Composite Tooling Prepregs

Composite Tooling PrepregsComposite Tooling Prepregs 2025-2033 Overview: Trends, Competitor Dynamics, and Opportunities

Composite Tooling Prepregs by Type (Carbon Fiber Prepregs, Glass Fiber Prepregs, Aramid Fiber-Reinforced Plastics, Others), by Application (Automotive, Manufacturing, Aerospace, Wind Energy, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

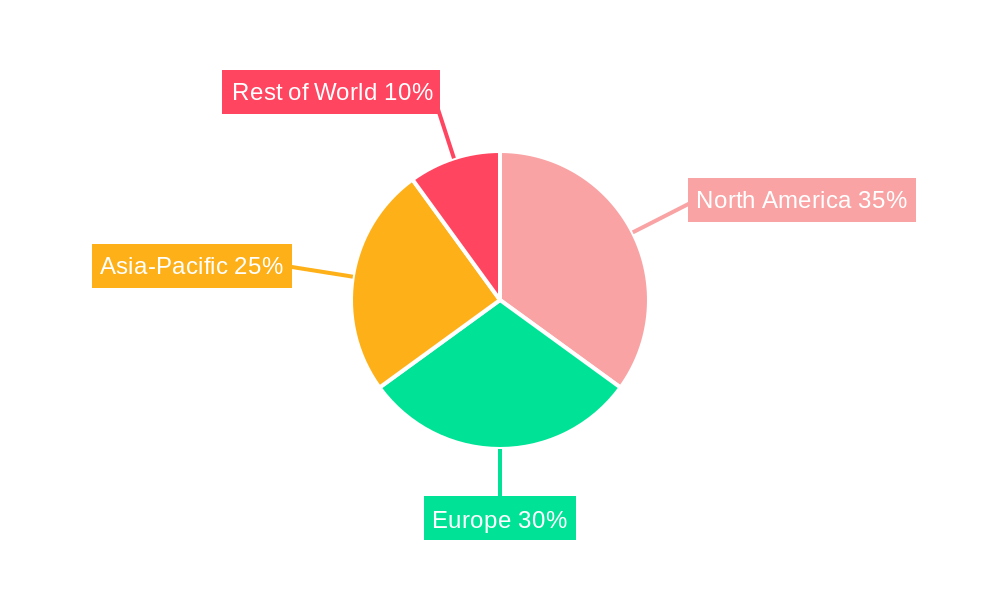

The global composite tooling prepregs market, valued at $708.9 million in 2025, is projected to experience robust growth, driven by increasing demand across diverse sectors. The automotive industry's push for lightweight and high-performance vehicles is a significant catalyst, coupled with the burgeoning aerospace sector's need for durable and lightweight composite materials in aircraft manufacturing. Furthermore, the renewable energy sector, particularly wind energy, is contributing substantially to market expansion as manufacturers seek cost-effective and efficient solutions for larger turbine blades. Advancements in material science leading to improved prepreg properties (e.g., enhanced strength-to-weight ratios, improved processability) and the development of more sustainable production methods are further fueling this growth. The market segmentation reveals that carbon fiber prepregs currently hold the largest share, reflecting their superior performance characteristics, albeit at a higher cost compared to alternatives like glass fiber prepregs. However, the latter segment is expected to exhibit substantial growth due to its cost-effectiveness and suitability for various applications. Geographic analysis suggests North America and Europe currently dominate the market, attributable to strong established manufacturing bases and early adoption of composite technologies; however, rapidly developing economies in Asia-Pacific, particularly China and India, present significant growth opportunities. While the market faces challenges such as the relatively high cost of carbon fiber prepregs and potential supply chain disruptions, overall the outlook remains positive, indicating sustained expansion throughout the forecast period. Competition among key players, including established giants and emerging innovators, will likely intensify, stimulating further technological advancements and market consolidation.

The 6.3% CAGR projected from 2025 to 2033 indicates a substantial market expansion. This growth trajectory is expected to be influenced by continued technological advancements that enhance prepreg performance, expanding their application in diverse industries beyond the current automotive, aerospace, and wind energy sectors. Factors like increasing government investments in infrastructure projects featuring composite materials and evolving manufacturing processes aiming at improved efficiency will also play a critical role. While challenges like the fluctuating prices of raw materials and potential environmental concerns related to production processes exist, the overall market dynamism, fueled by innovation and diversification of applications, suggests a resilient and steadily growing sector. The presence of both established global players and emerging regional manufacturers ensures a dynamic competitive landscape further contributing to market evolution.

