Engineered Wood Siding

Engineered Wood SidingEngineered Wood Siding Unlocking Growth Opportunities: Analysis and Forecast 2025-2033

Engineered Wood Siding by Type (Oriented Strand Board, High-density Fiberboard, Veneered Plywood), by Application (Residential, Commercial, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global engineered wood siding market is experiencing robust growth, driven by increasing demand for sustainable and aesthetically pleasing building materials. The market's expansion is fueled by several key factors. Firstly, the rising construction activity in both residential and commercial sectors, particularly in developing economies, significantly boosts demand. Secondly, engineered wood siding offers superior durability, low maintenance, and energy efficiency compared to traditional materials, making it a cost-effective and environmentally conscious choice. Furthermore, advancements in manufacturing techniques have led to the development of innovative products with enhanced performance characteristics and a wider range of styles and finishes, catering to diverse architectural preferences. The residential segment currently dominates the market, owing to the increasing preference for aesthetically appealing and long-lasting exteriors in new homes and renovations. However, the commercial sector is also showing promising growth potential, driven by the increasing adoption of engineered wood siding in various commercial buildings due to its durability and cost-effectiveness.

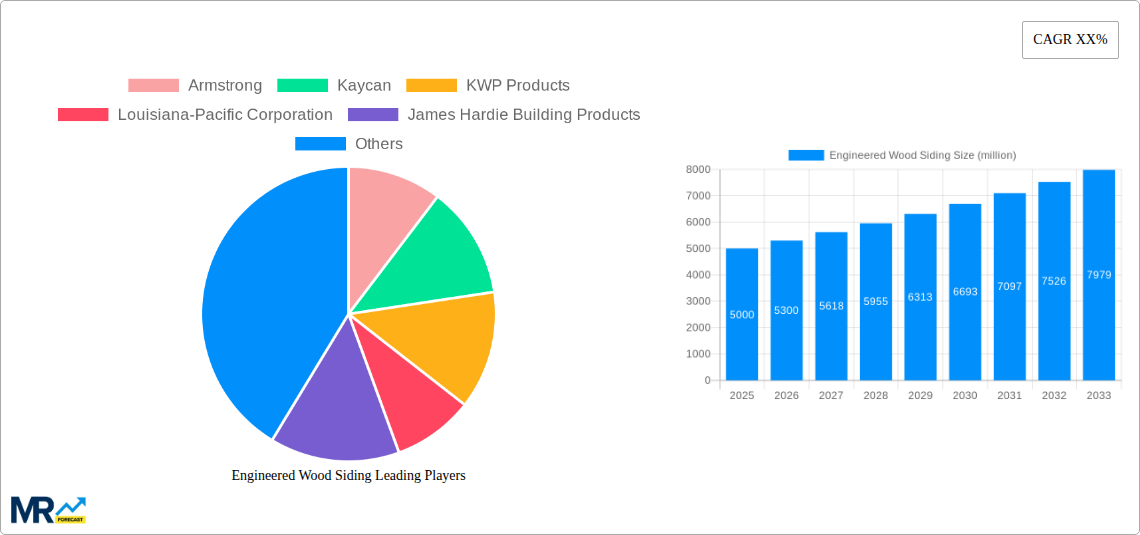

Despite these positive trends, the market faces certain challenges. Fluctuations in raw material prices, primarily lumber, can impact production costs and profitability. Moreover, stringent environmental regulations and concerns regarding the environmental impact of certain manufacturing processes pose potential restraints. However, the industry is actively addressing these concerns through sustainable sourcing practices and the development of eco-friendly production methods. Key players in the market, including Armstrong, Kaycan, KWP Products, and Louisiana-Pacific Corporation, are strategically investing in research and development, expanding their product portfolios, and focusing on strategic partnerships to maintain their market positions and capitalize on emerging growth opportunities. The market is expected to witness sustained growth throughout the forecast period (2025-2033), with a projected CAGR (assuming a reasonable CAGR of 5% based on industry averages for similar building materials) resulting in a significant increase in market value. Regional variations will exist, with North America and Asia-Pacific anticipated to lead the growth, driven by robust construction activity and increasing consumer preference for sustainable building products.

