Commercial Real Estate

Commercial Real EstateCommercial Real Estate 2025-2033 Overview: Trends, Competitor Dynamics, and Opportunities

Commercial Real Estate by Type (Community Business, Commerce Center, Others), by Application (Rental, Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Base Year: 2024

134 Pages

Key Insights

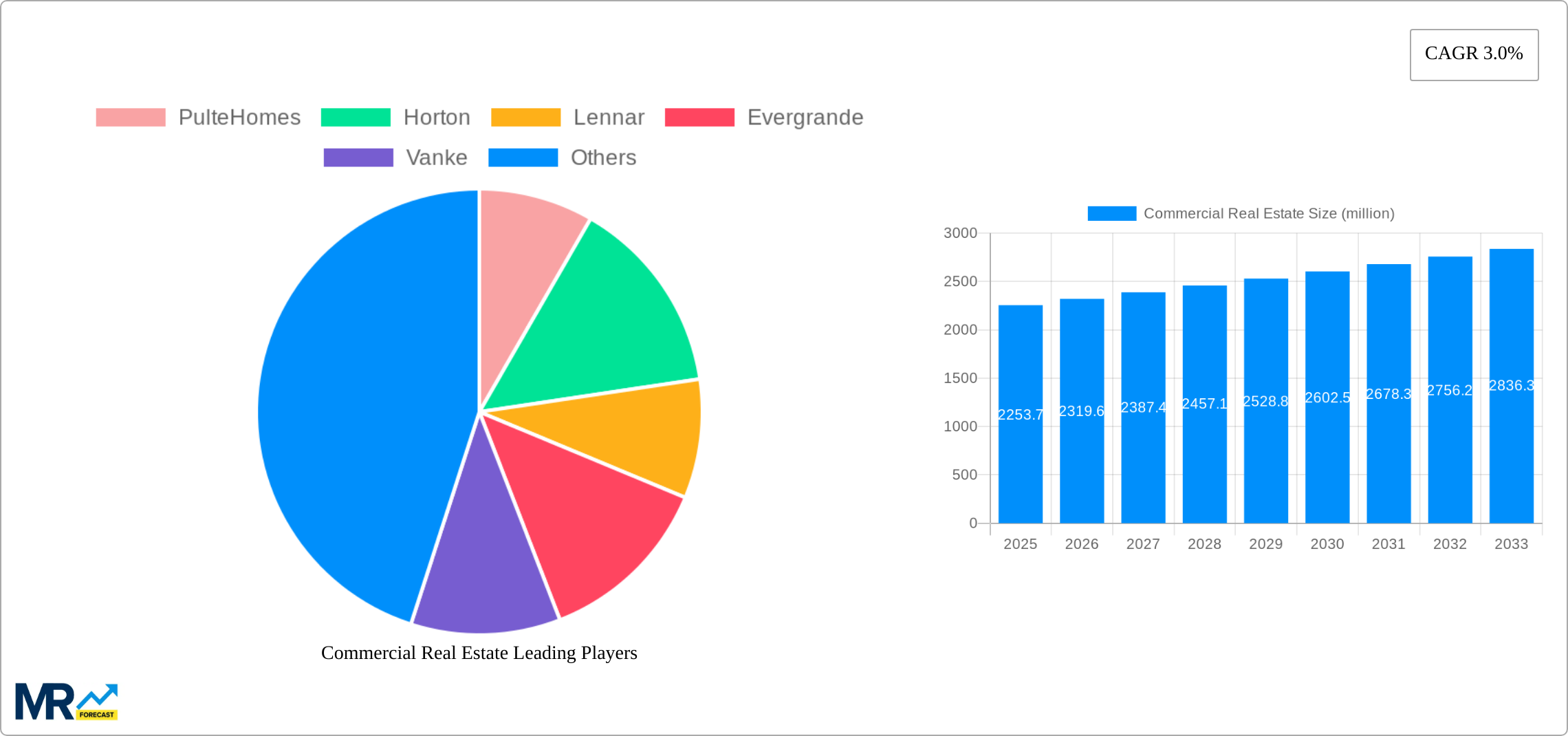

The global commercial real estate (CRE) market, valued at $2253.7 million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 3.0% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a robust global economy, particularly in emerging markets like Asia, fuels demand for office spaces, retail centers, and industrial properties. Secondly, the increasing adoption of technology in property management and the rise of flexible workspaces are reshaping the CRE landscape, stimulating investment and innovation. Finally, government initiatives promoting urban development and infrastructure projects contribute to a positive market outlook. The market is segmented by property type (community business, commerce center, others) and application (rental, sales), with significant variations in growth rates across these segments. Community business properties, fueled by localized economic activity, and rental applications, benefiting from a growing population and changing work styles, are expected to show robust growth.

However, the market faces challenges. Fluctuations in interest rates, economic downturns, and geopolitical instability can impact investment decisions and property values. Furthermore, the increasing prevalence of e-commerce continues to shift retail dynamics, impacting demand for traditional shopping centers. Competition among developers and the need for sustainable building practices also present ongoing considerations. Regional disparities in growth are expected, with North America and Asia-Pacific leading the market, driven by strong economies and substantial infrastructure development. Europe is also anticipated to show steady growth, though at a potentially slower pace than other regions due to factors like stricter regulations and economic uncertainties in certain markets. This comprehensive analysis of the CRE market provides invaluable insights for investors, developers, and industry stakeholders navigating this dynamic sector.

Commercial Real Estate Trends

The global commercial real estate market, valued at $XXX million in 2024, is poised for significant transformation over the forecast period (2025-2033). The market's trajectory is intricately linked to broader economic conditions, technological advancements, and evolving societal preferences. While the historical period (2019-2024) witnessed fluctuations influenced by factors such as the COVID-19 pandemic and subsequent economic uncertainty, the forecast period is expected to show a more consistent growth pattern, driven