 2019 & 2032

- Table 59: Global Cocoa Liquid Extract Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global Cocoa Liquid Extract Volume K Forecast, by Application 2019 & 2032

- Table 61: Global Cocoa Liquid Extract Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Cocoa Liquid Extract Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Cocoa Liquid Extract Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global Cocoa Liquid Extract Volume K Forecast, by Type 2019 & 2032

- Table 77: Global Cocoa Liquid Extract Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global Cocoa Liquid Extract Volume K Forecast, by Application 2019 & 2032

- Table 79: Global Cocoa Liquid Extract Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Cocoa Liquid Extract Volume K Forecast, by Country 2019 & 2032

- Table 81: China Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Cocoa Liquid Extract Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Cocoa Liquid Extract Volume (K) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.