Laser Welding Technology

Laser Welding TechnologyLaser Welding Technology Analysis 2025 and Forecasts 2033: Unveiling Growth Opportunities

Laser Welding Technology by Type (Heat Conduction Type Welding, Laser Deep Penetration Welding), by Application (Consumer Electronics, New Energy Vehicle, Semiconductor, Aerospace, Medical Instruments, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Base Year: 2024

107 Pages

Key Insights

The laser welding technology market, currently valued at $1281 million (2025), is poised for robust growth, exhibiting a compound annual growth rate (CAGR) of 10.8% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of laser welding in high-precision manufacturing sectors like consumer electronics and new energy vehicles is significantly boosting demand. Miniaturization trends and the need for hermetic sealing in electronics are fueling the adoption of laser welding for its ability to create clean, precise, and strong welds. Similarly, the automotive industry's shift towards electric vehicles (EVs) is creating opportunities, as laser welding is crucial in battery pack assembly and lightweight body construction. Furthermore, the semiconductor and medical device industries are adopting laser welding for its ability to join dissimilar materials with high precision, contributing to the market's growth. The growing demand for advanced medical devices requiring precise and reliable joining techniques further fuels this market segment.

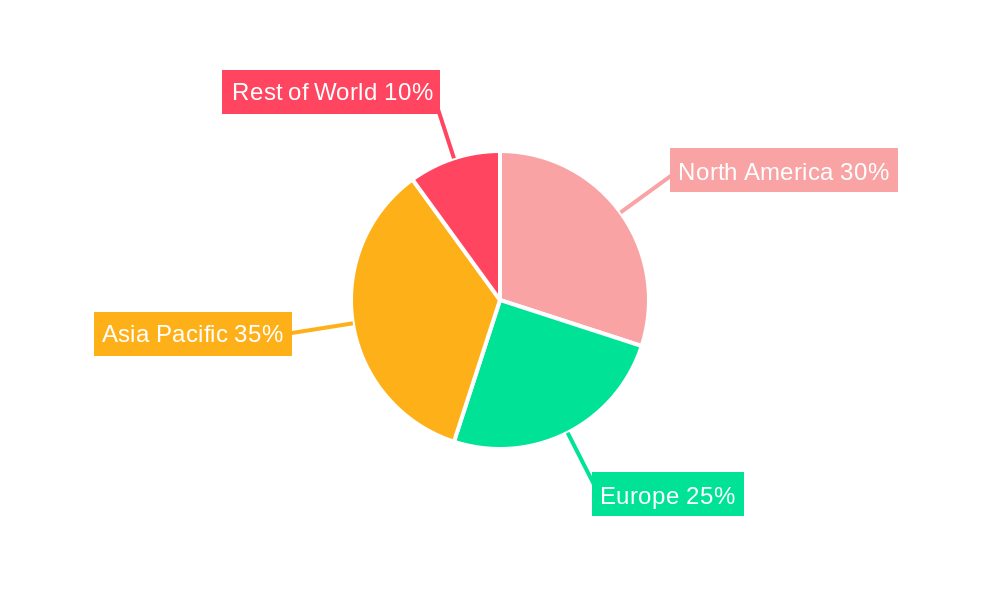

Growth restraints include the high initial investment costs associated with laser welding equipment and the requirement for skilled operators. However, technological advancements, such as the development of more efficient and cost-effective laser systems, are gradually mitigating these challenges. Emerging trends like automation and the integration of laser welding into smart manufacturing systems are expected to further drive market growth in the coming years. Segmentation analysis reveals that heat conduction type welding currently holds a significant market share, followed by laser deep penetration welding. Geographically, North America and Asia Pacific are expected to be the primary growth regions, driven by strong industrial activity and the presence of major market players. Key players such as Panasonic, TRUMPF, and LPKF are strategically investing in research and development to maintain their market positions and capitalize on emerging opportunities.

