Heavy Equipment Glass Replacement

Heavy Equipment Glass ReplacementHeavy Equipment Glass Replacement Analysis Report 2025: Market to Grow by a CAGR of XX to 2033, Driven by Government Incentives, Popularity of Virtual Assistants, and Strategic Partnerships

Heavy Equipment Glass Replacement by Type (Minor Repairs, Complete Glass Replacements), by Application (Construction Equipment, Agricultural Equipment, Mining Equipment, RV, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

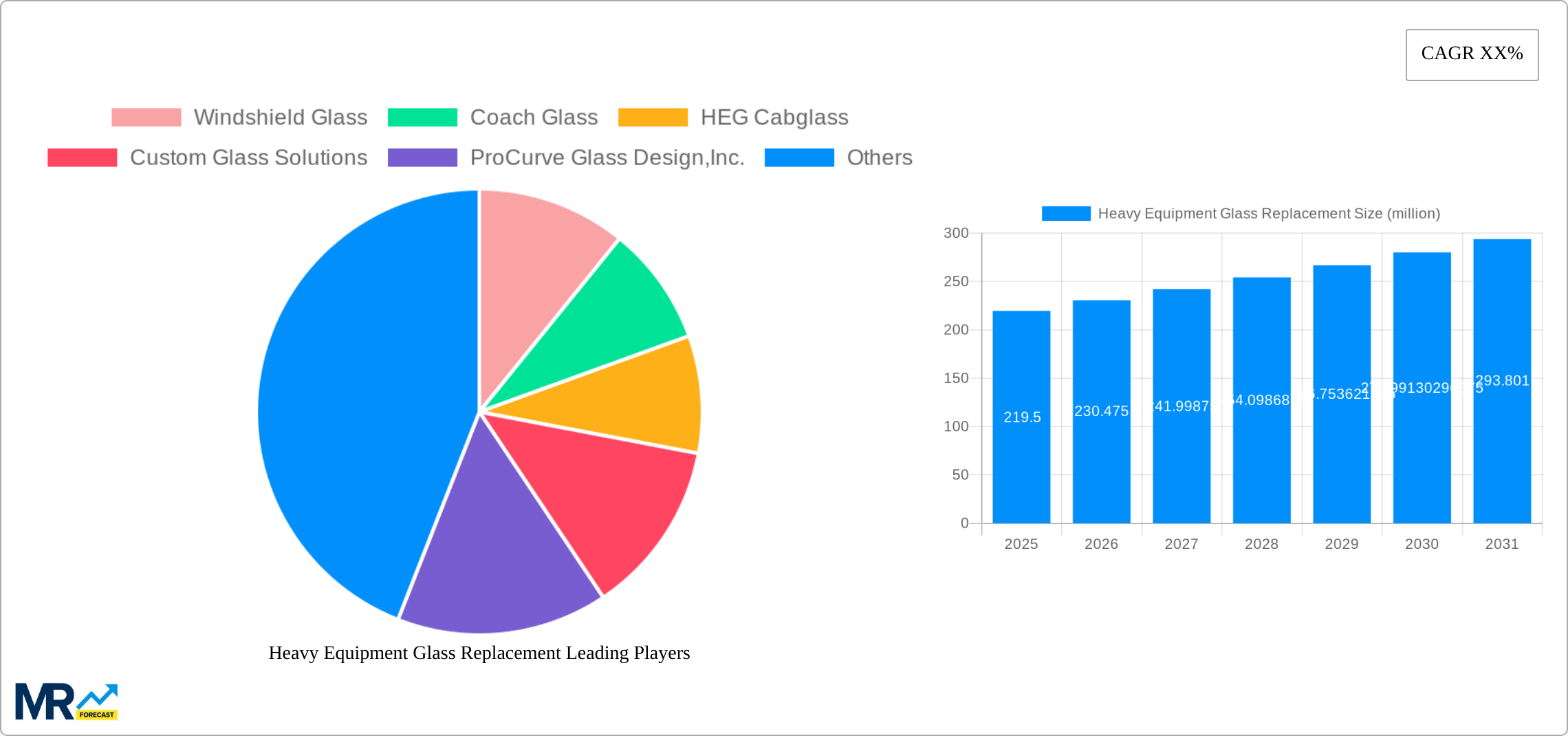

The heavy equipment glass replacement market, valued at $219.5 million in 2025, is poised for significant growth over the next decade. Driven by the increasing age and operational intensity of construction, agricultural, and mining equipment fleets, the demand for glass repairs and replacements is steadily rising. Furthermore, advancements in glass technology, including the development of stronger, more impact-resistant materials, are contributing to market expansion. The segment focused on complete glass replacements is expected to witness higher growth compared to minor repairs, as operators prioritize safety and operational efficiency. Regional variations exist, with North America and Europe currently holding the largest market shares due to established equipment fleets and robust infrastructure. However, rapidly developing economies in Asia-Pacific are exhibiting strong growth potential, driven by infrastructure development and increasing industrial activity. While the market faces restraints such as fluctuating raw material prices and economic downturns, the long-term outlook remains positive due to the inherent need for glass replacement in heavy equipment. The market is fragmented with numerous players ranging from specialized glass companies to regional auto glass installers, creating opportunities for both large-scale manufacturers and local businesses.

