Cold Storage Crypto Wallets

Cold Storage Crypto WalletsCold Storage Crypto Wallets Analysis 2025 and Forecasts 2033: Unveiling Growth Opportunities

Cold Storage Crypto Wallets by Type (USB Connectivity Type, Bluetooth Connectivity Type, NFC Connectivity), by Application (Individual, Professionals/Business), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

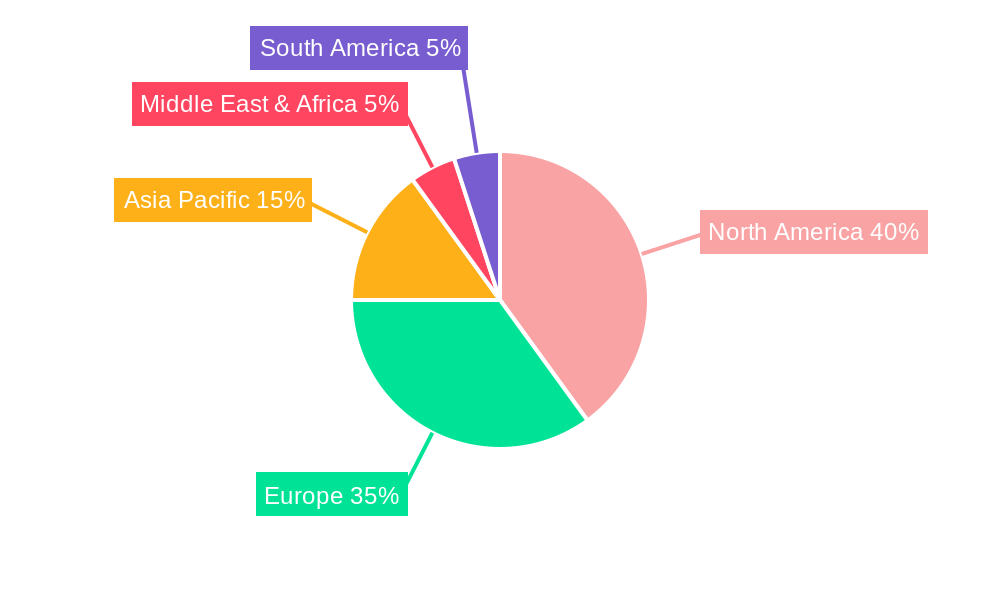

The cold storage cryptocurrency wallet market, valued at $549.5 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 13.2% from 2025 to 2033. This significant expansion is driven by increasing concerns regarding cryptocurrency exchange hacks and the inherent security risks associated with hot wallets. The rising adoption of cryptocurrencies by both individual investors and businesses, coupled with the growing awareness of the importance of securing digital assets offline, fuels this market's growth. Key market segments include USB, Bluetooth, and NFC connectivity types, catering to diverse user preferences and technological capabilities. The application segment is broadly divided into individual users and professionals/businesses, reflecting the widespread use of cold storage wallets across various demographics. Increased regulatory scrutiny of cryptocurrency exchanges and a rising preference for self-custody are further bolstering market expansion. Competition is fierce amongst established players like Ledger, Trezor, and KeepKey, along with emerging brands striving to carve out a niche through innovative features and improved user experience. Geographic distribution shows a strong presence across North America and Europe, with Asia Pacific poised for significant growth given the burgeoning cryptocurrency adoption in regions like India and China.

The market's restraints primarily stem from the relatively high initial cost of cold storage wallets compared to software-based alternatives. The technical expertise required for setup and secure usage can also pose a barrier for less tech-savvy users. However, the increasing sophistication of user interfaces and the growing availability of educational resources are mitigating these challenges. Future growth will likely be driven by the integration of advanced security features like biometric authentication and multi-signature support, further enhancing user trust and adoption. The development of more user-friendly interfaces will also play a crucial role in attracting a broader range of users, expanding the market beyond the tech-savvy segment. The ongoing evolution of cryptocurrency technology and regulatory frameworks will continue to shape the market's trajectory in the coming years.

Cold Storage Crypto Wallets Trends

The cold storage crypto wallet market, valued at USD 150 million in 2025, is projected to experience significant growth, reaching USD 800 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period (2025-2033). This robust growth is driven by the increasing adoption of cryptocurrencies and the inherent security concerns surrounding hot wallets, which are vulnerable to online attacks and hacks. Consumers and businesses are increasingly recognizing the superior security offered by cold storage solutions, which store private keys offline, making them significantly more resistant to theft and unauthorized access. The market has witnessed a shift towards more user-friendly interfaces and advanced security features, making cold storage wallets more accessible to a wider range of users, from individual investors to large-scale businesses managing substantial cryptocurrency holdings. The historical period (2019-2024) showed a steady but relatively slower growth compared to the projected exponential rise in the forecast period. This acceleration is fueled by factors such as the increasing sophistication of cyber threats, growing regulatory scrutiny of cryptocurrency exchanges, and a greater awareness among users about the importance of secure asset management. The market has seen significant innovation with the introduction of new models featuring enhanced security features like biometric authentication and improved user interfaces. This blend of security and accessibility is a major factor behind the market’s upward trajectory. Furthermore, the emergence of institutional investors in the cryptocurrency space is also significantly contributing to the demand for robust cold storage solutions. Competition among manufacturers is leading to continuous innovation and improvement in product features and functionalities, benefiting consumers by providing better value and security.

