IPO Readiness Service

IPO Readiness ServiceIPO Readiness Service Unlocking Growth Opportunities: Analysis and Forecast 2025-2033

IPO Readiness Service by Application (Large Enterprises, Small and Medium-Sized Enterprises), by Type (Financial Reporting and Audit Readiness, Operational Readiness, Strategic and Market Readiness, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

Market Size and Dynamics:

The global IPO Readiness Service market is projected to witness significant growth over the forecast period, reaching a value of USD XX million by 2033, expanding at a CAGR of XX% during the forecast period. The market growth is primarily driven by the increasing number of companies seeking to raise capital through initial public offerings (IPOs) and the stringent regulatory requirements for IPOs. Additionally, the growing awareness of the importance of IPO readiness services, which help companies prepare for the complex process of going public, is further fueling market expansion.

Competitive Landscape and Regional Trends:

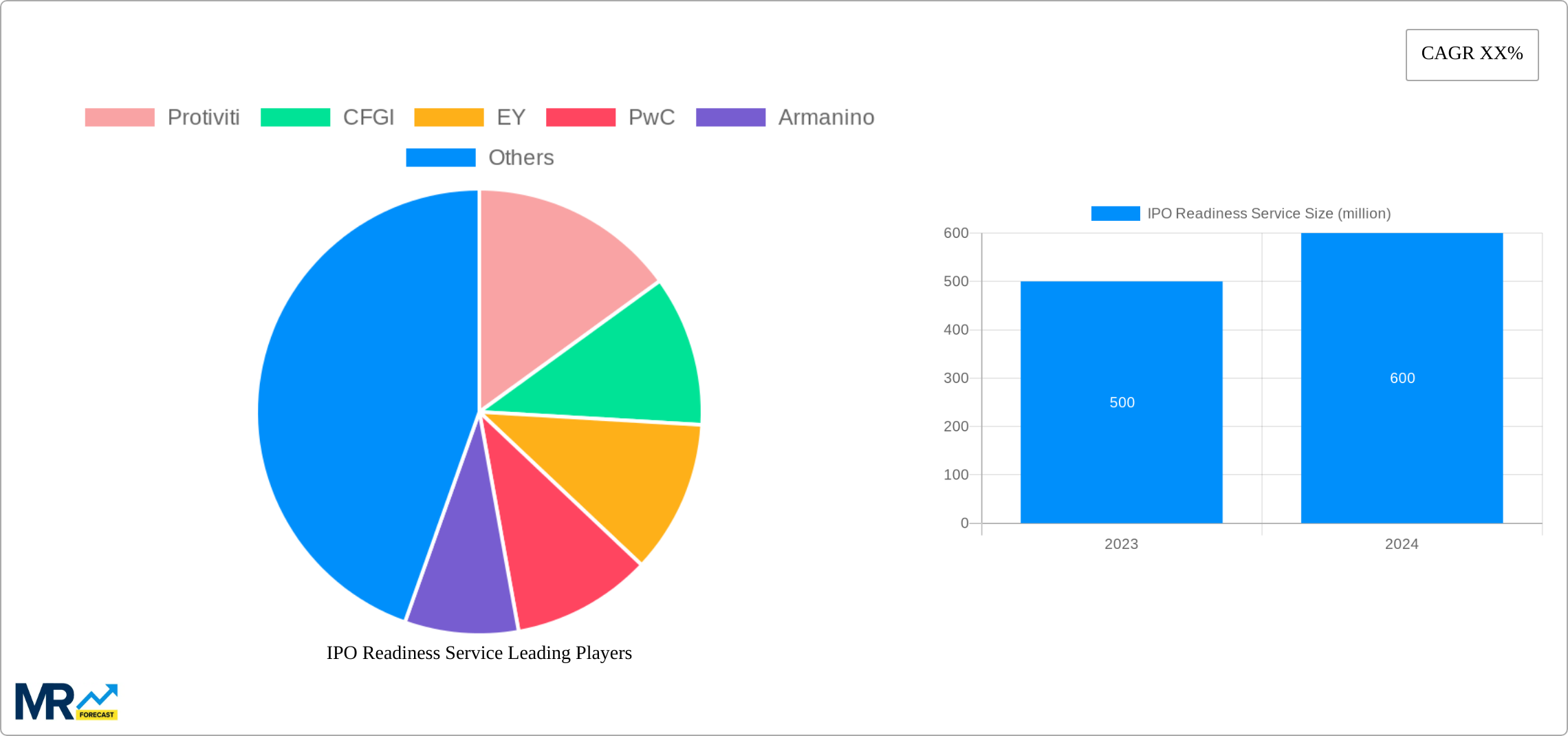

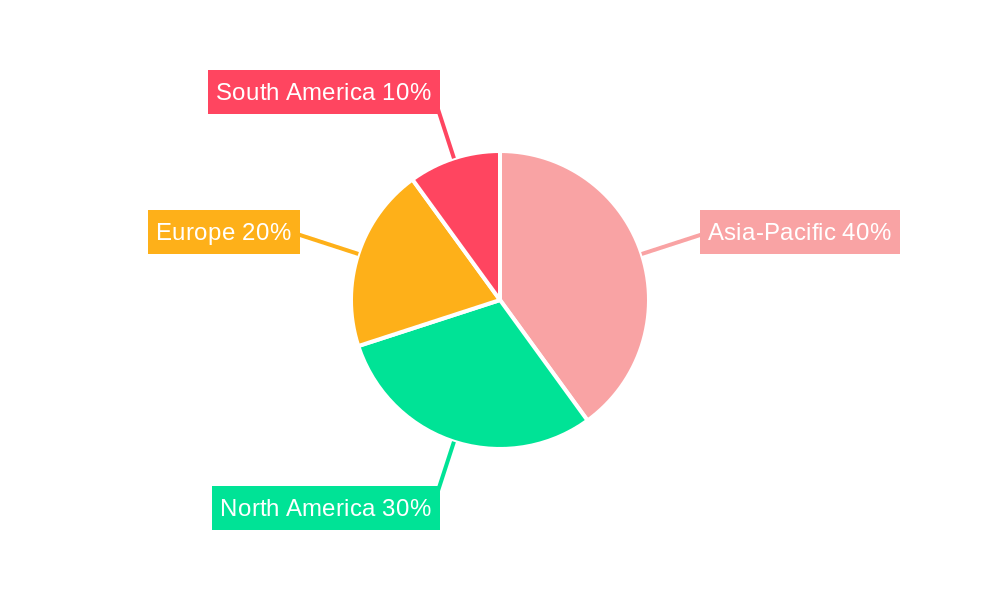

The IPO Readiness Service market is dominated by established players such as Protiviti, CFGI, EY, PwC, and Armanino. These companies offer comprehensive services covering financial reporting and audit readiness, operational readiness, strategic and market readiness, and other related areas. The market is further fragmented with a large number of regional and local players. North America and Europe account for the largest share of the global market, followed by Asia Pacific. However, emerging economies in the Middle East & Africa and Latin America are expected to provide significant growth opportunities in the future due to the increasing number of companies seeking to enter public markets.

IPO Readiness Service Industry Overview

The IPO readiness service market has gained significant traction in recent years, with businesses recognizing the importance of a well-prepared initial public offering (IPO). Companies seek expert guidance to navigate the complex processes and regulations associated with going public, ensuring a successful and seamless transition.

IPO Readiness Service Trends

