Construction Insurance

Construction InsuranceConstruction Insurance Report Probes the XXX million Size, Share, Growth Report and Future Analysis by 2033

Construction Insurance by Type (Professional Liability, Property and Casualty), by Application (Agency, Bancassurance, Digital & Direct Channels), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Base Year: 2024

126 Pages

Key Insights

The global construction insurance market is experiencing robust growth, driven by increasing construction activity worldwide and stricter regulatory requirements mandating comprehensive insurance coverage. This growth is further fueled by the rising complexity of construction projects, involving sophisticated technology and materials, leading to higher potential liability risks. The market is segmented by insurance type (professional liability, property & casualty) and distribution channel (agency, bancassurance, digital & direct). While professional liability insurance covers potential claims against contractors for errors or omissions, property and casualty insurance safeguards against damage to property during construction. Bancassurance channels are expanding, leveraging banks' existing customer relationships for insurance product distribution, while digital channels offer greater accessibility and efficiency. Regional variations exist, with North America and Europe currently holding significant market share due to mature economies and extensive construction activity. However, rapidly developing economies in Asia Pacific and the Middle East & Africa present considerable growth opportunities. Market restraints include economic fluctuations impacting construction investment, competition among insurers, and challenges in accurately assessing and managing risks in complex projects. The forecast period of 2025-2033 indicates sustained growth, although the pace might fluctuate depending on global economic conditions and infrastructure investment trends. Key players in this competitive landscape include global giants like Allianz, AIG, and Zurich, along with regional specialists, each leveraging their strengths in various segments and geographical areas.

The market's trajectory is shaped by several trends. The adoption of innovative technologies like Building Information Modeling (BIM) and Internet of Things (IoT) sensors improves risk assessment and loss prevention, impacting insurance pricing and product offerings. A rising focus on sustainable construction practices also influences risk profiles and necessitates tailored insurance solutions. Further, the increasing awareness of climate-related risks, such as extreme weather events, is leading to a greater demand for specialized coverage. Finally, regulatory changes and evolving industry standards continue to reshape the market, necessitating insurers to adapt their products and services to meet the changing demands of contractors and developers. Overall, the construction insurance market demonstrates significant potential, presenting both challenges and opportunities for insurers to effectively leverage market trends and regional variations for sustainable growth.

