Odor Control Agent

Odor Control AgentOdor Control Agent Strategic Insights: Analysis 2025 and Forecasts 2033

Odor Control Agent by Type (Powder, Granular, Liquid, Other), by Application (Water Treatment, Air Purification, Food and Beverage, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

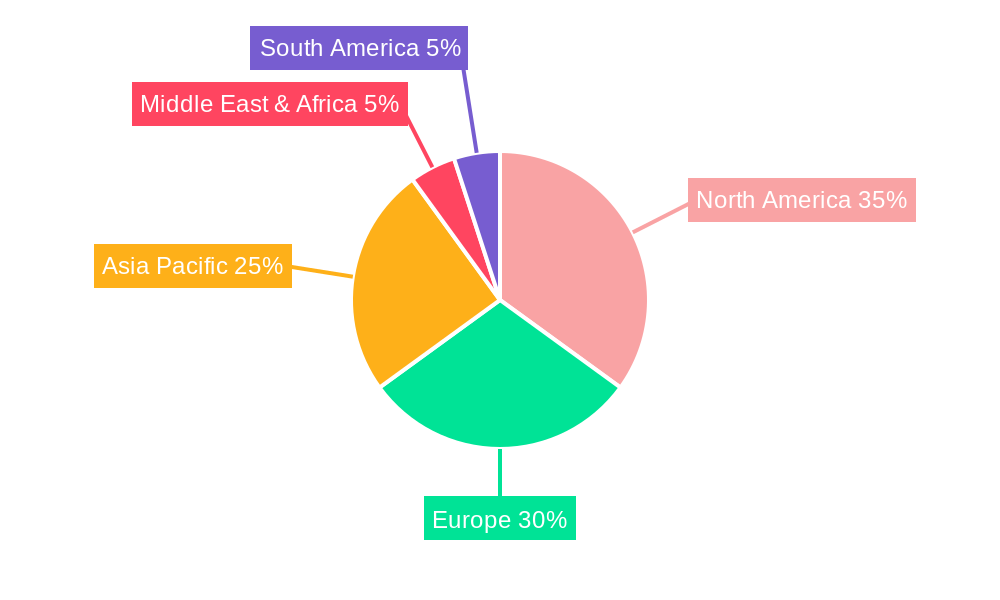

The global odor control agent market, valued at $2674.2 million in 2025, is projected to experience steady growth, driven by increasing environmental concerns and stringent regulations regarding air and water quality. The market's Compound Annual Growth Rate (CAGR) of 1.9% from 2025 to 2033 indicates a consistent, albeit moderate, expansion. Key drivers include rising demand from water treatment facilities aiming to improve effluent quality, the burgeoning food and beverage industry's focus on hygiene and product preservation, and the growing adoption of odor control solutions in air purification systems across various sectors, including industrial settings and public spaces. The powder segment currently holds a significant market share due to its ease of use and cost-effectiveness, while the water treatment application sector dominates overall demand, driven by expanding urban populations and industrial activities. However, challenges remain, including fluctuating raw material prices and the need for innovative, sustainable odor control solutions to address environmental concerns. Geographic distribution shows a strong presence in North America and Europe, primarily driven by well-established environmental regulations and consumer awareness. Asia-Pacific is also a region of significant growth potential, fuelled by rapid industrialization and urbanization.

The competitive landscape comprises both established multinational corporations and regional players. Companies like Ecolab, Calgon Carbon, and Cabot are key players, leveraging their extensive distribution networks and technological expertise. However, the entry of regional players, particularly in the Asia-Pacific region, is increasing competition and offering diverse product portfolios to cater to specific regional needs. Future growth will likely be influenced by the development of more efficient and environmentally friendly odor control agents, particularly those addressing emerging concerns about microplastics and other potential environmental impacts. The market will also continue to evolve towards more customized solutions catering to specific odor types and industrial applications. Technological advancements in odor detection and monitoring technologies will further enhance market expansion.