Driving Forces: What's Propelling the Cold Storage Crypto Wallets

The surging adoption of cryptocurrencies globally is the primary driver for the cold storage crypto wallet market. Concerns over security breaches and hacks targeting hot wallets, which are connected to the internet, are significantly propelling demand for offline, cold storage solutions. The increasing sophistication of cyberattacks targeting cryptocurrency exchanges and individual wallets has heightened awareness among users about the critical need for enhanced security measures. Institutional investors, increasingly involved in the cryptocurrency market, are demanding robust and secure storage solutions capable of managing substantial amounts of digital assets. The growing regulatory landscape, including requirements for better security practices for handling crypto assets, is also contributing to the uptake of cold storage wallets. Furthermore, advancements in technology, such as improved biometric authentication methods and user-friendly interfaces, are making cold storage wallets more accessible and appealing to a broader user base. The convenience of offline storage, coupled with the peace of mind that comes with knowing your assets are protected from online threats, is a significant factor driving market expansion. Finally, the growing education and awareness about the risks associated with online storage of cryptocurrencies is fostering a shift towards safer offline storage options.

Challenges and Restraints in Cold Storage Crypto Wallets

Despite the significant growth potential, the cold storage crypto wallet market faces certain challenges. The relatively higher cost compared to hot wallets can be a deterrent for some users, particularly individual investors with smaller holdings. The complexity of setting up and using some cold storage devices can pose a barrier to entry for less tech-savvy individuals. The risk of physical loss or damage to the device, which contains the private keys, is a significant concern. Losing the device effectively means losing access to the cryptocurrency, representing a substantial risk. Furthermore, the lack of standardized security protocols across different manufacturers can create inconsistencies in security levels and user experience. The market is also subject to technological advancements, with new and improved security features continuously emerging, requiring users to stay updated and adapt to newer technologies. Finally, the regulatory uncertainty surrounding cryptocurrencies in various jurisdictions could create challenges for the market’s long-term growth.

Key Region or Country & Segment to Dominate the Market

The North American region is projected to dominate the cold storage crypto wallet market during the forecast period (2025-2033). This dominance is largely attributed to the high cryptocurrency adoption rate in the region, coupled with a higher level of awareness about cybersecurity threats. Early adoption of cryptocurrency and the existence of a well-established technological infrastructure further strengthens the region's position.

- High Cryptocurrency Adoption: North America boasts a significant user base for cryptocurrencies, driving the demand for secure storage solutions.

- Strong Technological Infrastructure: Robust internet infrastructure and technological expertise enable easy adoption and integration of cold storage wallets.

- Higher Cybersecurity Awareness: Users in North America demonstrate a greater awareness of the risks associated with online storage of crypto assets.

- Regulatory Developments: Though still evolving, regulatory efforts in parts of North America are also influencing the adoption of secure storage solutions.

The Individual application segment is expected to significantly contribute to the market's growth. This is because a large number of cryptocurrency holders are individual investors who prioritize security for their personal digital assets.

- Increased Individual Cryptocurrency Investment: The number of individuals investing in cryptocurrencies continues to grow globally, thus increasing the need for secure storage.

- Enhanced Security Needs for Personal Assets: Individuals often hold a substantial portion of their net worth in cryptocurrencies, leading to higher emphasis on security measures.

- Growing Awareness of Security Risks: Educational campaigns and media coverage of cryptocurrency hacks have made individuals more aware of the importance of cold storage solutions.

- Ease of Use and Accessibility: The availability of user-friendly cold storage wallets is making this technology more accessible to individual users.

Growth Catalysts in Cold Storage Crypto Wallets Industry

The growing adoption of cryptocurrencies by institutions and governments, coupled with increasing awareness about the vulnerability of hot wallets to hacking and theft, is a significant catalyst for market expansion. Ongoing improvements in the security features of cold storage wallets, including the integration of advanced biometric authentication and multi-signature capabilities, further fuels growth. Furthermore, the increasing user-friendliness and ease of use of these devices are making them more accessible to a broader range of users. Finally, regulatory initiatives promoting better security practices for handling crypto assets are also contributing to market growth.

Leading Players in the Cold Storage Crypto Wallets

- Ledger

- Trezor

- KeepKey

- Digital BitBox

- Coinkite

- BitLox

- CoolWallet

- CryoBit

- ELLIPAL

- Keystone

- OneKey

- imkey

- SafePal

Significant Developments in Cold Storage Crypto Wallets Sector

- 2020: Ledger introduces Ledger Nano X with Bluetooth connectivity.

