Contractor Safety Management Software

Contractor Safety Management SoftwareContractor Safety Management Software Unlocking Growth Potential: Analysis and Forecasts 2025-2033

Contractor Safety Management Software by Type (Cloud-based, On-premises), by Application (Small and Medium Enterprises (SMEs), Large Enterprises), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The Contractor Safety Management Software market is experiencing robust growth, driven by increasing regulatory pressure on construction companies to ensure worker safety and the rising adoption of digital solutions to improve efficiency and reduce accidents. The market is segmented by deployment (cloud-based and on-premises) and user type (SMEs and large enterprises). Cloud-based solutions are gaining significant traction due to their scalability, accessibility, and cost-effectiveness compared to on-premises systems. Large enterprises, with their greater resources and complexity, are currently the larger segment, but the SME segment is exhibiting faster growth due to increasing awareness of safety regulations and the affordability of cloud-based solutions. Key market drivers include stricter government regulations regarding workplace safety, rising construction activity globally, and growing awareness of the financial and reputational risks associated with workplace accidents. The market is also influenced by trends such as the integration of IoT devices for real-time monitoring, the adoption of AI-powered analytics for risk prediction, and the increasing demand for comprehensive safety management platforms offering features beyond basic incident reporting. However, factors like high initial investment costs for some systems and the need for robust data security measures can act as restraints, especially for smaller companies. The market is highly competitive with established players like Cority, Enablon, and Gensuite alongside emerging technology providers catering to specific needs. Geographical distribution shows strong concentration in North America and Europe, reflecting these regions' mature construction sectors and stringent safety regulations; however, growth opportunities exist in rapidly developing economies in Asia-Pacific and the Middle East & Africa. We project a sustained period of market expansion, with significant gains expected in the coming decade fueled by technological advancements and broader adoption across all sectors of the construction industry.