- Increasing Demand for IPO Advisory Services: The growing number of companies planning to go public is driving the demand for IPO readiness services. As companies seek to maximize the value of their IPOs, they rely on advisors to provide expertise and support throughout the process.

- Focus on Compliance and Regulation: Stringent regulatory requirements and increased scrutiny of public companies emphasize the need for businesses to adhere to complex accounting, financial reporting, and governance standards.

- Digitalization and Automation: Technology plays a vital role in enhancing the efficiency and effectiveness of IPO readiness services. Digital tools streamline data collection, analysis, and reporting, enabling advisors to provide tailored solutions and timely insights.

- Expansion into Emerging Markets: As companies in developing countries seek to access international capital markets, the demand for IPO readiness services is expanding into emerging markets.

Driving Forces: What's Propelling the IPO Readiness Service

- Surge in Private Equity Investments: Private equity firms are increasingly investing in companies with potential to go public. This has spurred the need for IPO readiness services to prepare these companies for the rigors of the public market.

- Favorable Market Conditions: Bullish market conditions create an opportune time for businesses to consider IPOs. A strong economy and high investor confidence boost the likelihood of successful IPOs.

- Increased Competition: The growing number of companies going public intensifies competition for investor attention. This compels businesses to invest in IPO readiness services to differentiate themselves and attract investors.

Challenges and Restraints in IPO Readiness Service

- High Cost and Resource Intensiveness: IPO readiness services require significant investment in time, manpower, and external advisors. Smaller companies and startups may face challenges in accessing these services due to financial constraints.

- Complexity and Regulatory Burden: The regulatory landscape surrounding IPOs is complex and constantly evolving. Companies navigating this landscape without experienced advisors may face delays and potential legal risks.