Engineered Wood Siding Trends

The global engineered wood siding market, valued at XXX million units in 2025, is experiencing robust growth, driven by increasing construction activity and a shift towards sustainable building materials. The market's expansion is projected to continue throughout the forecast period (2025-2033), exceeding XXX million units by 2033. This growth is fueled by several factors, including the rising demand for aesthetically pleasing and durable exterior cladding in both residential and commercial sectors. Engineered wood siding offers a compelling alternative to traditional materials like vinyl or brick, providing comparable durability with a more natural look and feel. Furthermore, the increasing awareness of environmental concerns is driving the adoption of sustainably sourced engineered wood products, boosting the market's appeal. The historical period (2019-2024) witnessed significant growth, setting the stage for the strong forecast. Key trends shaping the market include the development of innovative designs, enhanced performance characteristics (e.g., improved resistance to moisture and insects), and a growing preference for customized finishes. Manufacturers are investing in research and development to improve the performance and aesthetics of their products, offering a wide array of options to meet diverse consumer needs. This competitive landscape fosters innovation and further propels market growth. The study period (2019-2033) reveals a consistent upward trajectory, indicating a resilient and expanding market sector.

Driving Forces: What's Propelling the Engineered Wood Siding Market?

Several factors are contributing to the rapid expansion of the engineered wood siding market. The increasing urbanization and rising disposable incomes in developing economies are leading to a surge in new construction projects, significantly boosting the demand for building materials. Engineered wood siding offers a cost-effective solution compared to traditional options, making it attractive for both residential and commercial applications. Moreover, its versatility in design and the availability of various finishes to complement diverse architectural styles are major drivers of its popularity. The growing awareness of the environmental impact of construction is also playing a crucial role. Engineered wood siding, often manufactured from sustainably sourced wood, aligns with the increasing demand for eco-friendly building materials. Government initiatives promoting sustainable construction practices and energy-efficient buildings are further bolstering market growth. Finally, advancements in manufacturing technologies are leading to the production of higher-quality engineered wood siding with enhanced durability, weather resistance, and aesthetic appeal, thus strengthening consumer preference.

Challenges and Restraints in Engineered Wood Siding

Despite the positive growth trajectory, the engineered wood siding market faces certain challenges. Fluctuations in raw material prices, particularly lumber, can significantly impact production costs and profitability. This price volatility presents a risk for manufacturers and can lead to price increases, potentially affecting market demand. Furthermore, the susceptibility of engineered wood siding to moisture damage, if not properly installed and maintained, can negatively impact its longevity and consumer perception. This necessitates thorough understanding and adherence to proper installation techniques. Competition from alternative cladding materials, such as vinyl and fiber cement, also poses a challenge. These materials often offer lower initial costs, though may lack the aesthetic appeal and environmental sustainability of engineered wood. Finally, stringent building codes and regulations in certain regions can impose limitations on the use of engineered wood siding, creating regional variations in market growth. Addressing these challenges requires innovative solutions, including improved manufacturing processes to reduce costs, enhanced product designs for improved moisture resistance, and targeted marketing campaigns highlighting the long-term benefits of engineered wood siding.

Key Region or Country & Segment to Dominate the Market

The residential segment is projected to dominate the engineered wood siding market throughout the forecast period (2025-2033). This is primarily driven by the ongoing expansion of the housing sector, particularly in rapidly developing economies. The surge in new home constructions and renovations fuels strong demand for aesthetically pleasing and durable exterior cladding materials. While the commercial sector also contributes significantly, the sheer scale of residential construction projects makes it the dominant market segment.

North America: This region is expected to maintain a significant market share, fueled by robust construction activity and a preference for sustainable building materials. The United States, in particular, is projected to be a key driver of growth within North America.

Europe: The European market is also poised for substantial growth, driven by rising construction spending and increasing adoption of eco-friendly building practices. Stringent environmental regulations are incentivizing the use of sustainable materials, bolstering the demand for engineered wood siding.

Asia-Pacific: This region exhibits high growth potential, underpinned by rapid urbanization and a surge in construction projects. Countries like China and India are experiencing substantial infrastructure development, driving significant demand for construction materials, including engineered wood siding.

Oriented Strand Board (OSB): OSB is anticipated to hold a substantial market share due to its cost-effectiveness and widespread availability. It offers a balance of performance and affordability, making it a popular choice for various applications.

In summary, the interplay of strong residential demand, particularly in North America and the Asia-Pacific region, coupled with the cost-effectiveness and availability of OSB, positions these segments as key drivers of market dominance in the coming years. The ongoing focus on sustainability further enhances the prospects of engineered wood siding in these regions and segments.

