Freight Audit and Payment Service

Freight Audit and Payment ServiceFreight Audit and Payment Service 2025 to Grow at XX CAGR with XXX million Market Size: Analysis and Forecasts 2033

Freight Audit and Payment Service by Type (Cross-border Trade, Domestic Trade), by Application (Ocean Transport, Air Transport, Land Transport, Combined Transport), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

Paragraph 1:

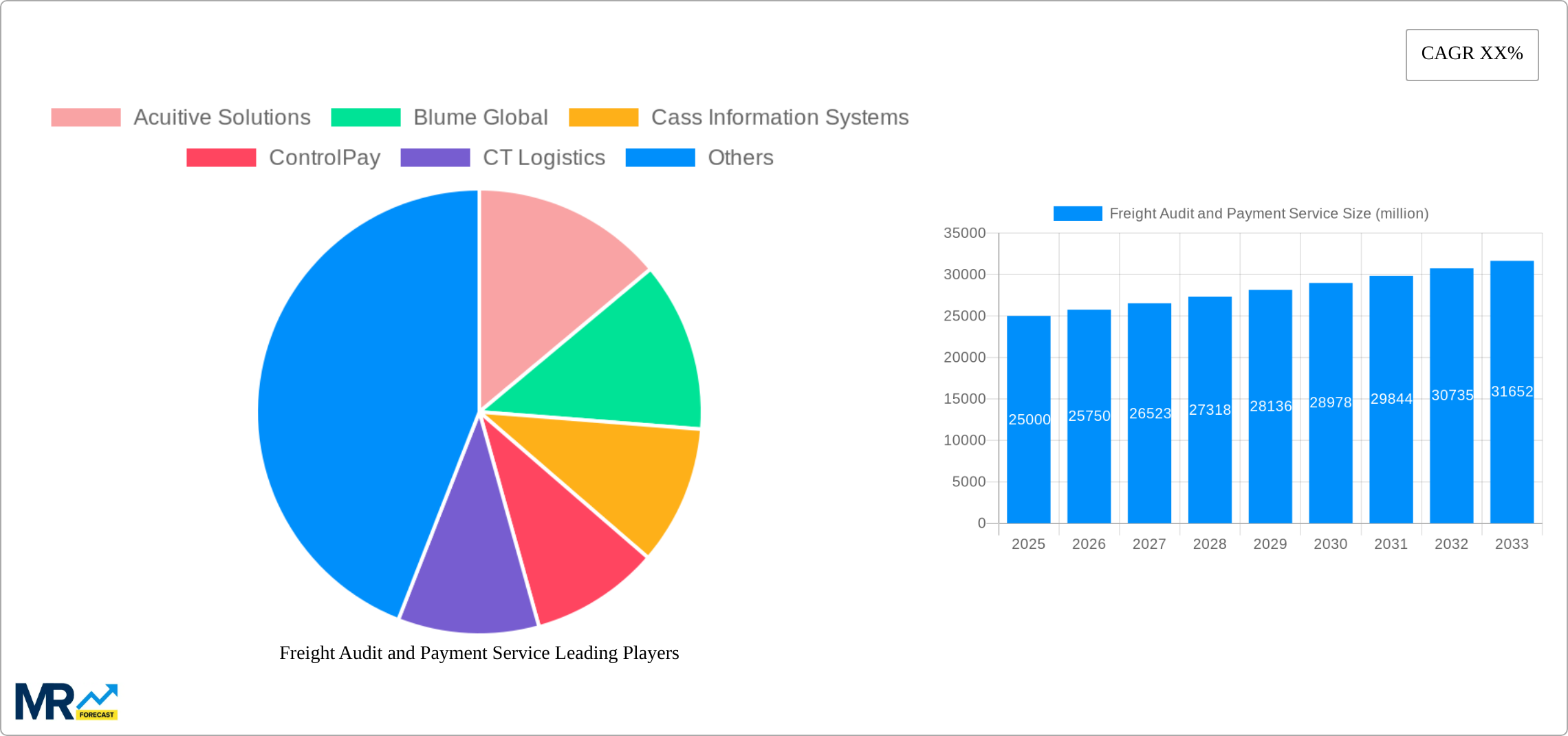

The Freight Audit and Payment (FAP) market has witnessed consistent growth, driven by the surge in e-commerce and global supply chains. Accounting for a market size of XXX million in 2025, the FAP market is projected to reach XXX million by 2033, exhibiting a CAGR of XX%. Key growth factors include the need for efficient cost management, improved accuracy, and enhanced supply chain visibility. Transnational trade, increased use of multiple transportation modes, and complex regulations further contribute to the market's expansion.

Paragraph 2:

The FAP market is segmented by type (cross-border trade, domestic trade) and application (ocean transport, air transport, land transport, combined transport). Major players include Acuitive Solutions, Blume Global, and Cass Information Systems, among others. Regional growth is expected to vary, with North America and Asia Pacific dominating the market. The industry faces challenges in data accuracy and integration, as well as the rise of new technologies like blockchain and artificial intelligence. However, increased adoption of automation and cloud solutions is projected to streamline processes and enhance overall efficiency.

