Digital Insomnia Therapeutics

Digital Insomnia TherapeuticsDigital Insomnia Therapeutics 2025 Trends and Forecasts 2033: Analyzing Growth Opportunities

Digital Insomnia Therapeutics by Type (Sleep Tracking App, Relaxation and Meditation Apps, CBT-I, Others), by Application (Medical, Household), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

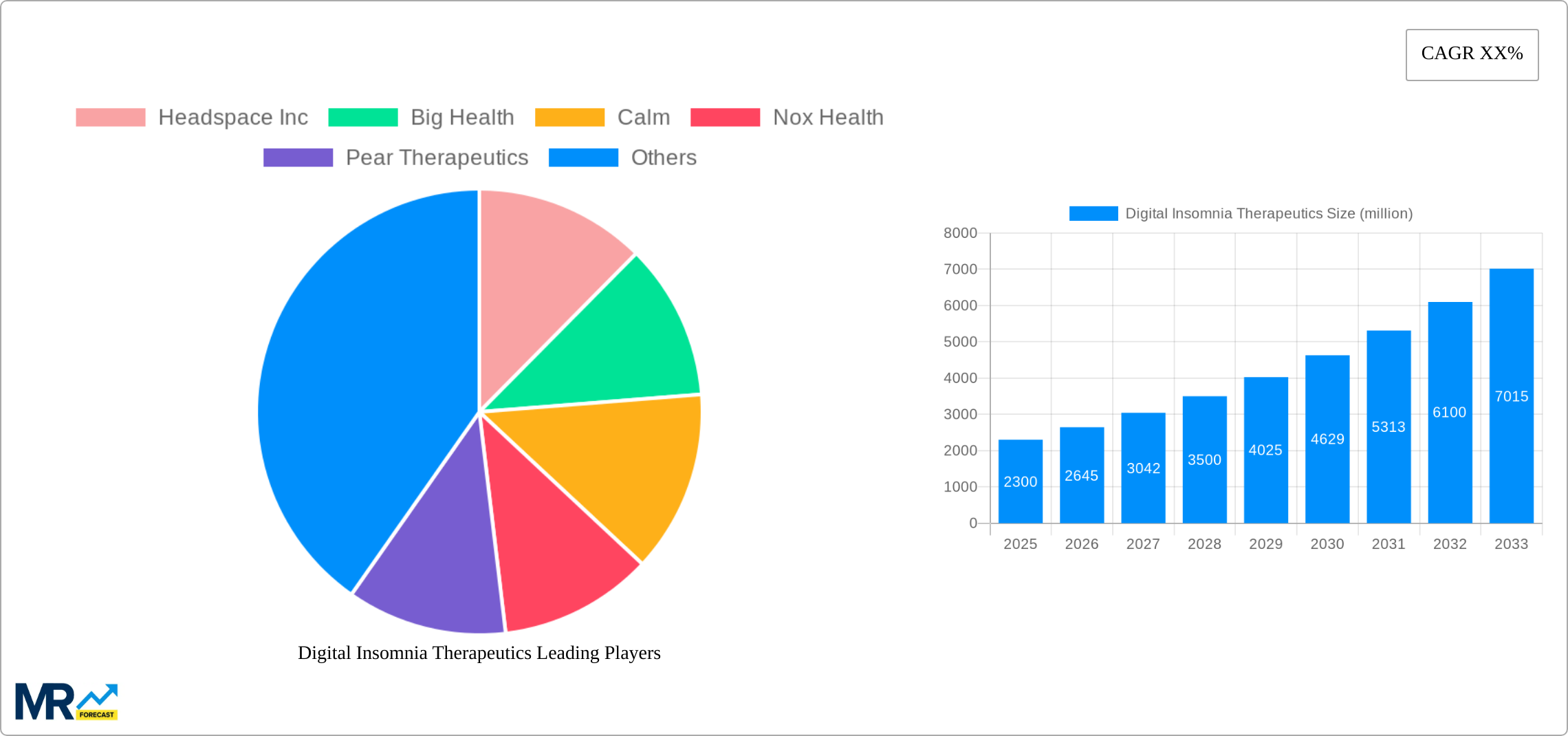

The digital insomnia therapeutics market is experiencing robust growth, driven by rising prevalence of sleep disorders, increasing smartphone penetration, and a growing preference for convenient, accessible healthcare solutions. The market, encompassing sleep tracking apps, relaxation and meditation apps, Cognitive Behavioral Therapy for Insomnia (CBT-I) apps, and other digital therapeutics, is projected to expand significantly over the next decade. While precise figures for market size and CAGR are unavailable, a reasonable estimation, based on industry reports indicating strong growth in the digital health sector and the increasing adoption of telehealth services, suggests a market valued at approximately $2 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 15-20% from 2025 to 2033. This growth is fueled by several key drivers: the rising prevalence of insomnia and sleep disorders globally; the increasing affordability and accessibility of smartphones and internet connectivity; the growing awareness of the benefits of digital therapeutics; and the limitations of traditional, in-person sleep therapy.

Market segmentation reveals strong demand across various application areas, including medical settings (integrating digital therapeutics into clinical practice) and home use. The CBT-I segment, offering structured and evidence-based therapy for insomnia, is anticipated to hold a substantial market share due to its effectiveness and the increasing demand for scientifically-backed solutions. Geographic analysis indicates that North America and Europe currently hold significant market shares, due to higher adoption rates and established healthcare infrastructures. However, Asia-Pacific is expected to exhibit the highest growth rate, fueled by increasing awareness, rising disposable incomes, and the expansion of digital healthcare infrastructure in key markets like India and China. Competitive pressures are increasing, with established players like Headspace and Calm competing with newer entrants focusing on specialized therapies and personalized solutions. The market faces potential restraints including data privacy concerns, regulatory hurdles, and the need for improved integration with existing healthcare systems. However, ongoing technological advancements, increasing investment in digital health, and a growing understanding of the benefits of digital therapeutics are likely to mitigate these challenges.

Digital Insomnia Therapeutics Trends

