Direct Store Delivery Service Software

Direct Store Delivery Service SoftwareDirect Store Delivery Service Software Strategic Insights: Analysis 2025 and Forecasts 2033

Direct Store Delivery Service Software by Application (Large Enterprises, SMEs), by Type (Cloud -Based, Web-based), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The Direct Store Delivery (DSD) service software market is experiencing robust growth, driven by the increasing need for efficient supply chain management and optimized last-mile delivery within the fast-moving consumer goods (FMCG) sector. Large enterprises and SMEs alike are adopting cloud-based and web-based DSD software to streamline operations, reduce costs, and enhance customer satisfaction. Key drivers include the rising demand for real-time visibility into inventory levels, improved route optimization capabilities, and enhanced data analytics for informed decision-making. The market is segmented by application (large enterprises and SMEs) and type (cloud-based and web-based), with cloud-based solutions gaining significant traction due to their scalability, accessibility, and cost-effectiveness. While initial investment in software and integration can be a restraint, the long-term return on investment (ROI) through increased efficiency and reduced operational costs outweighs the upfront expenditure. The market is geographically diverse, with North America and Europe currently holding significant market share, but Asia Pacific is projected to witness rapid growth in the coming years due to increasing e-commerce adoption and expanding FMCG sectors in developing economies. Competition is intensifying with numerous established players and emerging technology providers vying for market share. Technological advancements such as AI-powered route optimization, predictive analytics, and integration with IoT devices are shaping the future of DSD software, further propelling market growth.

The forecast period (2025-2033) anticipates a continued upward trend for DSD service software, fueled by ongoing digitalization efforts within the retail and CPG industries. The adoption of advanced analytics will allow businesses to gain deeper insights into consumer buying patterns, leading to improved inventory management and more targeted promotional strategies. Furthermore, the increasing integration of DSD software with other enterprise resource planning (ERP) systems will foster greater efficiency and data synchronization across the entire supply chain. The competitive landscape will remain dynamic, with mergers and acquisitions, strategic partnerships, and technological innovation driving further market consolidation and evolution. Companies are focusing on developing user-friendly interfaces, robust security features, and seamless integration capabilities to meet the evolving demands of their clients. The overall market outlook for DSD service software remains highly positive, with substantial growth opportunities across various regions and segments.

