Management Systems Certification

Management Systems CertificationManagement Systems Certification Report Probes the 2727.7 million Size, Share, Growth Report and Future Analysis by 2033

Management Systems Certification by Type (ISO 9001, ISO 14001, ISO 45001, SA 8000, IATF 16949, ISO/IEC 27001, Other), by Application (Consumer Goods & Retail, Agriculture and Food, Construction and Infrastructure, Energy and Power, Industrial and Manufacturing, Medical and Life Sciences, Oil & Gas and Petroleum, Automotive, Aerospace, IT and Telecom), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The Management Systems Certification market is a robust and expanding sector, projected to reach a value of $2727.7 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.1%. This growth is fueled by several key drivers. Increasing regulatory compliance requirements across diverse industries, from manufacturing and automotive to healthcare and IT, necessitate robust management systems. The rising awareness of environmental, social, and governance (ESG) factors further propels demand for certifications like ISO 14001 and SA 8000. Furthermore, the globalization of businesses necessitates standardized quality and safety protocols, solidifying the need for internationally recognized certifications. The market is segmented by certification type (ISO 9001, ISO 14001, ISO 45001, SA 8000, IATF 16949, ISO/IEC 27001, and others) and application across various sectors, reflecting the broad applicability of these certifications. Leading players such as SGS, TÜV SÜD, UL, and Bureau Veritas dominate the market, leveraging their global presence and extensive expertise.

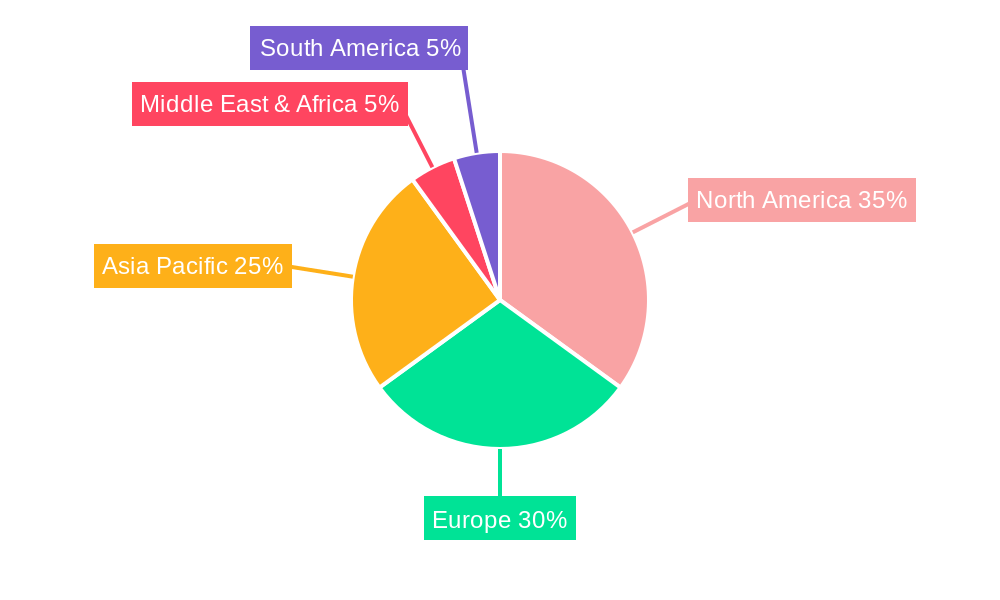

The market's growth trajectory is expected to continue throughout the forecast period (2025-2033), driven by ongoing technological advancements, increasing digitalization across industries, and a rising emphasis on supply chain resilience. While the specific restraining factors aren't detailed, potential challenges include the high cost of certification, the complexity of implementation, and the possibility of market saturation in certain established segments. However, the emergence of new certification standards and the expansion into developing economies are expected to offset these restraints. Geographic analysis reveals a diverse market landscape with North America and Europe currently holding significant shares, although the Asia-Pacific region is anticipated to experience substantial growth, driven by rapid industrialization and economic development within countries like China and India. The ongoing trend toward sustainability and ethical business practices will continue to significantly influence the demand for management systems certifications in the coming years.