The competitive landscape is characterized by a mix of large multinational corporations and smaller, regional players. Large manufacturers benefit from economies of scale and established distribution networks, while smaller firms often offer specialized services and quicker turnaround times. Industry consolidation is possible through mergers and acquisitions as larger firms seek to increase their market share. Future growth will be influenced by factors such as government regulations on safety standards in heavy equipment, technological advancements in glass production, and the overall health of the construction, agricultural, and mining sectors. Key market participants are constantly innovating to provide improved glass solutions with enhanced durability, impact resistance, and heat resistance, further fueling market growth. A focus on sustainable manufacturing practices and the utilization of recycled materials is also expected to gain momentum in the coming years.

Heavy Equipment Glass Replacement Trends

The heavy equipment glass replacement market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by increasing construction, agricultural, and mining activities globally, the demand for replacement glass across various equipment types is significantly expanding. The market witnessed a Compound Annual Growth Rate (CAGR) during the historical period (2019-2024), with the estimated market size in 2025 exceeding XXX million units. This growth is fueled by several factors, including the aging heavy equipment fleet requiring more frequent repairs and replacements, the rising adoption of advanced safety features incorporating specialized glass, and an increasing focus on operator comfort and visibility. While minor repairs still constitute a significant portion of the market, complete glass replacements are demonstrating faster growth due to the increasing complexity of heavy equipment glass and the rising costs associated with repairs that fall short of providing complete structural integrity. Furthermore, technological advancements in glass manufacturing, such as improved strength, impact resistance, and UV protection, are boosting market expansion. The forecast period (2025-2033) anticipates continued strong growth, propelled by ongoing infrastructure development projects, agricultural modernization, and the expanding mining sector, particularly in developing economies. This report provides detailed analysis across various segments including type (minor repairs, complete replacements), application (construction, agriculture, mining, RV, others), and geographical regions, offering valuable insights for businesses operating in this dynamic sector.

Driving Forces: What's Propelling the Heavy Equipment Glass Replacement Market?

Several key factors are driving the expansion of the heavy equipment glass replacement market. Firstly, the continuous growth of infrastructure development projects worldwide fuels an increased demand for construction equipment, leading to a higher incidence of glass damage and subsequent replacement needs. Agricultural modernization, particularly in regions with growing populations and food demands, requires robust and advanced agricultural machinery, significantly increasing the market for specialized, high-durability glass. The mining industry, with its inherent risks and harsh operating conditions, also contributes to a substantial demand for replacements. Moreover, the rising focus on operator safety and comfort plays a crucial role, as manufacturers incorporate enhanced glass solutions designed to improve visibility, reduce glare, and offer increased protection against impacts. The trend towards longer equipment lifespans, coupled with increasing maintenance and repair costs, also contributes to the growth of the market, as companies invest in preserving their existing fleets. Finally, advancements in glass manufacturing technologies, including the development of lighter, stronger, and more resistant glass types, further boost market expansion by providing superior durability and performance.

Challenges and Restraints in Heavy Equipment Glass Replacement

Despite the strong growth potential, the heavy equipment glass replacement market faces certain challenges. The high initial cost of specialized glass, coupled with the complexities of installation and repair, can act as a barrier for some end-users. This is especially true in regions with limited access to skilled technicians and specialized replacement parts. The fluctuating prices of raw materials used in glass manufacturing can also impact market dynamics, potentially leading to price volatility. Furthermore, the varied nature of heavy equipment and the diverse operational environments present logistical challenges in the efficient and timely provision of replacement services. Economic downturns or a decrease in construction, agricultural, or mining activities can negatively affect demand. Finally, the competitive landscape, with numerous players vying for market share, requires companies to continuously innovate and offer competitive pricing and services to remain successful.

Key Region or Country & Segment to Dominate the Market

Complete Glass Replacements Segment Dominance: The segment representing complete glass replacements is expected to exhibit the most significant growth during the forecast period (2025-2033). This is primarily due to factors like the increasing age of heavy equipment fleets necessitating comprehensive replacements rather than minor repairs, alongside the rising incorporation of advanced safety features and improved glass technologies.

