Food & Beverage Packaging PET Barrier Films

Food & Beverage Packaging PET Barrier FilmsFood & Beverage Packaging PET Barrier Films Strategic Roadmap: Analysis and Forecasts 2025-2033

Food & Beverage Packaging PET Barrier Films by Type (High Barrier PET Films, Low Barrier PET Films, World Food & Beverage Packaging PET Barrier Films Production ), by Application (Food Packaging, Beverage Packaging, World Food & Beverage Packaging PET Barrier Films Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

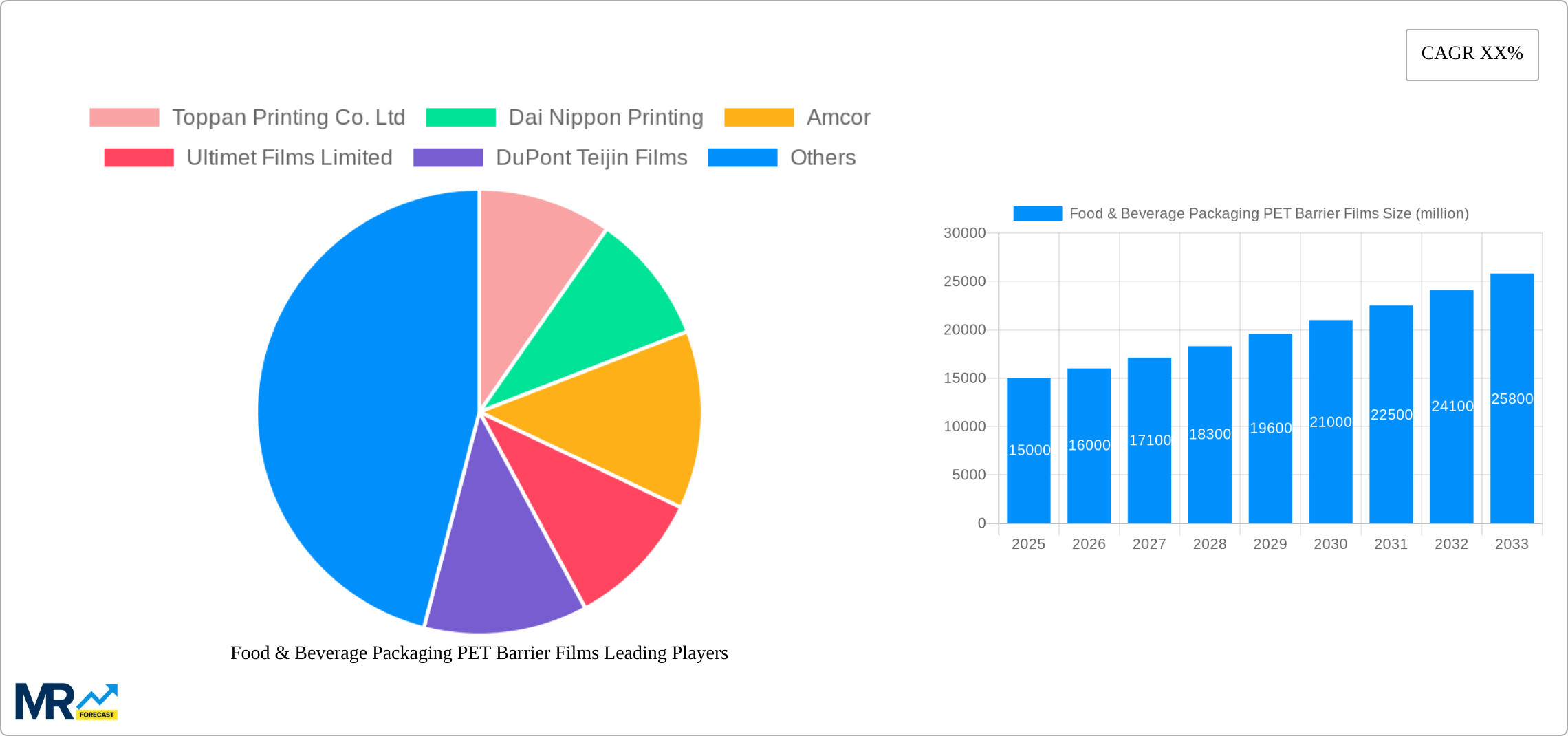

The global food and beverage packaging PET barrier films market is experiencing robust growth, driven by the increasing demand for extended shelf life and enhanced product protection across various food and beverage categories. The market is segmented by barrier type (high and low barrier) and application (food and beverage packaging), with high-barrier films commanding a larger share due to their superior protection against oxygen, moisture, and aroma transfer. This is particularly crucial for sensitive products like dairy, ready meals, and beverages requiring extended shelf life. Key trends include the adoption of sustainable and recyclable PET films, driven by growing environmental concerns and stringent regulations. Furthermore, innovations in film technology, such as multilayer structures and improved barrier properties, are fueling market expansion. Major players, including Toppan Printing, Amcor, and DuPont Teijin Films, are investing heavily in R&D and strategic partnerships to maintain their competitive edge. The Asia-Pacific region, particularly China and India, is expected to witness significant growth due to rising disposable incomes, urbanization, and increasing demand for convenient and packaged food and beverages. While the market faces constraints such as fluctuating raw material prices and potential supply chain disruptions, the overall outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) that suggests substantial market expansion throughout the forecast period (2025-2033).

The competitive landscape is characterized by both large multinational corporations and specialized film manufacturers. Companies are focusing on product differentiation through innovation in barrier technology, improved sustainability profiles, and enhanced customization options to meet the specific requirements of various food and beverage segments. Regional growth patterns vary, with developed markets exhibiting stable growth driven by product innovation and premiumization, while emerging economies are witnessing exponential growth due to rapid urbanization and rising consumer demand. Continued emphasis on sustainable packaging solutions, coupled with the development of advanced barrier technologies, will be key factors influencing market dynamics and shaping future growth trajectories within the food and beverage packaging PET barrier films sector. The market analysis strongly suggests a promising future for this industry, driven by technological advancements, evolving consumer preferences, and sustainable packaging initiatives.

Food & Beverage Packaging PET Barrier Films Trends