by a rebound in several key sectors. The increasing demand for flexible workspaces, fueled by the rise of remote work and hybrid work models, is reshaping the office market. E-commerce's continued expansion is leading to heightened demand for logistics and warehousing facilities, creating a robust sub-sector within commercial real estate. Furthermore, the growing emphasis on sustainability and environmentally conscious building practices is influencing both investor decisions and tenant preferences, creating opportunities for green building certifications and energy-efficient developments. The rise of proptech (property technology) is also streamlining processes such as property management, tenant acquisition, and investment analysis, impacting market efficiency and transparency. This report delves into these trends in detail, offering granular insights into market segmentation (community business, commerce centers, others; rental, sales), regional variations, and the competitive landscape dominated by key players like PulteHomes, Lennar, and others. The interplay of macroeconomic indicators, technological disruptors, and evolving consumer behavior will be crucial in shaping the future of commercial real estate. This report analyzes the interplay of these forces, providing a comprehensive overview of the market's dynamics. The base year for this analysis is 2025, with estimations and forecasts extending to 2033.

Driving Forces: What's Propelling the Commercial Real Estate Market?

Several key factors are fueling the growth of the commercial real estate market. Firstly, robust economic growth in several key regions is leading to increased demand for commercial spaces across various sectors. This heightened demand translates directly into increased property values and rental rates. Secondly, the ongoing urbanization trend, particularly in developing economies, continues to drive demand for commercial real estate, as businesses seek prime locations in densely populated areas. Technological advancements, including the proliferation of smart buildings and the integration of data analytics in property management, are improving efficiency and attracting investors. The increasing adoption of sustainable building practices, driven by both environmental concerns and cost savings, is also creating new investment opportunities in green buildings. Furthermore, favorable government policies, including tax incentives and infrastructure development projects, are creating a supportive environment for growth. Finally, the growing awareness among investors regarding the long-term stability and potential for high returns in the commercial real estate sector, despite inherent market volatility, is attracting a wider range of investors, including institutional investors and private equity firms. The confluence of these factors is creating a dynamic and expanding market.

