High Precision Integrated Navigation System

High Precision Integrated Navigation SystemHigh Precision Integrated Navigation System 2025 Trends and Forecasts 2033: Analyzing Growth Opportunities

High Precision Integrated Navigation System by Type (Loose Combination, Tight Combination), by Application (Civil, Military), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

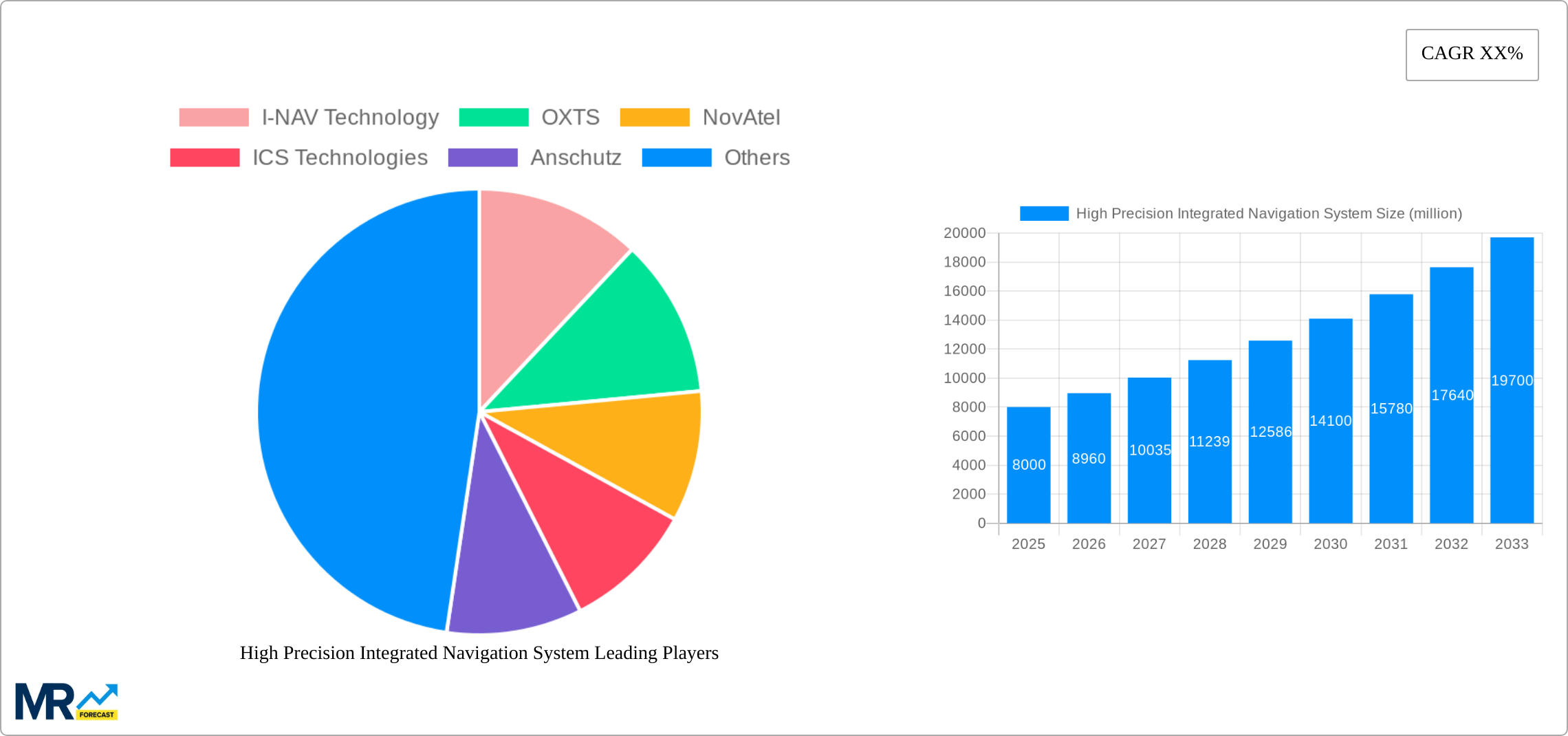

The High Precision Integrated Navigation System (HPINS) market is experiencing robust growth, driven by increasing demand across civil and military applications. The market's expansion is fueled by several key factors: the rising adoption of autonomous vehicles and drones requiring highly accurate positioning, the growing need for precise navigation in infrastructure development and surveying, and the increasing sophistication of military operations demanding reliable and secure navigation solutions. Technological advancements, such as the integration of multiple sensor technologies (GNSS, IMU, etc.) and the development of advanced algorithms for data fusion and error correction, are further propelling market growth. While the precise market size in 2025 is unavailable, considering a plausible CAGR of 12% (a conservative estimate based on similar tech sectors) and a reported value in the past (though year not specified), a reasonable projection for the 2025 market size would fall within the $2.5 billion to $3.5 billion range. This figure is further supported by the numerous companies operating within the space and their reported activities. Market segmentation shows a balance between loose and tight combinations, catering to diverse application needs and budget considerations.

