Data Collection and Labelling

Data Collection and LabellingData Collection and Labelling Insightful Analysis: Trends, Competitor Dynamics, and Opportunities 2025-2033

Data Collection and Labelling by Type (Text, Image or Video, Audio), by Application (IT, Government, Automotive, BFSI, Healthcare, Retail and E-commerce, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

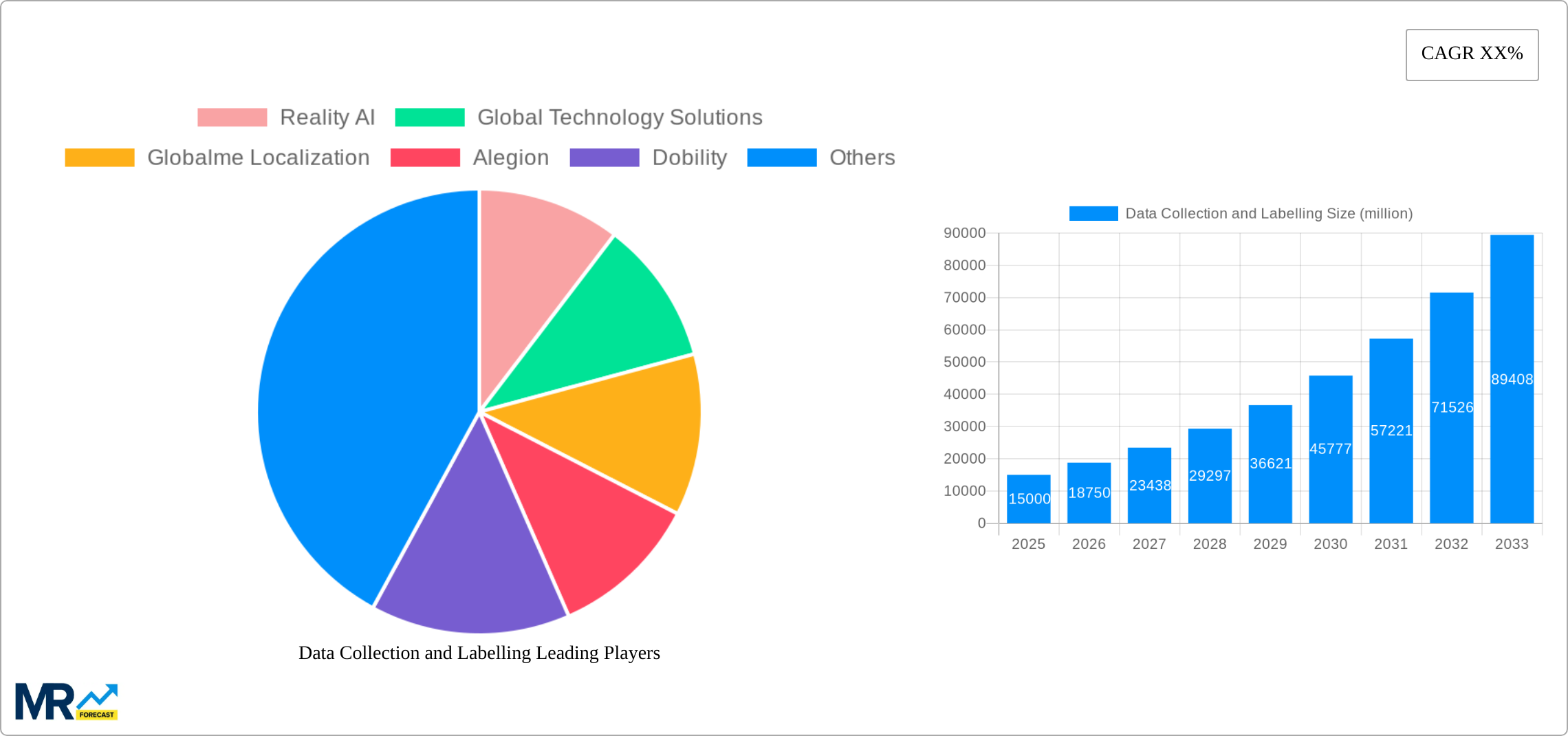

The data collection and labeling market is experiencing robust growth, fueled by the escalating demand for high-quality training data in artificial intelligence (AI) and machine learning (ML) applications. The market, estimated at $15 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 25% over the forecast period (2025-2033), reaching approximately $75 billion by 2033. This expansion is primarily driven by the increasing adoption of AI across diverse sectors, including healthcare (medical image analysis, drug discovery), automotive (autonomous driving systems), finance (fraud detection, risk assessment), and retail (personalized recommendations, inventory management). The rising complexity of AI models and the need for more diverse and nuanced datasets are significant contributing factors to this growth. Furthermore, advancements in data annotation tools and techniques, such as active learning and synthetic data generation, are streamlining the data labeling process and making it more cost-effective.

