Mold and Moisture Assessment

Mold and Moisture AssessmentMold and Moisture Assessment Strategic Roadmap: Analysis and Forecasts 2025-2033

Mold and Moisture Assessment by Type (Visual Assessment And Identification, Mold Sampling (Air, Surface and Large Sampling), Develop A Customized Mold Repair Plan, Repair and Repair Follow -Up, Other), by Application (Residential Building, Public Buildings, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The mold and moisture assessment market is experiencing robust growth, driven by increasing awareness of indoor air quality (IAQ) issues and their impact on human health. The rising prevalence of respiratory illnesses linked to mold exposure, stricter building codes and regulations mandating mold remediation, and a growing demand for professional assessments in both residential and commercial settings are key factors fueling market expansion. The market is segmented by service type (visual assessment, sampling, repair planning, remediation, and others) and application (residential, public buildings, and others). While the precise market size in 2025 is unavailable, considering a plausible CAGR of 5-7% (a conservative estimate based on similar environmental services markets), and assuming a 2019 market size within the range of $2-3 billion, we can project a 2025 market size in the $3-4 billion range. This growth is expected to continue through 2033, driven by technological advancements in mold detection and remediation techniques, increasing urbanization, and heightened focus on sustainable building practices.

The North American market currently holds a significant share, owing to stringent environmental regulations and heightened awareness among consumers. However, other regions, especially in Asia-Pacific and Europe, are witnessing rapid growth due to rising construction activity and increasing disposable incomes. While the market faces constraints such as high testing costs and a lack of awareness in certain regions, the overall outlook remains positive. The increasing availability of specialized services, the development of innovative and more efficient technologies, and the growing adoption of preventive measures are expected to mitigate these challenges and further fuel market growth in the coming years. Key players are focusing on expansion through strategic partnerships, technological innovation, and acquisitions to strengthen their market position.

