Enterprise Collaboration Service

Enterprise Collaboration ServiceEnterprise Collaboration Service Report Probes the 26590 million Size, Share, Growth Report and Future Analysis by 2033

Enterprise Collaboration Service by Type (Hardware, Software, Services (Consulting, Integration, and Maintenance)), by Application (Banking, Financial Services and Insurance, Retail, Healthcare, Government, Information Technology, Media and Entertainment, Education, Transportation and Manufacturing, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

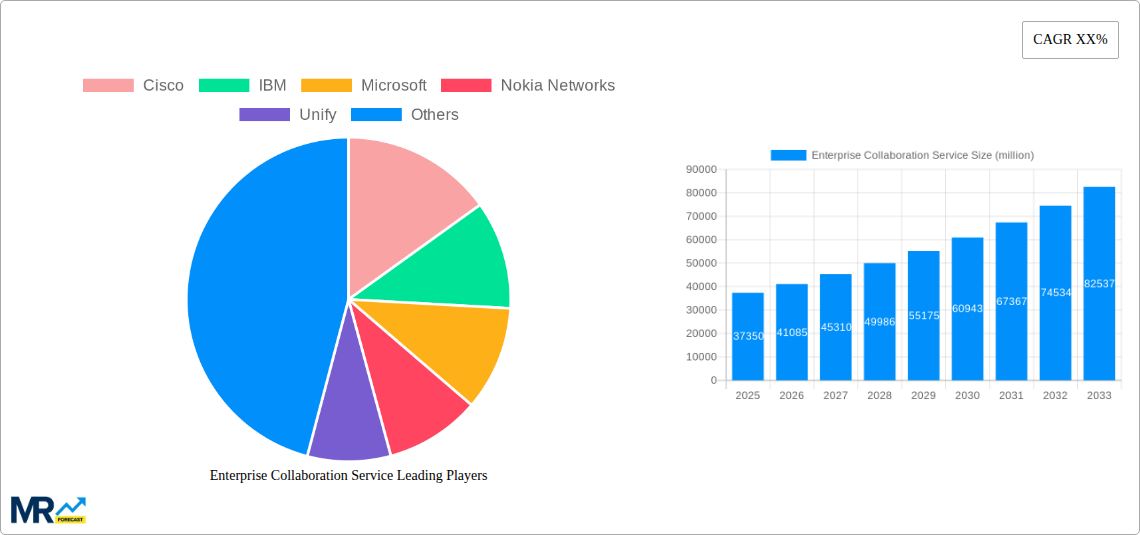

The Enterprise Collaboration Services (ECS) market, valued at $26.59 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of cloud-based solutions, remote work trends, and the need for enhanced communication and productivity across geographically dispersed teams. The market's Compound Annual Growth Rate (CAGR) of 5.0% from 2019 to 2024 indicates a steady upward trajectory, expected to continue through 2033. Key drivers include the rising demand for improved operational efficiency, enhanced employee collaboration, and seamless integration with existing business applications. The shift towards hybrid work models further accelerates the adoption of ECS, fostering the need for secure and reliable communication platforms that facilitate both in-office and remote interactions. Software solutions are expected to dominate the market, fueled by their scalability, flexibility, and cost-effectiveness compared to traditional hardware-based systems. Significant market segments include Banking, Financial Services and Insurance (BFSI), along with Retail, Healthcare, and IT sectors, each demonstrating high demand for secure and efficient collaboration tools.

Geographic expansion significantly influences market growth. North America and Europe currently hold substantial market shares, due to early adoption of collaborative technologies and robust digital infrastructure. However, the Asia-Pacific region is poised for rapid growth, fueled by increasing internet penetration, expanding digital literacy, and a growing number of businesses embracing digital transformation strategies. While competitive pressures from numerous vendors exist, the overall market demonstrates strong resilience and growth potential. The continuous innovation in features such as enhanced security, AI-powered functionalities, and improved integration capabilities will continue to shape the market landscape, attracting new players and fostering consolidation among established companies. The market's future trajectory indicates sustained growth, driven by technological advancements, evolving workplace dynamics, and the increasing reliance on digital tools for business operations.

