1. What is the projected Compound Annual Growth Rate (CAGR) of the Financial-grade DistributedDatabase?

The projected CAGR is approximately XX%.

Financial-grade DistributedDatabase

Financial-grade DistributedDatabaseFinancial-grade DistributedDatabase by Application (Bank, Securities, Insurance, Government Affairs, Others), by Type (Sub-database and Sub-table Middleware, Native Distributed, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

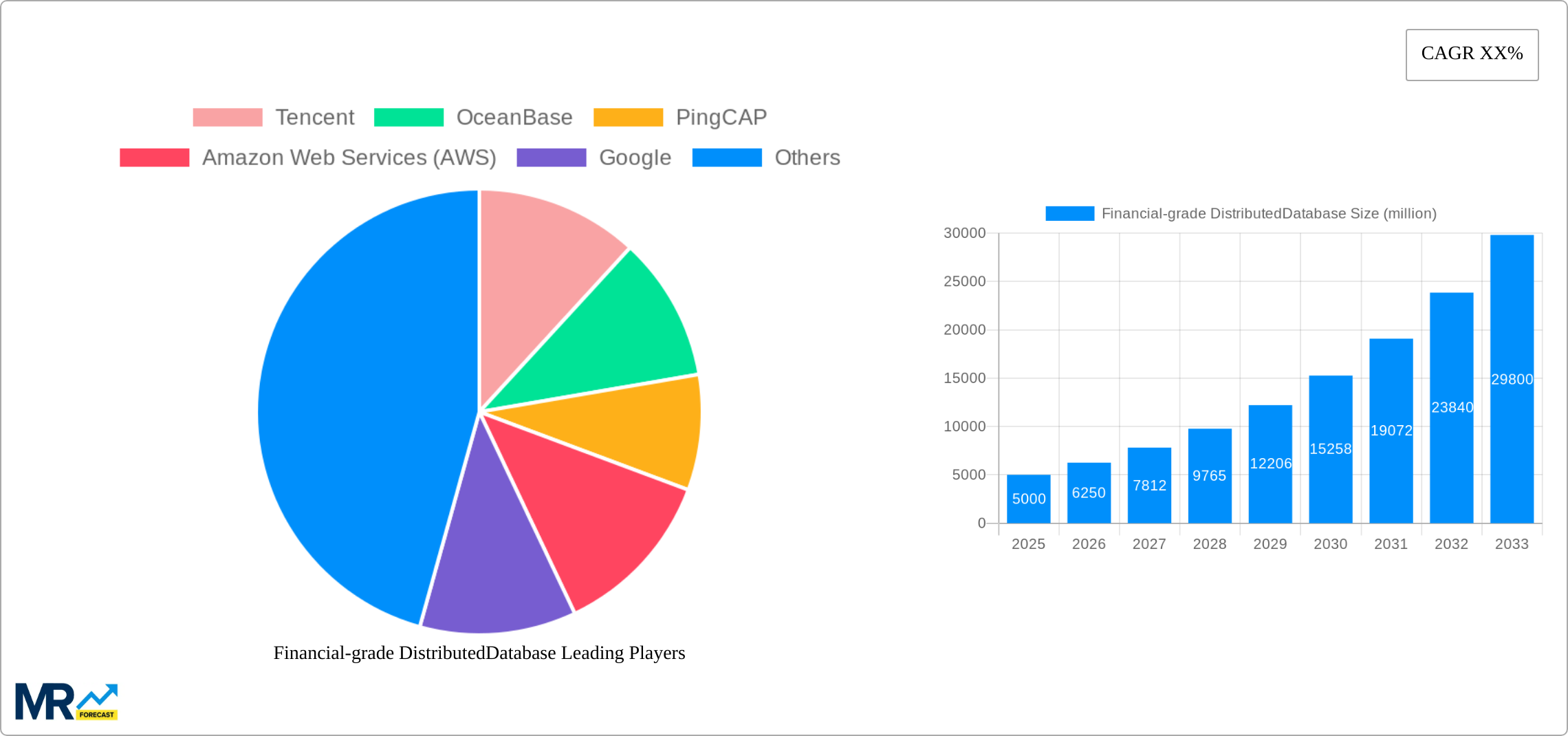

The global financial-grade distributed database market is experiencing robust growth, driven by the increasing demand for high-availability, scalability, and performance in financial applications. The market's expansion is fueled by the digital transformation within the banking, securities, and insurance sectors, necessitating robust and resilient database solutions capable of handling massive transaction volumes and complex data analytics. Key trends include the rising adoption of cloud-native architectures, the increasing preference for open-source solutions offering greater flexibility and cost-effectiveness, and the growing need for enhanced security and compliance features to meet stringent regulatory requirements. Leading players like Tencent, PingCAP, and AWS are actively innovating and expanding their offerings to cater to this burgeoning market, fostering competition and driving further advancements in technology. We estimate the market size in 2025 to be approximately $5 billion, with a projected Compound Annual Growth Rate (CAGR) of 25% from 2025 to 2033, leading to a market size exceeding $20 billion by 2033. This growth is primarily driven by increasing adoption across diverse applications within the financial sector. Segment-wise, sub-database and sub-table middleware solutions are currently leading, but native distributed databases are projected to witness significant growth owing to their inherent scalability and performance advantages. Geographic growth is expected to be strong across all regions, with North America and Asia Pacific leading in market share, though developing economies will present significant future opportunities.

While the market presents significant opportunities, challenges remain. These include the complexity of implementation and management of distributed databases, the need for skilled professionals to operate and maintain these systems, and the potential security risks associated with managing large and distributed datasets. Furthermore, the high initial investment costs associated with implementing these solutions can act as a barrier for smaller financial institutions. However, the long-term cost savings achieved through improved efficiency, scalability, and reduced downtime are anticipated to outweigh these initial costs, driving wider adoption. The continuous advancements in technology and the emergence of new players are shaping a dynamic and competitive market landscape.