The global food and beverage packaging PET barrier films market is experiencing robust growth, driven by escalating demand for convenient, safe, and extended-shelf-life food and beverage products. The market, valued at approximately $XX billion in 2024, is projected to reach $YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X%. This expansion is fueled by several converging factors including the increasing popularity of ready-to-eat meals, on-the-go consumption patterns, and heightened consumer awareness regarding food safety and preservation. The shift towards sustainable packaging solutions is also a significant trend, with manufacturers actively seeking PET barrier films that are recyclable and environmentally friendly. This demand is pushing innovation in barrier technology, leading to the development of thinner, stronger, and more efficient films. The market is witnessing a diversification of applications, with PET barrier films increasingly used in packaging for sensitive products like dairy, meat, and ready meals, owing to their superior oxygen and moisture barrier properties compared to conventional packaging materials. This trend is expected to continue driving market expansion in the coming years. Furthermore, advancements in coating and lamination technologies are enhancing the barrier properties of PET films, further expanding their suitability for a wider range of food and beverage products. The competitive landscape is characterized by both established players and emerging companies vying for market share through product innovation, strategic partnerships, and acquisitions. The rising adoption of advanced packaging technologies like active and intelligent packaging is also shaping the future trajectory of the PET barrier film market. These innovations are creating opportunities for improved product freshness, extended shelf life, and enhanced consumer experience. The market segmentation based on barrier type (high and low) and application (food vs. beverage) reveals unique growth dynamics, with high-barrier films experiencing a more substantial increase in demand, reflecting the needs of packaging increasingly sensitive products requiring robust protection.

Driving Forces: What's Propelling the Food & Beverage Packaging PET Barrier Films Market?

Several key factors are propelling the growth of the food and beverage packaging PET barrier films market. The burgeoning demand for convenient and ready-to-eat foods is a major driver, as these products require packaging that ensures extended shelf life and maintains product quality. Consumers' increasing preference for single-serve and portable packaging formats further contributes to this growth. Simultaneously, the rising focus on food safety and hygiene is driving the adoption of barrier films that effectively protect against contamination and spoilage. The superior barrier properties of PET films compared to traditional materials, particularly regarding oxygen and moisture protection, make them a preferred choice for packaging a wide array of food and beverage products, particularly those with extended shelf-life requirements. Moreover, advancements in film technology, including thinner yet stronger films and improved barrier coatings, contribute to cost optimization and enhanced performance, making them an attractive option for manufacturers. The growing awareness of environmental concerns and sustainability is also influencing market dynamics. Manufacturers are increasingly focusing on developing recyclable and eco-friendly PET barrier films, meeting growing consumer demand for sustainable packaging solutions. This shift is driving innovation and leading to the development of films with improved recyclability and reduced environmental impact, which in turn fuels the demand. Finally, technological advancements in printing and lamination techniques allow for aesthetically pleasing and functional packaging that enhances product branding and appeal, strengthening the overall demand for these films.