Enterprise Collaboration Service Trends

The enterprise collaboration service market is experiencing explosive growth, projected to reach tens of billions of dollars by 2033. The historical period (2019-2024) saw a steady climb fueled by the initial adoption of cloud-based solutions and the increasing need for remote work capabilities. However, the period from the base year (2025) to the estimated year (2025) marks a significant inflection point. The shift towards hybrid work models, accelerated by the pandemic, continues to be a dominant force. This report forecasts robust growth throughout the forecast period (2025-2033), driven not only by the sustained demand for remote work tools but also by the increasing adoption of advanced features such as AI-powered communication, enhanced security protocols, and integrated workflows across diverse applications. Companies are investing heavily in these services to improve employee productivity, streamline internal communication, foster better collaboration across teams and locations, and ultimately gain a competitive edge. The market is witnessing a consolidation of vendors, with larger players acquiring smaller ones to expand their product portfolios and service offerings. This trend further contributes to market growth by enhancing the scale and reach of enterprise collaboration solutions. Key market insights reveal a strong preference for cloud-based solutions, particularly Software as a Service (SaaS) models, owing to their flexibility, scalability, and cost-effectiveness. Furthermore, the increasing integration of collaboration platforms with other enterprise applications like CRM and ERP systems is a significant trend shaping the market's evolution. The growing importance of data security and compliance regulations is also influencing vendor strategies and customer choices. The adoption of advanced features like AI-powered transcription, real-time translation, and video conferencing analytics is further enhancing the value proposition of these services. The market is evolving from a mere communication tool to a comprehensive platform for enhancing overall business processes and operational efficiency.

Driving Forces: What's Propelling the Enterprise Collaboration Service

Several key factors are driving the phenomenal growth of the enterprise collaboration service market. The widespread adoption of hybrid and remote work models, necessitated by recent global events and evolving workforce preferences, has created an unprecedented demand for robust and reliable communication and collaboration tools. The need to maintain seamless communication and workflow efficiency across geographically dispersed teams is a primary driver. This has led companies to prioritize investments in cloud-based solutions that offer greater flexibility, scalability, and accessibility. Furthermore, the increasing sophistication of collaboration tools, fueled by advancements in artificial intelligence (AI) and machine learning (ML), is enhancing user experience and productivity. AI-powered features such as automated transcription, real-time translation, and intelligent meeting summaries are transforming the way businesses communicate and collaborate. The integration of collaboration platforms with other enterprise applications, such as Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems, is another crucial driver. This integration streamlines workflows and improves operational efficiency by consolidating communication and data management within a single platform. Finally, the rising focus on data security and regulatory compliance is driving the demand for secure and compliant collaboration solutions. Companies are increasingly seeking platforms that meet stringent security standards and comply with relevant regulations, further fueling market growth.

Challenges and Restraints in Enterprise Collaboration Service

Despite the significant growth potential, the enterprise collaboration service market faces certain challenges and restraints. One major hurdle is the complexity of integrating various collaboration platforms and applications within an organization's existing IT infrastructure. This can lead to compatibility issues, integration challenges, and increased IT management costs. Another challenge is ensuring data security and privacy within these platforms, particularly as organizations handle sensitive business information. Robust security measures and compliance with relevant data protection regulations are crucial, and any security breaches or data leaks can have severe consequences. The market is characterized by a diverse range of vendors and solutions, making it challenging for businesses to choose the most appropriate platform for their specific needs. The decision process often involves careful evaluation of various factors, including functionality, scalability, integration capabilities, security features, and cost-effectiveness. Furthermore, maintaining user adoption and engagement with collaboration tools can be challenging. Effective training and support are essential to ensure that employees fully utilize the platform's features and derive maximum value from their investments. Finally, the constantly evolving technological landscape demands continuous updates and upgrades to the collaboration platforms, requiring ongoing investment in maintenance and support.

Key Region or Country & Segment to Dominate the Market

The Software segment is poised to dominate the enterprise collaboration service market throughout the forecast period (2025-2033). This segment is expected to account for a significant portion of the overall market revenue, surpassing both hardware and services segments. The prevalence of cloud-based software solutions, offering superior scalability, flexibility, and cost-effectiveness, is a key factor driving this segment's growth.

- Software's dominance is fueled by:

- The increasing adoption of SaaS models for collaboration tools.

- The ease of deployment and management of software-based solutions.

- The continuous innovation and feature enhancements in software platforms.