Growth Catalysts in the Engineered Wood Siding Industry

The engineered wood siding industry's growth is fueled by several key catalysts. These include the increasing demand for eco-friendly building materials, rising disposable incomes leading to higher spending on home improvements, and advancements in manufacturing technology that have led to more durable and aesthetically pleasing products. Government incentives promoting sustainable construction and energy-efficient homes further enhance the market's expansion. The versatility of engineered wood siding, suitable for various architectural styles, also plays a significant role in its widespread adoption.

Leading Players in the Engineered Wood Siding Market

- Armstrong

- Kaycan (Kaycan)

- KWP Products

- Louisiana-Pacific Corporation (Louisiana-Pacific Corporation)

- James Hardie Building Products (James Hardie Building Products)

- Fortex

- Collins

- Roseburg Forest Products (Roseburg Forest Products)

- Allura USA

- St-Laurent

- Maibec

- Kastalon

Significant Developments in the Engineered Wood Siding Sector

- 2020: Several major manufacturers announced investments in expanding their production capacities to meet growing demand.

- 2021: Introduction of new engineered wood siding products with enhanced fire-resistance properties.

- 2022: A key player launched a new line of sustainably sourced engineered wood siding with improved aesthetic appeal.

- 2023: Several partnerships formed between siding manufacturers and building material distributors to expand market reach.

Comprehensive Coverage Engineered Wood Siding Report

This report provides a detailed analysis of the global engineered wood siding market, offering comprehensive insights into market trends, driving forces, challenges, and growth opportunities. It covers key market segments, including by type and application, and provides detailed regional breakdowns. The report also features profiles of leading players in the industry, highlighting their market share, competitive strategies, and recent developments. The forecasts presented are based on rigorous research and data analysis, providing valuable insights for stakeholders seeking to understand and navigate the dynamics of this dynamic market.

Engineered Wood Siding Segmentation

-

1. Type

- 1.1. Overview: Global Engineered Wood Siding Consumption Value

- 1.2. Oriented Strand Board

- 1.3. High-density Fiberboard

- 1.4. Veneered Plywood

-

2. Application

- 2.1. Overview: Global Engineered Wood Siding Consumption Value

- 2.2. Residential

- 2.3. Commercial

- 2.4. Others

Engineered Wood Siding Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Engineered Wood Siding REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Engineered Wood Siding Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Oriented Strand Board

- 5.1.2. High-density Fiberboard

- 5.1.3. Veneered Plywood

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Engineered Wood Siding Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Oriented Strand Board

- 6.1.2. High-density Fiberboard

- 6.1.3. Veneered Plywood

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Engineered Wood Siding Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Oriented Strand Board

- 7.1.2. High-density Fiberboard

- 7.1.3. Veneered Plywood

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Engineered Wood Siding Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Oriented Strand Board

- 8.1.2. High-density Fiberboard

- 8.1.3. Veneered Plywood

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Engineered Wood Siding Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Oriented Strand Board

- 9.1.2. High-density Fiberboard

- 9.1.3. Veneered Plywood

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Engineered Wood Siding Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Oriented Strand Board

- 10.1.2. High-density Fiberboard

- 10.1.3. Veneered Plywood

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Armstrong

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kaycan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KWP Products

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Louisiana-Pacific Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 James Hardie Building Products

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fortex

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Collins

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Roseburg Forest Products

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Allura USA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 St-Laurent

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Maibec

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kastalon

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Armstrong

- Figure 1: Global Engineered Wood Siding Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Engineered Wood Siding Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Engineered Wood Siding Revenue (million), by Type 2024 & 2032

- Figure 4: North America Engineered Wood Siding Volume (K), by Type 2024 & 2032

- Figure 5: North America Engineered Wood Siding Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Engineered Wood Siding Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Engineered Wood Siding Revenue (million), by Application 2024 & 2032

- Figure 8: North America Engineered Wood Siding Volume (K), by Application 2024 & 2032

- Figure 9: North America Engineered Wood Siding Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Engineered Wood Siding Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Engineered Wood Siding Revenue (million), by Country 2024 & 2032

- Figure 12: North America Engineered Wood Siding Volume (K), by Country 2024 & 2032

- Figure 13: North America Engineered Wood Siding Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Engineered Wood Siding Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Engineered Wood Siding Revenue (million), by Type 2024 & 2032

