Flame Retardants for Battery Electrolytes

Flame Retardants for Battery ElectrolytesFlame Retardants for Battery Electrolytes 2025-2033 Overview: Trends, Competitor Dynamics, and Opportunities

Flame Retardants for Battery Electrolytes by Application (Power Battery, Consumer Battery, Energy Storage Battery, World Flame Retardants for Battery Electrolytes Production ), by Type (Chloroethylene Carbonate (CEC), Fluoroethylene carbonate (FEC), Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global market for flame retardants in battery electrolytes is experiencing robust growth, driven by the burgeoning demand for electric vehicles (EVs) and energy storage systems (ESS). The increasing adoption of lithium-ion batteries across various applications, including power batteries for EVs, consumer electronics, and grid-scale energy storage, necessitates the use of flame retardants to enhance battery safety and prevent thermal runaway incidents. This market is segmented by application (power batteries, consumer batteries, energy storage batteries) and type (chloroethylene carbonate (CEC), fluoroethylene carbonate (FEC), and others). The high CAGR suggests a rapidly expanding market, fueled by continuous technological advancements in battery chemistry and stricter safety regulations globally. While the precise market size for 2025 is unavailable, estimations based on industry reports and growth trends suggest a figure in the range of $2-3 billion. This range accounts for variations in reporting methodologies and differing interpretations of market segmentation. The leading players in this market are actively investing in R&D to develop more effective and environmentally friendly flame retardants, further contributing to market expansion. However, challenges remain, including concerns about the environmental impact of certain flame retardants and the need for cost-effective solutions to ensure broader adoption.

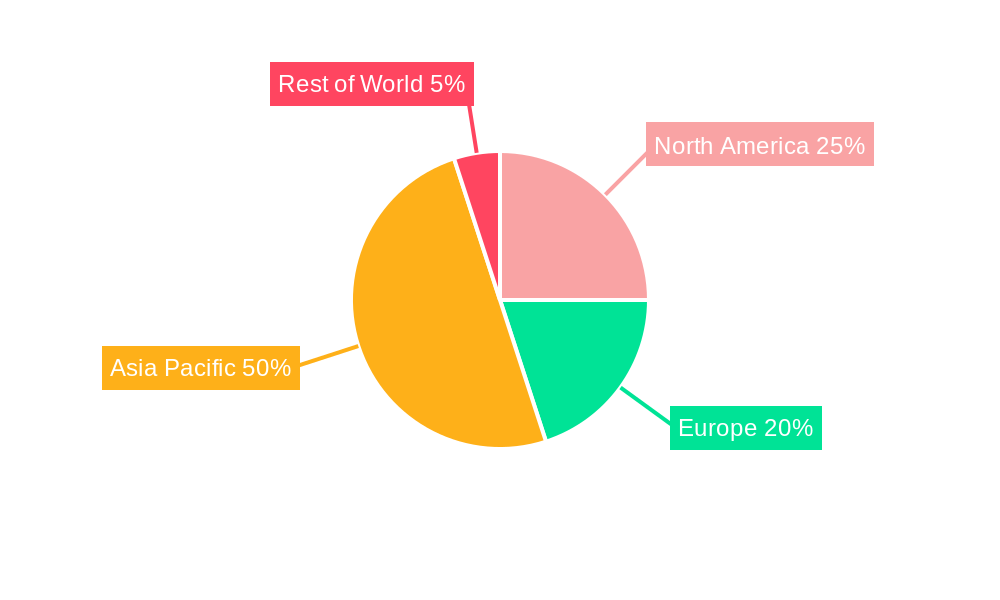

The geographic distribution of this market reveals a strong presence in Asia-Pacific, particularly China, driven by the region's dominance in battery manufacturing and the rapidly expanding EV market. North America and Europe also contribute significantly due to high demand for EVs and ESS in these regions. However, the growth potential in emerging economies, such as India and South-East Asia, is expected to be substantial, as these regions witness increased electrification and infrastructure development. Competition among key manufacturers, such as Shandong Genyuan New Materials, HSC Corporation, and Zhejiang Yongtai Technology, is intense, fostering innovation and driving down prices, which could influence market access and affordability. Future growth will depend on the successful development and adoption of next-generation battery technologies, as well as the continuous evolution of safer and more sustainable flame retardant solutions.