Looking ahead, the HPINS market is poised for significant expansion throughout the forecast period (2025-2033). Continued advancements in sensor technology, improved algorithms, and decreasing costs will broaden market accessibility. The increasing adoption of 5G and IoT technologies is expected to further enhance the capabilities and functionalities of HPINS, leading to new applications and market opportunities. However, challenges remain, including the need for robust cybersecurity measures and the potential for interference from external factors like atmospheric conditions and jamming signals. Regional growth will vary depending on infrastructure development, technological adoption rates, and government investment in defense and related sectors. North America and Europe are expected to maintain leading positions, while Asia-Pacific is projected to show the fastest growth rate driven by increasing infrastructure projects and a rising demand for autonomous systems.

High Precision Integrated Navigation System Trends

The global high-precision integrated navigation system (HPINS) market is experiencing robust growth, projected to reach several billion USD by 2033. This surge is driven by increasing demand across diverse sectors, including civil infrastructure, military operations, and various industrial applications. The market witnessed significant expansion during the historical period (2019-2024), exceeding several hundred million USD annually. This growth trajectory is expected to continue throughout the forecast period (2025-2033), fueled by technological advancements, rising adoption rates, and the expanding scope of applications. The base year for our analysis is 2025, which marks a pivotal point of transition towards advanced HPINS technologies. Key market insights reveal a growing preference for tightly integrated systems offering enhanced accuracy and reliability compared to loosely integrated counterparts. The demand for real-time, precise positioning data is driving innovation in sensor fusion techniques and the integration of multiple navigation modalities, including GPS, inertial measurement units (IMUs), and other sensor technologies. The military segment currently holds a significant market share, owing to the critical need for accurate navigation in defense applications. However, the civil segment is experiencing rapid growth, driven by increased use in autonomous vehicles, precision agriculture, and surveying. The Asia-Pacific region is poised to be a key growth driver due to significant investments in infrastructure and the burgeoning adoption of advanced technologies. Competitive dynamics are characterized by a mix of established players and emerging innovative companies, leading to continuous improvement in product features and cost-effectiveness.

Driving Forces: What's Propelling the High Precision Integrated Navigation System

Several key factors are propelling the growth of the high-precision integrated navigation system market. The increasing demand for accurate positioning and navigation in autonomous vehicles is a primary driver, with self-driving cars, drones, and robots all requiring highly reliable and precise location data. Furthermore, the expanding infrastructure development globally necessitates advanced surveying and mapping technologies, thereby boosting the demand for HPINS. The rise of precision agriculture, where farmers use GPS-guided machinery for optimized crop management, further contributes to market growth. Military applications, such as precise targeting and navigation of autonomous weapon systems, continue to be a significant market segment, demanding high-accuracy and robust solutions. Continuous technological advancements in sensor technology, processing power, and algorithms are constantly improving the accuracy and reliability of HPINS, driving market expansion. Government regulations and policies promoting the adoption of autonomous vehicles and intelligent transportation systems are also significantly influencing market growth, pushing the demand for reliable navigation systems. Finally, the increasing availability of high-quality data and improved integration of multiple navigation sources are contributing to the overall growth of the market. These advancements are leading to enhanced accuracy, reliability, and cost-effectiveness, making HPINS accessible to a wider range of applications.

Challenges and Restraints in High Precision Integrated Navigation System

Despite the significant growth potential, the high-precision integrated navigation system market faces several challenges. The high initial investment cost of HPINS can be a barrier for entry for smaller companies and users with limited budgets. The complexity of integrating various sensor technologies and algorithms necessitates significant expertise and specialized skills, hindering wider adoption. Environmental factors, such as signal interference and atmospheric conditions, can impact the accuracy and reliability of HPINS, creating challenges in demanding operational scenarios. Furthermore, cybersecurity concerns related to the vulnerability of navigation systems to hacking and spoofing are emerging as significant restraints. The development of effective countermeasures and robust security protocols is crucial to mitigate these risks. Finally, the regulatory landscape surrounding the use of HPINS can vary across different regions, creating complexities for manufacturers seeking global market penetration. Addressing these challenges requires collaborative efforts between technology developers, regulatory bodies, and end-users to ensure the safe and reliable deployment of HPINS across diverse applications.

