Film & Video Equipment Rental

Film & Video Equipment RentalFilm & Video Equipment Rental Strategic Roadmap: Analysis and Forecasts 2025-2033

Film & Video Equipment Rental by Type (Cameras, Lighting Equipment, Recording Equipment, Others), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global Film & Video Equipment Rental Market is projected to grow at a CAGR of XX% during the forecast period of 2025-2033, reaching a value of million US Dollars by 2033. The market size stood at million US Dollars in 2025. The market is driven by the increasing demand for high-quality video content and the proliferation of video streaming services. Additionally, the growing popularity of virtual reality (VR) and augmented reality (AR) is expected to fuel the demand for film and video equipment rentals. However, the market is restrained by the high cost of equipment and the need for skilled professionals to operate it.

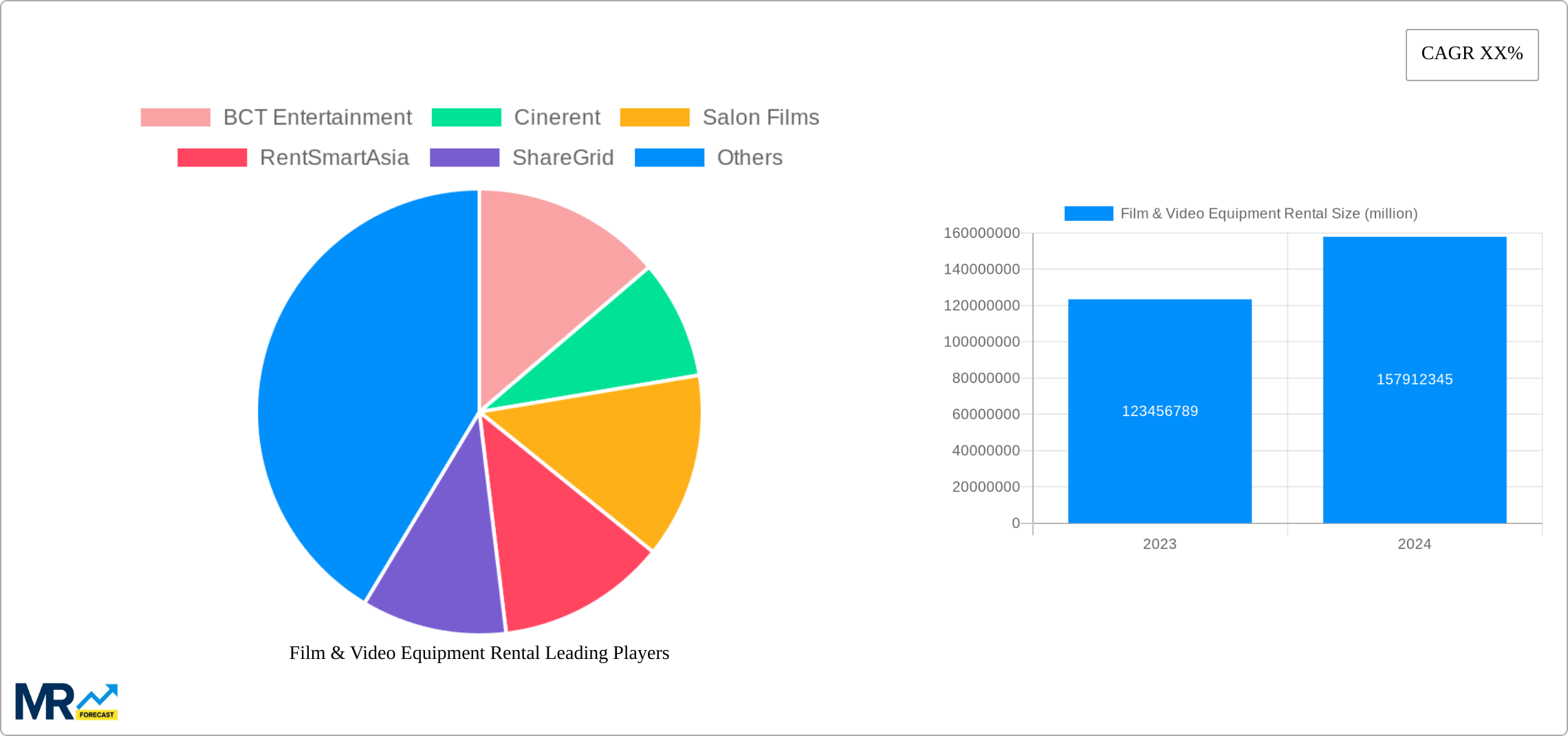

Key market trends include the increasing adoption of cloud-based platforms for equipment management, the growing popularity of subscription-based rental models, and the emergence of new technologies such as AI and machine learning for automating rental processes. Major players in the market include BCT Entertainment, Cinerent, Salon Films, RentSmartAsia, ShareGrid, Line 204, Quixote Studios, Wooden Nickel Lighting, The Camera Division, KitSplit, FatLlama, Parachut, LensRentals, BorrowLenses, Film Equipment Hire, Starling Productions, PATRIOT Rental, Canon, Shoot In China, True Colour Media, and Visual Impact Rentals.

Film & Video Equipment Rental Trends

The film and video equipment rental market is experiencing a surge in demand, driven by the rise of digital broadcasting, streaming services, and social media. The growing popularity of online video platforms such as YouTube, TikTok, and Instagram has fueled the need for professional-grade equipment to produce high-quality content. Moreover, the expansion of e-commerce and the increasing adoption of visual marketing strategies have further contributed to the market's growth.

Key market insights include:

- Growing demand for cameras, lighting equipment, and recording equipment

- Increasing adoption of virtual and augmented reality (VR/AR) technology

- Shift towards cloud-based rental services

- Growing importance of sustainability and environmental consciousness

Driving Forces: What's Propelling the Film & Video Equipment Rental

Several factors are propelling the film and video equipment rental market growth:

- Advanced technology and innovation: Constant advancements in camera technology, such as high dynamic range (HDR) and 8K resolution, are driving demand for upgraded equipment.

- Expanding video content production: The proliferation of content platforms has led to a substantial increase in the production of video content, fueling the need for equipment rentals.

- Flexible and cost-effective solution: Rental services provide flexibility and cost savings compared to purchasing equipment outright, making them attractive to small and medium-sized businesses.