Laser Welding Technology Trends

The global laser welding technology market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by increasing automation across various industries and the inherent advantages of laser welding, such as precision, speed, and minimal heat-affected zones, the market is witnessing a significant upswing. The study period of 2019-2033 reveals a clear trajectory of expansion, with the estimated year 2025 showcasing a substantial market size. The forecast period (2025-2033) promises continued expansion, building upon the historical period's (2019-2024) growth. Key market insights indicate a strong preference for laser welding in applications demanding high precision and efficiency. The automotive and electronics sectors are leading the charge, with the adoption of laser welding in battery production for electric vehicles and the manufacturing of intricate consumer electronics components driving significant market volume. Furthermore, the increasing demand for lightweight, high-strength materials in aerospace and medical applications fuels the market's growth. The preference for specific laser welding types, such as heat conduction welding for smaller, delicate components and laser deep penetration welding for thicker materials, influences market segmentation and future trends. The competitive landscape is dynamic, with established players and emerging companies vying for market share through innovation in laser technology and automation solutions. The market is witnessing a gradual shift towards automated and integrated laser welding systems, enhancing productivity and reducing operational costs. This trend reflects a broader industry move towards Industry 4.0 principles, requiring sophisticated and adaptable solutions. The increasing adoption of advanced laser sources and control systems further contributes to the market's growth and technological advancement, leading to enhanced welding quality, repeatability, and overall process efficiency. This is further bolstered by continuous research and development efforts focused on enhancing the capabilities and applications of laser welding technologies.

Driving Forces: What's Propelling the Laser Welding Technology

Several key factors propel the growth of the laser welding technology market. The increasing demand for high-precision and high-quality welds in various industries is paramount. Laser welding offers superior precision and control compared to traditional welding methods, leading to reduced waste and improved product quality. Automation is another significant driver, enabling increased productivity and reduced labor costs. Laser welding systems can be easily integrated into automated production lines, significantly boosting manufacturing efficiency. The rise of electric vehicles (EVs) and the associated need for efficient battery production is a major catalyst. Laser welding is crucial in creating robust and reliable battery packs, thus fueling market demand. Similarly, the electronics industry's demand for miniaturization and complex component assembly makes laser welding an indispensable technology. The aerospace and medical sectors, with their stringent quality requirements and need for lightweight components, increasingly adopt laser welding for its ability to produce high-strength, reliable welds. Government regulations and initiatives promoting sustainability and energy efficiency also contribute positively. Laser welding offers a cleaner and more energy-efficient welding process compared to some traditional methods, aligning with environmental goals. Finally, continuous technological advancements in laser technology are driving innovation, resulting in improved system performance, enhanced precision, and expanded application possibilities, thus further stimulating market growth.

Challenges and Restraints in Laser Welding Technology

Despite the promising outlook, the laser welding technology market faces several challenges. High initial investment costs for laser welding systems can pose a barrier for smaller companies, limiting wider adoption. The complexity of laser welding processes and the need for skilled operators also present obstacles. Proper training and expertise are essential for optimal performance and to minimize the risk of defects. Maintenance and upkeep of laser welding equipment can be expensive, requiring regular servicing and specialized expertise. This adds to the overall operational costs. Safety concerns related to laser radiation require stringent safety protocols and protective measures, adding to operational complexity. The need for specialized materials and surface preparation can increase the overall cost and complexity of the welding process. Competition from traditional welding methods, which might be cost-effective for specific applications, can hinder market penetration. Finally, the relatively high energy consumption of some laser welding systems is a point of concern, especially in industries striving for sustainable practices. Addressing these challenges effectively is crucial to unlock the full potential of laser welding technology and to ensure its wider adoption.

Key Region or Country & Segment to Dominate the Market

The consumer electronics segment is poised to dominate the laser welding market. The miniaturization trend and the need for high-precision joining in smartphones, laptops, and other electronic devices drive strong demand for laser welding technology.

- High Precision: Laser welding provides the precise joining required for intricate components found in consumer electronics.