Direct Store Delivery Service Software Trends

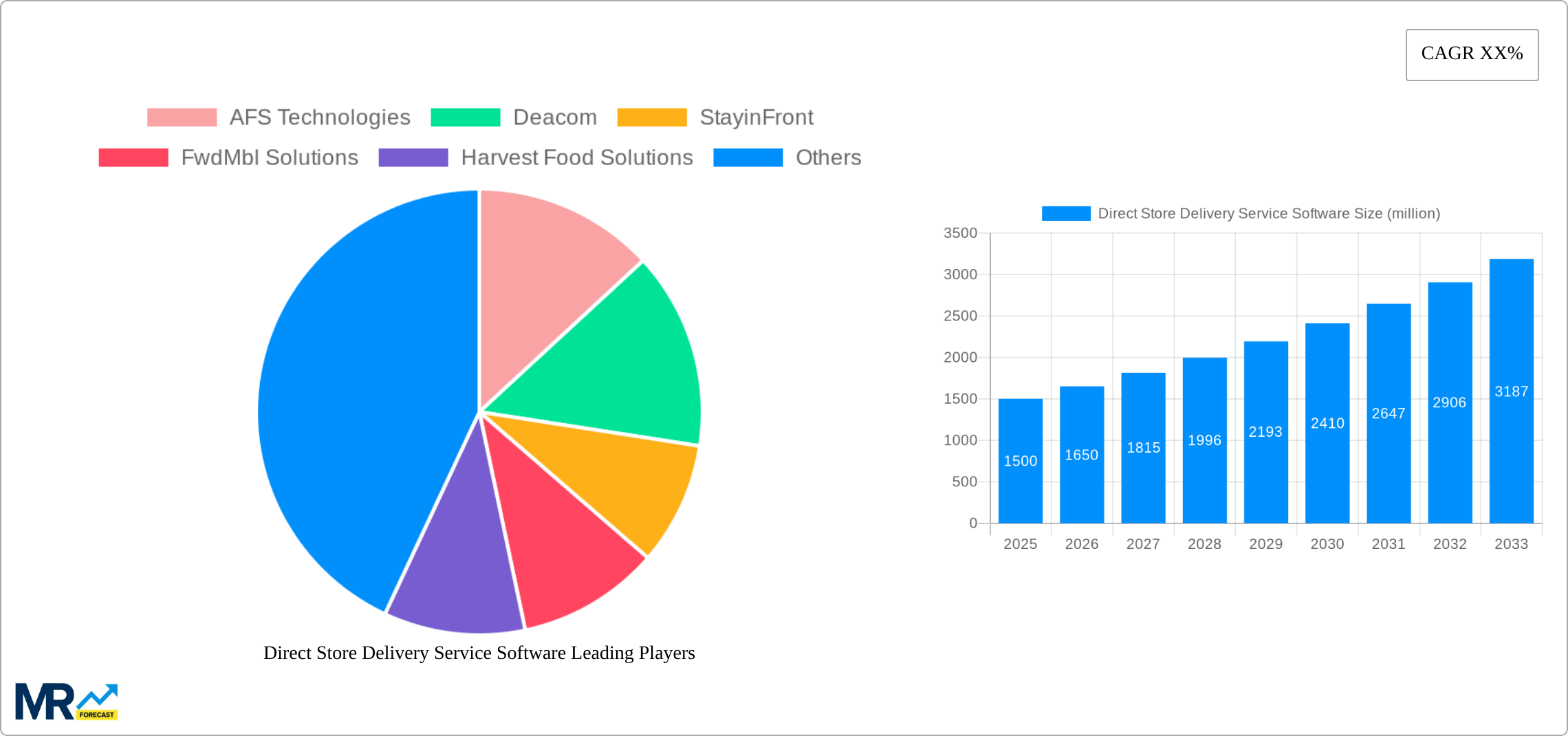

The Direct Store Delivery (DSD) service software market is experiencing robust growth, driven by the increasing need for efficient and optimized supply chain management across various industries. The market, valued at XXX million units in 2025, is projected to reach XXX million units by 2033, exhibiting a significant Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033). This expansion is fueled by several factors, including the rising adoption of cloud-based solutions, the growing demand for real-time data visibility, and the increasing pressure on businesses to reduce operational costs and improve delivery efficiency. The historical period (2019-2024) witnessed substantial market expansion, laying a solid foundation for future growth. Key market insights reveal a clear preference for integrated solutions that seamlessly connect various stages of the DSD process, from order management to route optimization and delivery tracking. The shift towards mobile-first solutions is also prominent, empowering field representatives with real-time information and streamlined workflows. Furthermore, the increasing adoption of advanced analytics and machine learning capabilities allows businesses to extract valuable insights from their data, leading to more informed decision-making and improved operational performance. The competitive landscape is dynamic, with established players and emerging startups vying for market share through continuous innovation and strategic partnerships. The integration of DSD software with other enterprise resource planning (ERP) systems is also a major trend, enhancing data consistency and operational efficiency. The overall market is characterized by a growing demand for scalable, flexible, and user-friendly solutions that can adapt to the evolving needs of businesses across various industry sectors.

Driving Forces: What's Propelling the Direct Store Delivery Service Software

Several factors are driving the growth of the DSD service software market. The primary driver is the escalating need for enhanced supply chain visibility and efficiency. Businesses across numerous sectors are recognizing the limitations of traditional DSD methods and are actively seeking technology solutions that can optimize delivery routes, reduce delivery times, and improve overall operational performance. The rise of e-commerce and the increasing demand for faster delivery times further amplify this need. Cloud-based DSD software offers scalability and flexibility, allowing businesses to adapt to fluctuating demand and expand their operations seamlessly. The integration of advanced analytics and reporting capabilities provides businesses with valuable insights into their operations, enabling data-driven decision-making for improved efficiency and profitability. Furthermore, the increasing adoption of mobile devices and the development of user-friendly mobile applications have simplified the DSD process, making it more accessible and convenient for field representatives and store personnel. The growing adoption of mobile technologies coupled with the increasing penetration of the internet and mobile networks has created a favorable environment for the market's expansion. Finally, regulatory compliance requirements and the need to track and manage inventory effectively are also contributing factors driving market growth.

