Duty Paid Retailing

Duty Paid RetailingDuty Paid Retailing 2025-2033 Trends: Unveiling Growth Opportunities and Competitor Dynamics

Duty Paid Retailing by Type (Cosmetics & Personal Care Products, Alcohol, Wine and Spirits, Tobacco & Cigarettes, Fashion & Luxury Goods, Confectionery & Food Stuff, Others), by Application (Airports, Seaports, Train Stations, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

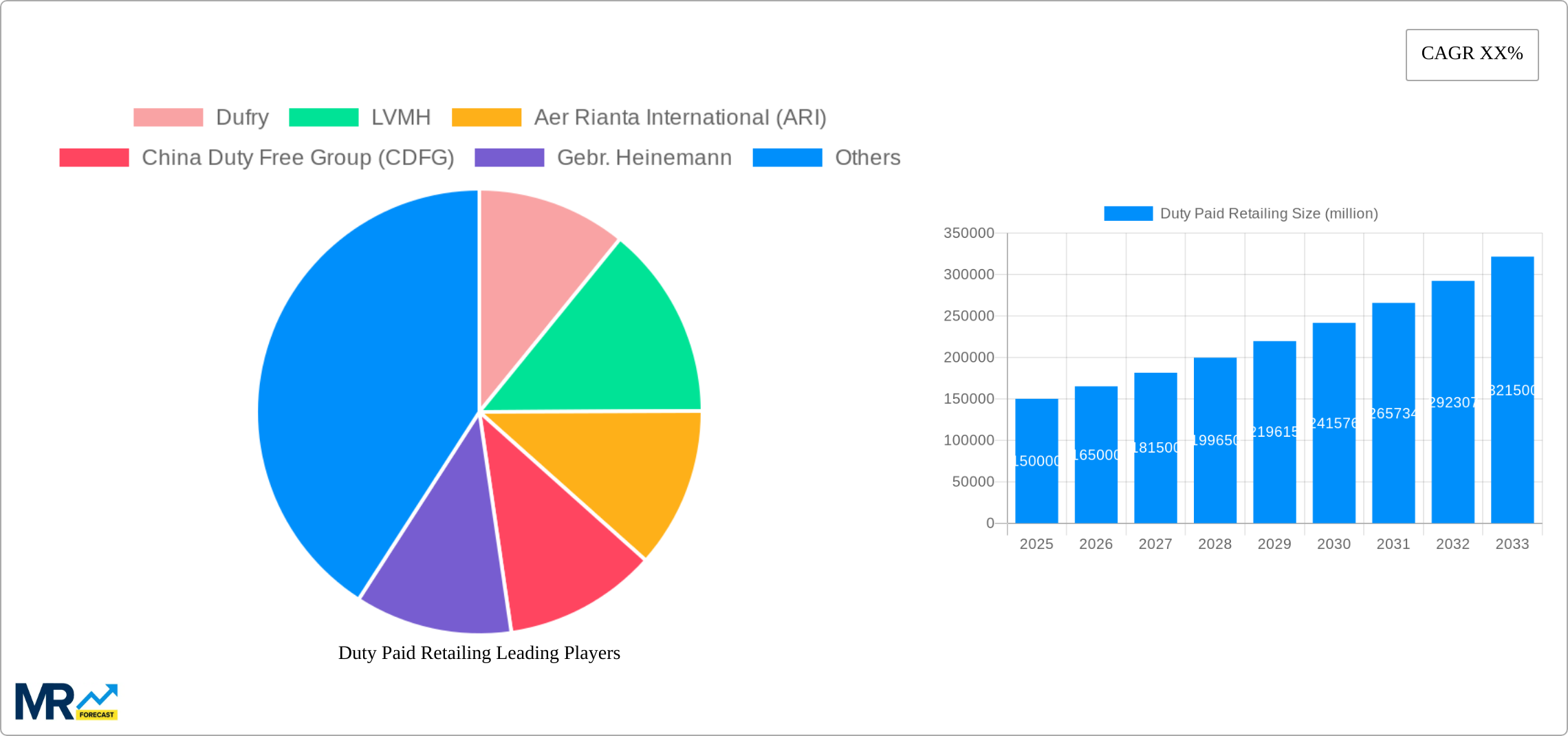

The duty-paid retailing market, encompassing diverse product categories like cosmetics, alcohol, tobacco, fashion, and confectionery, is experiencing robust growth, driven by increasing international travel and a rising preference for premium goods. The market's expansion is fueled by several key factors. Firstly, the resurgence of international travel post-pandemic is significantly boosting sales at airports, seaports, and train stations – key locations for duty-paid retail. Secondly, the evolving consumer preferences towards premium and luxury goods, particularly among affluent travelers, are driving demand for high-value items in duty-free and duty-paid settings. Strategic partnerships between retailers and brands further enhance product offerings and exclusivity, contributing to increased revenue streams. While economic downturns and fluctuating currency exchange rates can pose challenges, the overall market outlook remains positive, with continued growth expected across various regions. The Asia-Pacific region, particularly China, is anticipated to be a major growth driver, benefiting from a large and expanding middle class with increased disposable income and a penchant for international brands. Competition amongst established players like Dufry, LVMH, and China Duty Free Group is intense, leading to strategic acquisitions, expansion into new markets, and a focus on enhancing the customer experience.

Market segmentation reveals significant variations in product category performance. Cosmetics and personal care products remain a consistent top performer due to their high margins and popularity amongst travelers. Alcohol and wine sales are also strong, influenced by both duty savings and the availability of unique and exclusive products. The tobacco category, however, faces regulatory headwinds and declining consumption in many markets, resulting in slower growth. The geographical distribution of the market is also evolving, with developing economies in Asia and the Middle East exhibiting higher growth rates compared to more mature markets in North America and Europe. This dynamic interplay of factors requires retailers to adopt agile strategies focused on targeted product offerings, efficient supply chains, and adapting to evolving regulatory landscapes across diverse regions. The long-term forecast indicates sustained growth, driven by the anticipated increase in global travel and tourism and the continuous evolution of consumer preferences within the luxury and premium goods segment.

Duty Paid Retailing Trends