Challenges and Restraints in Food & Beverage Packaging PET Barrier Films Market

Despite the substantial growth potential, several challenges and restraints exist within the food and beverage packaging PET barrier films market. Fluctuations in the price of raw materials, particularly petroleum-based polymers, can significantly impact production costs and profitability. This price volatility poses a risk to manufacturers and necessitates effective cost management strategies. Furthermore, stringent regulations and safety standards related to food contact materials require manufacturers to comply with evolving guidelines, imposing compliance costs and technical challenges. Meeting these regulations can be complex and necessitates continuous investment in research and development to ensure products meet the required safety criteria. Competition from alternative packaging materials, such as paper-based alternatives and bioplastics, also poses a challenge. While PET films maintain a significant advantage in barrier properties, these alternatives are gaining traction due to increasing environmental concerns and the push for sustainable packaging solutions. The development and adoption of these alternative materials necessitate continuous innovation and adaptation within the PET film sector to remain competitive. Finally, the need for efficient and cost-effective recycling infrastructure remains a key obstacle, as the increasing demand for recycled PET content requires substantial investment and cooperation across the entire value chain to facilitate effective collection, sorting, and recycling processes.

Key Region or Country & Segment to Dominate the Market

The Asia-Pacific region is anticipated to dominate the global food & beverage packaging PET barrier films market throughout the forecast period (2025-2033). This dominance is largely attributed to several key factors:

- Rapid Economic Growth: The region boasts several rapidly developing economies with a burgeoning middle class, leading to increased disposable income and consumption of packaged food and beverages.

- Growing Food Processing Industry: The substantial expansion of the food processing and manufacturing industries in countries like China, India, and Southeast Asian nations significantly increases the demand for effective and efficient packaging solutions.

- Rising Demand for Convenience Foods: The increasing preference for ready-to-eat meals and convenient food options fuels the demand for packaging materials that guarantee product quality and shelf life.

- Favorable Government Policies: Supportive government policies and initiatives focusing on industrial development and food safety regulations contribute to market growth.

Within market segments, High Barrier PET Films are projected to dominate the market. This is primarily due to:

- Superior Protection: High-barrier films offer enhanced protection against oxygen, moisture, and other environmental factors, crucial for preserving the quality and extending the shelf life of sensitive food and beverage products. This is especially important for products with a long shelf-life requirement.

- Increased Demand for Sensitive Products: The rising demand for packaged dairy products, meat, and ready meals necessitates the use of high-barrier films to maintain product freshness and prevent spoilage.

- Higher Profit Margins: High-barrier films generally command higher prices compared to their low-barrier counterparts, leading to greater profitability for manufacturers.

The Food Packaging application segment is also expected to show significant growth, outpacing the beverage packaging segment, due to the wide variety of food products that benefit from the barrier properties of PET films.

The substantial market size in the Asia-Pacific region, coupled with the growing demand for high-barrier PET films in food packaging applications, positions this combination as the key driver of market growth in the coming years. This necessitates strategic focus from manufacturers on this area to maximize market penetration and capture significant market share.

Growth Catalysts in Food & Beverage Packaging PET Barrier Films Industry

Several factors are significantly contributing to the growth of the Food & Beverage Packaging PET Barrier Films industry. The increasing demand for convenience foods and ready-to-eat meals requires robust packaging solutions capable of preserving quality and extending shelf-life. Simultaneously, the rising awareness of food safety and hygiene pushes manufacturers toward utilizing advanced packaging materials that minimize contamination and spoilage. The development of innovative, sustainable, and recyclable packaging materials addresses growing environmental concerns, contributing to market expansion. Lastly, ongoing technological advancements in barrier film technology, along with improvements in printing and lamination techniques, further enhance the appeal and functionality of PET barrier films, strengthening the overall market outlook.

Leading Players in the Food & Beverage Packaging PET Barrier Films Market

- Toppan Printing Co., Ltd. [Toppan Printing Co., Ltd.]

- Dai Nippon Printing

- Amcor [Amcor]

- Ultimet Films Limited

- DuPont Teijin Films [DuPont]

- Toray Advanced Film [Toray Industries, Inc.]

- Mitsubishi PLASTICS

- Toyobo

- Mondi [Mondi]

- Wipak

- 3M [3M]

- Berry Plastics

- Sunrise

- ALIPLAST SpA

- JPFL Films

Significant Developments in Food & Beverage Packaging PET Barrier Films Sector

- 2020: Amcor launches a new range of recyclable PET barrier films for food packaging.