Construction Insurance Trends

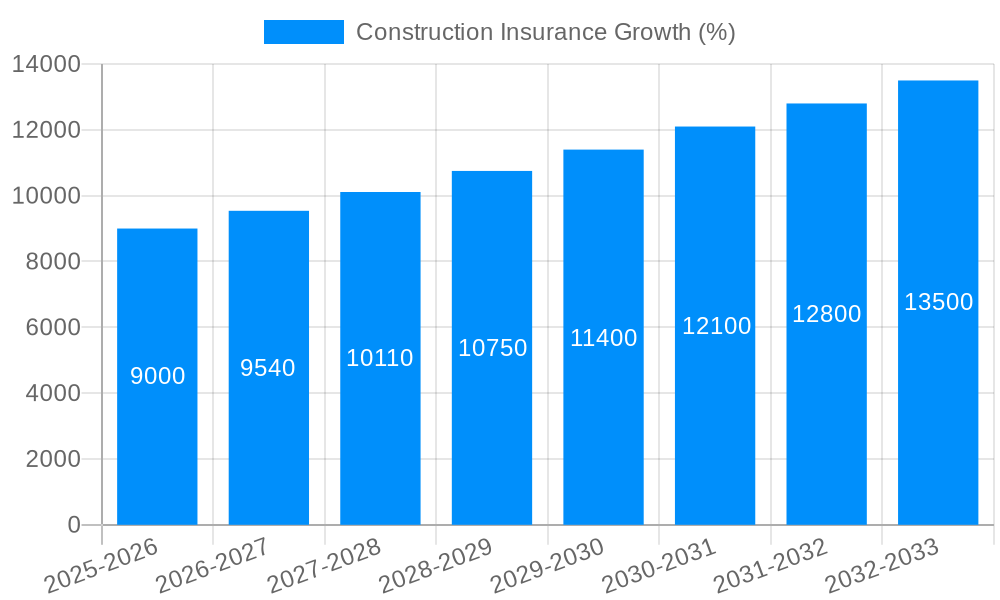

The global construction insurance market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. The period from 2019 to 2024 witnessed significant expansion, driven by a surge in global construction activity and a corresponding increase in risk exposure. This growth is expected to continue throughout the forecast period (2025-2033), although at a potentially moderated pace. Key market insights reveal a shift towards more sophisticated risk management strategies by construction companies, fueled by increasing awareness of potential liabilities and regulatory pressures. This has translated into a higher demand for comprehensive insurance packages encompassing property and casualty, professional liability, and specialized coverage for specific construction risks. The rise of digital channels and bancassurance distribution models are also reshaping the market landscape, enhancing accessibility and potentially lowering costs for smaller contractors. However, the industry faces considerable headwinds, including escalating claims costs, fluctuating economic conditions, and the increasing complexity of construction projects globally. The competitive landscape remains dynamic, with major players like Allianz, AIG, and Zurich constantly innovating to offer tailored solutions and strengthen their market presence. Market segmentation by type of coverage (e.g., professional liability, property and casualty) and application (e.g., agency, bancassurance) helps companies target their offerings effectively. The increasing adoption of technology, such as sophisticated risk modeling and AI-powered claims processing, is another transformative factor influencing market trends. The base year for this analysis is 2025, with estimates extending to 2033, providing a comprehensive outlook on this evolving sector. In the historical period (2019-2024), the market exhibited steady growth, exceeding expectations in several key regions.

Driving Forces: What's Propelling the Construction Insurance Market?

Several factors are propelling the growth of the construction insurance market. Firstly, the global boom in infrastructure development and construction projects across various sectors—residential, commercial, and industrial—directly increases the demand for risk mitigation strategies. Secondly, heightened regulatory scrutiny and stricter liability standards are pushing construction companies to secure comprehensive insurance coverage to protect themselves against potential financial losses from accidents, property damage, and legal disputes. The increasing complexity of large-scale projects, often involving multiple contractors and subcontractors, further necessitates robust insurance solutions. This complexity necessitates more comprehensive risk assessments and tailored insurance policies, leading to market expansion. Moreover, the growing awareness of environmental, social, and governance (ESG) factors within the construction industry is impacting insurance needs. Insurers are responding to this trend by offering policies specifically addressing ESG-related risks. Finally, technological advancements in risk assessment, claims processing, and fraud detection are contributing to market expansion by offering more efficient and accurate solutions.

Challenges and Restraints in Construction Insurance

Despite the positive growth outlook, the construction insurance market faces several significant challenges. One major obstacle is the escalating cost of claims, driven by factors such as rising material prices, labor shortages, and increasingly complex legal environments. This necessitates higher premiums, potentially making insurance less accessible to smaller contractors. Economic downturns and periods of market uncertainty can lead to decreased construction activity, directly impacting demand for insurance. The fluctuating availability and cost of reinsurance also pose a significant challenge to insurers, impacting their profitability and pricing strategies. Another constraint is the increasing frequency and severity of natural catastrophes and extreme weather events, leading to higher claim payouts and potentially impacting insurer solvency. Competition among insurers is intense, putting pressure on profitability and requiring constant innovation and efficiency improvements to maintain a competitive edge. Furthermore, accurately assessing and pricing risk in complex construction projects can be challenging, leading to potential underestimation and subsequent losses for insurers. Finally, regulatory changes and evolving legal frameworks can introduce complexities and uncertainty into the market.

Key Region or Country & Segment to Dominate the Market

The Property and Casualty segment is expected to dominate the construction insurance market throughout the forecast period. This is primarily due to the inherent risks involved in construction activities, including property damage, injury, and liability. Within this segment, the Agency application channel is projected to be a significant contributor to growth. While digital and direct channels are gaining traction, the traditional agency model remains dominant, particularly for larger, more complex projects.

- Property and Casualty: This segment provides coverage against damage to property, equipment, and materials, as well as liabilities arising from injuries or accidents during construction. The substantial financial risks associated with these factors make it the most significant segment within construction insurance.

- Agency Application Channel: Agents possess the expertise to tailor policies to the unique risks of each project. This specialized knowledge and personal service remain highly valued by many construction companies, particularly larger ones with complex insurance needs. The personal touch and advice provided by agents fosters trust and ensures adequate coverage.

- North America and Europe: These regions are anticipated to dominate the market due to high construction activity and sophisticated insurance markets. The robust regulatory frameworks and established insurance infrastructures in these regions support the growth of construction insurance.

The high value of construction projects in these regions necessitates comprehensive insurance coverage. This factor, coupled with established insurance markets and sophisticated risk management practices, contributes to the high volume of premiums and the dominance of these regions. Furthermore, government regulations and stricter safety standards further enhance the demand for comprehensive insurance within the construction sector. The continued expansion of infrastructure projects and private development across various sectors contributes significantly to market growth.

Within the Property and Casualty segment, considerable growth is anticipated in the developing economies of Asia and the Middle East. Although market penetration might be lower compared to mature markets, the rapid urbanization and infrastructure development in these regions are propelling significant demand for insurance coverage. However, several factors pose challenges to growth in these emerging markets, including limited insurance awareness, underdeveloped insurance infrastructure, and regulatory complexities.

