Motor Insurance

Motor InsuranceMotor Insurance Decade Long Trends, Analysis and Forecast 2025-2033

Motor Insurance by Type (Third-party Liability, Comprehensive), by Application (Car, Tram, Battery Car, Motorcycle, Tractor, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global motor insurance market is experiencing robust growth, driven by factors such as rising vehicle ownership, particularly in emerging economies, and increasing awareness of the importance of insurance coverage. The market is segmented by insurance type (third-party liability, comprehensive) and vehicle type (cars, trams, battery cars, motorcycles, tractors, etc.), offering diverse opportunities for insurers. A Compound Annual Growth Rate (CAGR) of, let's assume, 5% (a reasonable estimate given general industry growth trends) between 2025 and 2033 suggests a significant expansion of the market. Technological advancements, like telematics and AI-powered risk assessment, are transforming the industry, enabling more precise pricing and personalized services. This is fostering competition and innovation, pushing insurers to develop new products and services. However, challenges remain, including fluctuating fuel prices impacting vehicle usage and insurance premiums, increasing regulatory scrutiny in certain markets, and the potential for significant claims related to autonomous vehicles as they become more prevalent.

The market's geographical distribution shows significant regional variations. North America and Europe currently hold larger market shares due to higher vehicle ownership and well-established insurance markets. However, rapid economic growth and increasing vehicle sales in regions like Asia-Pacific, particularly in China and India, are expected to fuel substantial market expansion in these areas during the forecast period. The presence of major global players like Allianz, Zurich, and State Farm, along with regional insurers, indicates a competitive landscape with opportunities for both established and emerging companies. The increasing adoption of electric vehicles will likely present both opportunities and challenges – demanding specialized insurance products and raising questions around battery liability. Successfully navigating these dynamics will be crucial for insurers to capitalize on the substantial growth potential of the motor insurance market.

Motor Insurance Trends

The global motor insurance market, valued at approximately $XXX million in 2024, is poised for significant growth throughout the forecast period (2025-2033). The market’s expansion is driven by a confluence of factors, including the rising number of vehicles globally, particularly in developing economies experiencing rapid motorization. This increase in vehicle ownership translates directly into a greater demand for insurance coverage, fueling market expansion. Furthermore, evolving consumer preferences towards enhanced coverage options, such as comprehensive policies encompassing wider protection against risks, are contributing to the market's upward trajectory. Technological advancements, particularly the integration of telematics and AI-driven risk assessment, are also reshaping the industry landscape. These technologies offer more accurate risk profiling, leading to more personalized premiums and improved fraud detection, ultimately influencing market dynamics. The increasing adoption of electric and autonomous vehicles presents both challenges and opportunities. While these innovations introduce unique risk profiles requiring specific insurance solutions, they also create new avenues for insurers to innovate and expand their product offerings. The competitive landscape is dynamic, with established players vying for market share alongside the emergence of new entrants leveraging technological disruption. This competitive intensity is fostering innovation and driving down premiums in certain segments, benefiting consumers. Finally, regulatory changes and government initiatives aimed at improving road safety and promoting insurance penetration are further influencing market trends and fostering responsible growth. The overall picture suggests sustained and robust growth in the motor insurance sector, albeit with continuous adaptation to emerging technological and regulatory developments.

Driving Forces: What's Propelling the Motor Insurance Market?

Several key factors are accelerating the growth of the motor insurance market. Firstly, the expanding global vehicle fleet, particularly in rapidly developing economies, is a primary driver. More vehicles on the road inevitably translate to a higher demand for insurance. Secondly, heightened awareness of the financial implications of road accidents is pushing more individuals and businesses to secure comprehensive coverage. This shift in consumer attitudes is boosting demand across all insurance segments. Thirdly, the technological revolution impacting the insurance industry is significant. Telematics and AI are enabling more accurate risk assessment, leading to more competitive pricing and customized policies, thereby driving adoption. The rise of connected cars and the increasing availability of data are further fueling this trend. Moreover, supportive governmental policies aimed at improving road safety and mandating insurance coverage in many regions are positively impacting market growth. These regulations increase the mandatory insurance base, expanding the overall market size. Finally, the emergence of innovative insurance products tailored to specific vehicle types, such as electric vehicles and autonomous vehicles, is creating new market segments and opportunities for growth.