Flame Retardants for Battery Electrolytes Trends

The global market for flame retardants used in battery electrolytes is experiencing robust growth, projected to reach several billion units by 2033. Driven by the escalating demand for electric vehicles (EVs) and energy storage systems (ESS), the market exhibits a compound annual growth rate (CAGR) exceeding 15% during the forecast period (2025-2033). This surge is primarily attributed to the increasing awareness of safety concerns associated with lithium-ion batteries, particularly their vulnerability to thermal runaway and subsequent fires. Governments worldwide are implementing stricter safety regulations, pushing manufacturers to incorporate effective flame retardants into battery designs. The market is characterized by a diverse range of flame retardants, with chloroethylene carbonate (CEC) and fluoroethylene carbonate (FEC) emerging as leading contenders due to their high efficacy and compatibility with various battery chemistries. However, the market also faces challenges, including the high cost of some advanced flame retardants and ongoing research to find environmentally benign alternatives. The shift towards high-energy-density batteries for extended driving ranges in EVs is further stimulating demand for innovative flame retardants that can enhance safety without compromising battery performance. Competition among manufacturers is intense, with both established chemical companies and new entrants vying for market share through product innovation and strategic partnerships. The historical period (2019-2024) witnessed significant growth, setting the stage for the substantial expansion anticipated in the forecast period. The estimated market value for 2025 signifies a pivotal point in this trajectory, reflecting the accelerating adoption of flame retardants across various battery applications. Specific market segments like power batteries for EVs and large-scale energy storage solutions are expected to contribute significantly to overall market growth, exceeding hundreds of millions of units by the end of the forecast period. This expansive growth reflects not only the technological advancements in battery technology but also the increasing global shift towards sustainable energy solutions.

Driving Forces: What's Propelling the Flame Retardants for Battery Electrolytes Market?

Several key factors are driving the phenomenal growth of the flame retardants for battery electrolytes market. Firstly, the burgeoning electric vehicle (EV) industry is a major catalyst. As EV adoption accelerates globally to combat climate change and improve air quality, the demand for safe and reliable lithium-ion batteries increases exponentially. These batteries, while efficient, pose a significant fire risk if not properly protected. Flame retardants are thus crucial for mitigating this risk and ensuring consumer confidence in EV technology. Secondly, the expansion of the energy storage systems (ESS) market for grid stabilization and renewable energy integration fuels demand. Large-scale ESS deployments require a considerable number of batteries, necessitating the use of flame retardants to prevent widespread damage and potential hazards. Thirdly, stringent government regulations and safety standards are compelling battery manufacturers to prioritize safety features, including the incorporation of effective flame retardants. This regulatory push creates a significant market opportunity for manufacturers of these crucial additives. Finally, ongoing research and development efforts are leading to the creation of more efficient and environmentally friendly flame retardants, further boosting market growth. The development of innovative solutions addresses concerns surrounding the potential environmental impact of certain flame retardants and drives adoption by environmentally conscious manufacturers.

Challenges and Restraints in Flame Retardants for Battery Electrolytes

Despite the significant growth potential, several challenges and restraints hinder the expansion of the flame retardants for battery electrolytes market. One primary concern is the high cost associated with some advanced flame retardants, especially those offering superior performance and safety features. This cost can negatively impact the overall battery production cost and potentially limit wider adoption, especially in cost-sensitive applications. Furthermore, the environmental impact of certain flame retardants remains a significant concern. Some traditional flame retardants have been linked to potential environmental and health hazards, leading to increasing pressure for the development and adoption of more eco-friendly alternatives. This necessitates substantial research and development investment, potentially slowing down market penetration for greener options. Another challenge is the need to balance flame retardant efficacy with battery performance. The addition of flame retardants can sometimes negatively impact battery energy density, lifespan, and overall performance. Therefore, finding the optimal balance between safety and performance remains a key challenge for manufacturers. Finally, the evolving nature of battery technologies and chemistries requires continuous adaptation and innovation in flame retardant formulations to maintain compatibility and effectiveness. This ongoing need for product development represents both an opportunity and a challenge for players in the market.