The digital insomnia therapeutics market is experiencing explosive growth, driven by increasing prevalence of sleep disorders, rising smartphone penetration, and a growing preference for convenient, accessible healthcare solutions. The market, valued at $XXX million in 2025, is projected to reach $XXX million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033). Analysis of the historical period (2019-2024) reveals a significant upward trajectory, setting the stage for continued expansion. This growth is fueled by several factors, including the increasing awareness of the detrimental effects of chronic insomnia on physical and mental health, leading to proactive self-management strategies. The market is witnessing a diversification of offerings, with innovative approaches such as AI-powered sleep analysis, personalized CBT-I programs, and gamified relaxation techniques emerging as key differentiators. The accessibility and affordability of digital solutions compared to traditional therapeutic interventions are also significant contributing factors to the market's rapid expansion. Furthermore, the integration of wearables and smart home devices is facilitating continuous sleep data collection and personalized feedback, enhancing treatment efficacy and patient engagement. The market is witnessing a shift from standalone apps to comprehensive platforms offering integrated solutions combining sleep tracking, relaxation techniques, and cognitive behavioral therapy for insomnia (CBT-I). This holistic approach is proving highly effective in improving patient outcomes and driving market growth. The increasing adoption of telehealth and remote monitoring further contributes to the expansion of this market, particularly in underserved regions with limited access to traditional healthcare services. The competitive landscape is dynamic, with both established players and emerging startups vying for market share, fostering innovation and improving the quality of available digital insomnia therapeutics.

Driving Forces: What's Propelling the Digital Insomnia Therapeutics Market?

Several key factors are driving the rapid expansion of the digital insomnia therapeutics market. Firstly, the escalating prevalence of sleep disorders globally is a significant catalyst. Millions suffer from insomnia, and many are turning to convenient digital solutions for relief. Secondly, the widespread adoption of smartphones and other connected devices provides unparalleled access to these therapeutic apps and programs. This accessibility is particularly crucial for individuals who may face geographical or financial barriers to traditional treatments. The rising awareness of mental health concerns, including the importance of sleep hygiene, is also a major contributing factor. Individuals are increasingly proactive in seeking solutions for sleep problems, driving demand for digital interventions. The integration of advanced technologies such as AI and machine learning further enhances the effectiveness of these solutions. AI-powered analysis of sleep patterns allows for personalized interventions and treatment plans, significantly improving outcomes compared to generalized approaches. The growing acceptance of telehealth and remote patient monitoring significantly contributes to market growth by allowing broader access to care. Finally, the cost-effectiveness of digital therapeutics compared to traditional treatments, such as in-person therapy or medication, makes them an attractive option for both individuals and healthcare systems.

