Food Hygiene Audit

Food Hygiene AuditFood Hygiene Audit Is Set To Reach XXX million By 2033, Growing At A CAGR Of XX

Food Hygiene Audit by Type (Sensory Indicators, Physical and Chemical Indicators, Microbial Indicators), by Application (Food Processing Plants, Dining Room, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

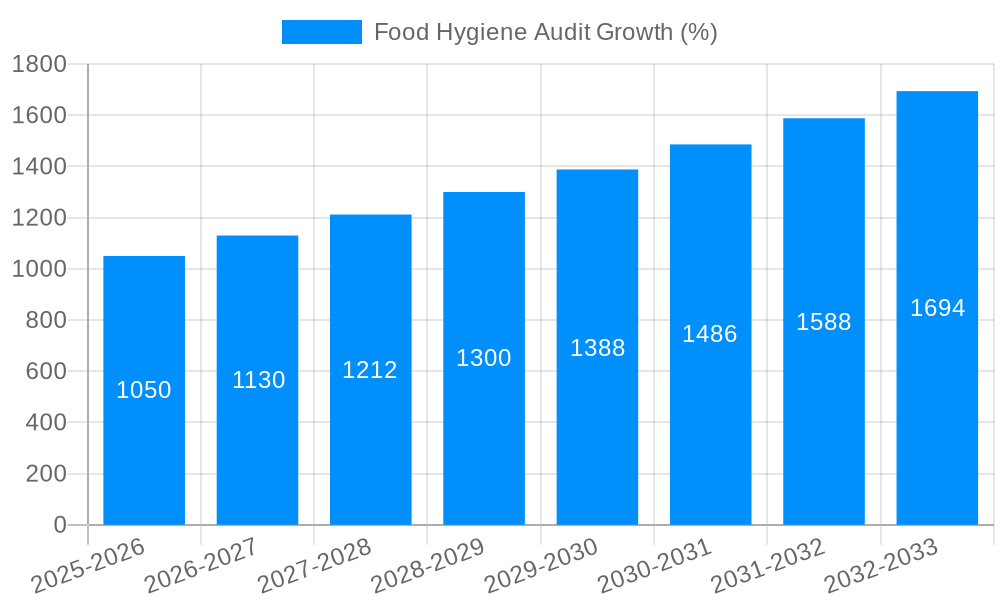

The global food hygiene audit market is experiencing robust growth, driven by increasing consumer awareness of food safety, stringent government regulations, and the rising prevalence of foodborne illnesses. The market, estimated at $15 billion in 2025, is projected to exhibit a compound annual growth rate (CAGR) of 7% from 2025 to 2033, reaching approximately $25 billion by 2033. This growth is fueled by several key factors. The increasing adoption of food safety management systems (FSMS), such as HACCP and ISO 22000, is mandating regular hygiene audits for food processing plants and related businesses. Furthermore, the expansion of the food processing and hospitality industries, particularly in developing economies, is creating significant demand for these services. Technological advancements, such as the implementation of digital auditing tools and remote monitoring systems, are streamlining the audit process and improving efficiency, contributing to market expansion. The market is segmented by indicator type (sensory, physical & chemical, microbial) and application (food processing plants, dining establishments, others), with food processing plants currently holding the largest market share due to stricter regulatory compliance requirements. Leading players include QIMA, SGS, and Bureau Veritas, among others, who are actively investing in expanding their service offerings and geographic reach to capitalize on the growing market opportunities.

The market's growth, however, is not without challenges. High audit costs can be a barrier for smaller food businesses, particularly in developing regions. Furthermore, inconsistencies in auditing standards and a lack of skilled auditors in certain areas pose limitations to market expansion. Despite these restraints, the long-term outlook for the food hygiene audit market remains positive, fueled by ongoing consumer demand for safer food products and a continuous tightening of regulatory frameworks worldwide. The increasing adoption of cloud-based solutions and the development of more sophisticated audit methodologies promise further market growth and refinement in the years to come. Regional variations in growth are expected, with North America and Europe maintaining a significant share due to robust regulatory environments and established audit infrastructures, while Asia-Pacific is poised for significant growth due to rapid industrialization and increasing consumer awareness.

Food Hygiene Audit Trends

The global food hygiene audit market is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. The period from 2019 to 2024 (Historical Period) witnessed a steady increase in demand driven by heightened consumer awareness regarding food safety, stringent government regulations, and the escalating prevalence of foodborne illnesses. The base year of 2025 marks a significant juncture, with the market exhibiting a consolidated growth trajectory. Our estimations for 2025 (Estimated Year) indicate substantial market expansion, which is set to continue throughout the forecast period (2025-2033). This expansion is fueled by several factors, including the increasing adoption of advanced technologies in food processing and the rising demand for certified food products across various segments. The study period (2019-2033) provides a comprehensive overview of the market's evolution, highlighting the significant shifts in consumer preferences, regulatory landscapes, and technological advancements. The increasing globalization of food supply chains also plays a crucial role, necessitating thorough audits to ensure compliance with international standards and consumer safety across borders. Furthermore, the rising prevalence of food fraud and the consequent need for robust verification mechanisms are driving increased investments in food hygiene audits. These audits are not just about compliance; they are becoming integral to maintaining brand reputation and customer trust. The market's growth is not uniform across all segments; certain areas, as we will explore later, are showing particularly strong growth, shaping the market's overall trajectory. The competitive landscape is also dynamic, with both established players and emerging companies vying for market share through innovation and strategic partnerships. Understanding these trends is crucial for stakeholders navigating this rapidly evolving market.