Odor Control Agent Trends

The global odor control agent market is experiencing robust growth, projected to reach several billion units by 2033. Driven by increasing environmental concerns and stringent regulations regarding odor emissions across various industries, the demand for effective odor control solutions is surging. The market is witnessing a shift towards more sustainable and environmentally friendly odor control agents, with a noticeable rise in the adoption of bio-based and renewable alternatives. This trend is further propelled by escalating consumer awareness of the health impacts of persistent odors, particularly in residential, commercial, and industrial settings. The historical period (2019-2024) saw steady growth, laying a strong foundation for the substantial expansion expected during the forecast period (2025-2033). Key market insights reveal a growing preference for granular and liquid odor control agents due to their ease of application and effectiveness across diverse applications. The water treatment segment continues to be a major driver, owing to the increasing need for efficient odor removal from wastewater and drinking water sources. However, the air purification segment is also experiencing rapid growth, fueled by rising concerns about indoor air quality and the need for effective odor control in various indoor environments, including homes, offices, and public spaces. The estimated market value for 2025 signifies a significant milestone in this expanding market, representing a substantial increase from previous years. The competitive landscape is dynamic, with major players focusing on product innovation, strategic partnerships, and geographic expansion to capitalize on the market's growth potential. This competitive intensity is further fostering innovation in odor control agent technology, leading to the development of more effective, sustainable, and cost-effective solutions.

Driving Forces: What's Propelling the Odor Control Agent Market?

Several factors are driving the growth of the odor control agent market. Stringent government regulations regarding air and water quality are forcing industries to adopt effective odor control measures, significantly boosting demand. The increasing awareness among consumers about the health implications of exposure to unpleasant odors is also a key driver. Industries like food and beverage, wastewater treatment, and animal feed processing are major consumers of odor control agents, contributing significantly to market expansion. The growing need for improved hygiene and sanitation in both residential and commercial settings fuels the demand for effective odor neutralizers and eliminators. Furthermore, the rise in construction and industrial activities is also indirectly contributing to market growth by generating a greater need for odor control solutions in new and existing facilities. Technological advancements in odor control technology are leading to the development of more effective and efficient agents, further fueling market growth. This includes the development of more targeted and specific odor-eliminating agents as well as improved delivery systems. The increasing adoption of sustainable and eco-friendly odor control agents is another important trend, driven by growing environmental concerns and a push towards greener solutions.

Challenges and Restraints in the Odor Control Agent Market

Despite the positive outlook, the odor control agent market faces certain challenges. The high cost of some advanced odor control technologies can be a barrier to adoption, particularly for smaller businesses or in developing economies. The potential toxicity of some odor control agents poses environmental and health concerns, necessitating stringent safety regulations and careful selection of products. The effectiveness of odor control agents can vary depending on the specific odor source and environmental conditions, requiring careful assessment and selection of appropriate products. Fluctuations in raw material prices can also impact the profitability of odor control agent manufacturers. Furthermore, the complexity of odor control strategies, particularly in dealing with complex odor mixtures, requires specialized expertise and careful planning. Finally, competition in the market is intense, requiring manufacturers to continuously innovate and offer cost-effective and high-performing products to maintain a competitive edge.

Key Region or Country & Segment to Dominate the Market

The water treatment application segment is poised to dominate the odor control agent market throughout the forecast period. This is driven by the ever-increasing need for clean and safe drinking water and the stringent regulations related to wastewater treatment globally. The growing population and industrialization are leading to increased water pollution, emphasizing the need for effective odor control in water treatment plants.

North America and Europe are expected to lead the market due to their stringent environmental regulations, advanced infrastructure, and high awareness of odor control's impact on public health. These regions have a strong focus on sustainability and environmental protection, driving the adoption of eco-friendly odor control agents.

Asia-Pacific, while currently a smaller contributor compared to North America and Europe, shows significant growth potential. Rapid industrialization and urbanization in countries like China and India are leading to increased demand for odor control solutions. The increasing disposable income and growing awareness of environmental issues in these regions further stimulate market growth.

Within the types of odor control agents, granular agents are gaining popularity due to their versatility, ease of use, and effectiveness in various applications. They are suitable for both water and air purification, contributing to their market dominance. The liquid form is also witnessing substantial growth due to its applicability in various industrial processes and its adaptability to different control methods like spraying or injection.