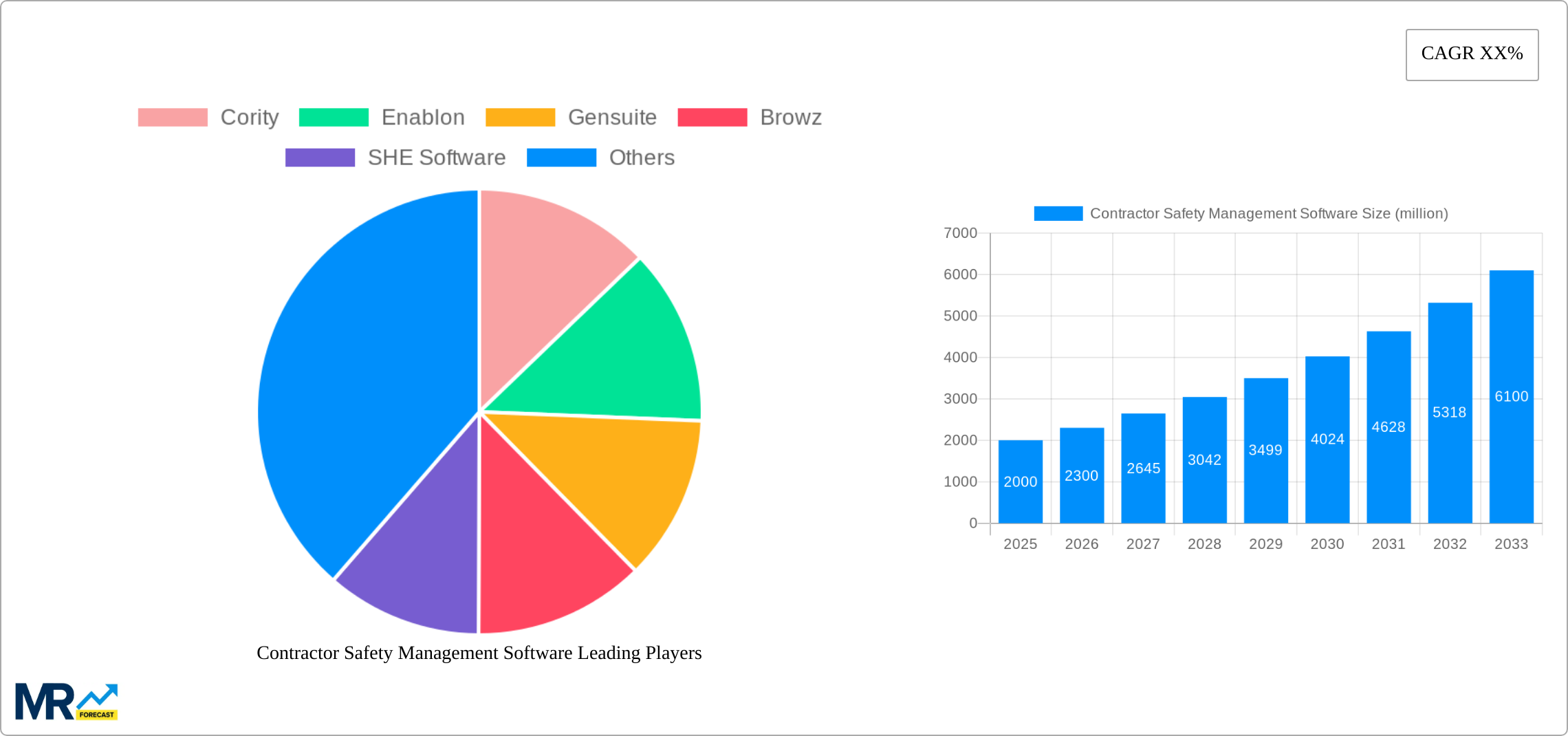

The forecast for the Contractor Safety Management Software market indicates a compound annual growth rate (CAGR) exceeding 10% from 2025 to 2033. This growth is projected to be driven by several factors including increasing construction activities globally, particularly in emerging markets; a rising emphasis on proactive risk management and preventative measures within organizations; and the growing acceptance of software-based solutions for their enhanced capabilities compared to traditional paper-based methods. The market’s competitive landscape remains dynamic, with both established players and new entrants vying for market share through innovation, strategic partnerships, and mergers and acquisitions. The ongoing integration of advanced technologies such as machine learning and artificial intelligence will further drive market evolution and growth, creating opportunities for companies that can effectively leverage these capabilities to offer improved functionalities and enhanced safety outcomes for their clients. The continuing focus on improving worker safety and reducing workplace incidents will sustain this positive market outlook throughout the forecast period.

Contractor Safety Management Software Trends

The Contractor Safety Management Software market is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. Driven by increasing regulatory pressures, a heightened focus on worker safety, and the inherent risks associated with contractor-based workforces, the demand for sophisticated software solutions is surging. The market's evolution is characterized by a shift towards cloud-based solutions, offering scalability, accessibility, and cost-effectiveness compared to on-premises deployments. This trend is further accelerated by the adoption of mobile technologies, enabling real-time data collection and communication directly in the field. The historical period (2019-2024) saw significant adoption among large enterprises, but the forecast period (2025-2033) indicates a substantial rise in uptake among Small and Medium Enterprises (SMEs), driven by affordability and user-friendly interfaces tailored to their specific needs. Key market insights reveal a growing preference for integrated platforms offering comprehensive functionalities, encompassing safety training management, incident reporting, risk assessment, and compliance tracking, all within a single ecosystem. The competitive landscape is dynamic, with established players and emerging startups vying for market share through continuous innovation and strategic partnerships. The estimated market value for 2025 signifies a significant milestone in the market's trajectory, reflecting the culmination of several years of growth and the anticipation of even more substantial expansion in the years to come. The market’s growth is not simply a matter of increasing adoption; it's a reflection of the evolving understanding of safety management's impact on operational efficiency, risk mitigation, and overall organizational success. The integration of advanced analytics and AI capabilities also promises to further enhance predictive capabilities and proactive risk management. This is transforming the industry from reactive incident management to a proactive, data-driven approach.

Driving Forces: What's Propelling the Contractor Safety Management Software Market?