Key Region or Country & Segment to Dominate the Market

The Asia-Pacific region is expected to dominate the flame retardants for battery electrolytes market due to the region's robust growth in the electric vehicle and energy storage sectors. China, in particular, is a major manufacturing hub for batteries and EVs, driving substantial demand for flame retardants. Within the market segmentation, the power battery segment is poised for the most significant growth. The proliferation of electric vehicles and the increasing demand for high-energy-density batteries for extended driving ranges are the primary drivers of this segment's expansion. This is further reinforced by the escalating adoption of large-scale energy storage systems for grid stabilization and renewable energy integration, also heavily reliant on power batteries.

Asia-Pacific (Dominant Region): This region's concentrated manufacturing base and rapid growth in EV and energy storage industries provide a huge market for flame retardants. China's significant role is undeniable.

Power Battery Segment (Dominant Segment): The massive growth in the EV and large-scale energy storage sectors is fueling significant demand for flame retardants specifically designed for power batteries.

Europe: While not as large in terms of production as Asia-Pacific, Europe is experiencing significant growth driven by stringent environmental regulations and a commitment to renewable energy.

North America: This region presents a significant market, mainly fueled by the expanding EV market and government incentives promoting electric vehicle adoption.

Chloroethylene Carbonate (CEC) and Fluoroethylene Carbonate (FEC): These types are preferred due to their high effectiveness and compatibility with various battery chemistries.

The dominance of these regions and segments reflects the global trends towards electrification and the increasing prioritization of battery safety. The substantial investment in battery manufacturing facilities and the rapid advancement of battery technologies further contribute to the growth and dominance of the Asian markets, particularly China, and solidify the importance of the power battery segment within the overall market.

Growth Catalysts in Flame Retardants for Battery Electrolytes Industry

The flame retardants for battery electrolytes industry is experiencing rapid growth, propelled by several key factors. The increasing demand for electric vehicles and energy storage systems is a primary driver, alongside stricter safety regulations and government initiatives promoting the adoption of sustainable energy solutions. Advancements in battery technology, particularly the development of high-energy-density batteries, necessitate the use of sophisticated flame retardants capable of maintaining safety without compromising performance. The ongoing research and development efforts in the field are also creating new opportunities, particularly in the area of eco-friendly flame retardants, responding to growing environmental concerns. These factors collectively contribute to a positive growth outlook for the industry.

Leading Players in the Flame Retardants for Battery Electrolytes Market

- Shandong Genyuan New Materials

- HSC Corporation

- Zhejiang Yongtai Technology

- Tinci Materials

- Suzhou Cheerchem Advanced Material

- Shenzhen Capchem

- Chunbo Fine Chem

Significant Developments in Flame Retardants for Battery Electrolytes Sector

- 2021: Several companies announced the launch of new, high-performance flame retardants tailored to the needs of advanced battery chemistries.

- 2022: Increased investment in research and development targeting eco-friendly and high-performance flame retardants.

- 2023: Several strategic partnerships formed between flame retardant manufacturers and battery producers to ensure optimal product integration and performance.

Comprehensive Coverage Flame Retardants for Battery Electrolytes Report

This report provides a comprehensive overview of the flame retardants for battery electrolytes market, covering key trends, growth drivers, challenges, and prominent players. It offers detailed analysis of market segmentation, regional dynamics, and future outlook, providing valuable insights for industry stakeholders. The study period (2019-2033), with a base year of 2025, offers a historical perspective and a clear vision of the future, supported by market estimations and forecasts. The report's findings are crucial for businesses making strategic decisions within the rapidly evolving battery industry.

