Liver-specific Assays Service

Liver-specific Assays ServiceLiver-specific Assays Service 2025-2033 Analysis: Trends, Competitor Dynamics, and Growth Opportunities

Liver-specific Assays Service by Type (Hepatocyte Uptake Assay, Hepatocyte clearance assay, Hepatocyte Biliary Excretion Assay, Hepatocyte Functional polarity assay, Hepatic phospholipidosis assay, Hepatic cholestasis assay, Other), by Application (Laboratory, Hospital), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

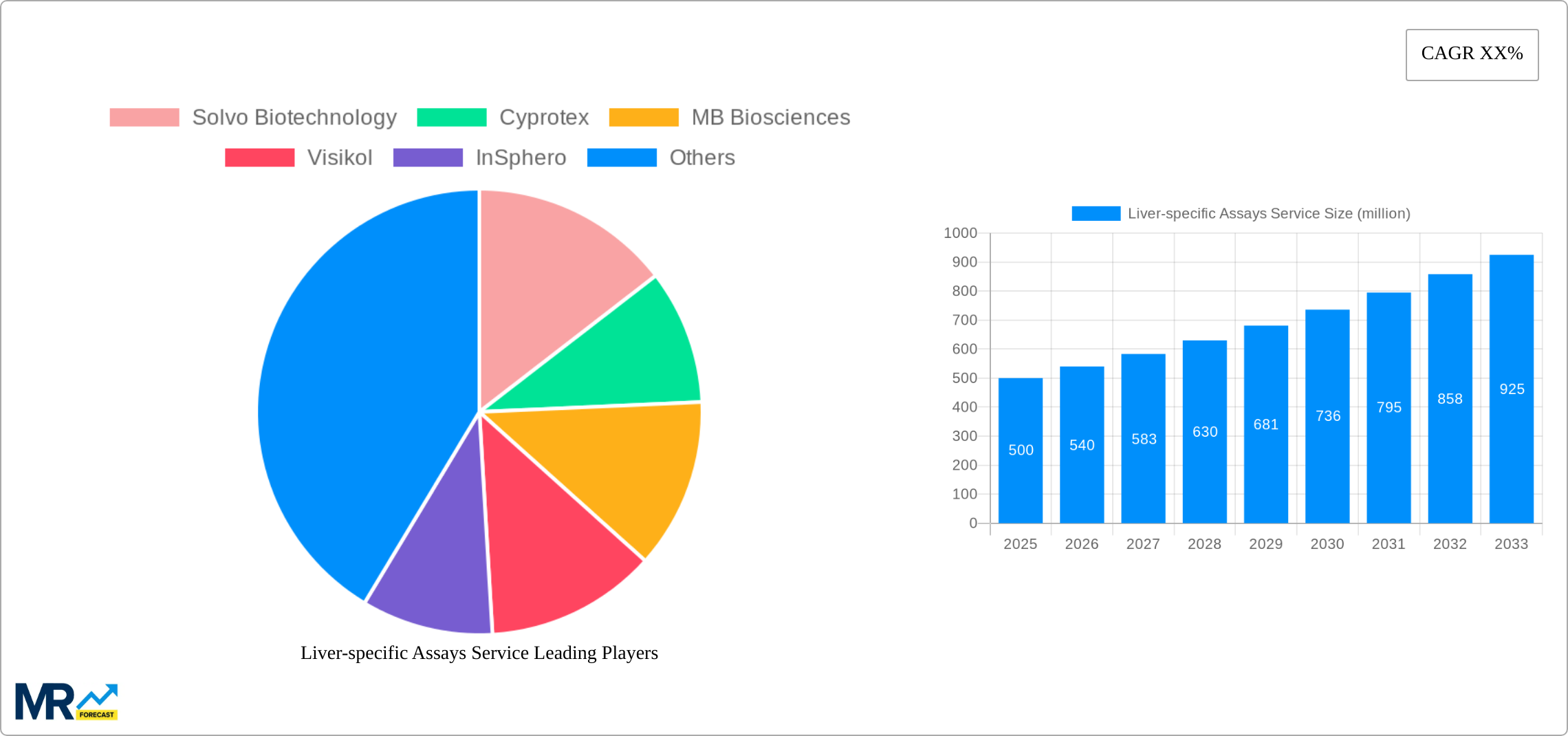

The global liver-specific assays service market is experiencing robust growth, driven by the increasing prevalence of liver diseases, the rising demand for drug development and toxicity testing, and advancements in assay technologies. The market, estimated at $500 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033, reaching approximately $900 million by 2033. This growth is fueled by several key factors. Firstly, the escalating incidence of chronic liver diseases like hepatitis, cirrhosis, and liver cancer necessitates more sophisticated diagnostic and therapeutic tools, creating a substantial demand for liver-specific assays. Secondly, the pharmaceutical industry's focus on developing new drugs and therapies for liver diseases is a major driver, as these assays are crucial for preclinical and clinical testing. Finally, technological innovations, such as the development of more sensitive and high-throughput assays, are improving accuracy and efficiency, further boosting market expansion. Segment-wise, Hepatocyte Uptake and Clearance assays currently dominate, followed by Hepatocyte Biliary Excretion Assays, reflecting the need to understand drug metabolism and elimination pathways within the liver. Geographically, North America and Europe hold significant market share due to well-established healthcare infrastructure, robust research activities, and high adoption rates of advanced technologies. However, the Asia-Pacific region is projected to witness the fastest growth, fueled by rising healthcare expenditure and growing awareness of liver health.

The market, while promising, faces some challenges. High assay costs and the need for specialized expertise can limit accessibility, particularly in developing economies. Furthermore, the complex regulatory landscape surrounding drug development and clinical trials can create hurdles for market expansion. Despite these restraints, ongoing research and development efforts focused on improving assay sensitivity, reducing costs, and streamlining workflows are expected to mitigate these challenges and drive continuous growth in the liver-specific assays service market throughout the forecast period. The diverse application segments, encompassing laboratory research, clinical diagnostics, and pharmaceutical development, indicate a broad and resilient market with strong future prospects. The leading companies in this space are continuously investing in research and development to offer innovative and cost-effective solutions, which will further propel market expansion.

Liver-specific Assays Service Trends