Challenges and Restraints in Digital Insomnia Therapeutics

Despite the significant growth potential, the digital insomnia therapeutics market faces several challenges. One major hurdle is ensuring the efficacy and safety of these digital interventions. Rigorous clinical validation and regulatory approval are essential to build trust and establish the credibility of these solutions. Data privacy and security concerns are also paramount. The collection and storage of sensitive personal health data require robust security measures to protect patient confidentiality. The potential for inaccurate diagnoses or inappropriate treatment recommendations, particularly without adequate clinician oversight, represents another substantial challenge. Ensuring the proper integration of digital therapeutics within established healthcare systems can also be complex. Interoperability with electronic health records and the need for clinician training and integration protocols present challenges for wider adoption. Moreover, variations in access to technology and digital literacy across different populations and geographical regions can limit the reach and effectiveness of these therapies. Addressing these issues through robust regulatory frameworks, ethical guidelines, and user-friendly interfaces is crucial for the long-term success of the digital insomnia therapeutics market. The potential for inaccurate self-diagnosis and the risk of over-reliance on digital solutions without professional guidance are concerns that require attention.

Key Region or Country & Segment to Dominate the Market

The North American market is expected to dominate the digital insomnia therapeutics market throughout the forecast period (2025-2033) due to high healthcare expenditure, advanced technology adoption, and a large population base facing sleep disorders. Within this region, the United States is projected to be a key driver of growth. Europe, especially Western Europe, is anticipated to demonstrate robust growth driven by increasing awareness of sleep health and rising adoption of digital health solutions.

Dominant Segment: CBT-I Apps: Cognitive Behavioral Therapy for Insomnia (CBT-I) apps are poised to dominate the market due to their proven clinical efficacy and high user engagement. These apps typically combine education on sleep hygiene, relaxation techniques, and cognitive restructuring exercises to help users manage insomnia. The growing body of evidence supporting the effectiveness of digital CBT-I has fuelled increased adoption by both individuals and healthcare providers. The efficacy of CBT-I is well-established, offering a compelling alternative to medication with fewer potential side effects. This segment's market share is expected to significantly increase due to its proven results and increasing demand for non-pharmacological sleep solutions. The development of personalized and adaptive CBT-I programs further enhances user engagement and treatment outcomes.

Dominant Application: Medical: The medical application segment is expected to contribute significantly to the market's growth, fueled by increasing integration of digital therapeutics into clinical care pathways. Healthcare providers are increasingly recognizing the value of digital solutions in managing insomnia, leading to their wider adoption in both public and private healthcare settings. The increasing integration of digital CBT-I apps into healthcare systems enhances treatment outcomes and reduces the burden on healthcare professionals. Integration of these applications in telehealth programs has also been seen as a significant factor.

Further Growth Potential: While CBT-I apps dominate the current market, there is significant potential for growth in other segments. The use of sleep tracking apps, offering personalized insights and guidance, is expected to continue growing. Relaxation and meditation apps also represent a substantial market segment, particularly as individuals increasingly prioritize stress management and mental well-being.

Growth Catalysts in the Digital Insomnia Therapeutics Industry

The digital insomnia therapeutics industry is poised for continued expansion driven by several key factors. The rising prevalence of sleep disorders globally is a primary catalyst, coupled with the increasing adoption of smartphones and other connected devices. The growing awareness of the importance of sleep health and the availability of effective digital interventions further fuel market growth. The increasing focus on personalized and adaptive treatments, leveraging AI and machine learning, promises to improve the efficacy and engagement of digital therapies. Furthermore, the decreasing cost of digital health solutions and the integration into telehealth platforms are contributing to wider access and adoption. The positive results demonstrated by clinical trials of digital CBT-I programs are further increasing the credibility and acceptance of this approach.

Leading Players in the Digital Insomnia Therapeutics Market

- Headspace Inc

- Big Health

- Calm

- Nox Health

- Pear Therapeutics

- OPTT Inc

- SilverCloud

- Curv Health

- Bodymatter Inc

- PrimeNap

Significant Developments in the Digital Insomnia Therapeutics Sector

- 2020: Several major players launched new features and updates to their sleep apps, incorporating AI-powered sleep analysis and personalized recommendations.

- 2021: Increased investment in the development and validation of digital CBT-I programs.

- 2022: Several FDA approvals and clearances granted for digital therapeutics for insomnia.