Composite Tooling Prepregs Trends

The global composite tooling prepregs market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by increasing demand across diverse sectors like aerospace, automotive, and wind energy, the market witnessed significant expansion during the historical period (2019-2024). The estimated market value for 2025 showcases a substantial increase compared to previous years. This upward trajectory is anticipated to continue throughout the forecast period (2025-2033), fueled by technological advancements, favorable government regulations promoting lightweighting and sustainability, and the rising adoption of composite materials in high-performance applications. The shift towards automation in manufacturing processes and the development of innovative prepreg formulations with enhanced properties further contribute to this positive trend. However, challenges like fluctuating raw material prices and the need for skilled labor to handle specialized prepregs pose some restraints. The market is characterized by a diverse range of players, each focusing on specific product segments and application areas. Competition is primarily based on factors such as product quality, pricing strategies, and technological innovation. Key players are constantly investing in R&D to develop advanced prepregs with superior performance characteristics, such as improved drape, lower viscosity, and enhanced durability. This intense competition fosters continuous market innovation and benefits end-users through better product offerings.

Driving Forces: What's Propelling the Composite Tooling Prepregs Market?

Several factors contribute to the market's rapid growth. The automotive industry's drive for lightweight vehicles to improve fuel efficiency and reduce emissions is a primary driver. Aerospace manufacturers are increasingly adopting composite materials for aircraft structures to reduce weight and improve fuel economy, further boosting the demand for composite tooling prepregs. The burgeoning wind energy sector relies heavily on composite materials for turbine blades, creating another significant market segment. Furthermore, the manufacturing sector is exploring the use of composite materials for various applications, recognizing their high strength-to-weight ratio and design flexibility. The development of advanced prepreg formulations tailored for specific applications, such as high-temperature resistance or improved impact strength, is also a major growth catalyst. Governments across the globe are increasingly promoting the use of lightweight and sustainable materials, resulting in favorable regulations and incentives that accelerate the adoption of composite tooling prepregs.

Challenges and Restraints in Composite Tooling Prepregs

Despite the positive growth outlook, several challenges hinder market expansion. Fluctuations in raw material prices, especially for carbon fiber, significantly impact the cost of prepregs, leading to price volatility and impacting profitability. The specialized nature of composite tooling prepregs requires skilled labor for handling and processing, creating a potential skills gap that could limit production capacity. The high initial investment required for manufacturing facilities and equipment can be a barrier to entry for new players, contributing to market concentration among established firms. Stringent quality control measures and the need for precise handling during manufacturing add to the overall production complexity and cost. Finally, environmental concerns related to the production and disposal of composite materials are also emerging as a consideration for the industry, requiring innovative and sustainable solutions.

Key Region or Country & Segment to Dominate the Market

The aerospace segment is expected to dominate the composite tooling prepregs market during the forecast period. This is primarily due to the growing demand for lightweight and high-strength aircraft components. The high cost of traditional materials like aluminum and steel, coupled with the advantages of composite materials in terms of fuel efficiency and structural performance, is pushing the adoption rate upward.

- North America and Europe are anticipated to be the leading regions, driven by the strong presence of major aerospace manufacturers and a well-established supply chain.

- Asia Pacific, particularly China, is also witnessing significant growth, fueled by expanding domestic aerospace industries and increased investment in wind energy infrastructure.

Furthermore, carbon fiber prepregs are projected to hold the largest market share within the type segment, owing to their superior mechanical properties and widespread applications in high-performance components.

- Carbon fiber's high strength-to-weight ratio is particularly attractive for aerospace applications, where weight reduction translates directly into improved fuel efficiency and payload capacity.

- The automotive industry is also increasingly adopting carbon fiber prepregs for lightweighting purposes.

While glass fiber prepregs provide a cost-effective alternative, carbon fiber's performance advantage secures its dominant position in the foreseeable future.

Growth Catalysts in Composite Tooling Prepregs Industry

The ongoing trend of lightweighting across various industries, coupled with the increasing demand for high-performance materials, serves as a significant growth catalyst. Furthermore, advancements in prepreg formulations leading to improved processing characteristics, reduced cycle times, and enhanced material properties are driving market expansion. Government initiatives promoting sustainable materials and the development of advanced manufacturing techniques are also fostering growth.

Leading Players in the Composite Tooling Prepregs Market

- 3A Associate Incorporated

- BPREG Composites

- Composites Evolution

- Dexcraft

- ENEOS Corporation

- Gurit [Gurit]

- Hexcel [Hexcel]

- Isola Group [Isola Group]

- Qingdao Regal New Material Co., LTD.

