Military Thermal Imaging Equipment

Military Thermal Imaging EquipmentMilitary Thermal Imaging Equipment Strategic Roadmap: Analysis and Forecasts 2025-2033

Military Thermal Imaging Equipment by Type (Man-portable, Fixed Mounted), by Application (Land, Marine, Airborne), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

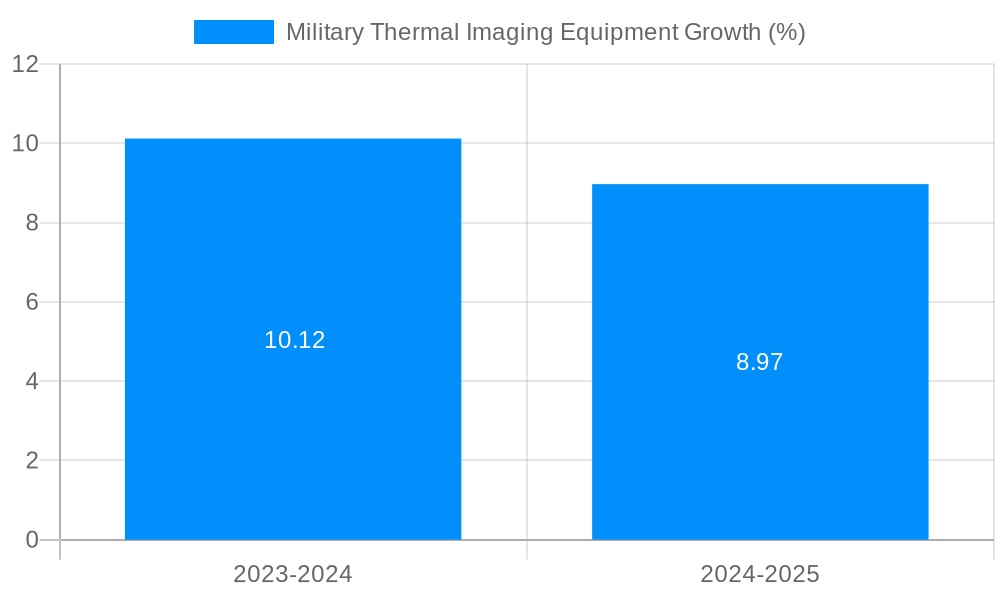

The global military thermal imaging equipment market is anticipated to witness substantial growth over the forecast period, progressing at a CAGR of 7.9% from 2025 to 2033. The market size is estimated to reach a valuation of 4067 million by 2033. Key factors driving this growth include the rising demand for enhanced situational awareness on the battlefield, advancements in thermal imaging technology, and increasing geopolitical tensions worldwide.

The market is segmented by type (man-portable, fixed-mounted), application (land, marine, airborne), and region. Man-portable thermal imaging equipment is expected to hold a significant market share due to its ease of use and portability. In terms of application, the land segment is projected to account for the largest share, driven by the growing demand for thermal imaging systems in ground combat operations. North America is anticipated to remain the largest regional market, with key players such as Lockheed Martin, FLIR Systems, and Raytheon holding prominent positions. Asia Pacific is expected to witness the highest growth rate over the forecast period, owing to the increasing defense spending in the region.

Military Thermal Imaging Equipment Trends

The global military thermal imaging equipment market is projected to reach $2,819.5 million by 2025, exhibiting a CAGR of 9.1% during the forecast period (2020-2025). Key market insights include:

- Growing demand for enhanced situational awareness and target detection in modern warfare

- Increasing adoption of thermal imaging technology in unmanned vehicles, airborne platforms, and ground-based systems

- Technological advancements in sensor performance, image processing, and data analytics

- Rising investments in national security and defense budgets by major economies

- Burgeoning threats of terrorism, asymmetric warfare, and cross-border conflicts

Driving Forces: What's Propelling the Military Thermal Imaging Equipment

Several factors are propelling the growth of the military thermal imaging equipment market:

- Increased need for enhanced situational awareness: Thermal imaging provides a significant advantage in low-visibility conditions, enabling military personnel to detect threats, navigate terrain, and make informed decisions.

