Glasswool Rolls

Glasswool RollsGlasswool Rolls Navigating Dynamics Comprehensive Analysis and Forecasts 2025-2033

Glasswool Rolls by Type (Below 15kg/m3, 15kg/m3-20kg/m3, 20kg/m3-25kg/m3, Above 25kg/m3), by Application (Construction Industry, Chemical Industry, Transportation Industry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global glasswool rolls market exhibits robust growth, driven by the expanding construction and industrial sectors. The market, segmented by density (Below 15kg/m3, 15kg/m3-20kg/m3, 20kg/m3-25kg/m3, Above 25kg/m3) and application (Construction, Chemical, Transportation, Others), is projected to experience significant expansion over the forecast period (2025-2033). While precise market size figures for 2019-2024 are unavailable, leveraging industry reports and assuming a conservative CAGR of 5% (a reasonable estimate given the steady growth of construction and insulation needs), we can infer a substantial market value. The construction industry's demand for thermal and acoustic insulation, coupled with increasing stringent building codes, is a primary growth driver. Furthermore, the chemical and transportation industries utilize glasswool rolls for various applications, contributing to overall market expansion. However, fluctuating raw material prices and environmental concerns related to manufacturing processes pose potential restraints. The market’s competitive landscape includes major players like Corning, Saint-Gobain (ISOVER), and Knauf Insulation, indicating considerable investment and innovation within the sector. Regional variations exist, with North America and Europe currently holding significant market share due to established infrastructure and higher adoption rates. However, the Asia-Pacific region, particularly China and India, is poised for rapid growth due to burgeoning construction activities and rising disposable incomes. The increasing focus on sustainable building practices and energy efficiency is expected to further fuel demand for high-performance glasswool insulation solutions in the coming years.

The strategic focus of key players is shifting towards product innovation and diversification to meet the evolving demands of different market segments. This includes developing products with improved thermal performance, enhanced fire resistance, and better sound absorption properties. Companies are also increasingly focusing on sustainable manufacturing practices to address environmental concerns. The emergence of new technologies and materials, alongside government initiatives promoting energy efficiency, will further shape the market trajectory. The forecast period will likely witness a shift towards higher-density glasswool rolls driven by their superior insulation capabilities. Geographical expansion into developing economies presents lucrative opportunities, especially as these regions witness rapid infrastructure development. However, maintaining a competitive edge will necessitate continuous innovation and adapting to the evolving regulatory landscape.