Flame Retardants for Battery Electrolytes Segmentation

-

1. Application

- 1.1. Power Battery

- 1.2. Consumer Battery

- 1.3. Energy Storage Battery

- 1.4. World Flame Retardants for Battery Electrolytes Production

-

2. Type

- 2.1. Chloroethylene Carbonate (CEC)

- 2.2. Fluoroethylene carbonate (FEC)

- 2.3. Other

Flame Retardants for Battery Electrolytes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Flame Retardants for Battery Electrolytes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Are there any restraints impacting market growth?

.

Which companies are prominent players in the Flame Retardants for Battery Electrolytes?

Key companies in the market include Shandong Genyuan New Materials,HSC Corporation,Zhejiang Yongtai Technology,Tinci Materials,Suzhou Cheerchem Advanced Material,Shenzhen Capchem,Chunbo Fine Chem

How can I stay updated on further developments or reports in the Flame Retardants for Battery Electrolytes?

To stay informed about further developments, trends, and reports in the Flame Retardants for Battery Electrolytes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flame Retardants for Battery Electrolytes," which aids in identifying and referencing the specific market segment covered.

Can you provide examples of recent developments in the market?

undefined

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

What is the projected Compound Annual Growth Rate (CAGR) of the Flame Retardants for Battery Electrolytes ?

The projected CAGR is approximately XX%.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flame Retardants for Battery Electrolytes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Battery

- 5.1.2. Consumer Battery

- 5.1.3. Energy Storage Battery

- 5.1.4. World Flame Retardants for Battery Electrolytes Production

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Chloroethylene Carbonate (CEC)

- 5.2.2. Fluoroethylene carbonate (FEC)

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Flame Retardants for Battery Electrolytes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Power Battery

- 6.1.2. Consumer Battery

- 6.1.3. Energy Storage Battery

- 6.1.4. World Flame Retardants for Battery Electrolytes Production

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Chloroethylene Carbonate (CEC)

- 6.2.2. Fluoroethylene carbonate (FEC)

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Flame Retardants for Battery Electrolytes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Power Battery

- 7.1.2. Consumer Battery

- 7.1.3. Energy Storage Battery

- 7.1.4. World Flame Retardants for Battery Electrolytes Production

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Chloroethylene Carbonate (CEC)

- 7.2.2. Fluoroethylene carbonate (FEC)

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Flame Retardants for Battery Electrolytes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Power Battery

- 8.1.2. Consumer Battery

- 8.1.3. Energy Storage Battery

- 8.1.4. World Flame Retardants for Battery Electrolytes Production

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Chloroethylene Carbonate (CEC)

- 8.2.2. Fluoroethylene carbonate (FEC)

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Flame Retardants for Battery Electrolytes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Power Battery

- 9.1.2. Consumer Battery

- 9.1.3. Energy Storage Battery

- 9.1.4. World Flame Retardants for Battery Electrolytes Production

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Chloroethylene Carbonate (CEC)

- 9.2.2. Fluoroethylene carbonate (FEC)

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Flame Retardants for Battery Electrolytes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Power Battery

- 10.1.2. Consumer Battery

- 10.1.3. Energy Storage Battery

- 10.1.4. World Flame Retardants for Battery Electrolytes Production

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Chloroethylene Carbonate (CEC)

- 10.2.2. Fluoroethylene carbonate (FEC)

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Shandong Genyuan New Materials

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HSC Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zhejiang Yongtai Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tinci Materials

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Suzhou Cheerchem Advanced Material

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shenzhen Capchem

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chunbo Fine Chem

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Shandong Genyuan New Materials

- Figure 1: Global Flame Retardants for Battery Electrolytes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Flame Retardants for Battery Electrolytes Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Flame Retardants for Battery Electrolytes Revenue (million), by Application 2024 & 2032