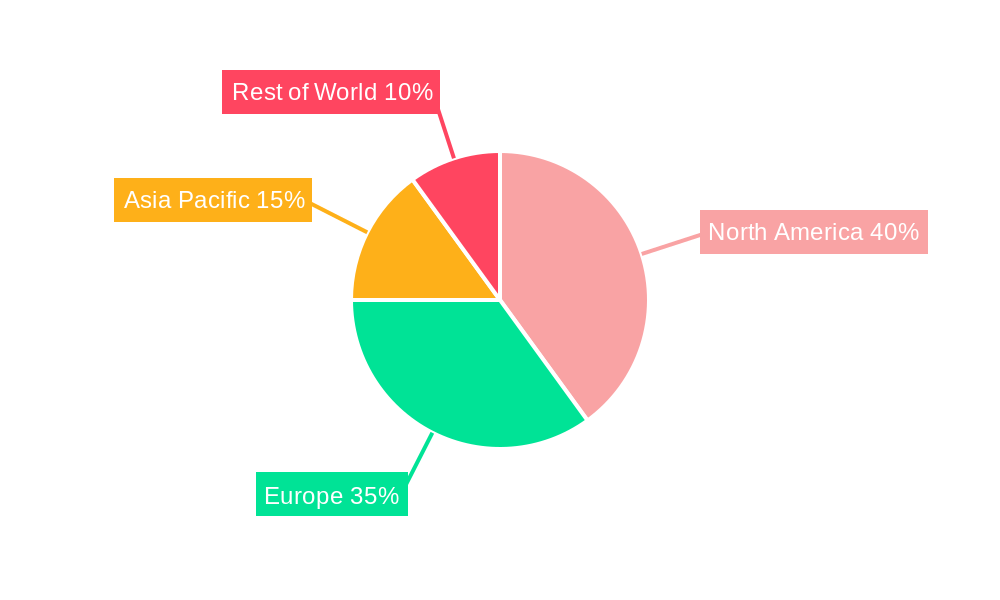

However, challenges remain. Data privacy concerns and regulations like GDPR necessitate robust data security measures, adding to the cost and complexity of data collection and labeling. The shortage of skilled data annotators also hinders market growth, necessitating investments in training and upskilling programs. Despite these restraints, the market’s inherent potential, coupled with ongoing technological advancements and increased industry investments, ensures sustained expansion in the coming years. Geographic distribution shows strong concentration in North America and Europe initially, but Asia-Pacific is poised for rapid growth due to increasing AI adoption and the availability of a large workforce. This makes strategic partnerships and global expansion crucial for market players aiming for long-term success.

Data Collection and Labelling Trends

The global data collection and labeling market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Driven by the insatiable appetite for artificial intelligence (AI) and machine learning (ML) applications across diverse sectors, the demand for high-quality, labeled datasets is soaring. The historical period (2019-2024) witnessed a significant surge in market activity, with companies like Scale AI and Labelbox emerging as major players. The estimated market value in 2025 is in the hundreds of millions, and the forecast period (2025-2033) promises even more dramatic expansion. This growth is fueled by several factors: the increasing availability of diverse data sources (text, image, video, audio), advancements in data annotation techniques, and the rising adoption of AI across industries. The market is witnessing a shift towards specialized labeling services, catering to the unique needs of specific sectors like healthcare (medical image analysis) and automotive (autonomous vehicle development). Furthermore, the emergence of new technologies like synthetic data generation is poised to reshape the landscape, offering cost-effective and privacy-preserving alternatives to traditional data collection methods. The competition is fierce, with established players vying for market share alongside agile startups offering innovative solutions. The base year for this analysis is 2025, providing a crucial benchmark for future projections. Overall, the data collection and labeling market exhibits a strong upward trajectory, reflecting the fundamental importance of high-quality data in the continued development and deployment of advanced AI technologies. This trend is expected to continue, leading to significant market expansion throughout the forecast period.

Driving Forces: What's Propelling the Data Collection and Labelling Market?