The high demand in water treatment is driven by:

- Stringent regulations: Governments are increasingly imposing strict rules regarding wastewater discharge, pushing treatment plants to employ advanced odor control technologies.

- Population growth: Growing urban populations lead to higher wastewater volumes, necessitating efficient odor management systems.

- Industrial wastewater: Many industries generate significant wastewater volumes with strong odors, requiring specialized odor control solutions.

- Public health concerns: Unpleasant odors associated with water sources pose public health risks, creating a strong impetus for effective odor control.

Growth Catalysts in the Odor Control Agent Industry

The odor control agent industry is experiencing substantial growth due to a convergence of factors including rising environmental concerns, stricter regulations, increased consumer awareness of health impacts of odors, and technological advancements. This combination is creating significant opportunities for innovation and market expansion across various applications, particularly in water and air purification. The development of sustainable and eco-friendly odor control solutions is also a key driver, contributing to market expansion.

Leading Players in the Odor Control Agent Market

- Ecolab

- Calgon Carbon

- Cabot

- Fujian Yuanli Active Carbon

- Haycarb

- Osaka

Significant Developments in the Odor Control Agent Sector

- 2021: Ecolab launched a new line of sustainable odor control agents for the food and beverage industry.

- 2022: Calgon Carbon introduced an advanced activated carbon technology for enhanced odor removal in wastewater treatment.

- 2023: Haycarb expanded its manufacturing capacity to meet the growing demand for its odor control products.

- 2024: A significant merger between two smaller players resulted in a larger market presence.

Comprehensive Coverage Odor Control Agent Report

This report provides a comprehensive analysis of the odor control agent market, covering market trends, driving forces, challenges, key players, and significant developments. The report offers in-depth insights into the various market segments, including application and type, providing a detailed understanding of the market dynamics. It projects market growth during the forecast period (2025-2033), giving stakeholders valuable information for strategic decision-making. With detailed analysis and insights, the report provides a valuable resource for both existing and new players in the industry.

Odor Control Agent Segmentation

-

1. Type

- 1.1. Powder

- 1.2. Granular

- 1.3. Liquid

- 1.4. Other

-

2. Application

- 2.1. Water Treatment

- 2.2. Air Purification

- 2.3. Food and Beverage

- 2.4. Other

Odor Control Agent Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Odor Control Agent REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.9% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Odor Control Agent Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Powder

- 5.1.2. Granular

- 5.1.3. Liquid

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Water Treatment

- 5.2.2. Air Purification

- 5.2.3. Food and Beverage

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Odor Control Agent Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Powder

- 6.1.2. Granular

- 6.1.3. Liquid

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Water Treatment

- 6.2.2. Air Purification

- 6.2.3. Food and Beverage

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Odor Control Agent Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Powder

- 7.1.2. Granular

- 7.1.3. Liquid

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Water Treatment

- 7.2.2. Air Purification

- 7.2.3. Food and Beverage

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Odor Control Agent Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Powder

- 8.1.2. Granular

- 8.1.3. Liquid

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Water Treatment

- 8.2.2. Air Purification

- 8.2.3. Food and Beverage

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Odor Control Agent Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Powder

- 9.1.2. Granular

- 9.1.3. Liquid

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Water Treatment

- 9.2.2. Air Purification

- 9.2.3. Food and Beverage

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Odor Control Agent Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Powder

- 10.1.2. Granular

- 10.1.3. Liquid

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Water Treatment

- 10.2.2. Air Purification

- 10.2.3. Food and Beverage

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ecolab

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Calgon Carbon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cabot

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fujian Yuanli Active Carbon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Haycarb

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Osaka

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Ecolab

- Figure 1: Global Odor Control Agent Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Odor Control Agent Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Odor Control Agent Revenue (million), by Type 2024 & 2032

- Figure 4: North America Odor Control Agent Volume (K), by Type 2024 & 2032

- Figure 5: North America Odor Control Agent Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Odor Control Agent Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Odor Control Agent Revenue (million), by Application 2024 & 2032

- Figure 8: North America Odor Control Agent Volume (K), by Application 2024 & 2032

- Figure 9: North America Odor Control Agent Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Odor Control Agent Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Odor Control Agent Revenue (million), by Country 2024 & 2032