The duty-paid retailing market, encompassing sales of goods exempt from local taxes in designated areas like airports and seaports, experienced significant shifts during the historical period (2019-2024). The COVID-19 pandemic severely impacted the industry, causing a dramatic decline in passenger traffic and consequently, sales. However, a strong recovery is underway, fueled by pent-up demand and the resurgence of international travel. The market is witnessing a notable shift towards experiential retail, with operators focusing on creating engaging environments that go beyond simple product displays. This includes personalized services, interactive displays, and the integration of technology to enhance the shopping experience. Furthermore, the rise of e-commerce and omnichannel strategies is changing the landscape, with duty-free operators exploring innovative ways to engage consumers before, during, and after their travel. Luxury goods and cosmetics continue to be key drivers of revenue, although the market is also seeing growth in other segments like confectionery and food, reflecting the evolving preferences of travelers. The increasing popularity of online pre-ordering and in-flight delivery services is further transforming the customer journey, creating both opportunities and challenges for traditional duty-paid retailers. The market value, estimated at XXX million units in 2025, is projected to experience substantial growth throughout the forecast period (2025-2033), reflecting the predicted rebound in global tourism and continued innovations within the industry. Competition remains fierce, with major players like Dufry and LVMH constantly striving for market share through strategic acquisitions, expansion into new locations, and the development of cutting-edge retail concepts. The industry is also witnessing the rise of smaller, specialized retailers focusing on niche products and personalized experiences.

Driving Forces: What's Propelling the Duty Paid Retailing

Several factors contribute to the growth of the duty-paid retailing market. Firstly, the steady rise in global air and sea passenger traffic is a fundamental driver. As more people travel internationally, the opportunity for duty-free purchases increases proportionally. Secondly, the allure of tax-free shopping acts as a significant incentive for consumers, providing them with substantial savings compared to domestic prices. This price advantage is particularly attractive for high-value items like luxury goods, alcohol, and cosmetics. Thirdly, the continuous innovation in retail experiences is enhancing the appeal of duty-free shopping. Operators are investing in creating aesthetically pleasing and engaging spaces, incorporating interactive technologies, and providing personalized services to enhance customer satisfaction and drive sales. Furthermore, the growing adoption of technology, such as mobile ordering and personalized recommendations, improves the efficiency and convenience of shopping, attracting tech-savvy travelers. Finally, strategic partnerships between duty-free operators and airlines or cruise lines provide additional opportunities for sales and enhance the overall shopping experience for travelers. These combined factors are poised to propel the duty-paid retailing market to substantial growth in the coming years.