- Growing adoption of unmanned systems: Unmanned vehicles and airborne platforms require advanced thermal imaging capabilities to perform surveillance, reconnaissance, and target acquisition missions autonomously.

- Technological advancements: Innovations in sensor technology, image processing algorithms, and data analytics are enhancing the performance, accuracy, and reliability of thermal imaging systems.

- Escalating security threats: The rise of terrorism, irregular warfare, and cross-border conflicts has increased the need for advanced surveillance and detection technologies to safeguard national security.

Challenges and Restraints in Military Thermal Imaging Equipment

Despite the growing demand, the market faces certain challenges:

- High cost of development and deployment: Thermal imaging systems are complex and expensive to develop and integrate into military platforms.

- Environmental constraints: Extreme temperatures, dust, and moisture can affect the performance and reliability of thermal imaging systems.

- Cybersecurity concerns: Thermal imaging systems are vulnerable to cyberattacks, which can compromise their functionality and data integrity.

- Limited availability of skilled operators: Operating and interpreting thermal imagery requires specialized training and expertise, which can be scarce in some regions.

Key Region or Country & Segment to Dominate the Market

Key Regions with Significant Market Share:

- North America: Leading the market due to high defense spending and advanced technological capabilities.

- Europe: Strong demand for thermal imaging equipment in defense and homeland security applications.

- Asia-Pacific: Growing regional conflicts and increased defense budgets in China and India.

Dominant Segment:

Type: Man-portable: This segment is expected to hold the largest market share due to the increasing demand for lightweight and mobile thermal imaging systems for use by individual soldiers and small units.

Growth Catalysts in Military Thermal Imaging Equipment Industry

Factors driving the market's growth include:

- Government investments in military modernization: Governments worldwide are investing heavily in upgrading their military capabilities, including thermal imaging equipment.

- Advancements in thermal sensor technology: The development of high-resolution sensors with enhanced sensitivity and lower power consumption is expanding application possibilities.

- Integration with artificial intelligence (AI): AI algorithms can automate target detection, classification, and tracking, improving situational awareness and reducing workload.

- Growing emphasis on border security: The need to monitor and protect borders from illegal activities is driving the adoption of thermal imaging systems.

Leading Players in the Military Thermal Imaging Equipment

Major players in the market include:

- Lockheed Martin

- FLIR Systems

- Raytheon

- L3 Technologies

- Leonardo DRS

- Teledyne Technologies

- Sofradir

- BAE Systems

- Northrop Grumman

- Harris

- Elbit Systems

- General Dynamics Mission Systems

- Guangzhou SAT

- Wuhan Guide Infrared

- Zhejiang Dali Technology

- Axis Communications AB

- ViPRO Corporation

Significant Developments in Military Thermal Imaging Equipment Sector

Recent developments in the sector include:

- Lockheed Martin's development of a compact, lightweight thermal imaging system for use in handheld devices.

- FLIR Systems' acquisition of the Norwegian company Prox Dynamics to enhance its drone and maritime thermal imaging capabilities.

- Raytheon's introduction of a new thermal sensor with improved image quality and reduced power consumption.

- Leonardo DRS's launch of a thermal imaging system with a wide field of view and high-resolution for ground vehicles.

Comprehensive Coverage Military Thermal Imaging Equipment Report

This report provides comprehensive coverage of the military thermal imaging equipment market, including:

- Market overview and dynamics

- Key market trends and drivers

- Comprehensive analysis of market segments

- Regional market analysis

- Competitive landscape

- Leading market players

- Recent industry developments

Military Thermal Imaging Equipment Segmentation

-

1. Type

- 1.1. Man-portable

- 1.2. Fixed Mounted

-

2. Application

- 2.1. Land

- 2.2. Marine

- 2.3. Airborne

Military Thermal Imaging Equipment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Military Thermal Imaging Equipment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.9% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Are there any restraints impacting market growth?