- Figure 12: North America Odor Control Agent Volume (K), by Country 2024 & 2032

- Figure 13: North America Odor Control Agent Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Odor Control Agent Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Odor Control Agent Revenue (million), by Type 2024 & 2032

- Figure 16: South America Odor Control Agent Volume (K), by Type 2024 & 2032

- Figure 17: South America Odor Control Agent Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Odor Control Agent Volume Share (%), by Type 2024 & 2032

- Figure 19: South America Odor Control Agent Revenue (million), by Application 2024 & 2032

- Figure 20: South America Odor Control Agent Volume (K), by Application 2024 & 2032

- Figure 21: South America Odor Control Agent Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Odor Control Agent Volume Share (%), by Application 2024 & 2032

- Figure 23: South America Odor Control Agent Revenue (million), by Country 2024 & 2032

- Figure 24: South America Odor Control Agent Volume (K), by Country 2024 & 2032

- Figure 25: South America Odor Control Agent Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Odor Control Agent Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Odor Control Agent Revenue (million), by Type 2024 & 2032

- Figure 28: Europe Odor Control Agent Volume (K), by Type 2024 & 2032

- Figure 29: Europe Odor Control Agent Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Odor Control Agent Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe Odor Control Agent Revenue (million), by Application 2024 & 2032

- Figure 32: Europe Odor Control Agent Volume (K), by Application 2024 & 2032

- Figure 33: Europe Odor Control Agent Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe Odor Control Agent Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe Odor Control Agent Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Odor Control Agent Volume (K), by Country 2024 & 2032

- Figure 37: Europe Odor Control Agent Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Odor Control Agent Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Odor Control Agent Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa Odor Control Agent Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa Odor Control Agent Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa Odor Control Agent Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa Odor Control Agent Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa Odor Control Agent Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa Odor Control Agent Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa Odor Control Agent Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa Odor Control Agent Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Odor Control Agent Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Odor Control Agent Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Odor Control Agent Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Odor Control Agent Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific Odor Control Agent Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific Odor Control Agent Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific Odor Control Agent Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific Odor Control Agent Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific Odor Control Agent Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific Odor Control Agent Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Odor Control Agent Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Odor Control Agent Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Odor Control Agent Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Odor Control Agent Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Odor Control Agent Volume Share (%), by Country 2024 & 2032

- Table 1: Global Odor Control Agent Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Odor Control Agent Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Odor Control Agent Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Odor Control Agent Volume K Forecast, by Type 2019 & 2032

- Table 5: Global Odor Control Agent Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Odor Control Agent Volume K Forecast, by Application 2019 & 2032

- Table 7: Global Odor Control Agent Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Odor Control Agent Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Odor Control Agent Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Odor Control Agent Volume K Forecast, by Type 2019 & 2032

- Table 11: Global Odor Control Agent Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Odor Control Agent Volume K Forecast, by Application 2019 & 2032

- Table 13: Global Odor Control Agent Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Odor Control Agent Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Odor Control Agent Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global Odor Control Agent Volume K Forecast, by Type 2019 & 2032

- Table 23: Global Odor Control Agent Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global Odor Control Agent Volume K Forecast, by Application 2019 & 2032

- Table 25: Global Odor Control Agent Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Odor Control Agent Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Odor Control Agent Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global Odor Control Agent Volume K Forecast, by Type 2019 & 2032

- Table 35: Global Odor Control Agent Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global Odor Control Agent Volume K Forecast, by Application 2019 & 2032

- Table 37: Global Odor Control Agent Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Odor Control Agent Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Odor Control Agent Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global Odor Control Agent Volume K Forecast, by Type 2019 & 2032

- Table 59: Global Odor Control Agent Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global Odor Control Agent Volume K Forecast, by Application 2019 & 2032

- Table 61: Global Odor Control Agent Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Odor Control Agent Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Odor Control Agent Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global Odor Control Agent Volume K Forecast, by Type 2019 & 2032

- Table 77: Global Odor Control Agent Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global Odor Control Agent Volume K Forecast, by Application 2019 & 2032

- Table 79: Global Odor Control Agent Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Odor Control Agent Volume K Forecast, by Country 2019 & 2032

- Table 81: China Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Odor Control Agent Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Odor Control Agent Volume (K) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.