Mold and Moisture Assessment Trends

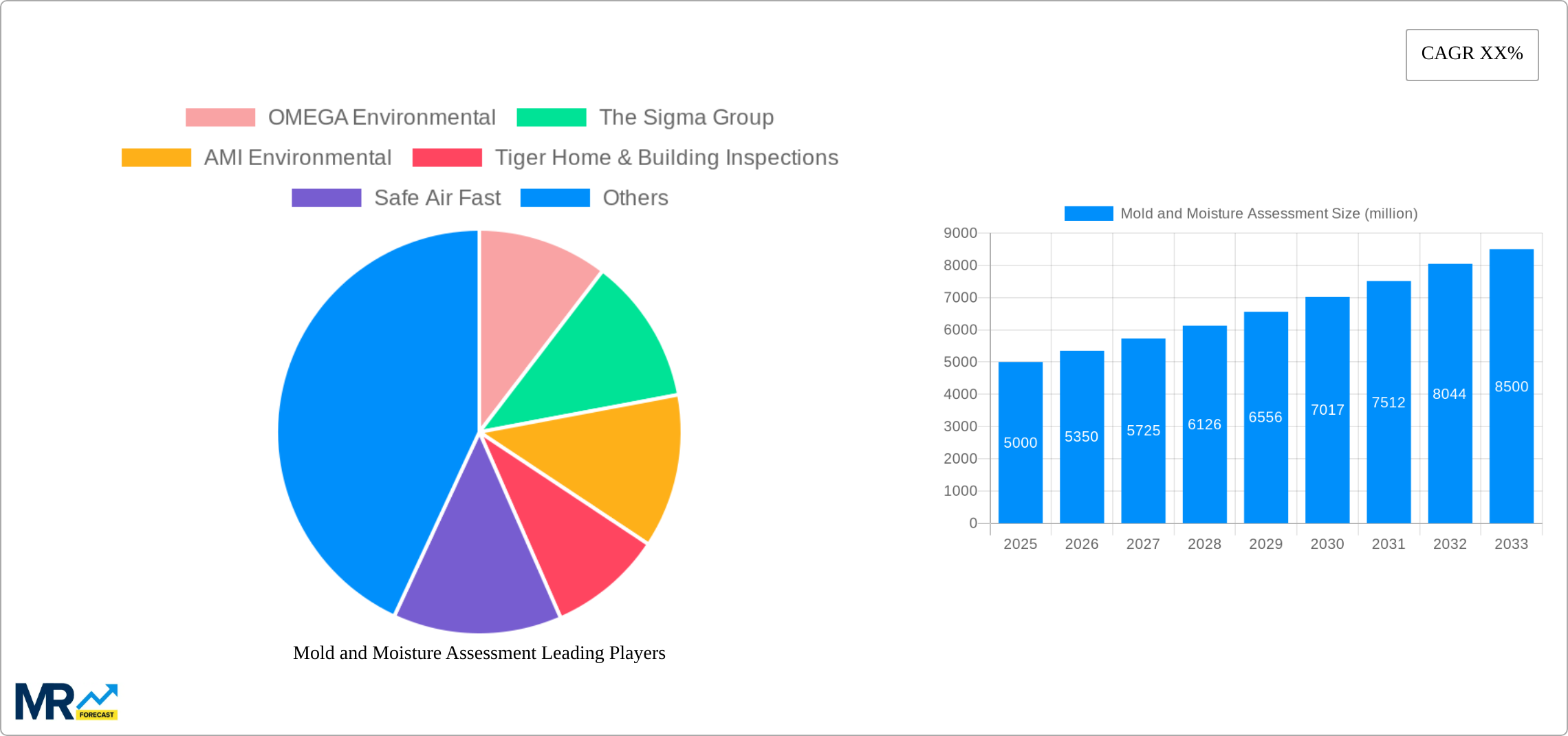

The global mold and moisture assessment market is experiencing robust growth, projected to reach XXX million units by 2033, from XXX million units in 2025. This substantial expansion reflects a heightened awareness of the health risks associated with mold and moisture damage, coupled with increasingly stringent building codes and regulations. The historical period (2019-2024) saw steady growth, driven primarily by the residential building sector. However, the forecast period (2025-2033) anticipates accelerated expansion, fueled by growth in both the residential and public building sectors, as well as the increasing demand for specialized services such as customized mold repair plans and comprehensive follow-up inspections. Market players are capitalizing on these trends by expanding their service portfolios and investing in advanced technologies for faster, more accurate mold and moisture detection. This includes the incorporation of thermal imaging, moisture meters, and advanced sampling techniques. Furthermore, the increasing prevalence of extreme weather events leading to water damage and subsequent mold growth is also a significant factor driving market demand. The market is segmented by type of service (visual assessment, sampling, repair planning, repair, and other), application (residential, public buildings, other), and geographical region. Analysis of these segments reveals distinct growth trajectories, with certain regions and service types exhibiting more rapid expansion than others. The base year for this analysis is 2025, and the study period covers 2019-2033, providing a comprehensive overview of market dynamics. Competition among industry players is intense, with companies differentiating themselves through specialized expertise, technological advancements, and customer service.

Driving Forces: What's Propelling the Mold and Moisture Assessment Market?

Several factors are propelling the growth of the mold and moisture assessment market. The rising awareness of the serious health consequences associated with mold exposure, including respiratory problems, allergies, and other illnesses, is a primary driver. Homeowners and building managers are increasingly proactive in identifying and mitigating mold risks, leading to increased demand for professional assessment and remediation services. Furthermore, stricter building codes and regulations in many regions mandate mold inspections and remediation, particularly in the aftermath of water damage events. The growing number of older buildings in need of renovation or repair also contributes to the market’s expansion, as these structures are more susceptible to moisture intrusion and mold growth. Insurance companies are also playing a significant role, often requiring mold assessments before settling claims related to water damage. Finally, advancements in technology, such as the development of more sophisticated detection equipment, are improving the efficiency and accuracy of mold and moisture assessments, making the service more appealing and cost-effective for clients. The increasing frequency and intensity of extreme weather events, such as hurricanes and floods, further exacerbate the problem, creating a larger market for mold remediation and preventive measures.

Challenges and Restraints in Mold and Moisture Assessment

Despite the significant growth potential, several challenges and restraints hinder the expansion of the mold and moisture assessment market. The highly fragmented nature of the industry, with numerous small and medium-sized enterprises competing for market share, can lead to price wars and reduced profit margins. The need for specialized expertise and certifications poses a barrier to entry for new companies, limiting competition and potentially slowing innovation. Inconsistent industry standards and regulations across different regions can create challenges for companies operating in multiple jurisdictions. The variability in mold growth and the complexity of assessing and remediating mold infestations can sometimes lead to unpredictable costs and timelines for projects, which can deter clients. Moreover, accurately assessing the extent of mold damage and determining the most effective remediation strategy can be challenging, requiring specialized skills and equipment. Finally, consumer awareness of the problem may vary geographically, influencing adoption rates in certain regions. Overcoming these challenges requires industry collaboration to establish consistent standards, promote professional development, and raise public awareness of the importance of mold and moisture assessment.