Management Systems Certification Trends

The global management systems certification market is experiencing robust growth, projected to reach several hundred million USD by 2033. Driven by increasing regulatory pressures, heightened consumer awareness of ethical and sustainable practices, and the inherent competitive advantage offered by certified management systems, the market shows significant promise. Analysis of the historical period (2019-2024) reveals a steady upward trajectory, with the base year 2025 showing considerable momentum. The forecast period (2025-2033) anticipates continued expansion, exceeding several hundred million USD in market value. This growth is fueled by a rising demand for certifications across various industries, particularly in sectors prioritizing quality, environmental responsibility, and occupational health and safety. The increasing adoption of integrated management systems, combining multiple certifications like ISO 9001 (Quality Management), ISO 14001 (Environmental Management), and ISO 45001 (Occupational Health and Safety), further contributes to market expansion. This integrated approach streamlines processes, reduces costs, and enhances overall organizational efficiency, attracting more businesses to seek certification. The shift towards digitalization and the emergence of cloud-based certification platforms are also shaping market dynamics, simplifying the certification process and making it more accessible to businesses of all sizes. This comprehensive report delves deeper into the intricacies of this growth, identifying key trends and drivers.

Driving Forces: What's Propelling the Management Systems Certification Market?

Several factors are propelling the growth of the management systems certification market. Firstly, stringent government regulations and industry standards are pushing businesses to adopt and demonstrate compliance with various management systems, making certification a necessity rather than an option. Secondly, the increasing focus on corporate social responsibility (CSR) and environmental, social, and governance (ESG) factors is driving demand for certifications like ISO 14001 and SA 8000, allowing companies to showcase their commitment to sustainability and ethical practices to stakeholders, investors, and consumers. Thirdly, the competitive landscape compels businesses to enhance operational efficiency and improve product quality, with management system certifications serving as a credible demonstration of these improvements. This leads to increased customer trust, improved brand reputation, and ultimately, a stronger market position. Finally, the growing awareness among businesses of the potential cost savings and risk mitigation associated with effective management systems is further accelerating the demand for certification. Reduced operational errors, improved resource management, and enhanced risk prevention contribute significantly to the bottom line, making certification a worthwhile investment for many organizations.

Challenges and Restraints in Management Systems Certification

Despite the significant growth potential, the management systems certification market faces certain challenges. The high cost of certification, including audit fees, training expenses, and the time investment required for implementation, can act as a barrier to entry, particularly for smaller businesses. The complexity of various standards and requirements can also prove daunting, requiring significant expertise and resources for successful implementation and maintenance. Furthermore, ensuring the long-term effectiveness of certified management systems beyond the initial certification process remains a challenge. Maintaining compliance and continuous improvement necessitates ongoing effort and investment, which can sometimes be overlooked. The risk of certification fraud and the variability in the quality of certification bodies also pose challenges. Ensuring the credibility and integrity of certifications requires robust oversight and a well-regulated certification landscape. Finally, the ongoing evolution of standards and requirements necessitates continuous adaptation and updating, adding to the overall burden on certified organizations.

Key Region or Country & Segment to Dominate the Market

The Industrial and Manufacturing segment is projected to dominate the management systems certification market due to the widespread adoption of quality and safety standards within this sector. The stringent requirements for product quality and consistency necessitate ISO 9001 and IATF 16949 certifications, significantly contributing to market growth within this segment. The increasing demand for sustainable manufacturing practices also drives the adoption of ISO 14001 certifications.

Industrial and Manufacturing: This sector's high volume of production and need for consistent quality and safety makes it a major driver of demand for various certifications like ISO 9001, ISO 14001, ISO 45001, and IATF 16949. The market value in this segment is projected to reach hundreds of millions of USD by 2033.

Key Regions: North America and Europe currently lead the market due to the established regulatory frameworks and high awareness of management system benefits. However, the Asia-Pacific region exhibits significant growth potential, fueled by rapid industrialization and increasing government emphasis on quality and safety standards. This region is projected to witness substantial growth over the forecast period, with its market value potentially reaching hundreds of millions of USD.

ISO 9001: This standard remains the most prevalent certification globally, demonstrating the enduring focus on quality management systems across industries. Its market share is expected to remain substantial throughout the forecast period.

ISO 14001: The growing concern for environmental sustainability is propelling the demand for ISO 14001 certifications, particularly within the Industrial and Manufacturing, Energy and Power, and Consumer Goods & Retail sectors. Its market value is projected to expand significantly in the coming years.

The combined market value of these key segments and regions is anticipated to account for a substantial portion of the total management systems certification market value by 2033, exceeding several hundred million USD.