- 2021: Trezor launches Trezor Model One, a smaller and more affordable device.

- 2022: Several manufacturers introduce improved security features like advanced biometric authentication and improved chipsets.

- 2023: Increased focus on user-friendly interfaces and mobile app integration.

- 2024: Several new cold storage wallets with NFC connectivity enter the market.

Comprehensive Coverage Cold Storage Crypto Wallets Report

The comprehensive report on the cold storage crypto wallet market provides a detailed analysis of market trends, driving factors, challenges, and key players, encompassing a historical period (2019-2024), a base year (2025), an estimated year (2025), and a forecast period (2025-2033). The report offers in-depth insights into various market segments, including device type (USB, Bluetooth, NFC), application (individual, professional/business), and geographic regions. The data presented helps stakeholders understand market dynamics, identify opportunities, and make informed business decisions in this rapidly growing sector.

Cold Storage Crypto Wallets Segmentation

-

1. Type

- 1.1. USB Connectivity Type

- 1.2. Bluetooth Connectivity Type

- 1.3. NFC Connectivity

-

2. Application

- 2.1. Individual

- 2.2. Professionals/Business

Cold Storage Crypto Wallets Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cold Storage Crypto Wallets REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.2% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cold Storage Crypto Wallets Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. USB Connectivity Type

- 5.1.2. Bluetooth Connectivity Type

- 5.1.3. NFC Connectivity

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Individual

- 5.2.2. Professionals/Business

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Cold Storage Crypto Wallets Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. USB Connectivity Type

- 6.1.2. Bluetooth Connectivity Type

- 6.1.3. NFC Connectivity

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Individual

- 6.2.2. Professionals/Business

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Cold Storage Crypto Wallets Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. USB Connectivity Type

- 7.1.2. Bluetooth Connectivity Type

- 7.1.3. NFC Connectivity

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Individual

- 7.2.2. Professionals/Business

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Cold Storage Crypto Wallets Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. USB Connectivity Type

- 8.1.2. Bluetooth Connectivity Type

- 8.1.3. NFC Connectivity

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Individual

- 8.2.2. Professionals/Business

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Cold Storage Crypto Wallets Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. USB Connectivity Type

- 9.1.2. Bluetooth Connectivity Type

- 9.1.3. NFC Connectivity

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Individual

- 9.2.2. Professionals/Business

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Cold Storage Crypto Wallets Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. USB Connectivity Type

- 10.1.2. Bluetooth Connectivity Type

- 10.1.3. NFC Connectivity

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Individual

- 10.2.2. Professionals/Business

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ledger

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trezor

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KeepKey

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Digital BitBox

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coinkite

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BitLox

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CoolWallet

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CryoBit

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ELLIPAL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Keystone

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OneKey

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 imkey

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SafePal

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Ledger

- Figure 1: Global Cold Storage Crypto Wallets Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cold Storage Crypto Wallets Revenue (million), by Type 2024 & 2032

- Figure 3: North America Cold Storage Crypto Wallets Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Cold Storage Crypto Wallets Revenue (million), by Application 2024 & 2032

- Figure 5: North America Cold Storage Crypto Wallets Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Cold Storage Crypto Wallets Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cold Storage Crypto Wallets Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cold Storage Crypto Wallets Revenue (million), by Type 2024 & 2032

- Figure 9: South America Cold Storage Crypto Wallets Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Cold Storage Crypto Wallets Revenue (million), by Application 2024 & 2032

- Figure 11: South America Cold Storage Crypto Wallets Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Cold Storage Crypto Wallets Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cold Storage Crypto Wallets Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cold Storage Crypto Wallets Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Cold Storage Crypto Wallets Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Cold Storage Crypto Wallets Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Cold Storage Crypto Wallets Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Cold Storage Crypto Wallets Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cold Storage Crypto Wallets Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cold Storage Crypto Wallets Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Cold Storage Crypto Wallets Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Cold Storage Crypto Wallets Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Cold Storage Crypto Wallets Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Cold Storage Crypto Wallets Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cold Storage Crypto Wallets Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cold Storage Crypto Wallets Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Cold Storage Crypto Wallets Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Cold Storage Crypto Wallets Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Cold Storage Crypto Wallets Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Cold Storage Crypto Wallets Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cold Storage Crypto Wallets Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Cold Storage Crypto Wallets Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cold Storage Crypto Wallets Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Cold Storage Crypto Wallets Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Cold Storage Crypto Wallets Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cold Storage Crypto Wallets Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Cold Storage Crypto Wallets Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Cold Storage Crypto Wallets Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cold Storage Crypto Wallets Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Cold Storage Crypto Wallets Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Cold Storage Crypto Wallets Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cold Storage Crypto Wallets Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Cold Storage Crypto Wallets Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Cold Storage Crypto Wallets Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cold Storage Crypto Wallets Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Cold Storage Crypto Wallets Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Cold Storage Crypto Wallets Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cold Storage Crypto Wallets Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Cold Storage Crypto Wallets Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Cold Storage Crypto Wallets Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cold Storage Crypto Wallets Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.