Key Region or Country & Segment to Dominate the Market

The residential building segment is projected to dominate the mold and moisture assessment market throughout the forecast period (2025-2033). This is driven by increased awareness among homeowners about the health risks of mold and the growing number of older homes requiring inspections and remediation. The market for mold sampling (air, surface, and large sampling) is also expected to show significant growth, reflecting the need for precise data to inform remediation strategies and meet regulatory compliance. The United States and other developed countries in North America and Europe are expected to maintain substantial market shares, due to factors such as stringent building codes and high awareness of mold-related health risks.

- Dominant Segment: Residential Building Applications

- High-Growth Segment: Mold Sampling (Air, Surface, and Large Sampling)

- Key Regions: North America (United States, Canada), Western Europe (Germany, UK, France), and certain rapidly developing Asian economies.

- Reasoning: High awareness of health risks in developed markets, strict building codes driving demand, and increased prevalence of water damage in homes due to various factors, including extreme weather events, contribute to the dominance of these segments and regions. The need for accurate data to inform remediation strategies further fuels the demand for comprehensive sampling services.

The North American market in particular benefits from a robust regulatory environment and greater awareness among homeowners regarding health concerns associated with mold. European markets also exhibit strong growth potential, spurred by an increase in stricter building codes and an evolving understanding of moisture-related damage. Rapidly developing Asian economies are also witnessing rising demand, largely driven by increasing urbanization and a growing middle class with more disposable income to address home maintenance issues. However, challenges in these developing markets include the lack of standardized testing methods and lack of awareness among the general population.

Growth Catalysts in the Mold and Moisture Assessment Industry

The mold and moisture assessment industry is experiencing significant growth spurred by rising awareness of the health impacts of mold exposure, stricter regulations, and advancements in detection technologies. This synergy fuels market demand as homeowners and building managers become more proactive in addressing moisture-related issues.

Leading Players in the Mold and Moisture Assessment Market

- OMEGA Environmental

- The Sigma Group

- AMI Environmental

- Tiger Home & Building Inspections

- Safe Air Fast

- EnviroNET, Inc

- EPA

- Alpine Building Performance

- Insight Environmental

- AirMD

- OccuHealth Inc

- Hawk Environmental Services

- Perfect Pollucon Services

- Sterling Home Inspections

- Certified Moisture Testing, LLC

- partner ESI

- RHP Risk Management

- Moisture & Mold Detection, Inc

- Indoor Science

- AMD Environmental

(Note: Many companies lack readily available global websites. Links are omitted where suitable URLs could not be found.)

Significant Developments in the Mold and Moisture Assessment Sector

- 2020: Increased adoption of non-destructive testing methods for moisture detection.

- 2021: Several states implement stricter building codes regarding mold remediation.

- 2022: Development of advanced AI-powered mold detection software.

- 2023: Growing emphasis on preventative mold mitigation strategies.

- 2024: Increased use of drone technology for large-scale building inspections.

Comprehensive Coverage Mold and Moisture Assessment Report

This report provides a comprehensive analysis of the mold and moisture assessment market, offering valuable insights into current trends, growth drivers, challenges, and key players. The detailed segmentation allows for a granular understanding of market dynamics, while the forecast projections provide a roadmap for future market behavior. This information is crucial for businesses operating in this sector, investors seeking opportunities, and policymakers aiming to improve building standards and public health.

Mold and Moisture Assessment Segmentation

-

1. Type

- 1.1. Visual Assessment And Identification

- 1.2. Mold Sampling (Air, Surface and Large Sampling)

- 1.3. Develop A Customized Mold Repair Plan

- 1.4. Repair and Repair Follow -Up

- 1.5. Other

-

2. Application

- 2.1. Residential Building

- 2.2. Public Buildings

- 2.3. Other

Mold and Moisture Assessment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mold and Moisture Assessment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

Are there any restraints impacting market growth?

.

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00 , USD 6720.00, and USD 8960.00 respectively.

What is the projected Compound Annual Growth Rate (CAGR) of the Mold and Moisture Assessment ?

The projected CAGR is approximately XX%.

Which companies are prominent players in the Mold and Moisture Assessment?

Key companies in the market include OMEGA Environmental,The Sigma Group,AMI Environmental,Tiger Home & Building Inspections,Safe Air Fast,EnviroNET, Inc,EPA,Alpine Building Performance,Insight Environmental,AirMD,OccuHealth Inc,Hawk Environmental Services,Perfect Pollucon Services,Sterling Home Inspections,Certified Moisture Testing, LLC,partner ESI,RHP Risk Management,Moisture & Mold Detection, Inc,Indoor Science,AMD Environmental,

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

How can I stay updated on further developments or reports in the Mold and Moisture Assessment?