Challenges and Restraints in Commercial Real Estate

Despite the positive growth outlook, the commercial real estate sector faces significant challenges. Economic downturns and financial market instability can significantly impact property values and rental income, creating uncertainty for investors and developers. Interest rate fluctuations and changes in lending policies can also impact market liquidity and accessibility to financing. Furthermore, regulatory changes and compliance requirements, particularly concerning environmental regulations and building codes, can add to operational costs and complexities. Competition within the market is intense, particularly in prime locations, which can exert downward pressure on prices and profit margins. Geopolitical events, natural disasters, and pandemics can disrupt supply chains, reduce occupancy rates, and cause significant market volatility. Finally, the increasing adoption of remote and hybrid work models is altering the demand for office space, creating both opportunities and challenges for landlords and developers. Effective risk management strategies and adaptability to these dynamic market conditions are crucial for navigating this complex landscape.

Key Region or Country & Segment to Dominate the Market

Dominant Regions: While specific figures are not provided, the report indicates robust growth in major metropolitan areas across the globe. Areas experiencing rapid urbanization and strong economic growth are likely to see outsized expansion. This includes regions with booming tech sectors or significant infrastructure development.

Dominant Segment: Commerce Centers: The commerce center segment, encompassing high-rise office buildings, shopping malls, and mixed-use developments, is expected to maintain a prominent position within the market. This stems from the continued demand for well-located, modern, and amenity-rich commercial spaces from large corporations and businesses. The increasing need for centralized locations conducive to collaboration and networking further fuels this demand. While the shift towards remote work is a factor, many companies still value in-person collaboration and the benefits of having a central office. Therefore, the design and functionality of commerce centers are adapting to these evolving needs, showcasing flexible workspaces, shared amenities, and enhanced technology integration.

Dominant Application: Sales: The sales segment, encompassing the purchase and resale of commercial properties, demonstrates consistent growth, influenced by a number of factors. Firstly, substantial investment capital is flowing into commercial real estate, driven by the search for assets perceived as relatively safe and able to provide a steady return, despite market fluctuations. The strong performance of this segment highlights the underlying belief in the long-term viability of commercial real estate as a stable asset class. Secondly, the increasing demand for high-quality commercial spaces, in line with the trends outlined earlier, enhances the value and desirability of existing properties, making sales transactions more profitable. The strength of the sales market also reflects investor confidence and their willingness to acquire properties, often with the intention of holding them for long-term appreciation or undertaking significant renovations to meet evolving market demands.

Growth Catalysts in the Commercial Real Estate Industry

The commercial real estate industry is experiencing growth driven by a confluence of factors. Robust economic growth in key regions fuels demand for commercial spaces, while urbanization trends further intensify this need. Technological advancements improve efficiency and attract investors, as does the increasing adoption of sustainable building practices. Government policies, especially tax incentives and infrastructure developments, offer significant support, while investor confidence in the long-term returns from this sector remains strong. This dynamic interplay of factors ensures the continuing expansion of the market.

Leading Players in the Commercial Real Estate Market

- PulteHomes

- Horton

- Lennar

- Evergrande

- Vanke

- Country Garden

- Poly Developments and Holdings Group

- SUNAC China Holdings Limited

- Longfor Group Holdings Limited

- Greenland Holdings Corporation Limited

- R&F Properties

- CR Land

- Greentown China Holdings Limited

- Agile Group Holdings Limited

- Wanda Group

- Hongsin

Significant Developments in the Commercial Real Estate Sector

- 2020: The COVID-19 pandemic significantly impacts occupancy rates in office spaces globally.

- 2021: Increased interest in sustainable and green building practices drives significant investment in environmentally conscious developments.