- 2023: Expansion of telehealth platforms incorporating digital insomnia therapeutics.

- 2024: Growth of partnerships between digital health companies and healthcare providers.

Comprehensive Coverage Digital Insomnia Therapeutics Report

This report provides a comprehensive overview of the digital insomnia therapeutics market, offering in-depth analysis of market trends, drivers, challenges, key players, and future growth prospects. The report covers various segments, including different types of apps and applications, providing a detailed picture of the market landscape and opportunities for both established companies and new entrants. The research methodology includes both primary and secondary research, ensuring accurate and reliable data. The report's key findings are presented in a clear and concise manner, making it a valuable resource for stakeholders across the digital health industry.

Digital Insomnia Therapeutics Segmentation

-

1. Type

- 1.1. Sleep Tracking App

- 1.2. Relaxation and Meditation Apps

- 1.3. CBT-I

- 1.4. Others

-

2. Application

- 2.1. Medical

- 2.2. Household

Digital Insomnia Therapeutics Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital Insomnia Therapeutics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

What is the projected Compound Annual Growth Rate (CAGR) of the Digital Insomnia Therapeutics ?

The projected CAGR is approximately XX%.

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00 , USD 6720.00, and USD 8960.00 respectively.

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Insomnia Therapeutics," which aids in identifying and referencing the specific market segment covered.

Can you provide examples of recent developments in the market?

undefined

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million .

What are some drivers contributing to market growth?

.

Are there any restraints impacting market growth?

.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Insomnia Therapeutics Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sleep Tracking App

- 5.1.2. Relaxation and Meditation Apps

- 5.1.3. CBT-I

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Medical

- 5.2.2. Household

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Digital Insomnia Therapeutics Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sleep Tracking App

- 6.1.2. Relaxation and Meditation Apps

- 6.1.3. CBT-I

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Medical

- 6.2.2. Household

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Digital Insomnia Therapeutics Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sleep Tracking App

- 7.1.2. Relaxation and Meditation Apps

- 7.1.3. CBT-I

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Medical

- 7.2.2. Household

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Digital Insomnia Therapeutics Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sleep Tracking App

- 8.1.2. Relaxation and Meditation Apps

- 8.1.3. CBT-I

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Medical

- 8.2.2. Household

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Digital Insomnia Therapeutics Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Sleep Tracking App

- 9.1.2. Relaxation and Meditation Apps

- 9.1.3. CBT-I

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Medical

- 9.2.2. Household

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Digital Insomnia Therapeutics Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Sleep Tracking App

- 10.1.2. Relaxation and Meditation Apps

- 10.1.3. CBT-I

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Medical

- 10.2.2. Household

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Headspace Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Big Health

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Calm

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nox Health

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pear Therapeutics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OPTT Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SilverCloud

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Curv Health

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bodymatter Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PrimeNap

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Headspace Inc

- Figure 1: Global Digital Insomnia Therapeutics Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Digital Insomnia Therapeutics Revenue (million), by Type 2024 & 2032

- Figure 3: North America Digital Insomnia Therapeutics Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Digital Insomnia Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 5: North America Digital Insomnia Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Digital Insomnia Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 7: North America Digital Insomnia Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital Insomnia Therapeutics Revenue (million), by Type 2024 & 2032

- Figure 9: South America Digital Insomnia Therapeutics Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Digital Insomnia Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 11: South America Digital Insomnia Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Digital Insomnia Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 13: South America Digital Insomnia Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Digital Insomnia Therapeutics Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Digital Insomnia Therapeutics Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Digital Insomnia Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Digital Insomnia Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Digital Insomnia Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Digital Insomnia Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Digital Insomnia Therapeutics Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Digital Insomnia Therapeutics Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Digital Insomnia Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Digital Insomnia Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Digital Insomnia Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Digital Insomnia Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Digital Insomnia Therapeutics Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Digital Insomnia Therapeutics Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Digital Insomnia Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Digital Insomnia Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Digital Insomnia Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Digital Insomnia Therapeutics Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Digital Insomnia Therapeutics Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Insomnia Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Digital Insomnia Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Digital Insomnia Therapeutics Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Insomnia Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Digital Insomnia Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Digital Insomnia Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital Insomnia Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Digital Insomnia Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Digital Insomnia Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Digital Insomnia Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Digital Insomnia Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Digital Insomnia Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Digital Insomnia Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Digital Insomnia Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Digital Insomnia Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Digital Insomnia Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Digital Insomnia Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Digital Insomnia Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Digital Insomnia Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.