Driving Forces: What's Propelling the Food Hygiene Audit Market?

Several key factors are driving the exponential growth of the food hygiene audit market. Firstly, escalating consumer awareness of food safety and quality is paramount. Consumers are increasingly demanding transparency and traceability in their food supply chain, leading to a surge in demand for certified products and independent audits. Secondly, governments worldwide are implementing stricter regulations and enforcing stricter penalties for non-compliance, making food hygiene audits a necessity for businesses operating in the food industry. These regulations vary across regions but generally aim to protect public health and ensure consumer safety. Thirdly, the growing incidence of foodborne illnesses and outbreaks is forcing businesses to prioritize food safety protocols. The consequences of food safety failures – including reputational damage, financial losses, and even legal repercussions – are significant, pushing companies to invest in comprehensive hygiene audits. Fourthly, the globalization of food supply chains complicates the process of ensuring food safety, necessitating stringent monitoring and auditing across various stages of production and distribution. This internationalization further contributes to the market expansion as businesses seek to navigate complex international standards and regulations. Finally, advancements in technology are making food hygiene audits more efficient and effective. New analytical techniques and digital platforms enable quicker, more accurate assessments, further fueling market growth.

Challenges and Restraints in Food Hygiene Audit Market

Despite the considerable growth potential, several challenges and restraints hinder the seamless expansion of the food hygiene audit market. Firstly, the high cost associated with conducting comprehensive audits can be a significant barrier for smaller businesses, particularly those in developing economies. This can lead to unequal playing fields and limit access to necessary food safety assessments. Secondly, the lack of standardization in auditing protocols and methodologies across different regions can lead to inconsistencies and complexities in assessing food safety compliance. This fragmented regulatory landscape creates challenges for businesses operating internationally. Thirdly, the complexity and diversity of the food supply chain pose significant hurdles in conducting comprehensive audits. Tracing food products across various stages, from farm to fork, requires sophisticated tracing and technology integration. Moreover, maintaining consistent data quality and accuracy is a major ongoing challenge. Fourthly, a shortage of skilled and certified auditors can restrict the capacity of the market to effectively address the growing demand. Training and certification programs are essential to bridge this gap. Finally, the ever-evolving nature of food safety regulations and technologies requires continuous adaptation and investment from auditing companies. Staying abreast of the latest developments and adopting new methodologies is crucial for maintaining competitiveness.

Key Region or Country & Segment to Dominate the Market

The food processing plant segment within the application category is poised for significant dominance in the food hygiene audit market. Food processing plants handle large volumes of food products, demanding stringent hygiene controls to minimize risks.

High-Volume Processing: The sheer scale of operations in food processing plants necessitates frequent and rigorous audits to ensure ongoing compliance with regulations and maintain consistently high safety standards.

Stringent Regulatory Scrutiny: Food processing plants are often subjected to the most intensive regulatory oversight, making regular hygiene audits not merely advisable but mandatory.

Complex Processes: The multifaceted processes involved in food processing, from raw material handling to packaging and distribution, demand comprehensive and specialized auditing expertise.

Technological Advancements: The increasing automation and technological integration within food processing plants necessitate audits that assess the hygiene and safety of these technological components as well.

Consumer Expectations: Public awareness of food safety is driving consumer preference toward brands that demonstrably maintain stringent hygiene practices, further incentivizing audits in this sector.

Geographically, developed regions such as North America and Europe are expected to continue driving market expansion due to stringent regulations, higher consumer awareness and robust technological infrastructure. However, rapidly developing economies in Asia-Pacific are also demonstrating significant growth potential. This region exhibits a burgeoning food processing sector and a rapidly increasing middle class with a higher disposable income and a growing concern for food safety. The demand for food hygiene audits in Asia-Pacific is consequently increasing, making it a key region for future market expansion.

Growth Catalysts in the Food Hygiene Audit Industry

The increasing stringency of food safety regulations globally, coupled with rising consumer demand for safe and high-quality food products, is a major catalyst driving the growth of the food hygiene audit industry. Technological advancements leading to more efficient and accurate audit methods are also significantly contributing to market expansion. Furthermore, an increasing awareness of the economic consequences associated with foodborne illnesses and breaches in food safety are incentivizing businesses to prioritize comprehensive hygiene audits.

Leading Players in the Food Hygiene Audit Market

- QIMA

- SGS

- HQTS Group Ltd

- TUV Sud

- GoAudits

- North Star Techno Services Pvt. Ltd.

