Credit Risk Management Service

Credit Risk Management ServiceCredit Risk Management Service Analysis Report 2025: Market to Grow by a CAGR of XX to 2033, Driven by Government Incentives, Popularity of Virtual Assistants, and Strategic Partnerships

Credit Risk Management Service by Type (Credit Scoring Services, Credit Monitoring Services, Credit Reporting Services, Others), by Application (Bank, Enterprise, Credit Unions, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global credit risk management services market is experiencing robust growth, driven by increasing regulatory scrutiny, the rising adoption of digital technologies, and the expanding need for sophisticated risk assessment tools across diverse sectors. The market, encompassing credit scoring, monitoring, and reporting services, caters to a broad client base including banks, enterprises, and credit unions. While precise figures are unavailable, considering the involvement of major players like SAS, Moody's Analytics, and S&P Global Ratings, alongside the significant investments in fintech solutions, the market size likely exceeds $50 billion in 2025, with a Compound Annual Growth Rate (CAGR) of around 8-10% projected for the forecast period (2025-2033). This growth is fueled by trends like the increasing adoption of AI and machine learning for enhanced risk prediction, the growth of open banking initiatives promoting data sharing, and the burgeoning demand for real-time credit risk assessment. However, challenges remain, including the high cost of implementing advanced technologies, data security concerns, and the complexities of complying with evolving regulatory frameworks.

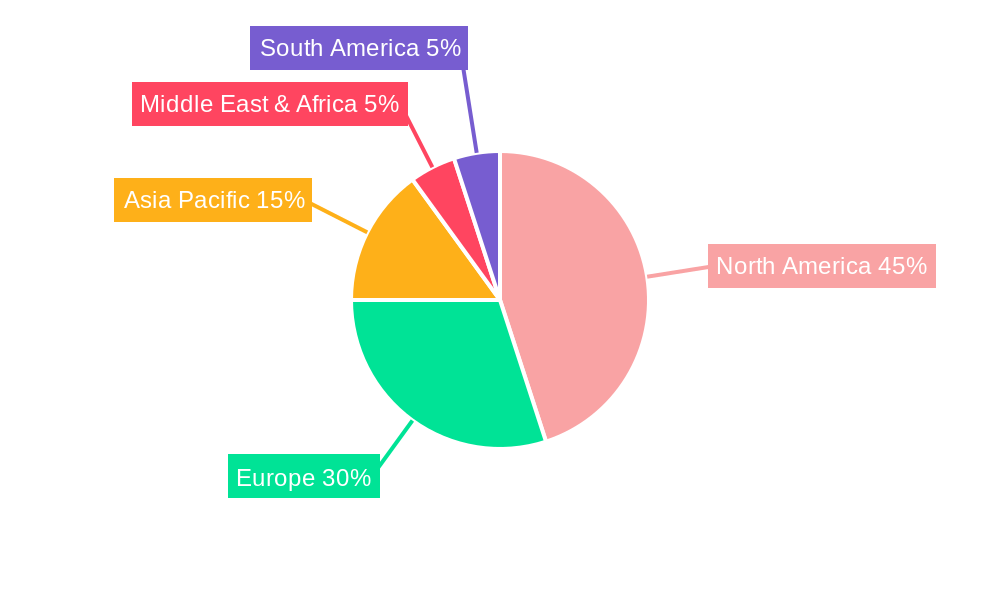

Segment-wise, credit scoring services are expected to maintain a leading position, driven by their critical role in loan origination and risk evaluation. Geographically, North America and Europe currently dominate the market due to advanced financial infrastructure and stringent regulatory environments. However, the Asia-Pacific region exhibits significant growth potential owing to rapid economic expansion and increasing financial inclusion initiatives. The competitive landscape is characterized by the presence of both large established players and agile fintech companies, creating a dynamic and innovative market environment. Continued technological advancements, coupled with a proactive regulatory stance, will shape the trajectory of this market in the coming years. The increasing focus on fraud detection and prevention further enhances the importance and growth of the Credit Risk Management Services market.

Credit Risk Management Service Trends

The global credit risk management service market is experiencing robust growth, projected to reach USD XX billion by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033). The market's expansion is driven by several converging factors. Firstly, the increasing complexity of financial regulations and compliance requirements across various jurisdictions necessitates sophisticated credit risk management solutions. Secondly, the rise of digital lending and fintech innovations has introduced new challenges and opportunities, necessitating advanced analytical tools and real-time monitoring capabilities. Thirdly, the growing adoption of big data analytics and artificial intelligence (AI) is transforming the way credit risk is assessed and managed, enabling more accurate predictions and proactive mitigation strategies. The historical period (2019-2024) witnessed substantial market growth, laying the foundation for the accelerated expansion predicted in the forecast period. The estimated market value in 2025 is projected at USD YY billion. This upward trajectory is further fueled by the increasing awareness among financial institutions and enterprises about the critical role of effective credit risk management in minimizing potential losses and ensuring financial stability. Furthermore, the integration of cloud-based solutions and the growing preference for outsourcing credit risk management functions contribute significantly to market expansion. Finally, the emergence of advanced credit scoring models that leverage alternative data sources, such as social media activity and mobile phone usage, are leading to improved risk assessment accuracy and enhanced credit availability for underserved populations.