Challenges and Restraints in Motor Insurance

Despite the promising growth outlook, the motor insurance market faces significant challenges. Fraudulent claims remain a substantial concern, impacting insurers' profitability and potentially leading to increased premiums for honest policyholders. The increasing cost of vehicle repairs and medical treatments related to accidents directly affects claim payouts, putting pressure on insurers' margins. Fluctuating economic conditions can influence consumer spending patterns, potentially leading to reduced insurance uptake or a shift towards cheaper, less comprehensive coverage. Furthermore, the rapid technological advancements, while offering opportunities, also pose challenges. Insurers must adapt quickly to incorporate new technologies and data analytics to remain competitive, which requires significant investment in infrastructure and skilled personnel. Lastly, stringent regulations and compliance requirements add to the operational complexity and costs for insurance providers. These regulations are necessary but can create hurdles to market entry and growth, particularly for smaller companies.

Key Region or Country & Segment to Dominate the Market

The Car segment within the motor insurance market is projected to maintain its dominance throughout the forecast period (2025-2033). This is primarily due to the sheer volume of cars on the roads globally, surpassing other vehicle types significantly.

Market Dominance: The car segment's sheer size and consistent demand make it the largest contributor to the overall motor insurance market revenue. Millions of car owners require insurance, creating a large and stable customer base for insurance providers.

Diverse Coverage Options: The car segment offers insurers a broad range of insurance products, from basic third-party liability to comprehensive packages with extensive coverage. This allows for targeted marketing and diversification of revenue streams.

Technological Advancements: The integration of telematics and other technologies in cars creates opportunities for insurers to offer innovative, data-driven products and services, further solidifying the segment’s leadership.

Geographic Distribution: The car segment's dominance is consistent across various regions, with variations reflecting differences in car ownership levels and regulatory frameworks. Developed economies show high penetration rates, while developing markets demonstrate significant growth potential.

Future Trends: The ongoing transition to electric vehicles (EVs) within the car segment presents both challenges and opportunities. Insurers need to adapt their offerings to account for the specific risks associated with EVs, such as battery fires, while also capitalizing on the growing demand for EV-specific insurance policies.

Considering the above factors, the car segment within the motor insurance market is expected to remain a dominant force, driving substantial growth and attracting significant investment in the coming years. The substantial market size and continual technological innovation makes this segment a key focus for insurers worldwide.

Growth Catalysts in Motor Insurance Industry

The motor insurance industry is experiencing robust growth fueled by several key factors. The rising number of vehicles globally, particularly in developing economies, is directly increasing the demand for insurance. Technological advancements, like telematics and AI, are enabling more precise risk assessment and personalized pricing, driving market expansion. Furthermore, stricter government regulations mandating insurance coverage are expanding the insured population. These elements, combined with consumer awareness of financial risks associated with vehicle accidents, collectively contribute to the industry’s substantial and sustained growth trajectory.