- 2021: DuPont Teijin Films introduces a high-barrier film with improved oxygen and moisture resistance.

- 2022: Mondi partners with a recycling company to improve the recyclability of its PET films.

- 2023: Toppan Printing Co., Ltd. invests in new technology to increase the production capacity of its PET barrier films.

- 2024: Several major players announce commitments to increase the use of recycled PET content in their films.

Comprehensive Coverage Food & Beverage Packaging PET Barrier Films Report

This report offers an in-depth analysis of the food & beverage packaging PET barrier films market, providing comprehensive insights into market trends, growth drivers, challenges, key players, and future prospects. The detailed segmentation of the market based on barrier type, application, and geographic regions allows for a granular understanding of the specific dynamics influencing each segment. The report uses data from the study period 2019-2024 as a historical foundation and offers detailed forecasts extending to 2033, providing clients with a long-term perspective on market evolution. This comprehensive analysis helps businesses make informed strategic decisions, identify potential growth opportunities, and gain a competitive edge in this dynamic market. The report includes quantitative data, projected market sizes in millions of units, and qualitative insights drawn from a thorough evaluation of the industry landscape.

Food & Beverage Packaging PET Barrier Films Segmentation

-

1. Type

- 1.1. High Barrier PET Films

- 1.2. Low Barrier PET Films

- 1.3. World Food & Beverage Packaging PET Barrier Films Production

-

2. Application

- 2.1. Food Packaging

- 2.2. Beverage Packaging

- 2.3. World Food & Beverage Packaging PET Barrier Films Production

Food & Beverage Packaging PET Barrier Films Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Food & Beverage Packaging PET Barrier Films REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Can you provide examples of recent developments in the market?

undefined

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

What are the main segments of the Food & Beverage Packaging PET Barrier Films?

The market segments include

Are there any restraints impacting market growth?

.

What is the projected Compound Annual Growth Rate (CAGR) of the Food & Beverage Packaging PET Barrier Films ?

The projected CAGR is approximately XX%.

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

What are some drivers contributing to market growth?

.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food & Beverage Packaging PET Barrier Films Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. High Barrier PET Films

- 5.1.2. Low Barrier PET Films

- 5.1.3. World Food & Beverage Packaging PET Barrier Films Production

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food Packaging

- 5.2.2. Beverage Packaging

- 5.2.3. World Food & Beverage Packaging PET Barrier Films Production

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Food & Beverage Packaging PET Barrier Films Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. High Barrier PET Films

- 6.1.2. Low Barrier PET Films

- 6.1.3. World Food & Beverage Packaging PET Barrier Films Production

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food Packaging

- 6.2.2. Beverage Packaging

- 6.2.3. World Food & Beverage Packaging PET Barrier Films Production

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Food & Beverage Packaging PET Barrier Films Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. High Barrier PET Films

- 7.1.2. Low Barrier PET Films

- 7.1.3. World Food & Beverage Packaging PET Barrier Films Production

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food Packaging

- 7.2.2. Beverage Packaging

- 7.2.3. World Food & Beverage Packaging PET Barrier Films Production

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Food & Beverage Packaging PET Barrier Films Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. High Barrier PET Films

- 8.1.2. Low Barrier PET Films

- 8.1.3. World Food & Beverage Packaging PET Barrier Films Production

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food Packaging

- 8.2.2. Beverage Packaging

- 8.2.3. World Food & Beverage Packaging PET Barrier Films Production

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Food & Beverage Packaging PET Barrier Films Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. High Barrier PET Films

- 9.1.2. Low Barrier PET Films

- 9.1.3. World Food & Beverage Packaging PET Barrier Films Production

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food Packaging

- 9.2.2. Beverage Packaging

- 9.2.3. World Food & Beverage Packaging PET Barrier Films Production

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Food & Beverage Packaging PET Barrier Films Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. High Barrier PET Films

- 10.1.2. Low Barrier PET Films

- 10.1.3. World Food & Beverage Packaging PET Barrier Films Production

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food Packaging

- 10.2.2. Beverage Packaging

- 10.2.3. World Food & Beverage Packaging PET Barrier Films Production

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Toppan Printing Co. Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dai Nippon Printing

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amcor

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ultimet Films Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DuPont Teijin Films

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Toray Advanced Film

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi PLASTICS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Toyobo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mondi

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wipak

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 3M

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Berry Plastics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sunrise

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ALIPLAST SpA

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 JPFL Films

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Toppan Printing Co. Ltd

- Figure 1: Global Food & Beverage Packaging PET Barrier Films Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Food & Beverage Packaging PET Barrier Films Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Food & Beverage Packaging PET Barrier Films Revenue (million), by Type 2024 & 2032