Construction Equipment Application: Within applications, the construction equipment sector is projected to dominate the market. The continuous expansion of infrastructure development projects globally, coupled with the substantial fleet size of construction equipment, generates significant demand for glass replacement services. The demanding nature of construction environments leads to higher instances of glass damage, contributing to the segment's leading market share.

North America: The strong construction and agricultural sectors in North America, coupled with robust infrastructure investments, position this region as a key market driver for heavy equipment glass replacements. The presence of established players and a well-developed supply chain further enhances its market dominance.

Europe: Europe is also a significant market, fueled by a robust construction industry and government initiatives focusing on infrastructure development. Stringent safety regulations also drive demand for high-quality replacement glass.

Asia-Pacific: Rapid economic growth and urbanization in several countries within the Asia-Pacific region are fueling substantial infrastructure development. The expanding mining and agricultural sectors also contribute to the rising demand for heavy equipment glass replacements. However, challenges related to supply chain logistics and skilled workforce availability may exist.

Rest of the World: This region, encompassing Latin America, the Middle East, and Africa, presents a significant albeit fragmented market. Growth in this region is driven by localized infrastructural projects and mining activities. However, market penetration may be hampered by economic fluctuations and infrastructural limitations.

The market's growth is inextricably linked to the overall economic health and infrastructural development of these key regions. Therefore, ongoing political and economic stability plays a crucial role in shaping market dynamics.

Growth Catalysts in the Heavy Equipment Glass Replacement Industry

The industry's growth is primarily fueled by the expansion of infrastructure projects worldwide, the rising demand for agricultural machinery, and the ongoing development of the mining sector. These factors, coupled with technological advancements in glass manufacturing leading to improved strength, durability, and safety features, create a strong foundation for continued market expansion. Increasing awareness of operator safety and comfort is further driving the demand for high-quality glass replacements.

Leading Players in the Heavy Equipment Glass Replacement Market

- Windshield Glass

- Coach Glass

- HEG Cabglass

- Custom Glass Solutions

- ProCurve Glass Design, Inc.

- Action Glass

- Sunrise Glass

- Lloyd's Of Shelton Auto Glass

- Paul's Glass

- USA Replacement Auto Glass

- City Glass Company

- West Virginia Glass Company

- Custom Glass & Screen

- Auto Glass Express

- Finn Lamex

- Joey's Glass Baytown

- FB Glass

- Luna Glass Work

- United Glass Services

- X-Treme Auto Glass

- North Alabama Glass

- Alderfer Auto Glass

- Four Seasons Auto Glass Ltd

- Ace Glass

- Dean's Autoglass

- Asahi India Glass Ltd

- Custom Tempered Glass

- Bradford Glass

(Note: Many of these companies lack readily available global websites. This list includes all companies mentioned in the prompt.)

Significant Developments in the Heavy Equipment Glass Replacement Sector

- 2020: Increased adoption of laminated glass for enhanced safety in heavy equipment.

- 2021: Several key players invested in automated glass cutting and installation technologies.

- 2022: Introduction of new glass formulations offering improved UV protection and impact resistance.

- 2023: Growth in partnerships between glass manufacturers and heavy equipment repair shops.

- 2024: Rising demand for customized glass solutions tailored to specific equipment models.

Comprehensive Coverage Heavy Equipment Glass Replacement Report

This report provides a detailed analysis of the heavy equipment glass replacement market, covering market size, trends, drivers, restraints, and key players. It offers a comprehensive outlook on the forecast period, providing valuable insights for businesses seeking to understand and capitalize on the growth opportunities within this dynamic sector. Segmentation by type of replacement (minor repairs, complete replacements) and equipment application (construction, agriculture, mining, etc.) allows for a granular understanding of market dynamics. Regional analysis further enhances the report’s value by providing tailored insights into key markets and growth potential.

Heavy Equipment Glass Replacement Segmentation

-

1. Type

- 1.1. Minor Repairs

- 1.2. Complete Glass Replacements

-

2. Application

- 2.1. Construction Equipment

- 2.2. Agricultural Equipment

- 2.3. Mining Equipment

- 2.4. RV

- 2.5. Others

Heavy Equipment Glass Replacement Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Heavy Equipment Glass Replacement REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

What are the main segments of the Heavy Equipment Glass Replacement?

The market segments include

What are the notable trends driving market growth?

.

Which companies are prominent players in the Heavy Equipment Glass Replacement?