Several key factors are driving the explosive growth of the data collection and labeling market. The relentless advancement of artificial intelligence and machine learning is paramount. AI algorithms are data-hungry, requiring vast quantities of meticulously labeled data to train effectively. This demand is amplified by the increasing sophistication of AI applications, pushing the need for more complex and nuanced datasets. The proliferation of data sources, including the internet of things (IoT), social media, and various sensor technologies, contributes significantly. This abundance of raw data, however, is useless without proper labeling and structuring, creating a burgeoning market for data annotation services. Furthermore, increasing government investments in AI and related technologies are stimulating growth. Governments worldwide are recognizing the transformative potential of AI and are actively funding research, development, and deployment initiatives, which, in turn, boost demand for high-quality labeled data. Finally, the expanding adoption of AI across diverse industries—from healthcare and finance to automotive and retail—is a primary driver. As more companies integrate AI into their operations, the demand for labeled data to power these applications will only intensify, creating significant opportunities for players in this space.

Challenges and Restraints in Data Collection and Labelling

Despite the immense growth potential, the data collection and labeling market faces significant challenges. Data privacy and security are paramount concerns. The increasing volume of personal and sensitive data being collected requires robust security measures to prevent breaches and ensure compliance with data privacy regulations like GDPR. The high cost of data annotation remains a major barrier to entry and adoption for many companies. Accurate and reliable labeling often requires skilled human annotators, resulting in labor-intensive and expensive processes. Data quality inconsistencies pose another hurdle. Inconsistent labeling can lead to biases in AI models, affecting their accuracy and reliability. Maintaining data quality across large and diverse datasets is a considerable undertaking. Finding and retaining skilled data annotators is a persistent challenge. The specialized skills required for accurate labeling make it difficult to find and retain enough qualified personnel to meet the growing demand. Moreover, the need for specialized tools and technologies adds to the overall cost. The development and maintenance of sophisticated annotation tools can be expensive, making it challenging for smaller companies to compete.

Key Region or Country & Segment to Dominate the Market

The North American market, particularly the United States, is currently dominating the data collection and labeling market due to the high concentration of technology companies and significant investments in AI research and development. However, the Asia-Pacific region is projected to witness rapid growth in the coming years, driven by the increasing adoption of AI in various sectors and the expansion of the IT infrastructure.

- North America (US): High concentration of tech companies, robust investment in AI, and established data annotation infrastructure.

- Asia-Pacific (China, India): Rapid growth driven by increasing AI adoption, expanding IT infrastructure, and a large pool of skilled labor at a potentially lower cost.

- Europe: Strong focus on data privacy regulations (GDPR), requiring high-quality data labeling for compliant AI systems.

Dominant Segment: Image and Video Data Labeling

The image and video data labeling segment commands a substantial portion of the market. This dominance stems from the widespread use of computer vision in various applications, including:

- Autonomous Vehicles: Requires massive datasets of labeled images and videos for training self-driving systems.

- Healthcare: Medical image analysis relies heavily on labeled data for diagnosis and treatment planning.

- Retail and E-commerce: Image recognition is crucial for product identification, visual search, and personalized recommendations.

- Surveillance and Security: Video analysis plays a crucial role in security systems and crime prevention. This segment's growth is closely tied to advancements in computer vision technologies and the increasing demand for visual AI applications across diverse industries. The complexity of labeling image and video data—requiring precise object detection, segmentation, and contextual understanding—contributes to the higher value and profitability of this segment within the broader data labeling market.

Growth Catalysts in the Data Collection and Labelling Industry

The increasing adoption of AI across various industries, coupled with the rise of advanced machine learning techniques and the availability of big data, is fueling significant growth in the data collection and labeling market. Furthermore, government initiatives promoting AI and data-driven technologies and the expanding use of computer vision and natural language processing are further accelerating market expansion. Innovation in data annotation tools and techniques also contributes to improved efficiency and accuracy, making data collection and labeling a more streamlined process.

Leading Players in the Data Collection and Labelling Market

- Reality AI

- Global Technology Solutions

- Globalme Localization

- Alegion

- Dobility

- Labelbox

- Scale AI

- Trilldata Technologies

- Playment

Significant Developments in the Data Collection and Labelling Sector

- 2020: Increased focus on synthetic data generation to address privacy concerns and data scarcity.

- 2021: Expansion of data labeling services into niche areas like medical image analysis and autonomous vehicle development.

- 2022: Adoption of automated data labeling tools and techniques to improve efficiency and reduce costs.

- 2023: Growing emphasis on data quality assurance and bias mitigation in data labeling processes.