.

What are the notable trends driving market growth?

.

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

Can you provide examples of recent developments in the market?

undefined

What are some drivers contributing to market growth?

.

Can you provide details about the market size?

The market size is estimated to be USD 4067 million as of 2022.

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

What are the main segments of the Military Thermal Imaging Equipment?

The market segments include

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Thermal Imaging Equipment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Man-portable

- 5.1.2. Fixed Mounted

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Land

- 5.2.2. Marine

- 5.2.3. Airborne

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Military Thermal Imaging Equipment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Man-portable

- 6.1.2. Fixed Mounted

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Land

- 6.2.2. Marine

- 6.2.3. Airborne

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Military Thermal Imaging Equipment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Man-portable

- 7.1.2. Fixed Mounted

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Land

- 7.2.2. Marine

- 7.2.3. Airborne

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Military Thermal Imaging Equipment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Man-portable

- 8.1.2. Fixed Mounted

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Land

- 8.2.2. Marine

- 8.2.3. Airborne

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Military Thermal Imaging Equipment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Man-portable

- 9.1.2. Fixed Mounted

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Land

- 9.2.2. Marine

- 9.2.3. Airborne

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Military Thermal Imaging Equipment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Man-portable

- 10.1.2. Fixed Mounted

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Land

- 10.2.2. Marine

- 10.2.3. Airborne

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Lockheed Martin

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FLIR Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Raytheon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 L3 Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leonardo DRS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teledyne Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sofradir

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BAE Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Northrop Grumman

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Harris

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Elbit Systems

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 General Dynamics Mission Systems

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Guangzhou SAT

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Wuhan Guide Infrared

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Zhejiang Dali Technology

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Axis Communications AB

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ViPRO Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Lockheed Martin

- Figure 1: Global Military Thermal Imaging Equipment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Military Thermal Imaging Equipment Revenue (million), by Type 2024 & 2032

- Figure 3: North America Military Thermal Imaging Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Military Thermal Imaging Equipment Revenue (million), by Application 2024 & 2032

- Figure 5: North America Military Thermal Imaging Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Military Thermal Imaging Equipment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Military Thermal Imaging Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Military Thermal Imaging Equipment Revenue (million), by Type 2024 & 2032

- Figure 9: South America Military Thermal Imaging Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Military Thermal Imaging Equipment Revenue (million), by Application 2024 & 2032

- Figure 11: South America Military Thermal Imaging Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Military Thermal Imaging Equipment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Military Thermal Imaging Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Military Thermal Imaging Equipment Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Military Thermal Imaging Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Military Thermal Imaging Equipment Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Military Thermal Imaging Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Military Thermal Imaging Equipment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Military Thermal Imaging Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Military Thermal Imaging Equipment Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Military Thermal Imaging Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Military Thermal Imaging Equipment Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Military Thermal Imaging Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Military Thermal Imaging Equipment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Military Thermal Imaging Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Military Thermal Imaging Equipment Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Military Thermal Imaging Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Military Thermal Imaging Equipment Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Military Thermal Imaging Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Military Thermal Imaging Equipment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Military Thermal Imaging Equipment Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Military Thermal Imaging Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Military Thermal Imaging Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Military Thermal Imaging Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Military Thermal Imaging Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Military Thermal Imaging Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Military Thermal Imaging Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Military Thermal Imaging Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Military Thermal Imaging Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Military Thermal Imaging Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Military Thermal Imaging Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Military Thermal Imaging Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Military Thermal Imaging Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Military Thermal Imaging Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Military Thermal Imaging Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Military Thermal Imaging Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Military Thermal Imaging Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Military Thermal Imaging Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Military Thermal Imaging Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Military Thermal Imaging Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Military Thermal Imaging Equipment Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.9% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.