Growth Catalysts in Management Systems Certification Industry

The management systems certification industry benefits from several growth catalysts. Increasing government regulations promoting compliance with international standards, coupled with the rising consumer demand for ethically sourced and sustainably produced goods, fosters adoption of various certifications. Furthermore, the competitive advantage gained through certification, reflected in enhanced customer trust and increased market share, motivates businesses to invest in these programs. Technological advancements, enabling smoother implementation and maintenance of management systems, also contribute to accelerated market growth.

Leading Players in the Management Systems Certification Market

- SGS

- TÜV SÜD

- UL

- Applus

- Bureau Veritas

- Intertek

- TÜV Rheinland

- TÜV NORD

- DNV

- Eurofins Scientific

- China Certification & Inspection

- ALS Global

- SIRIM QAS

- Dekra

- Lloyd's Register

Significant Developments in Management Systems Certification Sector

- 2020: Increased focus on remote auditing due to the COVID-19 pandemic.

- 2021: Revisions to several ISO standards, including ISO 9001 and ISO 14001, promoting greater integration and risk-based thinking.

- 2022: Growing adoption of digital tools and platforms for certification processes.

- 2023: Increased emphasis on supply chain sustainability and ethical sourcing leading to a rise in related certifications.

Comprehensive Coverage Management Systems Certification Report

This report offers a detailed analysis of the management systems certification market, providing comprehensive insights into market trends, driving forces, challenges, key players, and future growth prospects. The data used spans the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), presenting a comprehensive view of the market evolution and future trajectory. This in-depth analysis provides valuable information for businesses, investors, and stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market.

Management Systems Certification Segmentation

-

1. Type

- 1.1. ISO 9001

- 1.2. ISO 14001

- 1.3. ISO 45001

- 1.4. SA 8000

- 1.5. IATF 16949

- 1.6. ISO/IEC 27001

- 1.7. Other

-

2. Application

- 2.1. Consumer Goods & Retail

- 2.2. Agriculture and Food

- 2.3. Construction and Infrastructure

- 2.4. Energy and Power

- 2.5. Industrial and Manufacturing

- 2.6. Medical and Life Sciences

- 2.7. Oil & Gas and Petroleum

- 2.8. Automotive

- 2.9. Aerospace

- 2.10. IT and Telecom

Management Systems Certification Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Management Systems Certification REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.1% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Management Systems Certification," which aids in identifying and referencing the specific market segment covered.

What is the projected Compound Annual Growth Rate (CAGR) of the Management Systems Certification ?

The projected CAGR is approximately 5.1%.

What are the notable trends driving market growth?

.

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

Which companies are prominent players in the Management Systems Certification?

Key companies in the market include SGS,TUV SUD,UL,Applus,Bureau Veritas,Intertek,TÜV Rheinland,TUV NORD,DNV,Eurofins Scientific,China Certification & Inspection,ALS Global,SIRIM QAS,Dekra,Lloyd's Register,

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

Can you provide examples of recent developments in the market?

undefined

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00 , USD 5220.00, and USD 6960.00 respectively.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Management Systems Certification Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. ISO 9001

- 5.1.2. ISO 14001

- 5.1.3. ISO 45001

- 5.1.4. SA 8000

- 5.1.5. IATF 16949

- 5.1.6. ISO/IEC 27001

- 5.1.7. Other

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Goods & Retail

- 5.2.2. Agriculture and Food

- 5.2.3. Construction and Infrastructure

- 5.2.4. Energy and Power

- 5.2.5. Industrial and Manufacturing

- 5.2.6. Medical and Life Sciences

- 5.2.7. Oil & Gas and Petroleum

- 5.2.8. Automotive

- 5.2.9. Aerospace

- 5.2.10. IT and Telecom

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Management Systems Certification Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. ISO 9001

- 6.1.2. ISO 14001

- 6.1.3. ISO 45001

- 6.1.4. SA 8000

- 6.1.5. IATF 16949

- 6.1.6. ISO/IEC 27001

- 6.1.7. Other

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Consumer Goods & Retail

- 6.2.2. Agriculture and Food

- 6.2.3. Construction and Infrastructure

- 6.2.4. Energy and Power

- 6.2.5. Industrial and Manufacturing

- 6.2.6. Medical and Life Sciences

- 6.2.7. Oil & Gas and Petroleum

- 6.2.8. Automotive

- 6.2.9. Aerospace

- 6.2.10. IT and Telecom

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Management Systems Certification Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. ISO 9001