The global liver-specific assays service market is experiencing robust growth, projected to reach USD 2.5 billion by 2033, expanding at a CAGR of 7.8% during the forecast period (2025-2033). The market's expansion is driven by the escalating prevalence of liver diseases globally, the increasing demand for improved drug development and safety testing, and the rising adoption of advanced in vitro models. The historical period (2019-2024) witnessed significant growth fueled by technological advancements in assay techniques and the emergence of sophisticated 3D liver models. The base year 2025 shows a market valuation exceeding USD 1.2 billion, indicating a strong foundation for future expansion. Key market insights reveal a strong preference for hepatocyte-based assays due to their physiological relevance in mimicking liver function. Furthermore, the pharmaceutical and biotechnology industries are the primary drivers of market demand, investing heavily in preclinical drug testing to minimize risks and accelerate the drug development pipeline. The increasing adoption of these assays by contract research organizations (CROs) further fuels market growth, offering specialized services to pharmaceutical companies. The market is witnessing the emergence of high-throughput screening (HTS) compatible assays, enabling rapid and efficient drug screening processes, leading to significant cost savings and faster drug development cycles. Competition is fierce, with companies continually striving to offer superior assay performance and tailored solutions to specific client needs. This competitive landscape is pushing innovation and driving technological advancements within the liver-specific assays service sector. Future growth will be shaped by the integration of artificial intelligence and machine learning to enhance data analysis and predictive capabilities, as well as the increasing demand for personalized medicine approaches, demanding more sophisticated and tailored liver models.

Driving Forces: What's Propelling the Liver-specific Assays Service

Several factors contribute to the burgeoning liver-specific assays service market. The rising prevalence of chronic liver diseases, including viral hepatitis, non-alcoholic fatty liver disease (NAFLD), and alcoholic liver disease (ALD), creates a significant demand for accurate diagnostic tools and effective treatment strategies. This necessitates the use of robust and reliable liver-specific assays for drug development and toxicity testing. The pharmaceutical and biotechnology industries are increasingly prioritizing drug safety and efficacy, driving the adoption of sophisticated in vitro models like 3D liver tissues and organ-on-a-chip technologies. These models provide more accurate predictions of drug metabolism, toxicity, and efficacy compared to traditional 2D cell culture systems. Furthermore, regulatory requirements mandating comprehensive preclinical safety assessments are fueling the growth of the liver-specific assays service market. Stringent regulatory guidelines necessitate the use of validated and reliable assays to ensure drug safety and efficacy before human clinical trials. The increasing adoption of outsourced research services by pharmaceutical and biotechnology companies is another significant driver, as CROs play a crucial role in providing specialized services, including liver-specific assays. Finally, technological advancements in assay development and automation are contributing to increased throughput, reduced costs, and improved assay performance, making these services more accessible and attractive to a broader range of clients.