Freight Audit and Payment Service Trends

The freight audit and payment service industry is experiencing significant growth, driven by factors such as increased global trade, the rise of e-commerce, and the need for greater efficiency and cost control in supply chains. The market size is expected to reach $10 billion by 2025, growing at a compound annual growth rate (CAGR) of 9.5% from 2020 to 2025.

Key market insights include:

- Increasing adoption of cloud-based solutions: Cloud-based freight audit and payment services offer scalability, flexibility, and reduced IT costs, making them attractive to businesses of all sizes.

- Growing demand for automation: Businesses are seeking ways to automate their freight audit and payment processes to save time and reduce errors. Automation can handle complex calculations, identify discrepancies, and streamline workflows.

- Enhanced data analytics: Freight audit and payment services are leveraging data analytics to provide businesses with actionable insights into their freight spend, helping them optimize their supply chains and reduce costs.

- Integration with other supply chain applications: Freight audit and payment services are increasingly integrating with other supply chain applications, such as transportation management systems (TMS) and enterprise resource planning (ERP) systems, to provide end-to-end visibility and control.

Driving Forces: What's Propelling the Freight Audit and Payment Service

Several factors are driving the growth of the freight audit and payment service industry, including:

- Rising transportation costs: Increasing fuel prices, labor shortages, and other factors are driving up transportation costs, making it essential for businesses to control their freight spending.

- Supply chain disruptions: Global supply chain disruptions caused by the COVID-19 pandemic have highlighted the need for greater resilience and efficiency in supply chains. Freight audit and payment services can help businesses manage disruptions and reduce their impact.

- Increased regulatory compliance: Governments worldwide are implementing stricter regulations on freight transportation, including requirements for electronic logging devices (ELDs) and electronic bill of lading (eBOL). Freight audit and payment services can help businesses comply with these regulations.

- Growing focus on sustainability: Businesses are increasingly seeking to reduce their environmental impact, and freight audit and payment services can help them measure and track their carbon emissions from transportation.

Challenges and Restraints in Freight Audit and Payment Service

Despite the positive outlook, the freight audit and payment service industry faces some challenges and restraints, including:

- Fragmented market: The industry is fragmented, with numerous small and medium-sized players. This fragmentation can make it difficult for businesses to compare and select the right provider.

- Data accuracy and availability: The accuracy and availability of data can be a challenge for freight audit and payment services. Data can be scattered across multiple systems and sources, making it difficult to consolidate and analyze.

- Lack of standardization: There is a lack of standardization in the freight audit and payment industry, which can lead to inconsistencies and errors. This can make it difficult for businesses to compare rates and services across different providers.

- Security concerns: Freight audit and payment services handle sensitive financial and shipment information, which can make them a target for cyberattacks. Businesses need to ensure that their providers have adequate security measures in place.

Key Region or Country & Segment to Dominate the Market

Region: The Asia-Pacific (APAC) region is expected to dominate the freight audit and payment service market over the next five years. Factors such as rapid economic growth, increasing trade, and government initiatives are driving the market in this region.

Segment: The combined transport segment is expected to grow at the highest CAGR during the forecast period. This growth is attributed to the increasing adoption of intermodal transportation solutions by businesses seeking to optimize their supply chains and reduce costs.

Growth Catalysts in Freight Audit and Payment Service Industry

Several growth catalysts are expected to drive the freight audit and payment service industry in the coming years, including:

- Growing adoption of artificial intelligence (AI) and machine learning (ML): AI and ML can automate many tasks in the freight audit and payment process, further reducing costs and improving efficiency.

- Expansion of e-commerce: The growth of e-commerce is increasing the demand for freight audit and payment services, as businesses need to manage the complex logistics involved in online retail.

- Government regulations: Governments around the world are implementing stricter regulations on freight transportation, which will drive demand for compliance-related services from freight audit and payment providers.

- Increased focus on customer service: Freight audit and payment providers are focusing on providing exceptional customer service, including personalized support and proactive communication.

Leading Players in the Freight Audit and Payment Service

Leading players in the freight audit and payment service industry include:

- Acuitive Solutions

- Blume Global

- Cass Information Systems

- ControlPay

- CT Logistics

- CTSI-Global

- Data2Logistics

- enVista

- Green Mountain Technology

- Intelligent Audit

- INTERLOG

- nVision Global

- RateLinx

- Software Solutions Unlimited

- TranzAct

- Trax

- U.S. Bank

Significant Developments in Freight Audit and Payment Service Sector

Recent significant developments in the freight audit and payment service sector include:

- Acquisitions: Several major freight audit and payment providers have acquired smaller players to expand their capabilities and geographic reach.