- Renegade Materials

- SEIREN Co., LTD

- SHD Composite Materials Ltd

- Solvay [Solvay]

- TCR Composites, Inc

- Toray [Toray]

Significant Developments in Composite Tooling Prepregs Sector

- 2020: Hexcel launched a new range of high-performance carbon fiber prepregs for aerospace applications.

- 2021: Solvay introduced a sustainable prepreg system with reduced environmental impact.

- 2022: Gurit announced a strategic partnership to expand its global presence in the composite tooling market.

- 2023: Several companies invested heavily in R&D to develop new prepreg formulations with improved properties.

Comprehensive Coverage Composite Tooling Prepregs Report

This report provides a detailed analysis of the composite tooling prepregs market, covering market size, growth drivers, challenges, key players, and future trends. The report offers valuable insights for stakeholders in the industry, including manufacturers, suppliers, and end-users, to make informed business decisions. It provides comprehensive information on various segments, regions, and applications, enabling a complete understanding of the market dynamics.

Composite Tooling Prepregs Segmentation

-

1. Type

- 1.1. Carbon Fiber Prepregs

- 1.2. Glass Fiber Prepregs

- 1.3. Aramid Fiber-Reinforced Plastics

- 1.4. Others

-

2. Application

- 2.1. Automotive

- 2.2. Manufacturing

- 2.3. Aerospace

- 2.4. Wind Energy

- 2.5. Others

Composite Tooling Prepregs Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Composite Tooling Prepregs REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.3% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Composite Tooling Prepregs Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carbon Fiber Prepregs

- 5.1.2. Glass Fiber Prepregs

- 5.1.3. Aramid Fiber-Reinforced Plastics

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Manufacturing

- 5.2.3. Aerospace

- 5.2.4. Wind Energy

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Composite Tooling Prepregs Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Carbon Fiber Prepregs

- 6.1.2. Glass Fiber Prepregs

- 6.1.3. Aramid Fiber-Reinforced Plastics

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive

- 6.2.2. Manufacturing

- 6.2.3. Aerospace

- 6.2.4. Wind Energy

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Composite Tooling Prepregs Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Carbon Fiber Prepregs

- 7.1.2. Glass Fiber Prepregs

- 7.1.3. Aramid Fiber-Reinforced Plastics

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive

- 7.2.2. Manufacturing

- 7.2.3. Aerospace

- 7.2.4. Wind Energy

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Composite Tooling Prepregs Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Carbon Fiber Prepregs

- 8.1.2. Glass Fiber Prepregs

- 8.1.3. Aramid Fiber-Reinforced Plastics

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive

- 8.2.2. Manufacturing

- 8.2.3. Aerospace

- 8.2.4. Wind Energy

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Composite Tooling Prepregs Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Carbon Fiber Prepregs

- 9.1.2. Glass Fiber Prepregs

- 9.1.3. Aramid Fiber-Reinforced Plastics

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive

- 9.2.2. Manufacturing

- 9.2.3. Aerospace

- 9.2.4. Wind Energy

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Composite Tooling Prepregs Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Carbon Fiber Prepregs

- 10.1.2. Glass Fiber Prepregs

- 10.1.3. Aramid Fiber-Reinforced Plastics

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Automotive

- 10.2.2. Manufacturing

- 10.2.3. Aerospace

- 10.2.4. Wind Energy

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 3A Associate Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BPREG Composites

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Composites Evolution

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dexcraft

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ENEOS Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gurit

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hexcel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Isola Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Qingdao Regal New Material Co. LTD.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Renegade Materials

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SEIREN Co. LTD

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SHD Composite Materials Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Solvay

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TCR Composites Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Toray

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 3A Associate Incorporated

- Figure 1: Global Composite Tooling Prepregs Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Composite Tooling Prepregs Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Composite Tooling Prepregs Revenue (million), by Type 2024 & 2032

- Figure 4: North America Composite Tooling Prepregs Volume (K), by Type 2024 & 2032

- Figure 5: North America Composite Tooling Prepregs Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Composite Tooling Prepregs Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Composite Tooling Prepregs Revenue (million), by Application 2024 & 2032

- Figure 8: North America Composite Tooling Prepregs Volume (K), by Application 2024 & 2032

- Figure 9: North America Composite Tooling Prepregs Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Composite Tooling Prepregs Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Composite Tooling Prepregs Revenue (million), by Country 2024 & 2032

- Figure 12: North America Composite Tooling Prepregs Volume (K), by Country 2024 & 2032

- Figure 13: North America Composite Tooling Prepregs Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Composite Tooling Prepregs Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Composite Tooling Prepregs Revenue (million), by Type 2024 & 2032

- Figure 16: South America Composite Tooling Prepregs Volume (K), by Type 2024 & 2032