Challenges and Restraints in Duty Paid Retailing

Despite the positive growth outlook, several challenges restrain the duty-paid retailing market. The global economic climate, marked by fluctuating currency exchange rates and potential recessions, can significantly impact consumer spending on non-essential goods like luxury items. Terrorism, political instability, and health crises (like the COVID-19 pandemic) significantly disrupt international travel patterns, leading to decreased sales in the short term. Government regulations concerning the sale of certain goods, such as tobacco and alcohol, can impact product availability and profitability. Furthermore, increased competition among duty-free operators necessitates constant innovation and adaptation to maintain market share. Managing logistics and supply chains across international borders poses logistical complexities, particularly during peak travel seasons. Finally, maintaining security and combating counterfeiting are crucial concerns for maintaining consumer trust and brand reputation. Addressing these challenges effectively will be crucial for sustainable growth in the duty-paid retailing sector.

Key Region or Country & Segment to Dominate the Market

Airports: Airports consistently remain the dominant application segment, accounting for the majority of duty-paid retail sales globally. The high volume of international air travelers, combined with the captive audience within the airport environment, provides unparalleled opportunities for sales. The growth of hub airports with significant passenger traffic further enhances the segment’s dominance. Many key players concentrate their efforts on securing prime locations within major airports. Expansion into smaller regional airports also represents a promising growth area.

Cosmetics & Personal Care Products: This segment consistently displays robust growth, driven by the popularity of international brands and the higher spending power of travelers. Cosmetics and personal care products often benefit from attractive packaging and strong branding, enhancing their appeal as duty-free purchases. The availability of exclusive sets and larger sizes further adds to their appeal. Innovations in skincare and beauty trends also contribute to sustained demand.

Asia-Pacific: This region is expected to dominate the duty-paid retailing market due to rapid growth in international travel, rising disposable incomes, and a growing middle class with increasing purchasing power. The booming tourism sector in countries like China, Japan, South Korea, and Thailand significantly contributes to this dominance. Further expansion of air travel infrastructure within the region will likely solidify its leading position in the foreseeable future.

The combined effect of high passenger numbers at international airports, particularly within the Asia-Pacific region, coupled with the sustained popularity of cosmetics and personal care products, makes these segments the key drivers of market dominance within the duty-paid retailing sector.

Growth Catalysts in Duty Paid Retailing Industry

The duty-paid retailing industry is fueled by a confluence of factors driving substantial growth. The resurgence of international travel post-pandemic, combined with an increasing preference for luxury and experiential purchases, is a major catalyst. Moreover, strategic partnerships between operators, airlines, and cruise lines enhance accessibility and appeal. Technological advancements, such as mobile ordering and personalized recommendations, improve the shopping experience and drive sales. Finally, the expansion into new markets and emerging economies presents significant growth potential, contributing to the overall positive outlook for the industry.

Leading Players in the Duty Paid Retailing

- Dufry

- LVMH

- Aer Rianta International (ARI)

- China Duty Free Group (CDFG)

- Gebr. Heinemann

- King Power International Group (Thailand)

Significant Developments in Duty Paid Retailing Sector

- 2020: The COVID-19 pandemic significantly impacts global travel and duty-free sales.

- 2021: Many duty-free operators implement enhanced hygiene protocols and adapt to new travel restrictions.

- 2022: A gradual recovery in international travel leads to a resurgence in sales.

- 2023: Increased focus on digitalization and omnichannel strategies by major players.

- 2024: Continued expansion into emerging markets and new airport locations.

Comprehensive Coverage Duty Paid Retailing Report

This report offers a comprehensive analysis of the duty-paid retailing market, covering historical trends, current market dynamics, and future growth projections. It provides detailed insights into key segments, regions, and leading players, offering a valuable resource for stakeholders seeking a thorough understanding of this dynamic and evolving industry. The data presented is based on rigorous research and analysis, ensuring accuracy and reliability for informed decision-making.