- Miniaturization: The technology allows for the welding of extremely small components, crucial for compact device design.

- High-Volume Production: Laser welding's automation capabilities are ideally suited for the high-volume manufacturing demands of the consumer electronics industry.

- Increased Demand: The ever-growing global market for consumer electronics creates a significant and constantly expanding demand for efficient and precise welding solutions.

- Geographic Distribution: Growth is expected across major consumer electronics manufacturing hubs globally, including Asia (particularly China and South Korea), North America, and Europe.

Furthermore, the Asia-Pacific region, especially China, is projected to lead the market due to its large and rapidly growing consumer electronics manufacturing sector. Other significant regions include North America, driven by robust aerospace and automotive industries, and Europe, characterized by strong medical and industrial automation sectors.

- China's Manufacturing Prowess: China's dominance in consumer electronics manufacturing creates huge demand for laser welding solutions.

- Technological Advancements: Significant investments in R&D in the Asia-Pacific region are driving innovation and advancement of laser welding technology.

- Government Support: Policies promoting automation and technological upgrades further fuel growth within the region.

- Cost-Effectiveness: Some parts of Asia provide a cost-effective manufacturing environment, boosting the production and adoption of laser welding technology.

The heat conduction type welding segment will also show significant growth, particularly within consumer electronics due to its suitability for delicate components. Laser deep penetration welding will find greater use in applications requiring robust welds, such as in the automotive sector, particularly for electric vehicle battery production.

Growth Catalysts in Laser Welding Technology Industry

The laser welding technology industry is experiencing accelerated growth due to several catalysts: Increased demand for automation in manufacturing, particularly in sectors like automotive and electronics, drives adoption. Advancements in laser technology, resulting in improved precision, efficiency, and lower operational costs, fuel market expansion. The growing need for high-quality, reliable welds in diverse sectors, including aerospace, medical instruments, and renewable energy, further enhances market potential. Stringent quality standards and the desire for lightweight, high-strength materials are also key drivers of growth.

Leading Players in the Laser Welding Technology

- Panasonic Industry Europe GmbH

- Leister Technologies AG

- TRUMPF

- LPKF Laser & Electronics

- Emerson Electric

- Amada Miyachi

- Control Micro Systems

- Scantech Laser

- CEMAS Elettra

- Dukane IAS LLC

- Bielomatik Leuze

- Han's Laser

- Sono-Tek

- Doosan Corporation

Significant Developments in Laser Welding Technology Sector

- 2020: Introduction of a new high-power fiber laser for deep penetration welding by TRUMPF.

- 2021: Development of a robotic laser welding system for automated battery pack assembly by Panasonic.

- 2022: Launch of a compact and cost-effective laser welding system for consumer electronics by LPKF Laser & Electronics.

- 2023: Significant advancements in laser beam control systems leading to increased precision and repeatability across various manufacturers.

Comprehensive Coverage Laser Welding Technology Report

The laser welding technology market is poised for substantial growth over the forecast period, driven by the increasing demand for automation, higher precision welding, and the expanding applications across multiple sectors. This growth is further fueled by continuous technological advancements in laser sources and control systems, leading to improved welding quality, speed, and cost-effectiveness. The market offers significant opportunities for established players and new entrants to capitalize on the expanding industrial needs and emerging technologies in this rapidly evolving field.

Laser Welding Technology Segmentation

-

1. Type

- 1.1. Heat Conduction Type Welding

- 1.2. Laser Deep Penetration Welding

-

2. Application

- 2.1. Consumer Electronics

- 2.2. New Energy Vehicle

- 2.3. Semiconductor

- 2.4. Aerospace

- 2.5. Medical Instruments

- 2.6. Others

Laser Welding Technology Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Laser Welding Technology REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.8% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Table Of Content

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laser Welding Technology Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Heat Conduction Type Welding

- 5.1.2. Laser Deep Penetration Welding

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics

- 5.2.2. New Energy Vehicle

- 5.2.3. Semiconductor

- 5.2.4. Aerospace

- 5.2.5. Medical Instruments

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Laser Welding Technology Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Heat Conduction Type Welding