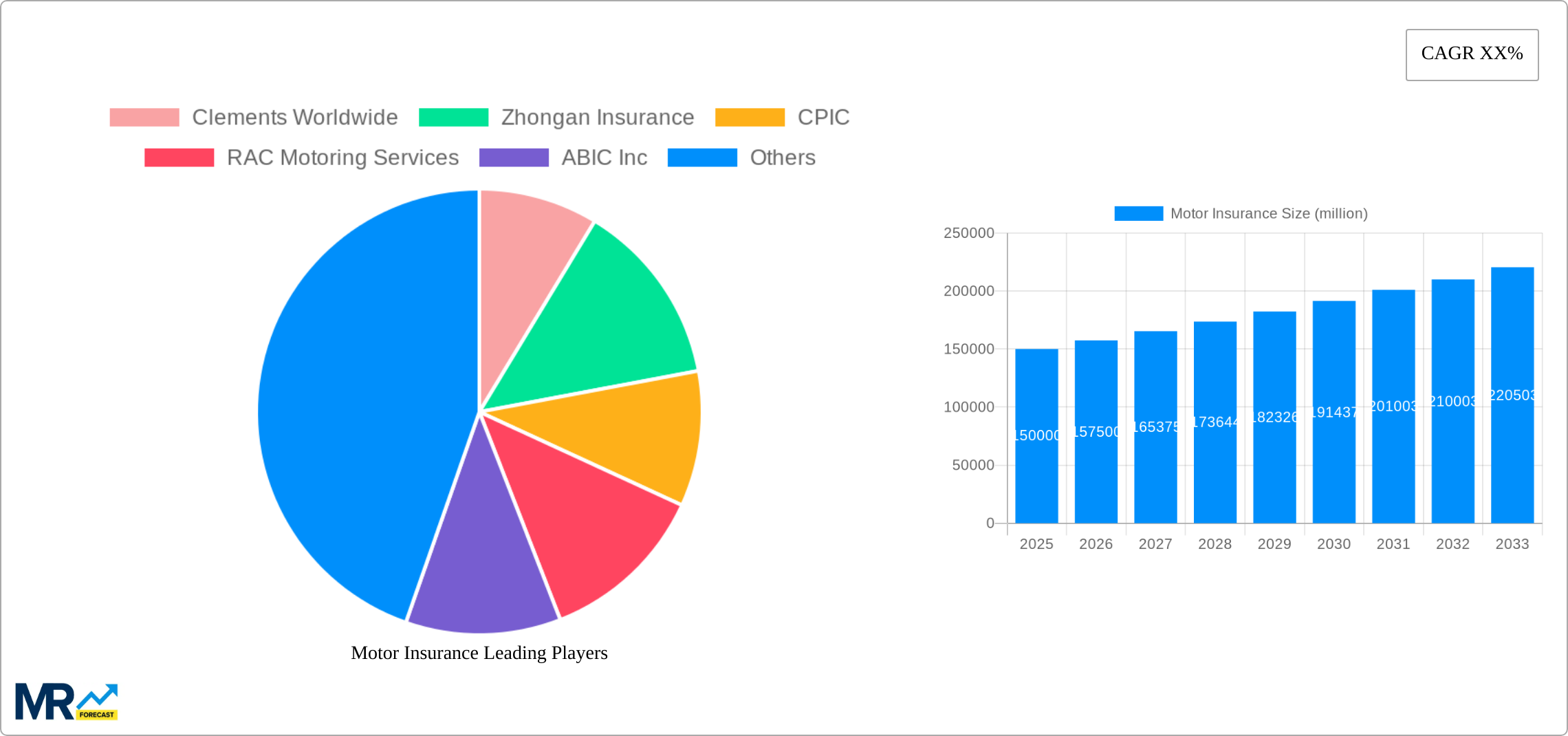

Leading Players in the Motor Insurance Market

- Clements Worldwide

- Zhongan Insurance

- CPIC

- RAC Motoring Services

- ABIC Inc

- Progressive Casualty Insurance Company [Progressive]

- Zurich Insurance Group [Zurich]

- RSA Insurance Group [RSA]

- Allstate Insurance Company [Allstate]

- NFU Mutual

- State Farm Mutual Automobile Insurance Company [State Farm]

- GEICO [GEICO]

- Chubb Ltd [Chubb]

- Nationwide Mutual Insurance [Nationwide]

- Liberty Mutual Insurance [Liberty Mutual]

- Assicurazioni Generali [Generali]

- PICC Property & Casualty

- Allianz SE [Allianz]

- Tesla [Tesla]

- Ping An Insurance(Group)

- PICC

Significant Developments in Motor Insurance Sector

- 2020: Increased adoption of telematics-based insurance policies.

- 2021: Several major insurers launched new insurance products tailored to electric vehicles.

- 2022: Regulatory changes in several countries aimed at improving road safety and increasing insurance penetration.

- 2023: Significant investments in AI and machine learning for fraud detection and risk assessment.

- 2024: Growing adoption of usage-based insurance models.

Comprehensive Coverage Motor Insurance Report

The motor insurance market demonstrates strong growth potential, driven by increasing vehicle ownership, technological advancements in risk assessment and policy offerings, and regulatory changes promoting wider insurance coverage. This combination of factors creates a favorable environment for sustained market expansion throughout the forecast period.

Motor Insurance Segmentation

-

1. Type

- 1.1. Third-party Liability

- 1.2. Comprehensive

-

2. Application

- 2.1. Car

- 2.2. Tram

- 2.3. Battery Car

- 2.4. Motorcycle

- 2.5. Tractor

- 2.6. Other

Motor Insurance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Motor Insurance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

What are the notable trends driving market growth?