The global financial-grade distributed database market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Driven by the increasing demand for high-availability, scalability, and performance in financial applications, this market segment is witnessing a rapid shift from traditional centralized database systems. The historical period (2019-2024) saw significant adoption, particularly within the banking and financial technology sectors, as institutions sought solutions to manage ever-increasing data volumes and complex transactions. The estimated market value in 2025 is projected to be in the hundreds of millions of dollars, with a substantial increase expected during the forecast period (2025-2033). Key market insights reveal a strong preference for native distributed databases due to their inherent scalability and fault tolerance, surpassing the limitations of sub-database and sub-table middleware solutions. This trend is further fueled by the rising adoption of cloud-based infrastructure and the increasing prevalence of microservices architectures. The competitive landscape is intensely dynamic, with both established tech giants like AWS and Google and innovative startups aggressively vying for market share. The market's maturation is evident in the growing sophistication of solutions, incorporating features like advanced data encryption, compliance with stringent financial regulations, and robust disaster recovery mechanisms. This ongoing evolution is driven by the ever-present need for enhanced security, regulatory compliance, and operational efficiency within the financial industry. Furthermore, the increasing complexity of financial applications, coupled with the demand for real-time analytics and decision-making, presents a compelling growth opportunity for providers of robust and reliable financial-grade distributed database solutions. The market’s growth is also influenced by the continuous development of new technologies like serverless computing and edge computing, both of which present opportunities for optimization and enhanced performance within the context of distributed database systems.

Several factors are propelling the growth of the financial-grade distributed database market. The explosive growth of data volume in the financial sector, driven by increasing transaction frequency, regulatory reporting requirements, and advanced analytics initiatives, necessitates solutions that can handle massive datasets with minimal latency. Traditional centralized databases struggle to meet these demands, leading to the adoption of distributed architectures offering superior scalability and fault tolerance. Cloud adoption is another significant driver, as financial institutions increasingly migrate their infrastructure to cloud platforms for cost optimization, enhanced agility, and improved scalability. Cloud-native distributed databases seamlessly integrate with cloud environments, offering a streamlined and efficient solution. The growing adoption of microservices architecture in financial applications also contributes to the market's growth. Microservices require a database solution capable of handling multiple independent services, and distributed databases perfectly align with this architectural style, facilitating independent scaling and fault isolation. Furthermore, the stringent regulatory requirements within the financial industry necessitate robust security and compliance features in database solutions. Financial-grade distributed databases are increasingly designed to meet these stringent requirements, providing features such as data encryption, access control, and audit trails. Finally, the rising demand for real-time analytics and decision-making capabilities in the financial sector further fuels the adoption of high-performance distributed databases, enabling rapid processing of vast amounts of data for insights that inform crucial business strategies.