- BSI Group

- Intertek

- Bureau Veritas

- ALS Global

- Comprehensive Food Safety

- EAGLE Certification Group

- AsureQuality

Significant Developments in the Food Hygiene Audit Sector

- 2020: Increased adoption of remote auditing technologies due to the COVID-19 pandemic.

- 2021: Several major players invested in developing AI-powered audit tools for enhanced efficiency and accuracy.

- 2022: New regulations introduced in several countries focusing on supply chain traceability and digitalization of audit records.

- 2023: Growing interest in blockchain technology for enhancing transparency and traceability in food supply chains.

Comprehensive Coverage Food Hygiene Audit Report

This report offers a thorough analysis of the food hygiene audit market, encompassing historical data, current market dynamics, and future projections. It provides a detailed examination of key market drivers, restraints, and emerging trends. Furthermore, the report presents an in-depth segment analysis, geographical breakdown, and competitive landscape, offering valuable insights for stakeholders in the food industry and the auditing sector. The report helps in making informed decisions regarding market entry, strategic partnerships and investment opportunities in this crucial sector.

Food Hygiene Audit Segmentation

-

1. Type

- 1.1. Sensory Indicators

- 1.2. Physical and Chemical Indicators

- 1.3. Microbial Indicators

-

2. Application

- 2.1. Food Processing Plants

- 2.2. Dining Room

- 2.3. Others

Food Hygiene Audit Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Food Hygiene Audit REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

What are the main segments of the Food Hygiene Audit?

The market segments include

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

What are the notable trends driving market growth?

.

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million .

Can you provide examples of recent developments in the market?

undefined

What are some drivers contributing to market growth?

.

How can I stay updated on further developments or reports in the Food Hygiene Audit?

To stay informed about further developments, trends, and reports in the Food Hygiene Audit, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Hygiene Audit Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sensory Indicators

- 5.1.2. Physical and Chemical Indicators

- 5.1.3. Microbial Indicators

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food Processing Plants

- 5.2.2. Dining Room

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Food Hygiene Audit Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sensory Indicators

- 6.1.2. Physical and Chemical Indicators

- 6.1.3. Microbial Indicators

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food Processing Plants

- 6.2.2. Dining Room

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Food Hygiene Audit Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sensory Indicators

- 7.1.2. Physical and Chemical Indicators

- 7.1.3. Microbial Indicators

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food Processing Plants

- 7.2.2. Dining Room

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Food Hygiene Audit Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sensory Indicators

- 8.1.2. Physical and Chemical Indicators

- 8.1.3. Microbial Indicators

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food Processing Plants

- 8.2.2. Dining Room

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Food Hygiene Audit Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Sensory Indicators

- 9.1.2. Physical and Chemical Indicators

- 9.1.3. Microbial Indicators

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food Processing Plants

- 9.2.2. Dining Room

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Food Hygiene Audit Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Sensory Indicators

- 10.1.2. Physical and Chemical Indicators

- 10.1.3. Microbial Indicators

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food Processing Plants

- 10.2.2. Dining Room

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 QIMA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SGS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HQTS Group Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TUV Sud

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GoAudits

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 North Star Techno Services Pvt. Ltd.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BSI Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Intertek

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bureau Veritas

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ALS Global

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Comprehensive Food Safety

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 EAGLE Certification Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AsureQuality

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 QIMA

- Figure 1: Global Food Hygiene Audit Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Food Hygiene Audit Revenue (million), by Type 2024 & 2032

- Figure 3: North America Food Hygiene Audit Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Food Hygiene Audit Revenue (million), by Application 2024 & 2032

- Figure 5: North America Food Hygiene Audit Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Food Hygiene Audit Revenue (million), by Country 2024 & 2032

- Figure 7: North America Food Hygiene Audit Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Food Hygiene Audit Revenue (million), by Type 2024 & 2032

- Figure 9: South America Food Hygiene Audit Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Food Hygiene Audit Revenue (million), by Application 2024 & 2032

- Figure 11: South America Food Hygiene Audit Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Food Hygiene Audit Revenue (million), by Country 2024 & 2032

- Figure 13: South America Food Hygiene Audit Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Food Hygiene Audit Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Food Hygiene Audit Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Food Hygiene Audit Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Food Hygiene Audit Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Food Hygiene Audit Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Food Hygiene Audit Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Food Hygiene Audit Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Food Hygiene Audit Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Food Hygiene Audit Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Food Hygiene Audit Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Food Hygiene Audit Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Food Hygiene Audit Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Food Hygiene Audit Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Food Hygiene Audit Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Food Hygiene Audit Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Food Hygiene Audit Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Food Hygiene Audit Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Food Hygiene Audit Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Food Hygiene Audit Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Food Hygiene Audit Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Food Hygiene Audit Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Food Hygiene Audit Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Food Hygiene Audit Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Food Hygiene Audit Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Food Hygiene Audit Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Food Hygiene Audit Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Food Hygiene Audit Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Food Hygiene Audit Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Food Hygiene Audit Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Food Hygiene Audit Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Food Hygiene Audit Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Food Hygiene Audit Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Food Hygiene Audit Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Food Hygiene Audit Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Food Hygiene Audit Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Food Hygiene Audit Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Food Hygiene Audit Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Food Hygiene Audit Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.