- 7.1.2. ISO 14001

- 7.1.3. ISO 45001

- 7.1.4. SA 8000

- 7.1.5. IATF 16949

- 7.1.6. ISO/IEC 27001

- 7.1.7. Other

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Consumer Goods & Retail

- 7.2.2. Agriculture and Food

- 7.2.3. Construction and Infrastructure

- 7.2.4. Energy and Power

- 7.2.5. Industrial and Manufacturing

- 7.2.6. Medical and Life Sciences

- 7.2.7. Oil & Gas and Petroleum

- 7.2.8. Automotive

- 7.2.9. Aerospace

- 7.2.10. IT and Telecom

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Management Systems Certification Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. ISO 9001

- 8.1.2. ISO 14001

- 8.1.3. ISO 45001

- 8.1.4. SA 8000

- 8.1.5. IATF 16949

- 8.1.6. ISO/IEC 27001

- 8.1.7. Other

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Consumer Goods & Retail

- 8.2.2. Agriculture and Food

- 8.2.3. Construction and Infrastructure

- 8.2.4. Energy and Power

- 8.2.5. Industrial and Manufacturing

- 8.2.6. Medical and Life Sciences

- 8.2.7. Oil & Gas and Petroleum

- 8.2.8. Automotive

- 8.2.9. Aerospace

- 8.2.10. IT and Telecom

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Management Systems Certification Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. ISO 9001

- 9.1.2. ISO 14001

- 9.1.3. ISO 45001

- 9.1.4. SA 8000

- 9.1.5. IATF 16949

- 9.1.6. ISO/IEC 27001

- 9.1.7. Other

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Consumer Goods & Retail

- 9.2.2. Agriculture and Food

- 9.2.3. Construction and Infrastructure

- 9.2.4. Energy and Power

- 9.2.5. Industrial and Manufacturing

- 9.2.6. Medical and Life Sciences

- 9.2.7. Oil & Gas and Petroleum

- 9.2.8. Automotive

- 9.2.9. Aerospace

- 9.2.10. IT and Telecom

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Management Systems Certification Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. ISO 9001

- 10.1.2. ISO 14001

- 10.1.3. ISO 45001

- 10.1.4. SA 8000

- 10.1.5. IATF 16949

- 10.1.6. ISO/IEC 27001

- 10.1.7. Other

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Consumer Goods & Retail

- 10.2.2. Agriculture and Food

- 10.2.3. Construction and Infrastructure

- 10.2.4. Energy and Power

- 10.2.5. Industrial and Manufacturing

- 10.2.6. Medical and Life Sciences

- 10.2.7. Oil & Gas and Petroleum

- 10.2.8. Automotive

- 10.2.9. Aerospace

- 10.2.10. IT and Telecom

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SGS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TUV SUD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Applus

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bureau Veritas

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Intertek

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TÜV Rheinland

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TUV NORD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DNV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eurofins Scientific

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 China Certification & Inspection

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ALS Global

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SIRIM QAS

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Dekra

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Lloyd's Register

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 SGS

- Figure 1: Global Management Systems Certification Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Management Systems Certification Revenue (million), by Type 2024 & 2032

- Figure 3: North America Management Systems Certification Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Management Systems Certification Revenue (million), by Application 2024 & 2032

- Figure 5: North America Management Systems Certification Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Management Systems Certification Revenue (million), by Country 2024 & 2032

- Figure 7: North America Management Systems Certification Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Management Systems Certification Revenue (million), by Type 2024 & 2032

- Figure 9: South America Management Systems Certification Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Management Systems Certification Revenue (million), by Application 2024 & 2032

- Figure 11: South America Management Systems Certification Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Management Systems Certification Revenue (million), by Country 2024 & 2032

- Figure 13: South America Management Systems Certification Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Management Systems Certification Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Management Systems Certification Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Management Systems Certification Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Management Systems Certification Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Management Systems Certification Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Management Systems Certification Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Management Systems Certification Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Management Systems Certification Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Management Systems Certification Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Management Systems Certification Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Management Systems Certification Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Management Systems Certification Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Management Systems Certification Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Management Systems Certification Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Management Systems Certification Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Management Systems Certification Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Management Systems Certification Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Management Systems Certification Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Management Systems Certification Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Management Systems Certification Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Management Systems Certification Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Management Systems Certification Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Management Systems Certification Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Management Systems Certification Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Management Systems Certification Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Management Systems Certification Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Management Systems Certification Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Management Systems Certification Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Management Systems Certification Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Management Systems Certification Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Management Systems Certification Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Management Systems Certification Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Management Systems Certification Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Management Systems Certification Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Management Systems Certification Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Management Systems Certification Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Management Systems Certification Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Management Systems Certification Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.1% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.