Glasswool Rolls Trends

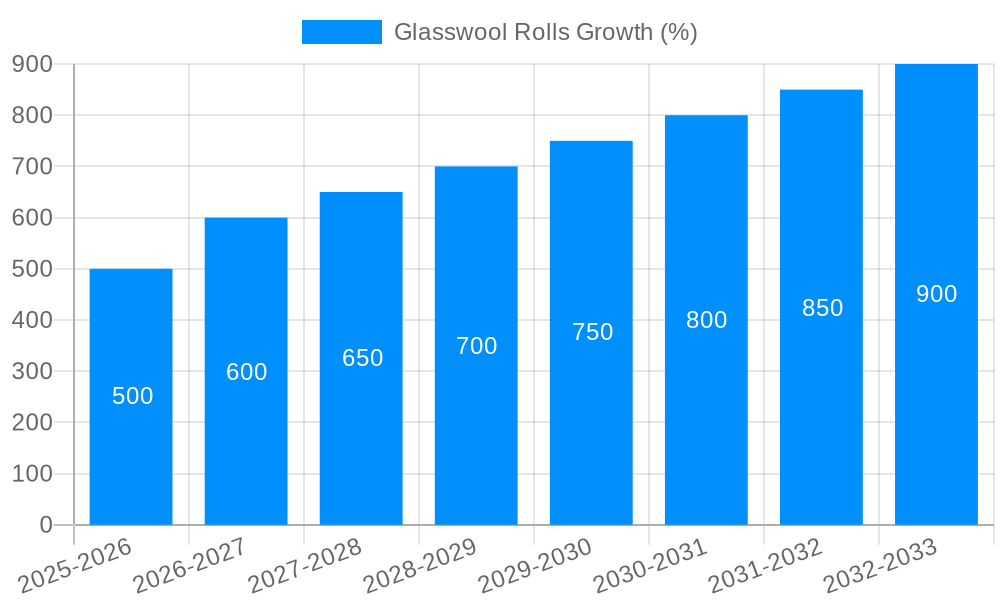

The global glasswool rolls market exhibited robust growth between 2019 and 2024, driven primarily by the burgeoning construction industry and increasing demand for thermal and acoustic insulation. The market value, exceeding several billion USD in 2024, is projected to continue its upward trajectory, with estimations suggesting a substantial rise to tens of billions of USD by 2033. This growth is fueled by several factors, including stringent building codes emphasizing energy efficiency, the rise of eco-conscious construction practices, and the expanding global infrastructure development projects. The market is segmented based on density (below 15kg/m³, 15-20kg/m³, 20-25kg/m³, above 25kg/m³), with the higher-density segments showing particularly strong growth due to their superior insulation properties. Demand is geographically diverse, with significant contributions from North America, Europe, and Asia-Pacific regions. Key players are strategically investing in research and development to improve product performance, expand production capacity, and explore new applications in niche sectors, such as industrial processes and transportation. The forecast period (2025-2033) anticipates a sustained growth rate, driven by ongoing urbanization and the increasing adoption of energy-efficient building materials worldwide. Innovation in manufacturing processes, leading to cost reductions and improved product quality, is further bolstering market expansion. The competition is intense, with major players focusing on expanding their market share through strategic alliances, acquisitions, and geographical expansion.

Driving Forces: What's Propelling the Glasswool Rolls Market?

Several key factors are propelling the growth of the glasswool rolls market. The most significant is the escalating demand for energy-efficient buildings. Governments worldwide are implementing stricter building codes and energy efficiency standards, mandating the use of high-performance insulation materials like glasswool. This regulatory push is a primary driver of market expansion, particularly in developed nations and rapidly developing economies. Furthermore, the rising awareness of environmental concerns and the growing adoption of sustainable building practices are contributing significantly to the demand for eco-friendly insulation solutions. Glasswool, a recyclable material with a relatively low environmental impact compared to some alternatives, is increasingly favored in green building projects. The booming construction industry, spurred by urbanization and infrastructure development globally, is another major catalyst. Large-scale construction projects, such as residential complexes, commercial buildings, and industrial facilities, require substantial quantities of insulation materials, creating a vast and expanding market for glasswool rolls. Finally, the inherent superior thermal and acoustic insulation properties of glasswool, coupled with its cost-effectiveness, make it a highly competitive option compared to other insulation materials.

Challenges and Restraints in the Glasswool Rolls Market

Despite the positive growth outlook, the glasswool rolls market faces certain challenges. Fluctuations in raw material prices, particularly those of glass and other essential components, can significantly impact production costs and profitability. The industry's reliance on energy-intensive manufacturing processes also presents a concern, making it vulnerable to energy price volatility and environmental regulations aimed at reducing carbon emissions. Competition from alternative insulation materials, such as mineral wool, polyurethane foam, and cellulose insulation, poses a challenge, requiring manufacturers to continuously innovate and improve their products to maintain a competitive edge. Furthermore, concerns about the potential health risks associated with handling glasswool, although mitigated by advancements in manufacturing and safety standards, can affect consumer perception and demand. Finally, geopolitical instability and economic downturns can create uncertainty and negatively impact construction activity, thereby reducing demand for glasswool rolls. Managing these challenges effectively will be crucial for sustainable growth in the market.