Driving Forces: What's Propelling the Credit Risk Management Service

Several key factors are driving the significant growth observed and projected in the credit risk management service market. The increasing prevalence of stringent regulatory compliance necessitates robust risk management frameworks, pushing financial institutions to invest heavily in advanced solutions. The rise of digital lending and the expansion of fintech significantly increase the volume of credit transactions, demanding sophisticated systems for risk assessment and monitoring. The adoption of advanced technologies such as AI, machine learning, and big data analytics allows for more precise risk scoring, fraud detection, and predictive modeling, thereby enhancing efficiency and accuracy. Moreover, the growing need for effective fraud prevention and the ability to manage risks associated with cybersecurity threats are major factors driving demand. Finally, the evolving customer expectations and the need for personalized financial services necessitate tailored credit risk management strategies, promoting market innovation and expansion. These factors collectively contribute to the robust growth trajectory of the credit risk management service market.

Challenges and Restraints in Credit Risk Management Service

Despite the considerable growth opportunities, the credit risk management service market faces several challenges. High implementation costs associated with advanced solutions and the requirement for specialized expertise can pose significant barriers, particularly for smaller financial institutions. The ever-evolving regulatory landscape necessitates continuous adaptation and updates to systems, increasing operational complexity and costs. Data security and privacy concerns remain paramount, requiring robust measures to protect sensitive customer information. Furthermore, the integration of various data sources and the management of complex datasets can present technical difficulties. The accuracy and reliability of credit scoring models, especially those relying on alternative data sources, are crucial and require ongoing validation and refinement. Finally, the scarcity of skilled professionals proficient in advanced risk management techniques poses a challenge to the market's expansion. Addressing these challenges will be key to sustaining the market's growth trajectory.

Key Region or Country & Segment to Dominate the Market

The North American region is projected to dominate the credit risk management service market throughout the study period (2019-2033), driven by the strong presence of major financial institutions and a robust regulatory environment. The region’s advanced technological infrastructure and significant investments in fintech also contribute to this dominance.

- High Adoption of Advanced Technologies: North America witnesses high adoption rates for AI, machine learning, and big data analytics in credit risk management.

- Stringent Regulatory Compliance: Strict regulatory requirements in the region push financial institutions to prioritize robust risk management solutions.

- Presence of Major Players: The region hosts many leading providers of credit risk management services, fueling competition and innovation.

- Significant Investment in Fintech: Continuous investment in fintech enhances digital lending and increases the demand for advanced risk management systems.

Furthermore, the Banking segment is expected to hold the largest market share within the application segment, owing to the substantial need for credit risk mitigation within the banking sector. Banks heavily rely on robust credit risk management to control potential losses and adhere to regulatory requirements. The increasing adoption of digital banking further fuels the demand for sophisticated risk management systems within this segment.

- Regulatory Compliance: Banks face stringent regulatory scrutiny, necessitating sophisticated risk management to comply with various regulations.

- High Credit Risk Exposure: Banks have a large credit risk exposure, making robust risk management critical for their financial stability.

- Sophisticated Risk Assessment Needs: Banks require advanced solutions capable of managing diverse credit risks accurately.

- Growing Digital Lending: The surge in digital lending increases the volume of transactions and demands more efficient risk management.

Within the "Type" segment, Credit Scoring Services are projected to experience substantial growth, primarily due to the increasing demand for accurate and efficient credit risk assessment. The development of advanced credit scoring models using alternative data sources and AI further fuels the demand within this segment.

Growth Catalysts in Credit Risk Management Service Industry

The credit risk management service industry is experiencing robust growth fueled by increasing regulatory pressures, the rise of digital lending, and the growing adoption of advanced technologies like AI and machine learning. These technologies enable more accurate risk assessment, improved fraud detection, and more efficient resource allocation. Furthermore, the increasing complexity of financial markets and the need for proactive risk mitigation strategies are driving demand for sophisticated solutions. The industry's growth is further fueled by the outsourcing trend, with financial institutions increasingly opting for specialized services to manage their credit risk efficiently.

