Electronic Grade High-purity Titanium

Electronic Grade High-purity TitaniumElectronic Grade High-purity Titanium Analysis Report 2025: Market to Grow by a CAGR of XX to 2033, Driven by Government Incentives, Popularity of Virtual Assistants, and Strategic Partnerships

Electronic Grade High-purity Titanium by Type (Overview: Global Electronic Grade High-purity Titanium Consumption Value, 4N, 4N5, 5N), by Application (Overview: Global Electronic Grade High-purity Titanium Consumption Value, Flat Panel Displays, Integrated Circuits, Photovoltaics, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

Market Analysis for Electronic Grade High-Purity Titanium

The global electronic grade high-purity titanium market is expected to reach a value of USD XXX million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033). The increasing demand for high-purity titanium in the semiconductor, flat panel display, and photovoltaic industries is driving market growth. Additionally, the growing adoption of advanced technologies such as 5G and IoT is fueling the need for high-performance materials, which has led to a rise in the use of electronic grade high-purity titanium. The market is segmented based on type (4N, 4N5, 5N) and application (flat panel displays, integrated circuits, photovoltaics, others).

Regional Dynamics and Key Players

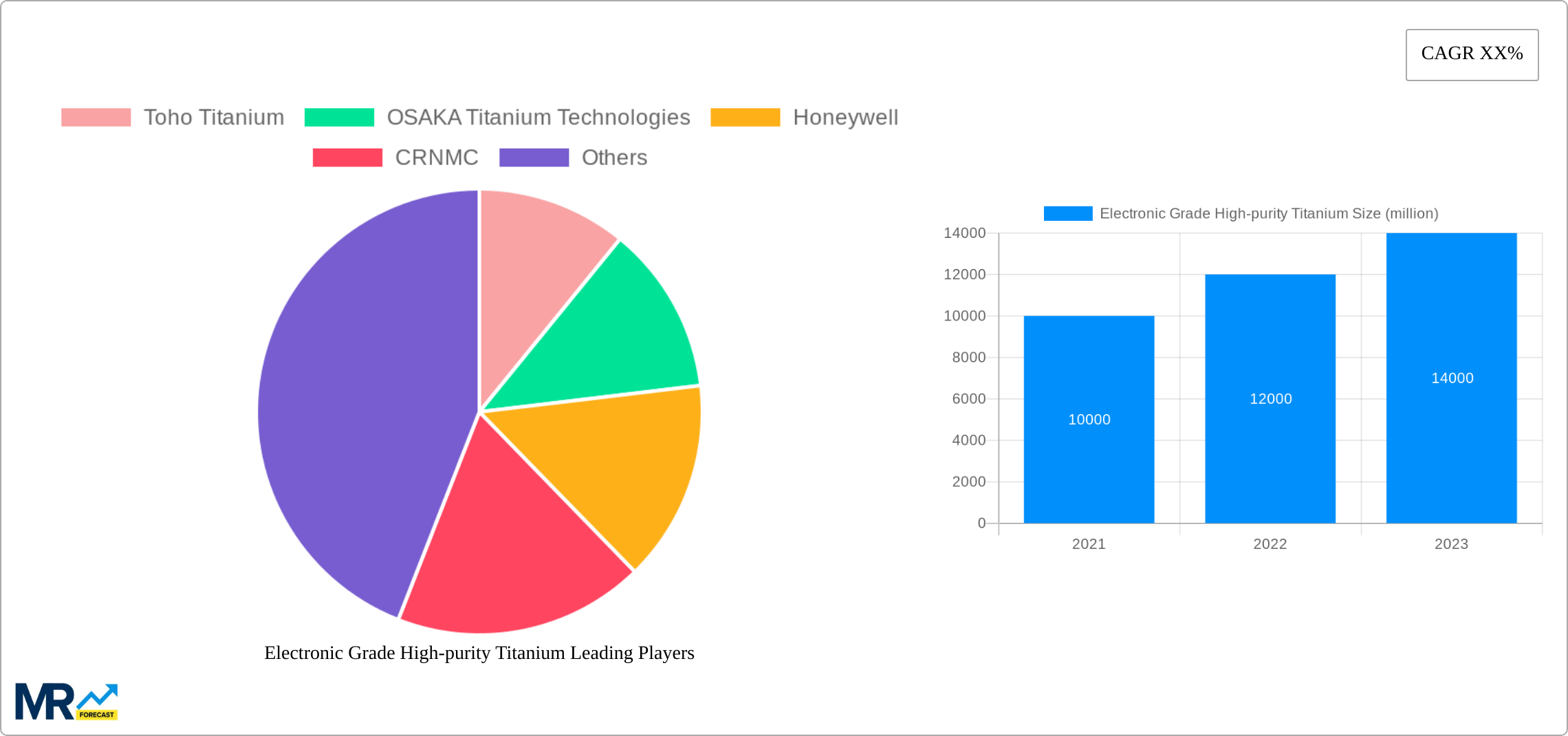

North America and Asia Pacific are expected to be the dominant regions in the electronic grade high-purity titanium market. The presence of major semiconductor and electronics manufacturing hubs in these regions is driving demand. Key players in the market include Toho Titanium, OSAKA Titanium Technologies, Honeywell, and CRNMC. These companies are focusing on expanding their production capacities and investing in research and development to meet the growing market demand. The market is also characterized by the presence of a number of emerging market entrants, which is expected to intensify competition in the future.

Electronic Grade High-purity Titanium Trends

The global market for electronic grade high-purity titanium is exhibiting robust growth, driven by the increasing demand for this material in the production of advanced electronic devices. The market is projected to reach a value of over USD 1.5 billion by 2025, growing at a CAGR of approximately 6% during the forecast period.

One of the key growth drivers is the increasing use of titanium in flat panel displays (FPDs). Titanium is used in the transparent conductive oxide (TCO) layer of FPDs, which allows light to pass through the display while blocking out harmful UV rays. The demand for FPDs is expected to continue to grow in the coming years, driven by the increasing popularity of smartphones, tablets, and other portable devices.

Another major growth driver is the increasing use of titanium in integrated circuits (ICs). Titanium is used in the metallization layer of ICs, which connects the different components of the chip. The demand for ICs is expected to continue to grow in the coming years as the number of electronic devices increases.