Key Region or Country & Segment to Dominate the Market

The market is witnessing strong growth across various regions, with the Asia-Pacific region expected to dominate in the coming years. This dominance is attributed to:

- Significant Investments in Infrastructure: Countries in the Asia-Pacific region are undertaking large-scale infrastructure projects, including high-speed rail networks, smart cities, and modernized transportation systems, all requiring precise navigation solutions.

- Growing Adoption of Autonomous Vehicles: The region is witnessing rapid advancements in the development and deployment of autonomous vehicles, further boosting the demand for HPINS.

- Expansion of the Military Segment: Increased defense spending in certain countries within the Asia-Pacific region drives the demand for high-precision navigation systems in military applications.

The military segment also holds a significant market share, with continued demand driven by:

- Enhanced Battlefield Awareness: HPINS provides crucial situational awareness to military forces, enhancing operational efficiency and reducing risks.

- Guided Weapon Systems: Precise navigation is essential for the effectiveness of guided missiles and other autonomous weapon systems.

- Autonomous Platforms: The increasing reliance on drones, unmanned aerial vehicles (UAVs), and autonomous ground vehicles in military operations fuels the demand for advanced HPINS.

In contrast to loosely integrated systems, tightly integrated HPINS are gaining significant traction due to their superior accuracy, reliability, and robustness. This preference stems from:

- Improved Sensor Fusion: Tight integration enables seamless fusion of data from multiple sensors, reducing errors and enhancing overall accuracy.

- Enhanced Robustness: The tight coupling of sensors and algorithms results in a more robust system that is less susceptible to interference and failures.

- Real-time Performance: Tightly integrated systems provide real-time, high-precision positioning data crucial for many applications.

Growth Catalysts in High Precision Integrated Navigation System Industry

The continued miniaturization and decreasing cost of high-performance sensors, coupled with advancements in data processing algorithms and increased computational power, are major growth catalysts. The emergence of new applications, such as autonomous delivery systems and precision robotics in various industries, further accelerates market expansion. Furthermore, supportive government initiatives and increased private investment in research and development are driving innovation and fueling the growth of the HPINS industry.

Leading Players in the High Precision Integrated Navigation System

- I-NAV Technology

- OXTS

- NovAtel

- ICS Technologies

- Anschutz

- Hensoldt

- Beijing BDStar Navigation

- Beijing Highlander Digital Technology

- Sanetel Technology

- Unicore Communications

- CHCNVA

- Bynav

- Guangzhou Asensing Technology

- Quectel

- Daisch

- Bdstar Navigation

- Joynext Technology

- Sand Canyon Tech

- SBG Systems

- Hi-Target

- Bewis Sensing

Significant Developments in High Precision Integrated Navigation System Sector

- 2020: NovAtel released a new generation of high-precision GNSS receivers.

- 2021: OXTS launched an improved inertial navigation system with enhanced accuracy.

- 2022: Several companies announced partnerships to integrate HPINS into autonomous vehicle platforms.

- 2023: Significant advancements in sensor fusion algorithms were reported, leading to improved accuracy and reliability.

Comprehensive Coverage High Precision Integrated Navigation System Report

This report provides a detailed analysis of the high-precision integrated navigation system market, covering market size, trends, growth drivers, challenges, key players, and future outlook. The report offers valuable insights for stakeholders, including manufacturers, suppliers, investors, and end-users, enabling informed decision-making and strategic planning within this rapidly evolving market. The comprehensive nature of the report includes in-depth segment analysis by type, application, and geography, offering a granular view of the market dynamics and future growth prospects.

High Precision Integrated Navigation System Segmentation

-

1. Type

- 1.1. Loose Combination

- 1.2. Tight Combination

-

2. Application

- 2.1. Civil

- 2.2. Military

High Precision Integrated Navigation System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High Precision Integrated Navigation System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Precision Integrated Navigation System," which aids in identifying and referencing the specific market segment covered.

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

What are the main segments of the High Precision Integrated Navigation System?

The market segments include

Which companies are prominent players in the High Precision Integrated Navigation System?