Duty Paid Retailing Segmentation

-

1. Type

- 1.1. Cosmetics & Personal Care Products

- 1.2. Alcohol, Wine and Spirits

- 1.3. Tobacco & Cigarettes

- 1.4. Fashion & Luxury Goods

- 1.5. Confectionery & Food Stuff

- 1.6. Others

-

2. Application

- 2.1. Airports

- 2.2. Seaports

- 2.3. Train Stations

- 2.4. Others

Duty Paid Retailing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Duty Paid Retailing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Duty Paid Retailing Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cosmetics & Personal Care Products

- 5.1.2. Alcohol, Wine and Spirits

- 5.1.3. Tobacco & Cigarettes

- 5.1.4. Fashion & Luxury Goods

- 5.1.5. Confectionery & Food Stuff

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Airports

- 5.2.2. Seaports

- 5.2.3. Train Stations

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Duty Paid Retailing Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cosmetics & Personal Care Products

- 6.1.2. Alcohol, Wine and Spirits

- 6.1.3. Tobacco & Cigarettes

- 6.1.4. Fashion & Luxury Goods

- 6.1.5. Confectionery & Food Stuff

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Airports

- 6.2.2. Seaports

- 6.2.3. Train Stations

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Duty Paid Retailing Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cosmetics & Personal Care Products

- 7.1.2. Alcohol, Wine and Spirits

- 7.1.3. Tobacco & Cigarettes

- 7.1.4. Fashion & Luxury Goods

- 7.1.5. Confectionery & Food Stuff

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Airports

- 7.2.2. Seaports

- 7.2.3. Train Stations

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Duty Paid Retailing Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cosmetics & Personal Care Products

- 8.1.2. Alcohol, Wine and Spirits

- 8.1.3. Tobacco & Cigarettes

- 8.1.4. Fashion & Luxury Goods

- 8.1.5. Confectionery & Food Stuff

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Airports

- 8.2.2. Seaports

- 8.2.3. Train Stations

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Duty Paid Retailing Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cosmetics & Personal Care Products

- 9.1.2. Alcohol, Wine and Spirits

- 9.1.3. Tobacco & Cigarettes

- 9.1.4. Fashion & Luxury Goods

- 9.1.5. Confectionery & Food Stuff

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Airports

- 9.2.2. Seaports

- 9.2.3. Train Stations

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Duty Paid Retailing Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cosmetics & Personal Care Products

- 10.1.2. Alcohol, Wine and Spirits

- 10.1.3. Tobacco & Cigarettes

- 10.1.4. Fashion & Luxury Goods

- 10.1.5. Confectionery & Food Stuff

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Airports

- 10.2.2. Seaports

- 10.2.3. Train Stations

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dufry

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LVMH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aer Rianta International (ARI)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Duty Free Group (CDFG)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gebr. Heinemann

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 King Power International Group (Thailand)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Dufry

- Figure 1: Global Duty Paid Retailing Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Duty Paid Retailing Revenue (million), by Type 2024 & 2032

- Figure 3: North America Duty Paid Retailing Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Duty Paid Retailing Revenue (million), by Application 2024 & 2032

- Figure 5: North America Duty Paid Retailing Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Duty Paid Retailing Revenue (million), by Country 2024 & 2032

- Figure 7: North America Duty Paid Retailing Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Duty Paid Retailing Revenue (million), by Type 2024 & 2032

- Figure 9: South America Duty Paid Retailing Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Duty Paid Retailing Revenue (million), by Application 2024 & 2032

- Figure 11: South America Duty Paid Retailing Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Duty Paid Retailing Revenue (million), by Country 2024 & 2032

- Figure 13: South America Duty Paid Retailing Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Duty Paid Retailing Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Duty Paid Retailing Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Duty Paid Retailing Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Duty Paid Retailing Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Duty Paid Retailing Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Duty Paid Retailing Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Duty Paid Retailing Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Duty Paid Retailing Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Duty Paid Retailing Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Duty Paid Retailing Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Duty Paid Retailing Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Duty Paid Retailing Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Duty Paid Retailing Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Duty Paid Retailing Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Duty Paid Retailing Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Duty Paid Retailing Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Duty Paid Retailing Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Duty Paid Retailing Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Duty Paid Retailing Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Duty Paid Retailing Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Duty Paid Retailing Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Duty Paid Retailing Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Duty Paid Retailing Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Duty Paid Retailing Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Duty Paid Retailing Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Duty Paid Retailing Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Duty Paid Retailing Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Duty Paid Retailing Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Duty Paid Retailing Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Duty Paid Retailing Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Duty Paid Retailing Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Duty Paid Retailing Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Duty Paid Retailing Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Duty Paid Retailing Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Duty Paid Retailing Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Duty Paid Retailing Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Duty Paid Retailing Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Duty Paid Retailing Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.