In addition to FPDs and ICs, titanium is also used in a variety of other electronic applications, such as photovoltaics, semiconductors, and capacitors. The demand for titanium in these applications is expected to continue to grow as the electronics industry continues to evolve.

Driving Forces: What's Propelling the Electronic Grade High-purity Titanium

Several factors are driving the growth of the electronic grade high-purity titanium market. These include:

- The increasing demand for electronic devices

- The development of new and innovative electronic devices

- The miniaturization of electronic devices

- The need for high-performance materials in electronic devices

The increasing demand for electronic devices is one of the main factors driving the growth of the electronic grade high-purity titanium market. As the global population grows, the demand for electronic devices is expected to continue to increase. This is because electronic devices are becoming an essential part of our lives. We use them to communicate, stay informed, and be entertained.

The development of new and innovative electronic devices is also driving the growth of the electronic grade high-purity titanium market. As technology advances, new types of electronic devices are being developed. These devices often require high-purity titanium to meet their performance requirements.

The miniaturization of electronic devices is another factor driving the growth of the electronic grade high-purity titanium market. As electronic devices become smaller, the need for high-purity titanium increases. This is because high-purity titanium is able to be processed into very thin films, which are essential for the miniaturization of electronic devices.

The need for high-performance materials in electronic devices is also driving the growth of the electronic grade high-purity titanium market. As electronic devices become more powerful, the need for high-performance materials increases. High-purity titanium is a high-performance material that can meet the demands of the most advanced electronic devices.

Challenges and Restraints in Electronic Grade High-purity Titanium

Despite the strong growth prospects for the electronic grade high-purity titanium market, there are a number of challenges and restraints that could impact the market's growth. These include:

- The high cost of electronic grade high-purity titanium

- The limited availability of electronic grade high-purity titanium

- The technological challenges associated with processing electronic grade high-purity titanium

The high cost of electronic grade high-purity titanium is one of the main challenges facing the market. This is because electronic grade high-purity titanium is a rare and difficult-to-process material. The limited availability of electronic grade high-purity titanium is another challenge facing the market. This is because the production of electronic grade high-purity titanium is a complex and time-consuming process.