- Figure 16: South America Engineered Wood Siding Volume (K), by Type 2024 & 2032

- Figure 17: South America Engineered Wood Siding Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Engineered Wood Siding Volume Share (%), by Type 2024 & 2032

- Figure 19: South America Engineered Wood Siding Revenue (million), by Application 2024 & 2032

- Figure 20: South America Engineered Wood Siding Volume (K), by Application 2024 & 2032

- Figure 21: South America Engineered Wood Siding Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Engineered Wood Siding Volume Share (%), by Application 2024 & 2032

- Figure 23: South America Engineered Wood Siding Revenue (million), by Country 2024 & 2032

- Figure 24: South America Engineered Wood Siding Volume (K), by Country 2024 & 2032

- Figure 25: South America Engineered Wood Siding Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Engineered Wood Siding Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Engineered Wood Siding Revenue (million), by Type 2024 & 2032

- Figure 28: Europe Engineered Wood Siding Volume (K), by Type 2024 & 2032

- Figure 29: Europe Engineered Wood Siding Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Engineered Wood Siding Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe Engineered Wood Siding Revenue (million), by Application 2024 & 2032

- Figure 32: Europe Engineered Wood Siding Volume (K), by Application 2024 & 2032

- Figure 33: Europe Engineered Wood Siding Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe Engineered Wood Siding Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe Engineered Wood Siding Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Engineered Wood Siding Volume (K), by Country 2024 & 2032

- Figure 37: Europe Engineered Wood Siding Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Engineered Wood Siding Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Engineered Wood Siding Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa Engineered Wood Siding Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa Engineered Wood Siding Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa Engineered Wood Siding Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa Engineered Wood Siding Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa Engineered Wood Siding Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa Engineered Wood Siding Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa Engineered Wood Siding Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa Engineered Wood Siding Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Engineered Wood Siding Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Engineered Wood Siding Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Engineered Wood Siding Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Engineered Wood Siding Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific Engineered Wood Siding Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific Engineered Wood Siding Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific Engineered Wood Siding Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific Engineered Wood Siding Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific Engineered Wood Siding Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific Engineered Wood Siding Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Engineered Wood Siding Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Engineered Wood Siding Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Engineered Wood Siding Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Engineered Wood Siding Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Engineered Wood Siding Volume Share (%), by Country 2024 & 2032

- Table 1: Global Engineered Wood Siding Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Engineered Wood Siding Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Engineered Wood Siding Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Engineered Wood Siding Volume K Forecast, by Type 2019 & 2032

- Table 5: Global Engineered Wood Siding Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Engineered Wood Siding Volume K Forecast, by Application 2019 & 2032

- Table 7: Global Engineered Wood Siding Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Engineered Wood Siding Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Engineered Wood Siding Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Engineered Wood Siding Volume K Forecast, by Type 2019 & 2032

- Table 11: Global Engineered Wood Siding Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Engineered Wood Siding Volume K Forecast, by Application 2019 & 2032

- Table 13: Global Engineered Wood Siding Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Engineered Wood Siding Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Engineered Wood Siding Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global Engineered Wood Siding Volume K Forecast, by Type 2019 & 2032

- Table 23: Global Engineered Wood Siding Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global Engineered Wood Siding Volume K Forecast, by Application 2019 & 2032

- Table 25: Global Engineered Wood Siding Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Engineered Wood Siding Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Engineered Wood Siding Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global Engineered Wood Siding Volume K Forecast, by Type 2019 & 2032

- Table 35: Global Engineered Wood Siding Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global Engineered Wood Siding Volume K Forecast, by Application 2019 & 2032

- Table 37: Global Engineered Wood Siding Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Engineered Wood Siding Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Engineered Wood Siding Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global Engineered Wood Siding Volume K Forecast, by Type 2019 & 2032

- Table 59: Global Engineered Wood Siding Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global Engineered Wood Siding Volume K Forecast, by Application 2019 & 2032

- Table 61: Global Engineered Wood Siding Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Engineered Wood Siding Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Engineered Wood Siding Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global Engineered Wood Siding Volume K Forecast, by Type 2019 & 2032

- Table 77: Global Engineered Wood Siding Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global Engineered Wood Siding Volume K Forecast, by Application 2019 & 2032

- Table 79: Global Engineered Wood Siding Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Engineered Wood Siding Volume K Forecast, by Country 2019 & 2032

- Table 81: China Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Engineered Wood Siding Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Engineered Wood Siding Volume (K) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.