- 2022: The rise of flexible workspaces and co-working spaces transforms the office landscape.

- 2023: Proptech solutions are increasingly adopted to enhance efficiency in property management and transactions.

Comprehensive Coverage Commercial Real Estate Report

This report offers a detailed analysis of the global commercial real estate market, covering trends, drivers, challenges, key players, and significant developments. It presents a comprehensive overview of the market's current state and future projections, providing valuable insights for investors, developers, and industry professionals alike. The report utilizes a robust methodology, combining historical data, market analysis, and expert projections to offer a reliable and insightful assessment of this dynamic sector.

Commercial Real Estate Segmentation

-

1. Type

- 1.1. Community Business

- 1.2. Commerce Center

- 1.3. Others

-

2. Application

- 2.1. Rental

- 2.2. Sales

Commercial Real Estate Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Commercial Real Estate REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.0% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Table Of Content

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Real Estate Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Community Business

- 5.1.2. Commerce Center

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Rental

- 5.2.2. Sales

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Commercial Real Estate Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Community Business

- 6.1.2. Commerce Center

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Rental

- 6.2.2. Sales

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Commercial Real Estate Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Community Business

- 7.1.2. Commerce Center

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Rental

- 7.2.2. Sales

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Commercial Real Estate Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Community Business

- 8.1.2. Commerce Center

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Rental

- 8.2.2. Sales

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Commercial Real Estate Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Community Business

- 9.1.2. Commerce Center

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Rental

- 9.2.2. Sales

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Commercial Real Estate Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Community Business

- 10.1.2. Commerce Center

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Rental

- 10.2.2. Sales

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 PulteHomes

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Horton

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lennar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Evergrande

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vanke

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Country Garden

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Poly

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SUNAC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LongFor

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Greenland

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 R&F

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CR Land

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Green Town

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Agile

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Wanda

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Hongsin

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 PulteHomes

List of Figures

- Figure 1: Global Commercial Real Estate Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Commercial Real Estate Revenue (million), by Type 2024 & 2032

- Figure 3: North America Commercial Real Estate Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Commercial Real Estate Revenue (million), by Application 2024 & 2032

- Figure 5: North America Commercial Real Estate Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Commercial Real Estate Revenue (million), by Country 2024 & 2032

- Figure 7: North America Commercial Real Estate Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Commercial Real Estate Revenue (million), by Type 2024 & 2032

- Figure 9: South America Commercial Real Estate Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Commercial Real Estate Revenue (million), by Application 2024 & 2032

- Figure 11: South America Commercial Real Estate Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Commercial Real Estate Revenue (million), by Country 2024 & 2032

- Figure 13: South America Commercial Real Estate Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Commercial Real Estate Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Commercial Real Estate Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Commercial Real Estate Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Commercial Real Estate Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Commercial Real Estate Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Commercial Real Estate Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Commercial Real Estate Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Commercial Real Estate Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Commercial Real Estate Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Commercial Real Estate Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Commercial Real Estate Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Commercial Real Estate Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Commercial Real Estate Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Commercial Real Estate Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Commercial Real Estate Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Commercial Real Estate Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Commercial Real Estate Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Commercial Real Estate Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Commercial Real Estate Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Commercial Real Estate Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Commercial Real Estate Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Commercial Real Estate Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Commercial Real Estate Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Commercial Real Estate Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Commercial Real Estate Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Commercial Real Estate Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Commercial Real Estate Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Commercial Real Estate Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Commercial Real Estate Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Commercial Real Estate Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Commercial Real Estate Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Commercial Real Estate Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Commercial Real Estate Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Commercial Real Estate Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Commercial Real Estate Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Commercial Real Estate Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Commercial Real Estate Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Commercial Real Estate Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.0% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Top-down and bottom-up approaches are used to validate the global market size and estimate the market size for manufactures, regional segemnts, product and application.

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Additionally after gathering mix and scattered data from wide range of sources, data is triangull- ated and correlated to come up with estimated figures which are further validated through primary mediums, or industry experts, opinion leader.

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.