Several key factors are driving the rapid expansion of the Contractor Safety Management Software market. Stringent government regulations and increasing penalties for safety violations are compelling organizations to adopt robust safety management systems. The rising awareness of the significant financial and reputational consequences of workplace accidents is further motivating businesses to invest in preventative measures, and software plays a crucial role in this. The growing complexity of contractor management, particularly in large-scale projects involving numerous contractors across diverse locations, necessitates efficient and centralized systems to oversee safety protocols and performance. Furthermore, the increasing demand for improved worker safety, not just as a legal requirement but also as a crucial aspect of corporate social responsibility, is a powerful driver. The ability of these software solutions to streamline communication, facilitate real-time collaboration, and ensure better visibility into safety performance across various projects and contractors represents a compelling value proposition for organizations. This translates to improved risk management, reduced incidents, and enhanced productivity, ultimately leading to considerable cost savings in the long run. The ease of access to data, through the adoption of cloud-based systems, also allows for improved trend analysis and informed decision-making, contributing significantly to the market's rapid growth.

Challenges and Restraints in Contractor Safety Management Software

Despite the significant growth potential, the Contractor Safety Management Software market faces several challenges. The initial investment costs associated with software implementation and ongoing maintenance can be a barrier for SMEs, particularly those with limited budgets. The integration of new software with existing systems can be complex and time-consuming, requiring significant IT resources and expertise. Ensuring data security and privacy is also a critical concern, particularly with cloud-based solutions that handle sensitive employee and project information. Moreover, user adoption and training can present hurdles, with the success of any software solution depending on the willingness and ability of users to effectively implement it. Resistance to change within organizations and a lack of understanding of the software's benefits can also hinder adoption. The need for constant updates and software maintenance to stay compliant with ever-evolving regulations represents an ongoing challenge for both users and software providers. Finally, the fragmented nature of the contractor industry, with varying safety standards and practices, necessitates highly adaptable and configurable software solutions.

Key Region or Country & Segment to Dominate the Market

The North American market is expected to dominate the Contractor Safety Management Software market throughout the forecast period (2025-2033). This dominance stems from stringent safety regulations, a strong focus on workplace safety, and the high concentration of large enterprises that are early adopters of innovative technology. European markets are also poised for significant growth due to increasing regulatory pressures and an escalating awareness of workplace safety.

- North America: High adoption rates among large enterprises and robust regulatory environment.

- Europe: Stringent regulations and growing awareness of workplace safety.

In terms of segments:

Cloud-Based Solutions: The cloud-based segment is projected to hold the largest market share throughout the forecast period, driven by its scalability, accessibility, cost-effectiveness, and ease of integration with other business applications. This segment is favored by both SMEs and large enterprises. Cloud-based solutions offer real-time data access, improved collaboration, and reduced IT infrastructure costs.

Large Enterprises: Large enterprises are the primary adopters of Contractor Safety Management Software, particularly cloud-based solutions. Their large-scale operations, complex contractor networks, and stringent safety requirements necessitate advanced software capabilities for effective safety management. The higher budgets and more developed IT infrastructure within large enterprises support the adoption of sophisticated and feature-rich software. They frequently demand advanced analytics and reporting capabilities, along with seamless integration with other enterprise resource planning (ERP) systems.

The paragraph above provides a detailed explanation supporting the points listed. The combination of strong regulatory environments, heightened awareness of safety issues, and the scalability and cost-effectiveness of cloud-based solutions are driving robust growth within these key regions and segments.

Growth Catalysts in Contractor Safety Management Software Industry

Several factors are catalyzing growth within the Contractor Safety Management Software industry. The increasing adoption of mobile technologies enables real-time data capture and analysis, improving response times and risk management. The integration of AI and machine learning capabilities enhances predictive analytics and proactive risk mitigation. Furthermore, the growing focus on data-driven decision-making fosters continuous improvement and enhanced safety protocols. Lastly, the increasing availability of user-friendly and cost-effective solutions broadens the market's reach, particularly to SMEs.