Leading Players in the Credit Risk Management Service

- SAS

- MCG Energy

- Pega

- Deloitte

- Moody's Analytics

- WNS

- S&P Global Ratings

- CBIZ

- Protiviti

- KPMG

- Citibank

- Bruin

- Enterslice

- Oracle

- Genpact

Significant Developments in Credit Risk Management Service Sector

- 2020: Increased adoption of cloud-based credit risk management solutions.

- 2021: Launch of several AI-powered credit scoring models by major players.

- 2022: Strengthening of regulatory frameworks related to data privacy and security in credit risk management.

- 2023: Increased focus on ESG (environmental, social, and governance) factors in credit risk assessments.

- Q1 2024: Several mergers and acquisitions among credit risk management service providers.

Comprehensive Coverage Credit Risk Management Service Report

This report provides a comprehensive analysis of the credit risk management service market, covering historical performance, current trends, and future projections. It delves into the key driving forces, challenges, and growth catalysts shaping the industry. The report offers detailed insights into regional and segmental market dynamics, highlighting key players and significant developments. It serves as a valuable resource for businesses, investors, and policymakers seeking a deep understanding of this rapidly evolving market.

Credit Risk Management Service Segmentation

-

1. Type

- 1.1. Credit Scoring Services

- 1.2. Credit Monitoring Services

- 1.3. Credit Reporting Services

- 1.4. Others

-

2. Application

- 2.1. Bank

- 2.2. Enterprise

- 2.3. Credit Unions

- 2.4. Others

Credit Risk Management Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Credit Risk Management Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Credit Risk Management Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Credit Scoring Services

- 5.1.2. Credit Monitoring Services

- 5.1.3. Credit Reporting Services

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bank

- 5.2.2. Enterprise

- 5.2.3. Credit Unions

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Credit Risk Management Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Credit Scoring Services

- 6.1.2. Credit Monitoring Services

- 6.1.3. Credit Reporting Services

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bank

- 6.2.2. Enterprise

- 6.2.3. Credit Unions

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Credit Risk Management Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Credit Scoring Services

- 7.1.2. Credit Monitoring Services

- 7.1.3. Credit Reporting Services

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bank

- 7.2.2. Enterprise

- 7.2.3. Credit Unions

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Credit Risk Management Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Credit Scoring Services

- 8.1.2. Credit Monitoring Services

- 8.1.3. Credit Reporting Services

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bank

- 8.2.2. Enterprise

- 8.2.3. Credit Unions

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Credit Risk Management Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Credit Scoring Services

- 9.1.2. Credit Monitoring Services

- 9.1.3. Credit Reporting Services

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bank

- 9.2.2. Enterprise

- 9.2.3. Credit Unions

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Credit Risk Management Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Credit Scoring Services

- 10.1.2. Credit Monitoring Services

- 10.1.3. Credit Reporting Services

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bank

- 10.2.2. Enterprise

- 10.2.3. Credit Unions

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SAS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MCG Energy

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pega

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Deloitte

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Moody's Analytics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 WNS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 S&P Global Ratings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CBIZ

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Protiviti

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KPMG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 citibank

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bruin

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Enterslice

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Oracle

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Genpact

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 SAS

- Figure 1: Global Credit Risk Management Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Credit Risk Management Service Revenue (million), by Type 2024 & 2032

- Figure 3: North America Credit Risk Management Service Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Credit Risk Management Service Revenue (million), by Application 2024 & 2032

- Figure 5: North America Credit Risk Management Service Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Credit Risk Management Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Credit Risk Management Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Credit Risk Management Service Revenue (million), by Type 2024 & 2032

- Figure 9: South America Credit Risk Management Service Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Credit Risk Management Service Revenue (million), by Application 2024 & 2032

- Figure 11: South America Credit Risk Management Service Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Credit Risk Management Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Credit Risk Management Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Credit Risk Management Service Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Credit Risk Management Service Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Credit Risk Management Service Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Credit Risk Management Service Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Credit Risk Management Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Credit Risk Management Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Credit Risk Management Service Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Credit Risk Management Service Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Credit Risk Management Service Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Credit Risk Management Service Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Credit Risk Management Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Credit Risk Management Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Credit Risk Management Service Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Credit Risk Management Service Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Credit Risk Management Service Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Credit Risk Management Service Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Credit Risk Management Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Credit Risk Management Service Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Credit Risk Management Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Credit Risk Management Service Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Credit Risk Management Service Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Credit Risk Management Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Credit Risk Management Service Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Credit Risk Management Service Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Credit Risk Management Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Credit Risk Management Service Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Credit Risk Management Service Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Credit Risk Management Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Credit Risk Management Service Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Credit Risk Management Service Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Credit Risk Management Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Credit Risk Management Service Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Credit Risk Management Service Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Credit Risk Management Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Credit Risk Management Service Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Credit Risk Management Service Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Credit Risk Management Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Credit Risk Management Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.