The technological challenges associated with processing electronic grade high-purity titanium are another challenge facing the market. This is because electronic grade high-purity titanium is a very delicate material that can be easily damaged during processing.

Key Region or Country & Segment to Dominate the Market

The Asia-Pacific region is the largest market for electronic grade high-purity titanium, accounting for over 50% of global demand. This is due to the region's strong electronics industry. China is the largest market for electronic grade high-purity titanium in the Asia-Pacific region, followed by Japan and South Korea.

The flat panel displays segment is the largest segment of the electronic grade high-purity titanium market, accounting for over 60% of global demand. This is due to the increasing demand for FPDs. The integrated circuits segment is the second largest segment of the electronic grade high-purity titanium market, accounting for over 20% of global demand. This is due to the increasing demand for ICs.

Growth Catalysts in Electronic Grade High-purity Titanium Industry

The growth of the electronic grade high-purity titanium market is being driven by a number of factors, including:

- The increasing demand for electronic devices

- The development of new and innovative electronic devices

- The miniaturization of electronic devices

- The need for high-performance materials in electronic devices

The increasing demand for electronic devices is one of the main factors driving the growth of the electronic grade high-purity titanium market. As the global population grows, the demand for electronic devices is expected to continue to increase. This is because electronic devices are becoming an essential part of our lives. We use them to communicate, stay informed, and be entertained.

The development of new and innovative electronic devices is also driving the growth of the electronic grade high-purity titanium market. As technology advances, new types of electronic devices are being developed. These devices often require high-purity titanium to meet their performance requirements.

The miniaturization of electronic devices is another factor driving the growth of the electronic grade high-purity titanium market. As electronic devices become smaller, the need for high-purity titanium increases. This is because high-purity titanium is able to be processed into very thin films, which are essential for the miniaturization of electronic devices.

The need for high-performance materials in electronic devices is also driving the growth of the electronic grade high-purity titanium market. As electronic devices become more powerful, the need for high-performance materials increases. High-purity titanium is a high-performance material that can meet the demands of the most advanced electronic devices.

Leading Players in the Electronic Grade High-purity Titanium

The electronic grade high-purity titanium market is dominated by a few large players, including:

- [Toho Titanium Co. Ltd.]( rel="nofollow")

- [Osaka Titanium Technologies Co. Ltd.]( rel="nofollow")

- [Honeywell International Inc.]( rel="nofollow")

- [CRNMC]( rel="nofollow")

These companies have a strong global presence and a long history of producing high-quality electronic grade high-purity titanium.

Significant Developments in Electronic Grade High-purity Titanium Sector

The electronic grade high-purity titanium sector is constantly evolving, with new technologies and products being developed all the time. Some of the most significant recent developments include:

- The development of new processes for producing electronic grade high-purity titanium

- The development of new alloys of electronic grade high-purity titanium

- The development of new applications for electronic grade high-purity titanium

These developments are expected to further drive the growth of the electronic grade high-purity titanium market in the coming years.

Comprehensive Coverage Electronic Grade High-purity Titanium Report

This report provides a comprehensive overview of the electronic grade high-purity titanium market. The report covers the market's key trends, drivers, challenges, and restraints. The report also provides a detailed analysis of the market's key segments and regions. The report is a valuable resource for anyone looking to understand the electronic grade high-purity titanium market.

Electronic Grade High-purity Titanium Segmentation

-

1. Type

- 1.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 1.2. 4N

- 1.3. 4N5

- 1.4. 5N

-

2. Application

- 2.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 2.2. Flat Panel Displays

- 2.3. Integrated Circuits

- 2.4. Photovoltaics

- 2.5. Others

Electronic Grade High-purity Titanium Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electronic Grade High-purity Titanium REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Can you provide examples of recent developments in the market?

undefined

Which companies are prominent players in the Electronic Grade High-purity Titanium?