To stay informed about further developments, trends, and reports in the Mold and Moisture Assessment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mold and Moisture Assessment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Visual Assessment And Identification

- 5.1.2. Mold Sampling (Air, Surface and Large Sampling)

- 5.1.3. Develop A Customized Mold Repair Plan

- 5.1.4. Repair and Repair Follow -Up

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential Building

- 5.2.2. Public Buildings

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Mold and Moisture Assessment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Visual Assessment And Identification

- 6.1.2. Mold Sampling (Air, Surface and Large Sampling)

- 6.1.3. Develop A Customized Mold Repair Plan

- 6.1.4. Repair and Repair Follow -Up

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential Building

- 6.2.2. Public Buildings

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Mold and Moisture Assessment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Visual Assessment And Identification

- 7.1.2. Mold Sampling (Air, Surface and Large Sampling)

- 7.1.3. Develop A Customized Mold Repair Plan

- 7.1.4. Repair and Repair Follow -Up

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential Building

- 7.2.2. Public Buildings

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Mold and Moisture Assessment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Visual Assessment And Identification

- 8.1.2. Mold Sampling (Air, Surface and Large Sampling)

- 8.1.3. Develop A Customized Mold Repair Plan

- 8.1.4. Repair and Repair Follow -Up

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential Building

- 8.2.2. Public Buildings

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Mold and Moisture Assessment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Visual Assessment And Identification

- 9.1.2. Mold Sampling (Air, Surface and Large Sampling)

- 9.1.3. Develop A Customized Mold Repair Plan

- 9.1.4. Repair and Repair Follow -Up

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential Building

- 9.2.2. Public Buildings

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Mold and Moisture Assessment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Visual Assessment And Identification

- 10.1.2. Mold Sampling (Air, Surface and Large Sampling)

- 10.1.3. Develop A Customized Mold Repair Plan

- 10.1.4. Repair and Repair Follow -Up

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential Building

- 10.2.2. Public Buildings

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 OMEGA Environmental

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Sigma Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AMI Environmental

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tiger Home & Building Inspections

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Safe Air Fast

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EnviroNET Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EPA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alpine Building Performance

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Insight Environmental

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AirMD

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OccuHealth Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hawk Environmental Services

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Perfect Pollucon Services

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sterling Home Inspections

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Certified Moisture Testing LLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 partner ESI

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 RHP Risk Management

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Moisture & Mold Detection Inc

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Indoor Science

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 AMD Environmental

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 OMEGA Environmental

- Figure 1: Global Mold and Moisture Assessment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Mold and Moisture Assessment Revenue (million), by Type 2024 & 2032

- Figure 3: North America Mold and Moisture Assessment Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Mold and Moisture Assessment Revenue (million), by Application 2024 & 2032

- Figure 5: North America Mold and Moisture Assessment Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Mold and Moisture Assessment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Mold and Moisture Assessment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Mold and Moisture Assessment Revenue (million), by Type 2024 & 2032

- Figure 9: South America Mold and Moisture Assessment Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Mold and Moisture Assessment Revenue (million), by Application 2024 & 2032

- Figure 11: South America Mold and Moisture Assessment Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Mold and Moisture Assessment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Mold and Moisture Assessment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Mold and Moisture Assessment Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Mold and Moisture Assessment Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Mold and Moisture Assessment Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Mold and Moisture Assessment Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Mold and Moisture Assessment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Mold and Moisture Assessment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Mold and Moisture Assessment Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Mold and Moisture Assessment Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Mold and Moisture Assessment Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Mold and Moisture Assessment Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Mold and Moisture Assessment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Mold and Moisture Assessment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Mold and Moisture Assessment Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Mold and Moisture Assessment Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Mold and Moisture Assessment Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Mold and Moisture Assessment Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Mold and Moisture Assessment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Mold and Moisture Assessment Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Mold and Moisture Assessment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Mold and Moisture Assessment Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Mold and Moisture Assessment Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Mold and Moisture Assessment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Mold and Moisture Assessment Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Mold and Moisture Assessment Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Mold and Moisture Assessment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Mold and Moisture Assessment Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Mold and Moisture Assessment Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Mold and Moisture Assessment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Mold and Moisture Assessment Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Mold and Moisture Assessment Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Mold and Moisture Assessment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Mold and Moisture Assessment Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Mold and Moisture Assessment Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Mold and Moisture Assessment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Mold and Moisture Assessment Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Mold and Moisture Assessment Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Mold and Moisture Assessment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Mold and Moisture Assessment Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.