- Figure 4: North America Food & Beverage Packaging PET Barrier Films Volume (K), by Type 2024 & 2032

- Figure 5: North America Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Food & Beverage Packaging PET Barrier Films Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Food & Beverage Packaging PET Barrier Films Revenue (million), by Application 2024 & 2032

- Figure 8: North America Food & Beverage Packaging PET Barrier Films Volume (K), by Application 2024 & 2032

- Figure 9: North America Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Food & Beverage Packaging PET Barrier Films Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Food & Beverage Packaging PET Barrier Films Revenue (million), by Country 2024 & 2032

- Figure 12: North America Food & Beverage Packaging PET Barrier Films Volume (K), by Country 2024 & 2032

- Figure 13: North America Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Food & Beverage Packaging PET Barrier Films Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Food & Beverage Packaging PET Barrier Films Revenue (million), by Type 2024 & 2032

- Figure 16: South America Food & Beverage Packaging PET Barrier Films Volume (K), by Type 2024 & 2032

- Figure 17: South America Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Food & Beverage Packaging PET Barrier Films Volume Share (%), by Type 2024 & 2032

- Figure 19: South America Food & Beverage Packaging PET Barrier Films Revenue (million), by Application 2024 & 2032

- Figure 20: South America Food & Beverage Packaging PET Barrier Films Volume (K), by Application 2024 & 2032

- Figure 21: South America Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Food & Beverage Packaging PET Barrier Films Volume Share (%), by Application 2024 & 2032

- Figure 23: South America Food & Beverage Packaging PET Barrier Films Revenue (million), by Country 2024 & 2032

- Figure 24: South America Food & Beverage Packaging PET Barrier Films Volume (K), by Country 2024 & 2032

- Figure 25: South America Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Food & Beverage Packaging PET Barrier Films Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Food & Beverage Packaging PET Barrier Films Revenue (million), by Type 2024 & 2032

- Figure 28: Europe Food & Beverage Packaging PET Barrier Films Volume (K), by Type 2024 & 2032

- Figure 29: Europe Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Food & Beverage Packaging PET Barrier Films Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe Food & Beverage Packaging PET Barrier Films Revenue (million), by Application 2024 & 2032

- Figure 32: Europe Food & Beverage Packaging PET Barrier Films Volume (K), by Application 2024 & 2032

- Figure 33: Europe Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe Food & Beverage Packaging PET Barrier Films Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe Food & Beverage Packaging PET Barrier Films Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Food & Beverage Packaging PET Barrier Films Volume (K), by Country 2024 & 2032

- Figure 37: Europe Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Food & Beverage Packaging PET Barrier Films Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Food & Beverage Packaging PET Barrier Films Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa Food & Beverage Packaging PET Barrier Films Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa Food & Beverage Packaging PET Barrier Films Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa Food & Beverage Packaging PET Barrier Films Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa Food & Beverage Packaging PET Barrier Films Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa Food & Beverage Packaging PET Barrier Films Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa Food & Beverage Packaging PET Barrier Films Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Food & Beverage Packaging PET Barrier Films Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Food & Beverage Packaging PET Barrier Films Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Food & Beverage Packaging PET Barrier Films Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific Food & Beverage Packaging PET Barrier Films Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific Food & Beverage Packaging PET Barrier Films Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific Food & Beverage Packaging PET Barrier Films Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific Food & Beverage Packaging PET Barrier Films Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Food & Beverage Packaging PET Barrier Films Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Food & Beverage Packaging PET Barrier Films Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Food & Beverage Packaging PET Barrier Films Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Food & Beverage Packaging PET Barrier Films Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Food & Beverage Packaging PET Barrier Films Volume Share (%), by Country 2024 & 2032

- Table 1: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Type 2019 & 2032

- Table 5: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Application 2019 & 2032

- Table 7: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Type 2019 & 2032

- Table 11: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Application 2019 & 2032

- Table 13: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Type 2019 & 2032

- Table 23: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Application 2019 & 2032

- Table 25: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Type 2019 & 2032

- Table 35: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Application 2019 & 2032

- Table 37: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Type 2019 & 2032

- Table 59: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Application 2019 & 2032

- Table 61: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Type 2019 & 2032

- Table 77: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Application 2019 & 2032

- Table 79: Global Food & Beverage Packaging PET Barrier Films Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Food & Beverage Packaging PET Barrier Films Volume K Forecast, by Country 2019 & 2032

- Table 81: China Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Food & Beverage Packaging PET Barrier Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Food & Beverage Packaging PET Barrier Films Volume (K) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.