Challenges and Restraints in Liver-specific Assays Service

Despite the significant growth potential, the liver-specific assays service market faces several challenges. The high cost associated with developing and maintaining advanced in vitro liver models, including primary hepatocytes and 3D liver tissues, poses a significant barrier for smaller companies and research institutions. The complexity of liver physiology and the inherent variability between different liver models can lead to inconsistencies in assay results, requiring careful validation and standardization procedures. This variability can affect the reliability and reproducibility of assay data, leading to uncertainties in drug development decisions. The lack of standardized protocols and guidelines for conducting and interpreting liver-specific assays can also present challenges for both service providers and users. The need for specialized expertise and technical skills in conducting and interpreting the results of these assays can limit accessibility for certain researchers and laboratories. Furthermore, the limited availability of high-quality primary human hepatocytes, a crucial component of many liver-specific assays, can constrain the capacity of service providers to meet the growing demand. Addressing these challenges through collaborations, standardization efforts, and technological advancements is crucial for the continued growth and sustainability of the liver-specific assays service market.

Key Region or Country & Segment to Dominate the Market

The North American region is expected to dominate the liver-specific assays service market throughout the forecast period (2025-2033), driven by the robust pharmaceutical and biotechnology industries, advanced research infrastructure, and stringent regulatory guidelines. Europe follows closely, with a strong focus on research and development in the life sciences sector. Asia-Pacific is anticipated to witness significant growth, fueled by rising healthcare expenditure, expanding pharmaceutical industries, and increasing awareness of liver diseases.

Dominant Segment (Type): Hepatocyte clearance assays hold a substantial market share due to their critical role in assessing drug metabolism and clearance, crucial for drug development and safety testing. These assays directly measure the removal of drugs from the bloodstream by the liver, providing vital information on drug pharmacokinetics. The demand for this assay is fueled by the increasing need for accurate predictions of drug clearance and potential drug interactions, contributing significantly to the overall market value.

Dominant Segment (Application): The pharmaceutical and biotechnology industries are the primary users of liver-specific assays, contributing to the significant market share of the laboratory application segment. This segment is driven by the increasing demand for preclinical drug development services, ensuring drug safety and efficacy before clinical trials. Hospitals also utilize these assays to aid in disease diagnosis and monitoring the effects of treatments on liver function.

The high demand from the pharmaceutical and biotechnology industries drives the market’s significant growth for hepatocyte clearance assays in the laboratory application segment, reaching an estimated USD 750 million in 2025, and projected to exceed USD 1.8 billion by 2033. This reflects the considerable investment in preclinical drug development and safety testing by these industries.

Growth Catalysts in Liver-specific Assays Service Industry

The liver-specific assays service industry is experiencing significant growth due to a confluence of factors. These include the rising prevalence of liver diseases globally, leading to increased demand for diagnostic and therapeutic solutions. The pharmaceutical and biotechnology sectors' heightened focus on drug safety and efficacy drives the adoption of sophisticated in vitro liver models for preclinical testing. Furthermore, technological advancements, such as high-throughput screening-compatible assays and the development of more physiologically relevant 3D liver models, enhance efficiency and accuracy. The increasing outsourcing of preclinical drug development services to CROs also plays a vital role in market expansion. These catalysts work in tandem to accelerate the growth and expansion of the liver-specific assays service market.

Leading Players in the Liver-specific Assays Service

- Solvo Biotechnology

- Cyprotex

- MB Biosciences

- Visikol

- InSphero

Significant Developments in Liver-specific Assays Service Sector

- 2021: Cyprotex launched a new range of high-throughput hepatocyte assays.

- 2022: MB Biosciences introduced an improved hepatic phospholipidosis assay.

- 2023: Solvo Biotechnology partnered with a major pharmaceutical company for a large-scale drug metabolism study.

- 2024: InSphero received regulatory approval for a novel 3D liver model.

Comprehensive Coverage Liver-specific Assays Service Report

This report provides a comprehensive analysis of the liver-specific assays service market, covering market size, growth drivers, challenges, key players, and future trends. It includes detailed segment analysis by assay type and application, regional market insights, and forecasts up to 2033. The report's key findings indicate a strong and sustained growth trajectory for the market, driven by increasing demand for preclinical drug testing and the adoption of advanced liver models. The report serves as a valuable resource for stakeholders seeking a thorough understanding of this rapidly evolving market.