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of financial-grade distributed databases. The complexity of implementing and managing distributed database systems is a major hurdle, requiring specialized expertise and substantial operational overhead. Ensuring data consistency and integrity across multiple nodes poses a significant challenge, requiring sophisticated mechanisms for data replication and conflict resolution. The cost of deploying and maintaining a distributed database infrastructure, including hardware, software, and skilled personnel, can be significant, particularly for smaller financial institutions. Security concerns are paramount in the financial sector, and ensuring the security of data spread across multiple nodes requires robust security measures and continuous vigilance. Integration with existing legacy systems can be challenging, requiring significant effort and potentially disrupting ongoing operations. Furthermore, ensuring compliance with stringent financial regulations, such as GDPR and CCPA, adds another layer of complexity to the implementation and operation of financial-grade distributed databases. Finally, the lack of standardized tools and methodologies for managing and monitoring distributed database systems can make operations more challenging, potentially leading to increased downtime and reduced efficiency.

The Banking segment within the North American and Asia-Pacific regions is poised to dominate the financial-grade distributed database market.

North America (US & Canada): The established financial sector in the US and Canada, coupled with significant investments in digital transformation and cloud adoption, fuels high demand for robust and scalable database solutions. Large financial institutions in these regions are early adopters of new technologies and are actively seeking solutions to improve efficiency and enhance their competitive edge. Stringent regulatory compliance requirements also necessitate the use of secure and reliable database systems.

Asia-Pacific (China, Japan, India): The rapid growth of the financial technology (FinTech) sector in the Asia-Pacific region is driving substantial demand for advanced database technologies. Countries like China, India, and Japan are experiencing significant digitalization efforts, leading to a surge in demand for scalable and high-performance database solutions to handle the escalating data volumes and transaction rates. The region's large population and increasing digital financial inclusion further enhance market growth.

Banking Segment Dominance: The banking sector's reliance on high-availability, transaction processing systems, and the need to handle vast amounts of customer data makes it the primary driver of growth within the financial-grade distributed database market. Banks are actively investing in upgrading their infrastructure to improve efficiency, enhance security, and meet regulatory requirements.

The Native Distributed type of database is also expected to lead the market. Its inherent scalability and fault tolerance make it the preferred choice over sub-database and sub-table middleware solutions, which are often limited in their ability to handle the extreme scale and performance requirements of modern financial applications.

The increasing adoption of cloud computing, the growing need for real-time analytics, and the rising demand for improved security and regulatory compliance are key growth catalysts within the financial-grade distributed database industry. These factors are driving the need for more scalable, resilient, and secure database solutions, creating a significant growth opportunity for providers of these technologies.

This report provides a comprehensive overview of the financial-grade distributed database market, including detailed analysis of market trends, growth drivers, challenges, and key players. It offers valuable insights into the competitive landscape, helping businesses to understand opportunities and potential risks in this rapidly evolving sector. The detailed segmentation analysis, regional breakdown, and forecast data provide a complete view of the market’s trajectory, enabling informed decision-making for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Tencent, OceanBase, PingCAP, Amazon Web Services (AWS), Google, Huawei, Zhongxing Telecommunication Equipment (ZTE), Transwarp Technology, SequoiaDB, Tianyun Rongchuang Data Technology(Beijing), Cockroach Labs, GBASE, Esgyn, GreatDB, Baidu, Alibaba Cloud, Wuhan Dameng Database, Kingbase, Shanghai Thermal Network Technology, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Financial-grade DistributedDatabase," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Financial-grade DistributedDatabase, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.