- The lower upfront investment costs compared to hardware solutions.

Geographically, North America and Western Europe are projected to be the leading regions in terms of market revenue and adoption rates. These regions have a well-established IT infrastructure, high digital literacy rates, and a strong presence of key players in the enterprise collaboration service market.

North America's dominance is attributed to:

- High technology adoption rates among enterprises.

- The presence of major tech companies and innovation hubs.

- A large number of early adopters of collaboration technologies.

- Well-developed IT infrastructure and support systems.

Western Europe's significant market share is due to:

- High concentration of multinational corporations.

- Increasing focus on improving employee productivity and collaboration.

- Government initiatives promoting digital transformation.

- High levels of investment in technology and infrastructure.

The Banking, Financial Services, and Insurance (BFSI) sector is a key application segment demonstrating significant growth potential. The BFSI sector requires secure and reliable communication and collaboration platforms for handling sensitive financial data and ensuring compliance with regulatory standards. The demand for secure communication and robust collaboration tools is driving strong adoption within this segment.

- BFSI sector growth is driven by:

- Stringent regulatory requirements for secure communication and data handling.

- The need to improve operational efficiency and customer service.

- The increasing adoption of cloud-based solutions for enhanced security and scalability.

- The growing importance of real-time collaboration among geographically dispersed teams.

The Information Technology sector is another important segment displaying strong growth. The sector's reliance on efficient collaboration among developers, engineers, and IT support teams fuels significant adoption.

- Information Technology sector's high growth is driven by:

- The high demand for real-time collaboration tools for software development and IT support.

- The increasing importance of remote team collaboration in software development projects.

- The need for seamless integration of collaboration platforms with existing IT infrastructure.

Other regions, including Asia-Pacific and Latin America, are expected to witness significant growth in the coming years, driven by increasing digitalization, rising internet penetration, and growing adoption of cloud-based solutions. However, these regions are expected to lag behind North America and Western Europe in terms of market size due to factors like lower technology adoption rates, limited IT infrastructure, and regulatory complexities.

Growth Catalysts in Enterprise Collaboration Service Industry

The continued growth of the enterprise collaboration service industry is fueled by several key catalysts: the persistent demand for hybrid work solutions, advancements in artificial intelligence (AI) and machine learning (ML) leading to more intelligent and intuitive platforms, increasing cloud adoption for enhanced scalability and cost-effectiveness, and a heightened focus on data security and compliance driving the demand for secure and reliable collaboration solutions.

Leading Players in the Enterprise Collaboration Service

- Cisco

- IBM

- Microsoft

- Nokia Networks

- Unify

- HP

- Mitel

- Polycom

- Fuze

- 8x8

- ShoreTel

- Cafex

- Tropo

- Vonage

- Atlassian

- GENBAND

Significant Developments in Enterprise Collaboration Service Sector

- 2020: Widespread adoption of cloud-based collaboration tools accelerates due to the COVID-19 pandemic.

- 2021: Increased focus on AI-powered features within collaboration platforms.

- 2022: Significant mergers and acquisitions among major vendors.

- 2023: Growing emphasis on data security and compliance in collaboration solutions.

- 2024: Introduction of innovative collaboration features like immersive virtual meeting experiences.

Comprehensive Coverage Enterprise Collaboration Service Report

This report provides a comprehensive overview of the enterprise collaboration service market, covering key trends, drivers, challenges, and opportunities. It offers detailed analysis of various segments, regions, and leading players, along with market forecasts for the period 2025-2033. The insights provided in this report are invaluable for businesses seeking to navigate the evolving landscape of enterprise collaboration and make informed strategic decisions.

Enterprise Collaboration Service Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services (Consulting, Integration, and Maintenance)

-

2. Application

- 2.1. Banking

- 2.2. Financial Services and Insurance

- 2.3. Retail

- 2.4. Healthcare

- 2.5. Government

- 2.6. Information Technology

- 2.7. Media and Entertainment

- 2.8. Education

- 2.9. Transportation and Manufacturing

- 2.10. Others

Enterprise Collaboration Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Enterprise Collaboration Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.0% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enterprise Collaboration Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services (Consulting, Integration, and Maintenance)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Banking