- Cross-industry collaborations: Partnerships between equipment rental companies and production studios, broadcasters, and entertainment organizations are creating new opportunities for market growth.

Challenges and Restraints in Film & Video Equipment Rental

Despite the strong growth outlook, the film and video equipment rental market faces certain challenges:

- Competition and market saturation: A large number of rental companies compete for market share, leading to intense competition and pricing pressures.

- Economic downturns: Economic recessions can impact the production of film and video content, leading to a decline in equipment rental demand.

- Technological advancements: Rapid technological advancements can make equipment obsolete quickly, requiring rental companies to invest in the latest technologies to remain competitive.

- Environmental concerns: The environmental impact of equipment manufacturing and transportation has led to increasing pressure for sustainable rental practices.

Key Region or Country & Segment to Dominate the Market

Region/Country:

- North America is expected to dominate the global film and video equipment rental market, driven by the presence of major production hubs in the United States and Canada.

Segment:

- Type: Cameras are projected to account for the largest share of the market due to the increasing demand for high-quality image capture.

- Application: Large enterprises are anticipated to be the dominant segment, driven by the production of high-budget films and television shows.

Growth Catalysts in Film & Video Equipment Rental Industry

- Technological advancements: The development of new technologies, such as mirrorless cameras, drones, and VR/AR equipment, is expected to drive market growth.

- Sustainability initiatives: Sustainable practices, including the use of eco-friendly equipment and reduction of carbon footprint, are gaining traction and becoming essential for competitive advantage.

- Increased investment: Increase in investment in equipment rentals, by both rental companies and production houses, is fostering the market's growth.

Leading Players in the Film & Video Equipment Rental

Significant Developments in Film & Video Equipment Rental Sector

- Increased adoption of cloud-based rental platforms for convenient and efficient equipment booking.

- Emergence of specialized rental services for specific equipment, such as drones and VR/AR gear.

- Growing popularity of subscription-based rental models, offering flexible and cost-effective access to equipment.

Comprehensive Coverage Film & Video Equipment Rental Report

This report provides a comprehensive analysis of the film and video equipment rental market, including key market trends, driving forces, challenges, regional analysis, growth catalysts, leading players, and significant developments. It offers valuable insights for manufacturers, rental companies, production studios, and investors seeking to understand the market landscape and make informed decisions.