Key companies in the market include Toho Titanium,OSAKA Titanium Technologies,Honeywell,CRNMC

Are there any restraints impacting market growth?

.

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00 , USD 5220.00, and USD 6960.00 respectively.

What is the projected Compound Annual Growth Rate (CAGR) of the Electronic Grade High-purity Titanium ?

The projected CAGR is approximately XX%.

How can I stay updated on further developments or reports in the Electronic Grade High-purity Titanium?

To stay informed about further developments, trends, and reports in the Electronic Grade High-purity Titanium, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

What are the main segments of the Electronic Grade High-purity Titanium?

The market segments include

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electronic Grade High-purity Titanium Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 5.1.2. 4N

- 5.1.3. 4N5

- 5.1.4. 5N

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 5.2.2. Flat Panel Displays

- 5.2.3. Integrated Circuits

- 5.2.4. Photovoltaics

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Electronic Grade High-purity Titanium Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 6.1.2. 4N

- 6.1.3. 4N5

- 6.1.4. 5N

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 6.2.2. Flat Panel Displays

- 6.2.3. Integrated Circuits

- 6.2.4. Photovoltaics

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Electronic Grade High-purity Titanium Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 7.1.2. 4N

- 7.1.3. 4N5

- 7.1.4. 5N

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 7.2.2. Flat Panel Displays

- 7.2.3. Integrated Circuits

- 7.2.4. Photovoltaics

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Electronic Grade High-purity Titanium Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 8.1.2. 4N

- 8.1.3. 4N5

- 8.1.4. 5N

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 8.2.2. Flat Panel Displays

- 8.2.3. Integrated Circuits

- 8.2.4. Photovoltaics

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Electronic Grade High-purity Titanium Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 9.1.2. 4N

- 9.1.3. 4N5

- 9.1.4. 5N

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 9.2.2. Flat Panel Displays

- 9.2.3. Integrated Circuits

- 9.2.4. Photovoltaics

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Electronic Grade High-purity Titanium Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 10.1.2. 4N

- 10.1.3. 4N5

- 10.1.4. 5N

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Overview: Global Electronic Grade High-purity Titanium Consumption Value

- 10.2.2. Flat Panel Displays

- 10.2.3. Integrated Circuits

- 10.2.4. Photovoltaics

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Toho Titanium

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 OSAKA Titanium Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CRNMC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Toho Titanium

- Figure 1: Global Electronic Grade High-purity Titanium Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Electronic Grade High-purity Titanium Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Electronic Grade High-purity Titanium Revenue (million), by Type 2024 & 2032

- Figure 4: North America Electronic Grade High-purity Titanium Volume (K), by Type 2024 & 2032

- Figure 5: North America Electronic Grade High-purity Titanium Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Electronic Grade High-purity Titanium Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Electronic Grade High-purity Titanium Revenue (million), by Application 2024 & 2032

- Figure 8: North America Electronic Grade High-purity Titanium Volume (K), by Application 2024 & 2032

- Figure 9: North America Electronic Grade High-purity Titanium Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Electronic Grade High-purity Titanium Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Electronic Grade High-purity Titanium Revenue (million), by Country 2024 & 2032

- Figure 12: North America Electronic Grade High-purity Titanium Volume (K), by Country 2024 & 2032

- Figure 13: North America Electronic Grade High-purity Titanium Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Electronic Grade High-purity Titanium Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Electronic Grade High-purity Titanium Revenue (million), by Type 2024 & 2032

- Figure 16: South America Electronic Grade High-purity Titanium Volume (K), by Type 2024 & 2032

- Figure 17: South America Electronic Grade High-purity Titanium Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Electronic Grade High-purity Titanium Volume Share (%), by Type 2024 & 2032

- Figure 19: South America Electronic Grade High-purity Titanium Revenue (million), by Application 2024 & 2032

- Figure 20: South America Electronic Grade High-purity Titanium Volume (K), by Application 2024 & 2032

- Figure 21: South America Electronic Grade High-purity Titanium Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Electronic Grade High-purity Titanium Volume Share (%), by Application 2024 & 2032