- 5.2.2. Financial Services and Insurance

- 5.2.3. Retail

- 5.2.4. Healthcare

- 5.2.5. Government

- 5.2.6. Information Technology

- 5.2.7. Media and Entertainment

- 5.2.8. Education

- 5.2.9. Transportation and Manufacturing

- 5.2.10. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Enterprise Collaboration Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services (Consulting, Integration, and Maintenance)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Banking

- 6.2.2. Financial Services and Insurance

- 6.2.3. Retail

- 6.2.4. Healthcare

- 6.2.5. Government

- 6.2.6. Information Technology

- 6.2.7. Media and Entertainment

- 6.2.8. Education

- 6.2.9. Transportation and Manufacturing

- 6.2.10. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Enterprise Collaboration Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services (Consulting, Integration, and Maintenance)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Banking

- 7.2.2. Financial Services and Insurance

- 7.2.3. Retail

- 7.2.4. Healthcare

- 7.2.5. Government

- 7.2.6. Information Technology

- 7.2.7. Media and Entertainment

- 7.2.8. Education

- 7.2.9. Transportation and Manufacturing

- 7.2.10. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Enterprise Collaboration Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services (Consulting, Integration, and Maintenance)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Banking

- 8.2.2. Financial Services and Insurance

- 8.2.3. Retail

- 8.2.4. Healthcare

- 8.2.5. Government

- 8.2.6. Information Technology

- 8.2.7. Media and Entertainment

- 8.2.8. Education

- 8.2.9. Transportation and Manufacturing

- 8.2.10. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Enterprise Collaboration Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services (Consulting, Integration, and Maintenance)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Banking

- 9.2.2. Financial Services and Insurance

- 9.2.3. Retail

- 9.2.4. Healthcare

- 9.2.5. Government

- 9.2.6. Information Technology

- 9.2.7. Media and Entertainment

- 9.2.8. Education

- 9.2.9. Transportation and Manufacturing

- 9.2.10. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Enterprise Collaboration Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services (Consulting, Integration, and Maintenance)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Banking

- 10.2.2. Financial Services and Insurance

- 10.2.3. Retail

- 10.2.4. Healthcare

- 10.2.5. Government

- 10.2.6. Information Technology

- 10.2.7. Media and Entertainment

- 10.2.8. Education

- 10.2.9. Transportation and Manufacturing

- 10.2.10. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cisco

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Microsoft

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nokia Networks

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unify

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Polycom

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fuze

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 8x8

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ShoreTel

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cafex

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Tropo

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Vonage

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Atlassian

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 GENBAND

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Cisco

- Figure 1: Global Enterprise Collaboration Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Enterprise Collaboration Service Revenue (million), by Type 2024 & 2032

- Figure 3: North America Enterprise Collaboration Service Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Enterprise Collaboration Service Revenue (million), by Application 2024 & 2032

- Figure 5: North America Enterprise Collaboration Service Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Enterprise Collaboration Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Enterprise Collaboration Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Enterprise Collaboration Service Revenue (million), by Type 2024 & 2032

- Figure 9: South America Enterprise Collaboration Service Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Enterprise Collaboration Service Revenue (million), by Application 2024 & 2032

- Figure 11: South America Enterprise Collaboration Service Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Enterprise Collaboration Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Enterprise Collaboration Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Enterprise Collaboration Service Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Enterprise Collaboration Service Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Enterprise Collaboration Service Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Enterprise Collaboration Service Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Enterprise Collaboration Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Enterprise Collaboration Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Enterprise Collaboration Service Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Enterprise Collaboration Service Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Enterprise Collaboration Service Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Enterprise Collaboration Service Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Enterprise Collaboration Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Enterprise Collaboration Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Enterprise Collaboration Service Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Enterprise Collaboration Service Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Enterprise Collaboration Service Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Enterprise Collaboration Service Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Enterprise Collaboration Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Enterprise Collaboration Service Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Enterprise Collaboration Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Enterprise Collaboration Service Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Enterprise Collaboration Service Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Enterprise Collaboration Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Enterprise Collaboration Service Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Enterprise Collaboration Service Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Enterprise Collaboration Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Enterprise Collaboration Service Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Enterprise Collaboration Service Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Enterprise Collaboration Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Enterprise Collaboration Service Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Enterprise Collaboration Service Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Enterprise Collaboration Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Enterprise Collaboration Service Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Enterprise Collaboration Service Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Enterprise Collaboration Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Enterprise Collaboration Service Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Enterprise Collaboration Service Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Enterprise Collaboration Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Enterprise Collaboration Service Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.