Film & Video Equipment Rental Segmentation

-

1. Type

- 1.1. Cameras

- 1.2. Lighting Equipment

- 1.3. Recording Equipment

- 1.4. Others

-

2. Application

- 2.1. Large Enterprises

- 2.2. SMEs

Film & Video Equipment Rental Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Film & Video Equipment Rental REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

How can I stay updated on further developments or reports in the Film & Video Equipment Rental?

To stay informed about further developments, trends, and reports in the Film & Video Equipment Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

What are some drivers contributing to market growth?

.

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

What are the main segments of the Film & Video Equipment Rental?

The market segments include

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million .

Are there any restraints impacting market growth?

.

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Film & Video Equipment Rental," which aids in identifying and referencing the specific market segment covered.

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Film & Video Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cameras

- 5.1.2. Lighting Equipment

- 5.1.3. Recording Equipment

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Large Enterprises

- 5.2.2. SMEs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Film & Video Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cameras

- 6.1.2. Lighting Equipment

- 6.1.3. Recording Equipment

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Large Enterprises

- 6.2.2. SMEs

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Film & Video Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cameras

- 7.1.2. Lighting Equipment

- 7.1.3. Recording Equipment

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Large Enterprises

- 7.2.2. SMEs

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Film & Video Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cameras

- 8.1.2. Lighting Equipment

- 8.1.3. Recording Equipment

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Large Enterprises

- 8.2.2. SMEs

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Film & Video Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cameras

- 9.1.2. Lighting Equipment

- 9.1.3. Recording Equipment

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Large Enterprises

- 9.2.2. SMEs

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Film & Video Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cameras

- 10.1.2. Lighting Equipment

- 10.1.3. Recording Equipment

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Large Enterprises

- 10.2.2. SMEs

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BCT Entertainment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cinerent

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Salon Films

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 RentSmartAsia

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ShareGrid

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Line 204

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Quixote Studios

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wooden Nickel Lighting

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Camera Division

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KitSplit

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FatLlama

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Parachut

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LensRentals

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BorrowLenses

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Film Equipment Hire

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Starling Productions

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 PATRIOT Rental

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Canon

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Shoot In China

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 True Colour Media

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Visual Impact Rentals

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 BCT Entertainment

- Figure 1: Global Film & Video Equipment Rental Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Film & Video Equipment Rental Revenue (million), by Type 2024 & 2032

- Figure 3: North America Film & Video Equipment Rental Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Film & Video Equipment Rental Revenue (million), by Application 2024 & 2032

- Figure 5: North America Film & Video Equipment Rental Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Film & Video Equipment Rental Revenue (million), by Country 2024 & 2032

- Figure 7: North America Film & Video Equipment Rental Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Film & Video Equipment Rental Revenue (million), by Type 2024 & 2032

- Figure 9: South America Film & Video Equipment Rental Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Film & Video Equipment Rental Revenue (million), by Application 2024 & 2032

- Figure 11: South America Film & Video Equipment Rental Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Film & Video Equipment Rental Revenue (million), by Country 2024 & 2032

- Figure 13: South America Film & Video Equipment Rental Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Film & Video Equipment Rental Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Film & Video Equipment Rental Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Film & Video Equipment Rental Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Film & Video Equipment Rental Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Film & Video Equipment Rental Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Film & Video Equipment Rental Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Film & Video Equipment Rental Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Film & Video Equipment Rental Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Film & Video Equipment Rental Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Film & Video Equipment Rental Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Film & Video Equipment Rental Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Film & Video Equipment Rental Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Film & Video Equipment Rental Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Film & Video Equipment Rental Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Film & Video Equipment Rental Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Film & Video Equipment Rental Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Film & Video Equipment Rental Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Film & Video Equipment Rental Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Film & Video Equipment Rental Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Film & Video Equipment Rental Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Film & Video Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Film & Video Equipment Rental Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Film & Video Equipment Rental Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Film & Video Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Film & Video Equipment Rental Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Film & Video Equipment Rental Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Film & Video Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Film & Video Equipment Rental Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Film & Video Equipment Rental Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Film & Video Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Film & Video Equipment Rental Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Film & Video Equipment Rental Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Film & Video Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Film & Video Equipment Rental Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Film & Video Equipment Rental Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Film & Video Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Film & Video Equipment Rental Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Film & Video Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.