- Figure 23: South America Electronic Grade High-purity Titanium Revenue (million), by Country 2024 & 2032

- Figure 24: South America Electronic Grade High-purity Titanium Volume (K), by Country 2024 & 2032

- Figure 25: South America Electronic Grade High-purity Titanium Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Electronic Grade High-purity Titanium Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Electronic Grade High-purity Titanium Revenue (million), by Type 2024 & 2032

- Figure 28: Europe Electronic Grade High-purity Titanium Volume (K), by Type 2024 & 2032

- Figure 29: Europe Electronic Grade High-purity Titanium Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Electronic Grade High-purity Titanium Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe Electronic Grade High-purity Titanium Revenue (million), by Application 2024 & 2032

- Figure 32: Europe Electronic Grade High-purity Titanium Volume (K), by Application 2024 & 2032

- Figure 33: Europe Electronic Grade High-purity Titanium Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe Electronic Grade High-purity Titanium Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe Electronic Grade High-purity Titanium Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Electronic Grade High-purity Titanium Volume (K), by Country 2024 & 2032

- Figure 37: Europe Electronic Grade High-purity Titanium Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Electronic Grade High-purity Titanium Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Electronic Grade High-purity Titanium Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa Electronic Grade High-purity Titanium Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa Electronic Grade High-purity Titanium Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa Electronic Grade High-purity Titanium Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa Electronic Grade High-purity Titanium Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa Electronic Grade High-purity Titanium Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa Electronic Grade High-purity Titanium Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa Electronic Grade High-purity Titanium Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa Electronic Grade High-purity Titanium Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Electronic Grade High-purity Titanium Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Electronic Grade High-purity Titanium Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Electronic Grade High-purity Titanium Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Electronic Grade High-purity Titanium Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific Electronic Grade High-purity Titanium Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific Electronic Grade High-purity Titanium Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific Electronic Grade High-purity Titanium Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific Electronic Grade High-purity Titanium Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific Electronic Grade High-purity Titanium Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific Electronic Grade High-purity Titanium Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Electronic Grade High-purity Titanium Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Electronic Grade High-purity Titanium Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Electronic Grade High-purity Titanium Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Electronic Grade High-purity Titanium Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Electronic Grade High-purity Titanium Volume Share (%), by Country 2024 & 2032

- Table 1: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Electronic Grade High-purity Titanium Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Electronic Grade High-purity Titanium Volume K Forecast, by Type 2019 & 2032

- Table 5: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Electronic Grade High-purity Titanium Volume K Forecast, by Application 2019 & 2032

- Table 7: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Electronic Grade High-purity Titanium Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Electronic Grade High-purity Titanium Volume K Forecast, by Type 2019 & 2032

- Table 11: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Electronic Grade High-purity Titanium Volume K Forecast, by Application 2019 & 2032

- Table 13: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Electronic Grade High-purity Titanium Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global Electronic Grade High-purity Titanium Volume K Forecast, by Type 2019 & 2032

- Table 23: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global Electronic Grade High-purity Titanium Volume K Forecast, by Application 2019 & 2032

- Table 25: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Electronic Grade High-purity Titanium Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global Electronic Grade High-purity Titanium Volume K Forecast, by Type 2019 & 2032

- Table 35: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global Electronic Grade High-purity Titanium Volume K Forecast, by Application 2019 & 2032

- Table 37: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Electronic Grade High-purity Titanium Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global Electronic Grade High-purity Titanium Volume K Forecast, by Type 2019 & 2032

- Table 59: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global Electronic Grade High-purity Titanium Volume K Forecast, by Application 2019 & 2032

- Table 61: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Electronic Grade High-purity Titanium Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global Electronic Grade High-purity Titanium Volume K Forecast, by Type 2019 & 2032

- Table 77: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global Electronic Grade High-purity Titanium Volume K Forecast, by Application 2019 & 2032

- Table 79: Global Electronic Grade High-purity Titanium Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Electronic Grade High-purity Titanium Volume K Forecast, by Country 2019 & 2032

- Table 81: China Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Electronic Grade High-purity Titanium Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Electronic Grade High-purity Titanium Volume (K) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.