- Partnerships: Freight audit and payment providers are partnering with other supply chain technology providers to offer integrated solutions to customers.

- Product innovations: Providers are investing in developing new products and features to meet the evolving needs of businesses.

- Cloud adoption: There is a growing adoption of cloud-based freight audit and payment services, as businesses seek to reduce IT costs and improve flexibility.

Comprehensive Coverage Freight Audit and Payment Service Report

For a comprehensive overview of the freight audit and payment service industry, including market size, forecasts, competitive landscape, and industry trends, refer to the [full report]( rel="nofollow").

Freight Audit and Payment Service Segmentation

-

1. Type

- 1.1. Cross-border Trade

- 1.2. Domestic Trade

-

2. Application

- 2.1. Ocean Transport

- 2.2. Air Transport

- 2.3. Land Transport

- 2.4. Combined Transport

Freight Audit and Payment Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Freight Audit and Payment Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Can you provide examples of recent developments in the market?

undefined

What are some drivers contributing to market growth?

.

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Freight Audit and Payment Service," which aids in identifying and referencing the specific market segment covered.

What are the main segments of the Freight Audit and Payment Service?

The market segments include

How can I stay updated on further developments or reports in the Freight Audit and Payment Service?

To stay informed about further developments, trends, and reports in the Freight Audit and Payment Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00 , USD 5220.00, and USD 6960.00 respectively.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Freight Audit and Payment Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cross-border Trade

- 5.1.2. Domestic Trade

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Ocean Transport

- 5.2.2. Air Transport

- 5.2.3. Land Transport

- 5.2.4. Combined Transport

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Freight Audit and Payment Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cross-border Trade

- 6.1.2. Domestic Trade

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Ocean Transport

- 6.2.2. Air Transport

- 6.2.3. Land Transport

- 6.2.4. Combined Transport

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Freight Audit and Payment Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cross-border Trade

- 7.1.2. Domestic Trade

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Ocean Transport

- 7.2.2. Air Transport

- 7.2.3. Land Transport

- 7.2.4. Combined Transport

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Freight Audit and Payment Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cross-border Trade

- 8.1.2. Domestic Trade

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Ocean Transport

- 8.2.2. Air Transport

- 8.2.3. Land Transport

- 8.2.4. Combined Transport

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Freight Audit and Payment Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cross-border Trade

- 9.1.2. Domestic Trade

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Ocean Transport

- 9.2.2. Air Transport

- 9.2.3. Land Transport

- 9.2.4. Combined Transport

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Freight Audit and Payment Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cross-border Trade

- 10.1.2. Domestic Trade

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Ocean Transport

- 10.2.2. Air Transport

- 10.2.3. Land Transport

- 10.2.4. Combined Transport

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Acuitive Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Blume Global

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cass Information Systems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ControlPay

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CT Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CTSI-Global

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Data2Logistics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 enVista

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Green Mountain Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Intelligent Audit

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 INTERLOG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 nVision Global

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 RateLinx

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Software Solutions Unlimited

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 TranzAct

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Trax

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 U.S. Bank

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Acuitive Solutions

- Figure 1: Global Freight Audit and Payment Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Freight Audit and Payment Service Revenue (million), by Type 2024 & 2032

- Figure 3: North America Freight Audit and Payment Service Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Freight Audit and Payment Service Revenue (million), by Application 2024 & 2032

- Figure 5: North America Freight Audit and Payment Service Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Freight Audit and Payment Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Freight Audit and Payment Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Freight Audit and Payment Service Revenue (million), by Type 2024 & 2032

- Figure 9: South America Freight Audit and Payment Service Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Freight Audit and Payment Service Revenue (million), by Application 2024 & 2032

- Figure 11: South America Freight Audit and Payment Service Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Freight Audit and Payment Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Freight Audit and Payment Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Freight Audit and Payment Service Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Freight Audit and Payment Service Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Freight Audit and Payment Service Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Freight Audit and Payment Service Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Freight Audit and Payment Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Freight Audit and Payment Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Freight Audit and Payment Service Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Freight Audit and Payment Service Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Freight Audit and Payment Service Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Freight Audit and Payment Service Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Freight Audit and Payment Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Freight Audit and Payment Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Freight Audit and Payment Service Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Freight Audit and Payment Service Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Freight Audit and Payment Service Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Freight Audit and Payment Service Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Freight Audit and Payment Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Freight Audit and Payment Service Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Freight Audit and Payment Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Freight Audit and Payment Service Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Freight Audit and Payment Service Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Freight Audit and Payment Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Freight Audit and Payment Service Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Freight Audit and Payment Service Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Freight Audit and Payment Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Freight Audit and Payment Service Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Freight Audit and Payment Service Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Freight Audit and Payment Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Freight Audit and Payment Service Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Freight Audit and Payment Service Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Freight Audit and Payment Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Freight Audit and Payment Service Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Freight Audit and Payment Service Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Freight Audit and Payment Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Freight Audit and Payment Service Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Freight Audit and Payment Service Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Freight Audit and Payment Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Freight Audit and Payment Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.