Comprehensive Coverage Data Collection and Labelling Report

This report provides a comprehensive overview of the data collection and labeling market, analyzing key trends, driving forces, challenges, and growth opportunities. It offers insights into the competitive landscape, highlighting leading players and significant industry developments. The report also features detailed market segmentation by data type (text, image, video, audio), application (IT, government, automotive, BFSI, healthcare, retail and e-commerce), and region. The report's projections extend to 2033, offering valuable insights for stakeholders interested in this rapidly growing sector.

Data Collection and Labelling Segmentation

-

1. Type

- 1.1. Text

- 1.2. Image or Video

- 1.3. Audio

-

2. Application

- 2.1. IT

- 2.2. Government

- 2.3. Automotive

- 2.4. BFSI

- 2.5. Healthcare

- 2.6. Retail and E-commerce

- 2.7. Others

Data Collection and Labelling Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Data Collection and Labelling REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Collection and Labelling Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Text

- 5.1.2. Image or Video

- 5.1.3. Audio

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. IT

- 5.2.2. Government

- 5.2.3. Automotive

- 5.2.4. BFSI

- 5.2.5. Healthcare

- 5.2.6. Retail and E-commerce

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Data Collection and Labelling Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Text

- 6.1.2. Image or Video

- 6.1.3. Audio

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. IT

- 6.2.2. Government

- 6.2.3. Automotive

- 6.2.4. BFSI

- 6.2.5. Healthcare

- 6.2.6. Retail and E-commerce

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Data Collection and Labelling Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Text

- 7.1.2. Image or Video

- 7.1.3. Audio

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. IT

- 7.2.2. Government

- 7.2.3. Automotive

- 7.2.4. BFSI

- 7.2.5. Healthcare

- 7.2.6. Retail and E-commerce

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Data Collection and Labelling Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Text

- 8.1.2. Image or Video

- 8.1.3. Audio

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. IT

- 8.2.2. Government

- 8.2.3. Automotive

- 8.2.4. BFSI

- 8.2.5. Healthcare

- 8.2.6. Retail and E-commerce

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Data Collection and Labelling Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Text

- 9.1.2. Image or Video

- 9.1.3. Audio

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. IT

- 9.2.2. Government

- 9.2.3. Automotive

- 9.2.4. BFSI

- 9.2.5. Healthcare

- 9.2.6. Retail and E-commerce

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Data Collection and Labelling Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Text

- 10.1.2. Image or Video

- 10.1.3. Audio

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. IT

- 10.2.2. Government

- 10.2.3. Automotive

- 10.2.4. BFSI

- 10.2.5. Healthcare

- 10.2.6. Retail and E-commerce

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Reality AI

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Global Technology Solutions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Globalme Localization

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alegion

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dobility

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Labelbox

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Scale AI

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Trilldata Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Playment

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Reality AI

- Figure 1: Global Data Collection and Labelling Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Data Collection and Labelling Revenue (million), by Type 2024 & 2032

- Figure 3: North America Data Collection and Labelling Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Data Collection and Labelling Revenue (million), by Application 2024 & 2032

- Figure 5: North America Data Collection and Labelling Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Data Collection and Labelling Revenue (million), by Country 2024 & 2032

- Figure 7: North America Data Collection and Labelling Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Data Collection and Labelling Revenue (million), by Type 2024 & 2032

- Figure 9: South America Data Collection and Labelling Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Data Collection and Labelling Revenue (million), by Application 2024 & 2032

- Figure 11: South America Data Collection and Labelling Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Data Collection and Labelling Revenue (million), by Country 2024 & 2032

- Figure 13: South America Data Collection and Labelling Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Data Collection and Labelling Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Data Collection and Labelling Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Data Collection and Labelling Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Data Collection and Labelling Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Data Collection and Labelling Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Data Collection and Labelling Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Data Collection and Labelling Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Data Collection and Labelling Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Data Collection and Labelling Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Data Collection and Labelling Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Data Collection and Labelling Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Data Collection and Labelling Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Data Collection and Labelling Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Data Collection and Labelling Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Data Collection and Labelling Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Data Collection and Labelling Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Data Collection and Labelling Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Data Collection and Labelling Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Data Collection and Labelling Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Data Collection and Labelling Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Data Collection and Labelling Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Data Collection and Labelling Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Data Collection and Labelling Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Data Collection and Labelling Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Data Collection and Labelling Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Data Collection and Labelling Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Data Collection and Labelling Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Data Collection and Labelling Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Data Collection and Labelling Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Data Collection and Labelling Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Data Collection and Labelling Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Data Collection and Labelling Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Data Collection and Labelling Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Data Collection and Labelling Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Data Collection and Labelling Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Data Collection and Labelling Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Data Collection and Labelling Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Data Collection and Labelling Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.