Key Region or Country & Segment to Dominate the Market

The Construction Industry segment is projected to dominate the glasswool rolls market throughout the forecast period (2025-2033). This dominance is underpinned by several factors:

Massive infrastructure development: Global urbanization and the ongoing need for new residential and commercial buildings continue to drive robust demand.

Energy efficiency mandates: Stringent building codes worldwide are increasingly emphasizing energy efficiency, boosting the adoption of glasswool for insulation.

Growing awareness of sustainability: The construction industry is moving towards sustainable practices, and glasswool's relatively low environmental impact makes it a preferred choice.

Cost-effectiveness: Glasswool offers a good balance between performance and cost, making it attractive for large-scale construction projects.

Versatility: Glasswool rolls can be easily adapted for various applications in building construction, increasing its demand.

Geographically, North America and Europe are expected to remain significant markets, driven by established construction activity and stringent energy regulations. However, the Asia-Pacific region is predicted to experience the highest growth rate due to rapid urbanization, industrialization, and increasing disposable incomes. Within the density segments, the 15kg/m³-20kg/m³ range is likely to see strong growth due to its balance of performance and affordability, making it suitable for various applications in both residential and commercial construction. The higher density segments (above 25kg/m³) will also see growth, particularly in specialized applications requiring superior insulation performance.

Growth Catalysts in the Glasswool Rolls Industry

The glasswool rolls industry's growth is fueled by several converging trends. Increased government initiatives promoting energy efficiency in buildings, coupled with rising awareness among consumers about sustainable construction practices, are driving demand. Technological advancements in manufacturing processes are leading to cost reductions and improved product quality, making glasswool a more competitive option compared to alternatives. The booming construction sector globally, driven by urbanization and infrastructure development, creates immense demand for this versatile insulation material. Finally, innovative applications of glasswool in niche sectors, such as industrial processes and transportation, are opening up new market avenues for growth.

Leading Players in the Glasswool Rolls Market

- Corning Incorporated (Corning)

- Thermo Fisher Scientific (Thermo Scientific)

- ISOVER (Saint-Gobain) (Saint-Gobain)

- Knauf Insulation Ltd

- IKING GROUP

- MilliporeSigma (Merck KGaA, Darmstadt, Germany)

- United Scientific

- Ohio Valley Specialty Chemical

- LECO Corporation

- Chemglass Life Sciences

- Micromeritics Instrument Corporation

- Teledyne Tekmar

- Ce Elantech, Inc

- Hach Company

- Cole-Parmer

- Crescent Chemical Co., Inc

- ROCKAL

- PerkinElmer US LLC (PerkinElmer)

- KCC CORPORATION

- STM Technologies Srl.

- Johns Manville (Johns Manville)

- Huamei Energy-saving Technology Group Co., Ltd.

Significant Developments in the Glasswool Rolls Sector

- 2021: Knauf Insulation launched a new range of glasswool rolls with enhanced fire-resistant properties.

- 2022: Saint-Gobain invested in expanding its glasswool production capacity in Southeast Asia to meet growing demand.

- 2023: Several major manufacturers introduced glasswool rolls with improved acoustic insulation properties.

- 2024: A significant partnership formed between a major glasswool manufacturer and a construction company to promote the use of sustainable building materials.

Comprehensive Coverage Glasswool Rolls Report

This report provides a detailed analysis of the global glasswool rolls market, covering historical data (2019-2024), the estimated year (2025), and a comprehensive forecast for 2025-2033. The report segments the market by type (density) and application, providing insights into key market trends, growth drivers, challenges, and competitive dynamics. It includes profiles of major players, analysis of regional markets, and a discussion of significant developments in the industry. The report is a valuable resource for businesses involved in the manufacturing, distribution, and use of glasswool rolls, offering strategic insights to support informed decision-making and investment strategies.