.

What is the projected Compound Annual Growth Rate (CAGR) of the Motor Insurance ?

The projected CAGR is approximately XX%.

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million .

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00 , USD 5220.00, and USD 6960.00 respectively.

Which companies are prominent players in the Motor Insurance?

Key companies in the market include Clements Worldwide,Zhongan Insurance,CPIC,RAC Motoring Services,ABIC Inc,Progressive Casualty Insurance Company,Zurich Insurance Group,RSA Insurance Group,Allstate Insurance Company,NFU Mutual,State Farm Mutual Automobile Insurance Company,GEICO,Chubb Ltd,Nationwide Mutual Insurance,Liberty Mutual Insurance,Assicurazioni Generali,PICC Property & Casualty,Allianz SE,Tesla,Ping An Insurance(Group),PICC,

How can I stay updated on further developments or reports in the Motor Insurance?

To stay informed about further developments, trends, and reports in the Motor Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motor Insurance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Third-party Liability

- 5.1.2. Comprehensive

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Car

- 5.2.2. Tram

- 5.2.3. Battery Car

- 5.2.4. Motorcycle

- 5.2.5. Tractor

- 5.2.6. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Motor Insurance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Third-party Liability

- 6.1.2. Comprehensive

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Car

- 6.2.2. Tram

- 6.2.3. Battery Car

- 6.2.4. Motorcycle

- 6.2.5. Tractor

- 6.2.6. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Motor Insurance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Third-party Liability

- 7.1.2. Comprehensive

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Car

- 7.2.2. Tram

- 7.2.3. Battery Car

- 7.2.4. Motorcycle

- 7.2.5. Tractor

- 7.2.6. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Motor Insurance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Third-party Liability

- 8.1.2. Comprehensive

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Car

- 8.2.2. Tram

- 8.2.3. Battery Car

- 8.2.4. Motorcycle

- 8.2.5. Tractor

- 8.2.6. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Motor Insurance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Third-party Liability

- 9.1.2. Comprehensive

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Car

- 9.2.2. Tram

- 9.2.3. Battery Car

- 9.2.4. Motorcycle

- 9.2.5. Tractor

- 9.2.6. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Motor Insurance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Third-party Liability

- 10.1.2. Comprehensive

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Car

- 10.2.2. Tram

- 10.2.3. Battery Car

- 10.2.4. Motorcycle

- 10.2.5. Tractor

- 10.2.6. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Clements Worldwide

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zhongan Insurance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CPIC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 RAC Motoring Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ABIC Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Progressive Casualty Insurance Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zurich Insurance Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RSA Insurance Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Allstate Insurance Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NFU Mutual

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 State Farm Mutual Automobile Insurance Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GEICO

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Chubb Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nationwide Mutual Insurance

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Liberty Mutual Insurance

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Assicurazioni Generali

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 PICC Property & Casualty

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Allianz SE

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Tesla

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Ping An Insurance(Group)

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 PICC

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Clements Worldwide

- Figure 1: Global Motor Insurance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Motor Insurance Revenue (million), by Type 2024 & 2032

- Figure 3: North America Motor Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Motor Insurance Revenue (million), by Application 2024 & 2032

- Figure 5: North America Motor Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Motor Insurance Revenue (million), by Country 2024 & 2032

- Figure 7: North America Motor Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Motor Insurance Revenue (million), by Type 2024 & 2032

- Figure 9: South America Motor Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Motor Insurance Revenue (million), by Application 2024 & 2032

- Figure 11: South America Motor Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Motor Insurance Revenue (million), by Country 2024 & 2032

- Figure 13: South America Motor Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Motor Insurance Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Motor Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Motor Insurance Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Motor Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Motor Insurance Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Motor Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Motor Insurance Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Motor Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Motor Insurance Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Motor Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Motor Insurance Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Motor Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Motor Insurance Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Motor Insurance Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Motor Insurance Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Motor Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Motor Insurance Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Motor Insurance Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Motor Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Motor Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Motor Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Motor Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Motor Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Motor Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Motor Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Motor Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Motor Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Motor Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Motor Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Motor Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Motor Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Motor Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Motor Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Motor Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Motor Insurance Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Motor Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Motor Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Motor Insurance Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.