Liver-specific Assays Service Segmentation

-

1. Type

- 1.1. Hepatocyte Uptake Assay

- 1.2. Hepatocyte clearance assay

- 1.3. Hepatocyte Biliary Excretion Assay

- 1.4. Hepatocyte Functional polarity assay

- 1.5. Hepatic phospholipidosis assay

- 1.6. Hepatic cholestasis assay

- 1.7. Other

-

2. Application

- 2.1. Laboratory

- 2.2. Hospital

Liver-specific Assays Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Liver-specific Assays Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Liver-specific Assays Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hepatocyte Uptake Assay

- 5.1.2. Hepatocyte clearance assay

- 5.1.3. Hepatocyte Biliary Excretion Assay

- 5.1.4. Hepatocyte Functional polarity assay

- 5.1.5. Hepatic phospholipidosis assay

- 5.1.6. Hepatic cholestasis assay

- 5.1.7. Other

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Laboratory

- 5.2.2. Hospital

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Liver-specific Assays Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hepatocyte Uptake Assay

- 6.1.2. Hepatocyte clearance assay

- 6.1.3. Hepatocyte Biliary Excretion Assay

- 6.1.4. Hepatocyte Functional polarity assay

- 6.1.5. Hepatic phospholipidosis assay

- 6.1.6. Hepatic cholestasis assay

- 6.1.7. Other

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Laboratory

- 6.2.2. Hospital

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Liver-specific Assays Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hepatocyte Uptake Assay

- 7.1.2. Hepatocyte clearance assay

- 7.1.3. Hepatocyte Biliary Excretion Assay

- 7.1.4. Hepatocyte Functional polarity assay

- 7.1.5. Hepatic phospholipidosis assay

- 7.1.6. Hepatic cholestasis assay

- 7.1.7. Other

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Laboratory

- 7.2.2. Hospital

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Liver-specific Assays Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hepatocyte Uptake Assay

- 8.1.2. Hepatocyte clearance assay

- 8.1.3. Hepatocyte Biliary Excretion Assay

- 8.1.4. Hepatocyte Functional polarity assay

- 8.1.5. Hepatic phospholipidosis assay

- 8.1.6. Hepatic cholestasis assay

- 8.1.7. Other

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Laboratory

- 8.2.2. Hospital

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Liver-specific Assays Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hepatocyte Uptake Assay

- 9.1.2. Hepatocyte clearance assay

- 9.1.3. Hepatocyte Biliary Excretion Assay

- 9.1.4. Hepatocyte Functional polarity assay

- 9.1.5. Hepatic phospholipidosis assay

- 9.1.6. Hepatic cholestasis assay

- 9.1.7. Other

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Laboratory

- 9.2.2. Hospital

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Liver-specific Assays Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hepatocyte Uptake Assay

- 10.1.2. Hepatocyte clearance assay

- 10.1.3. Hepatocyte Biliary Excretion Assay

- 10.1.4. Hepatocyte Functional polarity assay

- 10.1.5. Hepatic phospholipidosis assay

- 10.1.6. Hepatic cholestasis assay

- 10.1.7. Other

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Laboratory

- 10.2.2. Hospital

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Solvo Biotechnology

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cyprotex

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MB Biosciences

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Visikol

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 InSphero

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Solvo Biotechnology

- Figure 1: Global Liver-specific Assays Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Liver-specific Assays Service Revenue (million), by Type 2024 & 2032

- Figure 3: North America Liver-specific Assays Service Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Liver-specific Assays Service Revenue (million), by Application 2024 & 2032

- Figure 5: North America Liver-specific Assays Service Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Liver-specific Assays Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Liver-specific Assays Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Liver-specific Assays Service Revenue (million), by Type 2024 & 2032

- Figure 9: South America Liver-specific Assays Service Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Liver-specific Assays Service Revenue (million), by Application 2024 & 2032

- Figure 11: South America Liver-specific Assays Service Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Liver-specific Assays Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Liver-specific Assays Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Liver-specific Assays Service Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Liver-specific Assays Service Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Liver-specific Assays Service Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Liver-specific Assays Service Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Liver-specific Assays Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Liver-specific Assays Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Liver-specific Assays Service Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Liver-specific Assays Service Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Liver-specific Assays Service Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Liver-specific Assays Service Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Liver-specific Assays Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Liver-specific Assays Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Liver-specific Assays Service Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Liver-specific Assays Service Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Liver-specific Assays Service Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Liver-specific Assays Service Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Liver-specific Assays Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Liver-specific Assays Service Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Liver-specific Assays Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Liver-specific Assays Service Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Liver-specific Assays Service Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Liver-specific Assays Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Liver-specific Assays Service Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Liver-specific Assays Service Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Liver-specific Assays Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Liver-specific Assays Service Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Liver-specific Assays Service Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Liver-specific Assays Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Liver-specific Assays Service Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Liver-specific Assays Service Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Liver-specific Assays Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Liver-specific Assays Service Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Liver-specific Assays Service Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Liver-specific Assays Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Liver-specific Assays Service Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Liver-specific Assays Service Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Liver-specific Assays Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Liver-specific Assays Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.