- 6.1.2. Laser Deep Penetration Welding

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Consumer Electronics

- 6.2.2. New Energy Vehicle

- 6.2.3. Semiconductor

- 6.2.4. Aerospace

- 6.2.5. Medical Instruments

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Laser Welding Technology Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Heat Conduction Type Welding

- 7.1.2. Laser Deep Penetration Welding

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Consumer Electronics

- 7.2.2. New Energy Vehicle

- 7.2.3. Semiconductor

- 7.2.4. Aerospace

- 7.2.5. Medical Instruments

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Laser Welding Technology Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Heat Conduction Type Welding

- 8.1.2. Laser Deep Penetration Welding

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Consumer Electronics

- 8.2.2. New Energy Vehicle

- 8.2.3. Semiconductor

- 8.2.4. Aerospace

- 8.2.5. Medical Instruments

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Laser Welding Technology Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Heat Conduction Type Welding

- 9.1.2. Laser Deep Penetration Welding

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Consumer Electronics

- 9.2.2. New Energy Vehicle

- 9.2.3. Semiconductor

- 9.2.4. Aerospace

- 9.2.5. Medical Instruments

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Laser Welding Technology Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Heat Conduction Type Welding

- 10.1.2. Laser Deep Penetration Welding

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Consumer Electronics

- 10.2.2. New Energy Vehicle

- 10.2.3. Semiconductor

- 10.2.4. Aerospace

- 10.2.5. Medical Instruments

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Panasonic Industry Europe GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leister Technologies AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TRUMPF

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LPKF Laser & Electronics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emerson Electric

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Amada Miyachi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Control Micro Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Scantech Laser

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CEMAS Elettra

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dukane IAS LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bielomatik Leuze

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Han's Laser

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sono-Tek

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Doosan Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Panasonic Industry Europe GmbH

List of Figures

- Figure 1: Global Laser Welding Technology Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Laser Welding Technology Revenue (million), by Type 2024 & 2032

- Figure 3: North America Laser Welding Technology Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Laser Welding Technology Revenue (million), by Application 2024 & 2032

- Figure 5: North America Laser Welding Technology Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Laser Welding Technology Revenue (million), by Country 2024 & 2032

- Figure 7: North America Laser Welding Technology Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Laser Welding Technology Revenue (million), by Type 2024 & 2032

- Figure 9: South America Laser Welding Technology Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Laser Welding Technology Revenue (million), by Application 2024 & 2032

- Figure 11: South America Laser Welding Technology Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Laser Welding Technology Revenue (million), by Country 2024 & 2032

- Figure 13: South America Laser Welding Technology Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Laser Welding Technology Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Laser Welding Technology Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Laser Welding Technology Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Laser Welding Technology Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Laser Welding Technology Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Laser Welding Technology Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Laser Welding Technology Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Laser Welding Technology Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Laser Welding Technology Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Laser Welding Technology Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Laser Welding Technology Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Laser Welding Technology Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Laser Welding Technology Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Laser Welding Technology Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Laser Welding Technology Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Laser Welding Technology Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Laser Welding Technology Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Laser Welding Technology Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Laser Welding Technology Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Laser Welding Technology Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Laser Welding Technology Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Laser Welding Technology Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Laser Welding Technology Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Laser Welding Technology Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Laser Welding Technology Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Laser Welding Technology Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Laser Welding Technology Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Laser Welding Technology Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Laser Welding Technology Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Laser Welding Technology Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Laser Welding Technology Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Laser Welding Technology Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Laser Welding Technology Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Laser Welding Technology Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Laser Welding Technology Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Laser Welding Technology Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Laser Welding Technology Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Laser Welding Technology Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.8% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Top-down and bottom-up approaches are used to validate the global market size and estimate the market size for manufactures, regional segemnts, product and application.

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Additionally after gathering mix and scattered data from wide range of sources, data is triangull- ated and correlated to come up with estimated figures which are further validated through primary mediums, or industry experts, opinion leader.

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.