Challenges and Restraints in Direct Store Delivery Service Software

Despite the significant growth potential, the DSD service software market faces several challenges. High initial investment costs associated with implementing and integrating new software can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). The complexity of integrating DSD software with existing enterprise systems can also present significant technical challenges and require substantial expertise. Data security and privacy concerns are also paramount, as DSD software often handles sensitive customer and business data. Ensuring the security of this data is crucial to maintaining customer trust and complying with relevant regulations. Furthermore, the need for ongoing training and support for users can be costly and time-consuming. Maintaining the accuracy and reliability of data across multiple systems and locations can also be a challenge, particularly for businesses with large and geographically dispersed operations. Lastly, the ever-evolving technological landscape and the need to adapt to new technologies and industry standards can impose an ongoing burden on businesses that implement DSD software. Effectively addressing these challenges is vital to ensuring the continued growth and adoption of DSD service software.

Key Region or Country & Segment to Dominate the Market

The North American and European markets are expected to dominate the DSD service software market during the forecast period, driven by high technological adoption rates and a well-established infrastructure supporting digital transformations within the logistics and retail industries. Within these regions, large enterprises will represent a significant portion of the market, owing to their higher budgets and the need for sophisticated solutions to manage extensive distribution networks.

Large Enterprises: This segment is driving growth due to their need for scalable, integrated solutions to manage complex DSD operations across vast geographical areas. They prioritize features such as advanced analytics, real-time visibility, and seamless integration with other enterprise systems. The significant investment power of these companies facilitates the rapid adoption of cutting-edge technology.

Cloud-Based Solutions: The preference for cloud-based solutions is undeniable, fueled by their inherent scalability, cost-effectiveness, and accessibility. Cloud solutions eliminate the need for significant upfront investment in hardware and infrastructure, making them attractive to businesses of all sizes. Furthermore, cloud-based platforms offer enhanced collaboration and data sharing capabilities, improving efficiency and communication across the supply chain.

North America: This region is a key driver due to the high adoption rate of technological advancements, a strong focus on improving supply chain efficiency, and the presence of major players in the DSD software industry. The robust e-commerce sector and the demand for faster deliveries are further fueling the adoption of advanced DSD solutions in North America.

The paragraph above highlights the synergy between these key segments. Large enterprises, particularly in North America, are actively adopting cloud-based DSD solutions to streamline their operations and gain a competitive edge in a rapidly evolving market. The cost-effectiveness, scalability, and advanced features of cloud-based solutions perfectly align with the needs and resources of large enterprises. The increasing demand for real-time visibility and data-driven decision-making are key factors driving the adoption of these advanced technologies. As cloud technologies continue to mature and become more sophisticated, their dominance in the DSD software market is only expected to strengthen further.

Growth Catalysts in Direct Store Delivery Service Software Industry

The increasing adoption of mobile technologies, the growing demand for enhanced supply chain visibility, and the continuous advancements in data analytics and artificial intelligence are all key growth catalysts for the DSD service software industry. These factors are working together to create a more efficient, transparent, and data-driven DSD process. The rise of e-commerce and the corresponding pressure for faster and more reliable deliveries are further accelerating the demand for advanced DSD solutions.

Leading Players in the Direct Store Delivery Service Software

- AFS Technologies

- Deacom

- StayinFront

- FwdMbl Solutions

- Harvest Food Solutions

- HighJump

- GizMobile NorthWest

- LaceUp Solutions

- Invasystems

- ExtenData

- Pepperi

- Westrom Software

- Encompass Technologies

- Spring Global

- Vincle

- xkzero

- Zetes

Significant Developments in Direct Store Delivery Service Software Sector

- 2020: Several major players announced strategic partnerships to expand their reach and integrate their DSD solutions with other enterprise systems.