- Figure 17: South America Composite Tooling Prepregs Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Composite Tooling Prepregs Volume Share (%), by Type 2024 & 2032

- Figure 19: South America Composite Tooling Prepregs Revenue (million), by Application 2024 & 2032

- Figure 20: South America Composite Tooling Prepregs Volume (K), by Application 2024 & 2032

- Figure 21: South America Composite Tooling Prepregs Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Composite Tooling Prepregs Volume Share (%), by Application 2024 & 2032

- Figure 23: South America Composite Tooling Prepregs Revenue (million), by Country 2024 & 2032

- Figure 24: South America Composite Tooling Prepregs Volume (K), by Country 2024 & 2032

- Figure 25: South America Composite Tooling Prepregs Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Composite Tooling Prepregs Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Composite Tooling Prepregs Revenue (million), by Type 2024 & 2032

- Figure 28: Europe Composite Tooling Prepregs Volume (K), by Type 2024 & 2032

- Figure 29: Europe Composite Tooling Prepregs Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Composite Tooling Prepregs Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe Composite Tooling Prepregs Revenue (million), by Application 2024 & 2032

- Figure 32: Europe Composite Tooling Prepregs Volume (K), by Application 2024 & 2032

- Figure 33: Europe Composite Tooling Prepregs Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe Composite Tooling Prepregs Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe Composite Tooling Prepregs Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Composite Tooling Prepregs Volume (K), by Country 2024 & 2032

- Figure 37: Europe Composite Tooling Prepregs Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Composite Tooling Prepregs Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Composite Tooling Prepregs Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa Composite Tooling Prepregs Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa Composite Tooling Prepregs Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa Composite Tooling Prepregs Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa Composite Tooling Prepregs Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa Composite Tooling Prepregs Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa Composite Tooling Prepregs Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa Composite Tooling Prepregs Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa Composite Tooling Prepregs Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Composite Tooling Prepregs Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Composite Tooling Prepregs Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Composite Tooling Prepregs Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Composite Tooling Prepregs Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific Composite Tooling Prepregs Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific Composite Tooling Prepregs Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific Composite Tooling Prepregs Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific Composite Tooling Prepregs Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific Composite Tooling Prepregs Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific Composite Tooling Prepregs Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Composite Tooling Prepregs Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Composite Tooling Prepregs Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Composite Tooling Prepregs Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Composite Tooling Prepregs Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Composite Tooling Prepregs Volume Share (%), by Country 2024 & 2032

- Table 1: Global Composite Tooling Prepregs Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Composite Tooling Prepregs Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Composite Tooling Prepregs Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Composite Tooling Prepregs Volume K Forecast, by Type 2019 & 2032

- Table 5: Global Composite Tooling Prepregs Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Composite Tooling Prepregs Volume K Forecast, by Application 2019 & 2032

- Table 7: Global Composite Tooling Prepregs Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Composite Tooling Prepregs Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Composite Tooling Prepregs Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Composite Tooling Prepregs Volume K Forecast, by Type 2019 & 2032

- Table 11: Global Composite Tooling Prepregs Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Composite Tooling Prepregs Volume K Forecast, by Application 2019 & 2032

- Table 13: Global Composite Tooling Prepregs Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Composite Tooling Prepregs Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Composite Tooling Prepregs Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global Composite Tooling Prepregs Volume K Forecast, by Type 2019 & 2032

- Table 23: Global Composite Tooling Prepregs Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global Composite Tooling Prepregs Volume K Forecast, by Application 2019 & 2032

- Table 25: Global Composite Tooling Prepregs Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Composite Tooling Prepregs Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Composite Tooling Prepregs Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global Composite Tooling Prepregs Volume K Forecast, by Type 2019 & 2032

- Table 35: Global Composite Tooling Prepregs Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global Composite Tooling Prepregs Volume K Forecast, by Application 2019 & 2032

- Table 37: Global Composite Tooling Prepregs Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Composite Tooling Prepregs Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Composite Tooling Prepregs Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global Composite Tooling Prepregs Volume K Forecast, by Type 2019 & 2032

- Table 59: Global Composite Tooling Prepregs Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global Composite Tooling Prepregs Volume K Forecast, by Application 2019 & 2032

- Table 61: Global Composite Tooling Prepregs Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Composite Tooling Prepregs Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Composite Tooling Prepregs Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global Composite Tooling Prepregs Volume K Forecast, by Type 2019 & 2032

- Table 77: Global Composite Tooling Prepregs Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global Composite Tooling Prepregs Volume K Forecast, by Application 2019 & 2032

- Table 79: Global Composite Tooling Prepregs Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Composite Tooling Prepregs Volume K Forecast, by Country 2019 & 2032

- Table 81: China Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Composite Tooling Prepregs Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Composite Tooling Prepregs Volume (K) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.