Glasswool Rolls Segmentation

-

1. Type

- 1.1. Overview: Global Glasswool Rolls Consumption Value

- 1.2. Below 15kg/m3

- 1.3. 15kg/m3-20kg/m3

- 1.4. 20kg/m3-25kg/m3

- 1.5. Above 25kg/m3

-

2. Application

- 2.1. Overview: Global Glasswool Rolls Consumption Value

- 2.2. Construction Industry

- 2.3. Chemical Industry

- 2.4. Transportation Industry

- 2.5. Others

Glasswool Rolls Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Glasswool Rolls REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Glasswool Rolls Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Below 15kg/m3

- 5.1.2. 15kg/m3-20kg/m3

- 5.1.3. 20kg/m3-25kg/m3

- 5.1.4. Above 25kg/m3

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Construction Industry

- 5.2.2. Chemical Industry

- 5.2.3. Transportation Industry

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Glasswool Rolls Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Below 15kg/m3

- 6.1.2. 15kg/m3-20kg/m3

- 6.1.3. 20kg/m3-25kg/m3

- 6.1.4. Above 25kg/m3

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Construction Industry

- 6.2.2. Chemical Industry

- 6.2.3. Transportation Industry

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Glasswool Rolls Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Below 15kg/m3

- 7.1.2. 15kg/m3-20kg/m3

- 7.1.3. 20kg/m3-25kg/m3

- 7.1.4. Above 25kg/m3

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Construction Industry

- 7.2.2. Chemical Industry

- 7.2.3. Transportation Industry

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Glasswool Rolls Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Below 15kg/m3

- 8.1.2. 15kg/m3-20kg/m3

- 8.1.3. 20kg/m3-25kg/m3

- 8.1.4. Above 25kg/m3

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Construction Industry

- 8.2.2. Chemical Industry

- 8.2.3. Transportation Industry

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Glasswool Rolls Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Below 15kg/m3

- 9.1.2. 15kg/m3-20kg/m3

- 9.1.3. 20kg/m3-25kg/m3

- 9.1.4. Above 25kg/m3

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Construction Industry

- 9.2.2. Chemical Industry

- 9.2.3. Transportation Industry

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Glasswool Rolls Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Below 15kg/m3

- 10.1.2. 15kg/m3-20kg/m3

- 10.1.3. 20kg/m3-25kg/m3

- 10.1.4. Above 25kg/m3

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Construction Industry

- 10.2.2. Chemical Industry

- 10.2.3. Transportation Industry

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Corning

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thermo Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ISOVER(Saint-Gobain)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Knauf Insulation Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IKING GROUP

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MilliporeSigma

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 United Scientific

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ohio Valley Specialty Chemical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LECO Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Chemglass Life Sciences

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Micromeritics Instrument Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Teledyne Tekmar

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ce Elantech Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hach Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Cole-Parmer

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Crescent Chemical Co Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ROCKAL

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Perkin Elmer US LLC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 KCC CORPORATION

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 STM Technologies Srl.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Johns Manville

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Huamei Energy-saving Technology Group Co. Ltd.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Corning

- Figure 1: Global Glasswool Rolls Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Glasswool Rolls Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Glasswool Rolls Revenue (million), by Type 2024 & 2032

- Figure 4: North America Glasswool Rolls Volume (K), by Type 2024 & 2032

- Figure 5: North America Glasswool Rolls Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Glasswool Rolls Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Glasswool Rolls Revenue (million), by Application 2024 & 2032

- Figure 8: North America Glasswool Rolls Volume (K), by Application 2024 & 2032

- Figure 9: North America Glasswool Rolls Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Glasswool Rolls Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Glasswool Rolls Revenue (million), by Country 2024 & 2032

- Figure 12: North America Glasswool Rolls Volume (K), by Country 2024 & 2032

- Figure 13: North America Glasswool Rolls Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Glasswool Rolls Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Glasswool Rolls Revenue (million), by Type 2024 & 2032

- Figure 16: South America Glasswool Rolls Volume (K), by Type 2024 & 2032

- Figure 17: South America Glasswool Rolls Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Glasswool Rolls Volume Share (%), by Type 2024 & 2032