- Market Volatility and Economic Downturns: Market volatility and economic downturns can impact the timing and success of IPOs. Advisors need to anticipate and mitigate these risks to ensure a successful outcome.

Key Region or Country & Segment to Dominate the Market

Key Region:

- North America is expected to dominate the IPO readiness service market due to the large number of companies going public and the well-established regulatory environment.

Segments:

- Application: Large enterprises account for a significant share of the market due to their size and complexity.

- Type: Financial reporting and audit readiness is critical for companies to meet regulatory requirements and ensure accuracy of financial statements.

- Others: Strategic and market readiness services gain increasing attention as companies focus on developing long-term growth strategies and positioning themselves in the public markets.

Growth Catalysts in IPO Readiness Service Industry

- Government initiatives to support IPOs

- Increasing investor appetite for public offerings

- Adoption of digital tools to streamline IPO preparation

- Growing presence of private equity and venture capital firms

Leading Players in the IPO Readiness Service

IPO Readiness Service Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. Small and Medium-Sized Enterprises

-

2. Type

- 2.1. Financial Reporting and Audit Readiness

- 2.2. Operational Readiness

- 2.3. Strategic and Market Readiness

- 2.4. Others

IPO Readiness Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

IPO Readiness Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Which companies are prominent players in the IPO Readiness Service?

Key companies in the market include Protiviti,CFGI,EY,PwC,Armanino,Deloitte,KPMG,FTI Consulting,BCG,BerryDunn,VantagePoint,Riveron Advisory,BDO,Grant Thornton,RSM

Can you provide examples of recent developments in the market?

undefined

How can I stay updated on further developments or reports in the IPO Readiness Service?

To stay informed about further developments, trends, and reports in the IPO Readiness Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

What are the notable trends driving market growth?

.

What are the main segments of the IPO Readiness Service?

The market segments include

What is the projected Compound Annual Growth Rate (CAGR) of the IPO Readiness Service ?

The projected CAGR is approximately XX%.

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IPO Readiness Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. Small and Medium-Sized Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Financial Reporting and Audit Readiness

- 5.2.2. Operational Readiness

- 5.2.3. Strategic and Market Readiness

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America IPO Readiness Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. Small and Medium-Sized Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Financial Reporting and Audit Readiness

- 6.2.2. Operational Readiness

- 6.2.3. Strategic and Market Readiness

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America IPO Readiness Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. Small and Medium-Sized Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Financial Reporting and Audit Readiness

- 7.2.2. Operational Readiness

- 7.2.3. Strategic and Market Readiness

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe IPO Readiness Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. Small and Medium-Sized Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Financial Reporting and Audit Readiness

- 8.2.2. Operational Readiness

- 8.2.3. Strategic and Market Readiness

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa IPO Readiness Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. Small and Medium-Sized Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Financial Reporting and Audit Readiness

- 9.2.2. Operational Readiness

- 9.2.3. Strategic and Market Readiness

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific IPO Readiness Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. Small and Medium-Sized Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Financial Reporting and Audit Readiness

- 10.2.2. Operational Readiness

- 10.2.3. Strategic and Market Readiness

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Protiviti

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CFGI

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 EY

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PwC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Armanino

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Deloitte

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KPMG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FTI Consulting

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BCG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BerryDunn

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 VantagePoint

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Riveron Advisory

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BDO

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Grant Thornton

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 RSM

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Protiviti

- Figure 1: Global IPO Readiness Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America IPO Readiness Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America IPO Readiness Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America IPO Readiness Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America IPO Readiness Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America IPO Readiness Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America IPO Readiness Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America IPO Readiness Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America IPO Readiness Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America IPO Readiness Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America IPO Readiness Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America IPO Readiness Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America IPO Readiness Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe IPO Readiness Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe IPO Readiness Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe IPO Readiness Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe IPO Readiness Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe IPO Readiness Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe IPO Readiness Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa IPO Readiness Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa IPO Readiness Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa IPO Readiness Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa IPO Readiness Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa IPO Readiness Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa IPO Readiness Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific IPO Readiness Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific IPO Readiness Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific IPO Readiness Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific IPO Readiness Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific IPO Readiness Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific IPO Readiness Service Revenue Share (%), by Country 2024 & 2032

- Table 1: Global IPO Readiness Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global IPO Readiness Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global IPO Readiness Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global IPO Readiness Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global IPO Readiness Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global IPO Readiness Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global IPO Readiness Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global IPO Readiness Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global IPO Readiness Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global IPO Readiness Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global IPO Readiness Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global IPO Readiness Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global IPO Readiness Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global IPO Readiness Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global IPO Readiness Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global IPO Readiness Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global IPO Readiness Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global IPO Readiness Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global IPO Readiness Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific IPO Readiness Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.