Leading Players in the Contractor Safety Management Software Market

- Cority

- Enablon

- Gensuite

- Browz

- SHE Software

- ASK EHS

- SAI Global

- Jobber Software

- Contractor Compliance

- Procore Technologies

Significant Developments in Contractor Safety Management Software Sector

- 2020: Several vendors launched integrated platforms combining safety management with other functionalities like project management.

- 2021: Increased focus on AI-powered predictive analytics for risk assessment.

- 2022: Expansion of mobile application capabilities for real-time data collection.

- 2023: Growing adoption of cloud-based solutions among SMEs.

Comprehensive Coverage Contractor Safety Management Software Report

This report provides a comprehensive analysis of the Contractor Safety Management Software market, encompassing historical data (2019-2024), current estimates (2025), and future projections (2025-2033). It delves into market trends, driving forces, challenges, key players, and significant developments. The report offers detailed insights into various market segments, including cloud-based vs. on-premises solutions and applications across SMEs and large enterprises, providing a valuable resource for stakeholders seeking to understand and navigate this rapidly evolving market. The detailed regional breakdown allows for focused analysis and informed strategic decision-making.

Contractor Safety Management Software Segmentation

-

1. Type

- 1.1. Cloud-based

- 1.2. On-premises

-

2. Application

- 2.1. Small and Medium Enterprises (SMEs)

- 2.2. Large Enterprises

Contractor Safety Management Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Contractor Safety Management Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contractor Safety Management Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cloud-based

- 5.1.2. On-premises

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Small and Medium Enterprises (SMEs)

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Contractor Safety Management Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cloud-based

- 6.1.2. On-premises

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Small and Medium Enterprises (SMEs)

- 6.2.2. Large Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Contractor Safety Management Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cloud-based

- 7.1.2. On-premises

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Small and Medium Enterprises (SMEs)

- 7.2.2. Large Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Contractor Safety Management Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cloud-based

- 8.1.2. On-premises

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Small and Medium Enterprises (SMEs)

- 8.2.2. Large Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Contractor Safety Management Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cloud-based

- 9.1.2. On-premises

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Small and Medium Enterprises (SMEs)

- 9.2.2. Large Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Contractor Safety Management Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cloud-based

- 10.1.2. On-premises

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Small and Medium Enterprises (SMEs)

- 10.2.2. Large Enterprises

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cority

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Enablon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gensuite

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Browz

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SHE Software

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ASK EHS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SAI Global

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jobber Software

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Contractor Compliance

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Procore Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Cority

- Figure 1: Global Contractor Safety Management Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Contractor Safety Management Software Revenue (million), by Type 2024 & 2032

- Figure 3: North America Contractor Safety Management Software Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Contractor Safety Management Software Revenue (million), by Application 2024 & 2032

- Figure 5: North America Contractor Safety Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Contractor Safety Management Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Contractor Safety Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Contractor Safety Management Software Revenue (million), by Type 2024 & 2032

- Figure 9: South America Contractor Safety Management Software Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Contractor Safety Management Software Revenue (million), by Application 2024 & 2032

- Figure 11: South America Contractor Safety Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Contractor Safety Management Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Contractor Safety Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Contractor Safety Management Software Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Contractor Safety Management Software Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Contractor Safety Management Software Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Contractor Safety Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Contractor Safety Management Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Contractor Safety Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Contractor Safety Management Software Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Contractor Safety Management Software Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Contractor Safety Management Software Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Contractor Safety Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Contractor Safety Management Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Contractor Safety Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Contractor Safety Management Software Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Contractor Safety Management Software Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Contractor Safety Management Software Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Contractor Safety Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Contractor Safety Management Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Contractor Safety Management Software Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Contractor Safety Management Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Contractor Safety Management Software Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Contractor Safety Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Contractor Safety Management Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Contractor Safety Management Software Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Contractor Safety Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Contractor Safety Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Contractor Safety Management Software Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Contractor Safety Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Contractor Safety Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Contractor Safety Management Software Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Contractor Safety Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Contractor Safety Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Contractor Safety Management Software Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Contractor Safety Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Contractor Safety Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Contractor Safety Management Software Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Contractor Safety Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Contractor Safety Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Contractor Safety Management Software Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.