Key companies in the market include I-NAV Technology,OXTS,NovAtel,ICS Technologies,Anschutz,Hensoldt,Beijing BDStar Navigation,Beijing Highlander Digital Technology,Sanetel Technology,Unicore Communications,CHCNVA,Bynav,Guangzhou Asensing Technology,Quectel,Daisch,Bdstar Navigation,Joynext Technology,Sand Canyon Tech,SBG Systems,Hi-Target,Bewis Sensing,

What is the projected Compound Annual Growth Rate (CAGR) of the High Precision Integrated Navigation System ?

The projected CAGR is approximately XX%.

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00 , USD 5220.00, and USD 6960.00 respectively.

What are some drivers contributing to market growth?

.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Precision Integrated Navigation System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Loose Combination

- 5.1.2. Tight Combination

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Civil

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America High Precision Integrated Navigation System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Loose Combination

- 6.1.2. Tight Combination

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Civil

- 6.2.2. Military

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America High Precision Integrated Navigation System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Loose Combination

- 7.1.2. Tight Combination

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Civil

- 7.2.2. Military

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe High Precision Integrated Navigation System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Loose Combination

- 8.1.2. Tight Combination

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Civil

- 8.2.2. Military

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa High Precision Integrated Navigation System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Loose Combination

- 9.1.2. Tight Combination

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Civil

- 9.2.2. Military

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific High Precision Integrated Navigation System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Loose Combination

- 10.1.2. Tight Combination

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Civil

- 10.2.2. Military

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 I-NAV Technology

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 OXTS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NovAtel

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ICS Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Anschutz

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hensoldt

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Beijing BDStar Navigation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Beijing Highlander Digital Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sanetel Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Unicore Communications

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CHCNVA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bynav

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Guangzhou Asensing Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Quectel

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Daisch

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Bdstar Navigation

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Joynext Technology

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Sand Canyon Tech

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 SBG Systems

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Hi-Target

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Bewis Sensing

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 I-NAV Technology

- Figure 1: Global High Precision Integrated Navigation System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America High Precision Integrated Navigation System Revenue (million), by Type 2024 & 2032

- Figure 3: North America High Precision Integrated Navigation System Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America High Precision Integrated Navigation System Revenue (million), by Application 2024 & 2032

- Figure 5: North America High Precision Integrated Navigation System Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America High Precision Integrated Navigation System Revenue (million), by Country 2024 & 2032

- Figure 7: North America High Precision Integrated Navigation System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America High Precision Integrated Navigation System Revenue (million), by Type 2024 & 2032

- Figure 9: South America High Precision Integrated Navigation System Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America High Precision Integrated Navigation System Revenue (million), by Application 2024 & 2032

- Figure 11: South America High Precision Integrated Navigation System Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America High Precision Integrated Navigation System Revenue (million), by Country 2024 & 2032

- Figure 13: South America High Precision Integrated Navigation System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe High Precision Integrated Navigation System Revenue (million), by Type 2024 & 2032

- Figure 15: Europe High Precision Integrated Navigation System Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe High Precision Integrated Navigation System Revenue (million), by Application 2024 & 2032

- Figure 17: Europe High Precision Integrated Navigation System Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe High Precision Integrated Navigation System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe High Precision Integrated Navigation System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa High Precision Integrated Navigation System Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa High Precision Integrated Navigation System Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa High Precision Integrated Navigation System Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa High Precision Integrated Navigation System Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa High Precision Integrated Navigation System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa High Precision Integrated Navigation System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High Precision Integrated Navigation System Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific High Precision Integrated Navigation System Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific High Precision Integrated Navigation System Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific High Precision Integrated Navigation System Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific High Precision Integrated Navigation System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific High Precision Integrated Navigation System Revenue Share (%), by Country 2024 & 2032

- Table 1: Global High Precision Integrated Navigation System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global High Precision Integrated Navigation System Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global High Precision Integrated Navigation System Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global High Precision Integrated Navigation System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global High Precision Integrated Navigation System Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global High Precision Integrated Navigation System Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global High Precision Integrated Navigation System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global High Precision Integrated Navigation System Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global High Precision Integrated Navigation System Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global High Precision Integrated Navigation System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global High Precision Integrated Navigation System Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global High Precision Integrated Navigation System Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global High Precision Integrated Navigation System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global High Precision Integrated Navigation System Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global High Precision Integrated Navigation System Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global High Precision Integrated Navigation System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global High Precision Integrated Navigation System Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global High Precision Integrated Navigation System Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global High Precision Integrated Navigation System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific High Precision Integrated Navigation System Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.