Key companies in the market include Windshield Glass,Coach Glass,HEG Cabglass,Custom Glass Solutions,ProCurve Glass Design,Inc.,Action Glass,Sunrise Glass,Lloyd's Of Shelton Auto Glass,Paul's Glass,USA Replacement Auto Glass,City Glass Company,West Virginia Glass Company,Custom Glass & Screen,Auto Glass Express,Finn Lamex,Joey's Glass Baytown,FB Glass,Luna Glass Work,United Glass Services,X-Treme Auto Glass,North Alabama Glass,Alderfer Auto Glass,Four Seasons Auto Glass Ltd,Ace Glass,Dean's Autoglass,Asahi India Glass Ltd,Custom Tempered Glass,Bradford Glass,

Are there any restraints impacting market growth?

.

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million .

What are some drivers contributing to market growth?

.

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

How can I stay updated on further developments or reports in the Heavy Equipment Glass Replacement?

To stay informed about further developments, trends, and reports in the Heavy Equipment Glass Replacement, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Heavy Equipment Glass Replacement Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Minor Repairs

- 5.1.2. Complete Glass Replacements

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Construction Equipment

- 5.2.2. Agricultural Equipment

- 5.2.3. Mining Equipment

- 5.2.4. RV

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Heavy Equipment Glass Replacement Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Minor Repairs

- 6.1.2. Complete Glass Replacements

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Construction Equipment

- 6.2.2. Agricultural Equipment

- 6.2.3. Mining Equipment

- 6.2.4. RV

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Heavy Equipment Glass Replacement Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Minor Repairs

- 7.1.2. Complete Glass Replacements

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Construction Equipment

- 7.2.2. Agricultural Equipment

- 7.2.3. Mining Equipment

- 7.2.4. RV

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Heavy Equipment Glass Replacement Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Minor Repairs

- 8.1.2. Complete Glass Replacements

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Construction Equipment

- 8.2.2. Agricultural Equipment

- 8.2.3. Mining Equipment

- 8.2.4. RV

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Heavy Equipment Glass Replacement Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Minor Repairs

- 9.1.2. Complete Glass Replacements

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Construction Equipment

- 9.2.2. Agricultural Equipment

- 9.2.3. Mining Equipment

- 9.2.4. RV

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Heavy Equipment Glass Replacement Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Minor Repairs

- 10.1.2. Complete Glass Replacements

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Construction Equipment

- 10.2.2. Agricultural Equipment

- 10.2.3. Mining Equipment

- 10.2.4. RV

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Windshield Glass

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Coach Glass

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HEG Cabglass

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Custom Glass Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ProCurve Glass DesignInc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Action Glass

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sunrise Glass

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lloyd's Of Shelton Auto Glass

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Paul's Glass

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 USA Replacement Auto Glass

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 City Glass Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 West Virginia Glass Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Custom Glass & Screen

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Auto Glass Express

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Finn Lamex

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Joey's Glass Baytown

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 FB Glass

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Luna Glass Work

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 United Glass Services

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 X-Treme Auto Glass

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 North Alabama Glass

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Alderfer Auto Glass

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Four Seasons Auto Glass Ltd

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Ace Glass

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Dean's Autoglass

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Asahi India Glass Ltd

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Custom Tempered Glass

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Bradford Glass

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.1 Windshield Glass

- Figure 1: Global Heavy Equipment Glass Replacement Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Heavy Equipment Glass Replacement Revenue (million), by Type 2024 & 2032

- Figure 3: North America Heavy Equipment Glass Replacement Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Heavy Equipment Glass Replacement Revenue (million), by Application 2024 & 2032

- Figure 5: North America Heavy Equipment Glass Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Heavy Equipment Glass Replacement Revenue (million), by Country 2024 & 2032

- Figure 7: North America Heavy Equipment Glass Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Heavy Equipment Glass Replacement Revenue (million), by Type 2024 & 2032

- Figure 9: South America Heavy Equipment Glass Replacement Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Heavy Equipment Glass Replacement Revenue (million), by Application 2024 & 2032

- Figure 11: South America Heavy Equipment Glass Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Heavy Equipment Glass Replacement Revenue (million), by Country 2024 & 2032

- Figure 13: South America Heavy Equipment Glass Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Heavy Equipment Glass Replacement Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Heavy Equipment Glass Replacement Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Heavy Equipment Glass Replacement Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Heavy Equipment Glass Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Heavy Equipment Glass Replacement Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Heavy Equipment Glass Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Heavy Equipment Glass Replacement Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Heavy Equipment Glass Replacement Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Heavy Equipment Glass Replacement Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Heavy Equipment Glass Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Heavy Equipment Glass Replacement Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Heavy Equipment Glass Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Heavy Equipment Glass Replacement Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Heavy Equipment Glass Replacement Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Heavy Equipment Glass Replacement Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Heavy Equipment Glass Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Heavy Equipment Glass Replacement Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Heavy Equipment Glass Replacement Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Heavy Equipment Glass Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Heavy Equipment Glass Replacement Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.