- Figure 4: North America Flame Retardants for Battery Electrolytes Volume (K), by Application 2024 & 2032

- Figure 5: North America Flame Retardants for Battery Electrolytes Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Flame Retardants for Battery Electrolytes Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Flame Retardants for Battery Electrolytes Revenue (million), by Type 2024 & 2032

- Figure 8: North America Flame Retardants for Battery Electrolytes Volume (K), by Type 2024 & 2032

- Figure 9: North America Flame Retardants for Battery Electrolytes Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Flame Retardants for Battery Electrolytes Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Flame Retardants for Battery Electrolytes Revenue (million), by Country 2024 & 2032

- Figure 12: North America Flame Retardants for Battery Electrolytes Volume (K), by Country 2024 & 2032

- Figure 13: North America Flame Retardants for Battery Electrolytes Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Flame Retardants for Battery Electrolytes Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Flame Retardants for Battery Electrolytes Revenue (million), by Application 2024 & 2032

- Figure 16: South America Flame Retardants for Battery Electrolytes Volume (K), by Application 2024 & 2032

- Figure 17: South America Flame Retardants for Battery Electrolytes Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Flame Retardants for Battery Electrolytes Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Flame Retardants for Battery Electrolytes Revenue (million), by Type 2024 & 2032

- Figure 20: South America Flame Retardants for Battery Electrolytes Volume (K), by Type 2024 & 2032

- Figure 21: South America Flame Retardants for Battery Electrolytes Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Flame Retardants for Battery Electrolytes Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Flame Retardants for Battery Electrolytes Revenue (million), by Country 2024 & 2032

- Figure 24: South America Flame Retardants for Battery Electrolytes Volume (K), by Country 2024 & 2032

- Figure 25: South America Flame Retardants for Battery Electrolytes Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Flame Retardants for Battery Electrolytes Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Flame Retardants for Battery Electrolytes Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Flame Retardants for Battery Electrolytes Volume (K), by Application 2024 & 2032

- Figure 29: Europe Flame Retardants for Battery Electrolytes Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Flame Retardants for Battery Electrolytes Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Flame Retardants for Battery Electrolytes Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Flame Retardants for Battery Electrolytes Volume (K), by Type 2024 & 2032

- Figure 33: Europe Flame Retardants for Battery Electrolytes Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Flame Retardants for Battery Electrolytes Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Flame Retardants for Battery Electrolytes Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Flame Retardants for Battery Electrolytes Volume (K), by Country 2024 & 2032

- Figure 37: Europe Flame Retardants for Battery Electrolytes Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Flame Retardants for Battery Electrolytes Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Flame Retardants for Battery Electrolytes Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Flame Retardants for Battery Electrolytes Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Flame Retardants for Battery Electrolytes Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Flame Retardants for Battery Electrolytes Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Flame Retardants for Battery Electrolytes Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Flame Retardants for Battery Electrolytes Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Flame Retardants for Battery Electrolytes Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Flame Retardants for Battery Electrolytes Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Flame Retardants for Battery Electrolytes Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Flame Retardants for Battery Electrolytes Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Flame Retardants for Battery Electrolytes Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Flame Retardants for Battery Electrolytes Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Flame Retardants for Battery Electrolytes Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Flame Retardants for Battery Electrolytes Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Flame Retardants for Battery Electrolytes Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Flame Retardants for Battery Electrolytes Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Flame Retardants for Battery Electrolytes Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Flame Retardants for Battery Electrolytes Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Flame Retardants for Battery Electrolytes Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Flame Retardants for Battery Electrolytes Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Flame Retardants for Battery Electrolytes Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Flame Retardants for Battery Electrolytes Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Flame Retardants for Battery Electrolytes Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Flame Retardants for Battery Electrolytes Volume Share (%), by Country 2024 & 2032

- Table 1: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Flame Retardants for Battery Electrolytes Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Flame Retardants for Battery Electrolytes Volume K Forecast, by Country 2019 & 2032

- Table 81: China Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Flame Retardants for Battery Electrolytes Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Flame Retardants for Battery Electrolytes Volume (K) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.