Growth Catalysts in Construction Insurance Industry

The construction insurance industry is experiencing growth spurred by increased construction activity globally, stricter regulatory compliance requirements, and the growing awareness of potential liabilities. Technological advancements in risk assessment and claims management are also driving efficiency and market expansion. The rise of specialized insurance products tailored to specific construction risks, such as those related to green building and infrastructure projects, further catalyzes market growth.

Leading Players in the Construction Insurance Market

- Allianz

- AIG

- Tokio Marine

- ACE & Chubb (Note: ACE has merged with Chubb)

- XL Group (Now part of AXA)

- QBE

- Zurich Insurance

- AXA

- Beazley

- Munich Re

- Mapfre

- Manulife

- Nationwide

- State Farm

- Berkshire Hathaway

- Liberty Mutual

- Travelers

Significant Developments in Construction Insurance Sector

- 2020: Increased focus on cyber security risks within construction projects.

- 2021: Several major insurers introduced new products addressing ESG considerations in construction.

- 2022: Significant rise in claims related to supply chain disruptions and material cost inflation.

- 2023: Growing adoption of AI-powered risk assessment tools by insurers.

- 2024: Several regulatory changes impacting construction insurance liability in key markets.

Comprehensive Coverage Construction Insurance Report

This report offers a detailed analysis of the construction insurance market, projecting substantial growth over the next decade. It examines key market trends, driving factors, challenges, and significant developments. The report also profiles leading players in the industry, analyzing their strategies and market positions, while providing insights into key regional and segmental growth opportunities. A detailed segmentation by insurance type (Property & Casualty, Professional Liability), application (Agency, Bancassurance, Digital & Direct Channels), and geographic region provides a comprehensive overview of the market landscape. The study utilizes data spanning the historical period (2019-2024) and projects the market's trajectory through 2033, enabling informed decision-making for industry stakeholders.

Construction Insurance Segmentation

-

1. Type

- 1.1. Professional Liability

- 1.2. Property and Casualty

-

2. Application

- 2.1. Agency

- 2.2. Bancassurance

- 2.3. Digital & Direct Channels

Construction Insurance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Insurance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Table Of Content

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Insurance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Professional Liability

- 5.1.2. Property and Casualty

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Agency

- 5.2.2. Bancassurance

- 5.2.3. Digital & Direct Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Construction Insurance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Professional Liability

- 6.1.2. Property and Casualty

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Agency

- 6.2.2. Bancassurance

- 6.2.3. Digital & Direct Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Construction Insurance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Professional Liability

- 7.1.2. Property and Casualty

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Agency

- 7.2.2. Bancassurance

- 7.2.3. Digital & Direct Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Construction Insurance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Professional Liability

- 8.1.2. Property and Casualty

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Agency

- 8.2.2. Bancassurance

- 8.2.3. Digital & Direct Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Construction Insurance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Professional Liability

- 9.1.2. Property and Casualty

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Agency

- 9.2.2. Bancassurance

- 9.2.3. Digital & Direct Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Construction Insurance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Professional Liability

- 10.1.2. Property and Casualty

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Agency

- 10.2.2. Bancassurance

- 10.2.3. Digital & Direct Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Allianz

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AIG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tokio Marine

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ACE&Chubb

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 XL Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 QBE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zurich Insurance

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AXA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beazley

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Munich Re

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mapfre

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Manulife

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nationwide

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 State Farm

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Berkshire Hathaway

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Liberty Mutual

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Travelers

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Allianz

List of Figures

- Figure 1: Global Construction Insurance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Construction Insurance Revenue (million), by Type 2024 & 2032

- Figure 3: North America Construction Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Construction Insurance Revenue (million), by Application 2024 & 2032

- Figure 5: North America Construction Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Construction Insurance Revenue (million), by Country 2024 & 2032

- Figure 7: North America Construction Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Construction Insurance Revenue (million), by Type 2024 & 2032

- Figure 9: South America Construction Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Construction Insurance Revenue (million), by Application 2024 & 2032

- Figure 11: South America Construction Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Construction Insurance Revenue (million), by Country 2024 & 2032

- Figure 13: South America Construction Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Construction Insurance Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Construction Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Construction Insurance Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Construction Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Construction Insurance Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Construction Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Construction Insurance Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Construction Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Construction Insurance Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Construction Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Construction Insurance Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Construction Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Construction Insurance Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Construction Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Construction Insurance Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Construction Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Construction Insurance Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Construction Insurance Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Construction Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Construction Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Construction Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Construction Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Construction Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Construction Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Construction Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Construction Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Construction Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Construction Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Construction Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Construction Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Construction Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Construction Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Construction Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Construction Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Construction Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Construction Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Construction Insurance Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Top-down and bottom-up approaches are used to validate the global market size and estimate the market size for manufactures, regional segemnts, product and application.

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Additionally after gathering mix and scattered data from wide range of sources, data is triangull- ated and correlated to come up with estimated figures which are further validated through primary mediums, or industry experts, opinion leader.

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.