- 2021: Significant investments were made in research and development to improve the functionality and capabilities of DSD software, particularly in the area of artificial intelligence and machine learning.

- 2022: The launch of several new cloud-based DSD solutions designed for SMEs signified an expansion of the market to smaller businesses.

- 2023: Increased focus on data security and compliance regulations resulted in enhanced security features and improved data encryption protocols within DSD software.

Comprehensive Coverage Direct Store Delivery Service Software Report

This report provides a comprehensive overview of the DSD service software market, analyzing current trends, driving forces, challenges, and key players. It offers detailed insights into market segmentation, regional performance, and future growth projections, empowering businesses to make informed decisions regarding DSD software adoption and optimization. The comprehensive data analysis and market forecasts provide a valuable resource for industry stakeholders, investors, and researchers seeking a deeper understanding of this dynamic market.

Direct Store Delivery Service Software Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. SMEs

-

2. Type

- 2.1. Cloud -Based

- 2.2. Web-based

Direct Store Delivery Service Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Direct Store Delivery Service Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) of the Direct Store Delivery Service Software ?

The projected CAGR is approximately XX%.

How can I stay updated on further developments or reports in the Direct Store Delivery Service Software?

To stay informed about further developments, trends, and reports in the Direct Store Delivery Service Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

Can you provide examples of recent developments in the market?

undefined

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million .

What are the notable trends driving market growth?

.

What are some drivers contributing to market growth?

.

Are there any restraints impacting market growth?

.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Direct Store Delivery Service Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud -Based

- 5.2.2. Web-based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Direct Store Delivery Service Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. SMEs

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud -Based

- 6.2.2. Web-based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Direct Store Delivery Service Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. SMEs

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud -Based

- 7.2.2. Web-based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Direct Store Delivery Service Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. SMEs

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud -Based

- 8.2.2. Web-based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Direct Store Delivery Service Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. SMEs

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud -Based

- 9.2.2. Web-based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Direct Store Delivery Service Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. SMEs

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud -Based

- 10.2.2. Web-based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AFS Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Deacom

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 StayinFront

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FwdMbl Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Harvest Food Solutions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HighJump

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GizMobile NorthWest

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LaceUp Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Invasystems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ExtenData

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pepperi

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Westrom Software

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Encompass Technologies

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Spring Global

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Vincle

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 xkzero

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Zetes

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 AFS Technologies

- Figure 1: Global Direct Store Delivery Service Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Direct Store Delivery Service Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Direct Store Delivery Service Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Direct Store Delivery Service Software Revenue (million), by Type 2024 & 2032

- Figure 5: North America Direct Store Delivery Service Software Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Direct Store Delivery Service Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Direct Store Delivery Service Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Direct Store Delivery Service Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Direct Store Delivery Service Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Direct Store Delivery Service Software Revenue (million), by Type 2024 & 2032

- Figure 11: South America Direct Store Delivery Service Software Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Direct Store Delivery Service Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Direct Store Delivery Service Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Direct Store Delivery Service Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Direct Store Delivery Service Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Direct Store Delivery Service Software Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Direct Store Delivery Service Software Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Direct Store Delivery Service Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Direct Store Delivery Service Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Direct Store Delivery Service Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Direct Store Delivery Service Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Direct Store Delivery Service Software Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Direct Store Delivery Service Software Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Direct Store Delivery Service Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Direct Store Delivery Service Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Direct Store Delivery Service Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Direct Store Delivery Service Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Direct Store Delivery Service Software Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Direct Store Delivery Service Software Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Direct Store Delivery Service Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Direct Store Delivery Service Software Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Direct Store Delivery Service Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Direct Store Delivery Service Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Direct Store Delivery Service Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Direct Store Delivery Service Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Direct Store Delivery Service Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Direct Store Delivery Service Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Direct Store Delivery Service Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Direct Store Delivery Service Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Direct Store Delivery Service Software Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Direct Store Delivery Service Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Direct Store Delivery Service Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Direct Store Delivery Service Software Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Direct Store Delivery Service Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Direct Store Delivery Service Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Direct Store Delivery Service Software Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Direct Store Delivery Service Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Direct Store Delivery Service Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Direct Store Delivery Service Software Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Direct Store Delivery Service Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Direct Store Delivery Service Software Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.