- Figure 19: South America Glasswool Rolls Revenue (million), by Application 2024 & 2032

- Figure 20: South America Glasswool Rolls Volume (K), by Application 2024 & 2032

- Figure 21: South America Glasswool Rolls Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Glasswool Rolls Volume Share (%), by Application 2024 & 2032

- Figure 23: South America Glasswool Rolls Revenue (million), by Country 2024 & 2032

- Figure 24: South America Glasswool Rolls Volume (K), by Country 2024 & 2032

- Figure 25: South America Glasswool Rolls Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Glasswool Rolls Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Glasswool Rolls Revenue (million), by Type 2024 & 2032

- Figure 28: Europe Glasswool Rolls Volume (K), by Type 2024 & 2032

- Figure 29: Europe Glasswool Rolls Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Glasswool Rolls Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe Glasswool Rolls Revenue (million), by Application 2024 & 2032

- Figure 32: Europe Glasswool Rolls Volume (K), by Application 2024 & 2032

- Figure 33: Europe Glasswool Rolls Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe Glasswool Rolls Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe Glasswool Rolls Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Glasswool Rolls Volume (K), by Country 2024 & 2032

- Figure 37: Europe Glasswool Rolls Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Glasswool Rolls Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Glasswool Rolls Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa Glasswool Rolls Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa Glasswool Rolls Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa Glasswool Rolls Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa Glasswool Rolls Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa Glasswool Rolls Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa Glasswool Rolls Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa Glasswool Rolls Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa Glasswool Rolls Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Glasswool Rolls Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Glasswool Rolls Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Glasswool Rolls Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Glasswool Rolls Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific Glasswool Rolls Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific Glasswool Rolls Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific Glasswool Rolls Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific Glasswool Rolls Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific Glasswool Rolls Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific Glasswool Rolls Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Glasswool Rolls Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Glasswool Rolls Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Glasswool Rolls Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Glasswool Rolls Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Glasswool Rolls Volume Share (%), by Country 2024 & 2032

- Table 1: Global Glasswool Rolls Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Glasswool Rolls Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Glasswool Rolls Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Glasswool Rolls Volume K Forecast, by Type 2019 & 2032

- Table 5: Global Glasswool Rolls Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Glasswool Rolls Volume K Forecast, by Application 2019 & 2032

- Table 7: Global Glasswool Rolls Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Glasswool Rolls Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Glasswool Rolls Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Glasswool Rolls Volume K Forecast, by Type 2019 & 2032

- Table 11: Global Glasswool Rolls Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Glasswool Rolls Volume K Forecast, by Application 2019 & 2032

- Table 13: Global Glasswool Rolls Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Glasswool Rolls Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Glasswool Rolls Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global Glasswool Rolls Volume K Forecast, by Type 2019 & 2032

- Table 23: Global Glasswool Rolls Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global Glasswool Rolls Volume K Forecast, by Application 2019 & 2032

- Table 25: Global Glasswool Rolls Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Glasswool Rolls Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Glasswool Rolls Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global Glasswool Rolls Volume K Forecast, by Type 2019 & 2032

- Table 35: Global Glasswool Rolls Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global Glasswool Rolls Volume K Forecast, by Application 2019 & 2032

- Table 37: Global Glasswool Rolls Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Glasswool Rolls Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Glasswool Rolls Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global Glasswool Rolls Volume K Forecast, by Type 2019 & 2032

- Table 59: Global Glasswool Rolls Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global Glasswool Rolls Volume K Forecast, by Application 2019 & 2032

- Table 61: Global Glasswool Rolls Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Glasswool Rolls Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Glasswool Rolls Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global Glasswool Rolls Volume K Forecast, by Type 2019 & 2032

- Table 77: Global Glasswool Rolls Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global Glasswool Rolls Volume K Forecast, by Application 2019 & 2032

- Table 79: Global Glasswool Rolls Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Glasswool Rolls Volume K Forecast, by Country 2019 & 2032

- Table 81: China Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Glasswool Rolls Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Glasswool Rolls Volume (K) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.