Outboard Motor Rebuild Service

Outboard Motor Rebuild ServiceOutboard Motor Rebuild Service Decade Long Trends, Analysis and Forecast 2025-2033

Outboard Motor Rebuild Service by Type (Total Engine Rebuilds, Partial Engine Rebuilds), by Application (Business, Individual), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

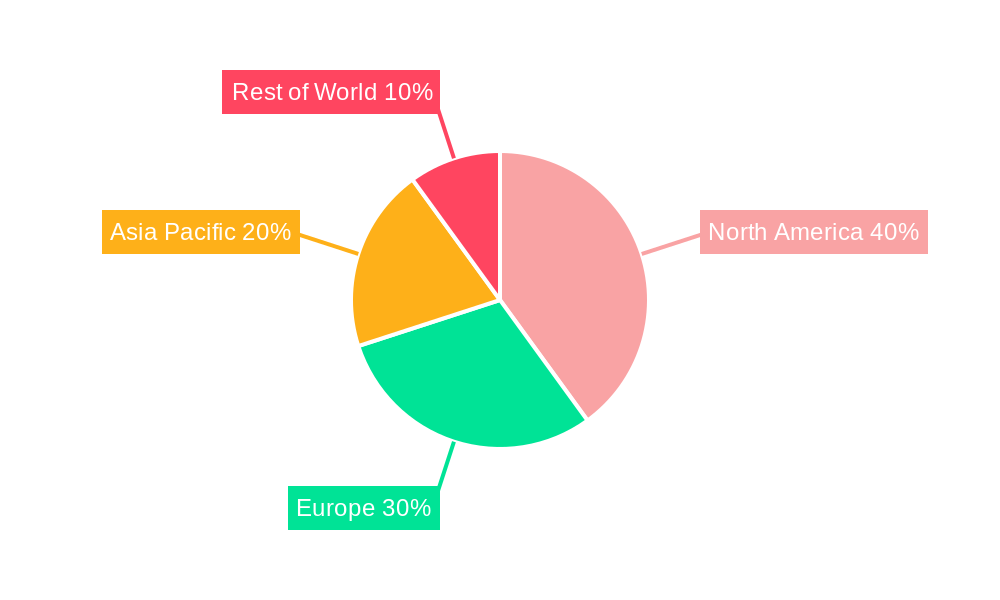

The outboard motor rebuild service market, valued at $529.8 million in 2025, presents a lucrative opportunity for businesses specializing in marine engine repair. This market is driven by the increasing popularity of boating and fishing activities, leading to a higher demand for reliable outboard motor maintenance and repair services. The aging outboard motor fleet also contributes significantly to market growth, as older engines require more frequent repairs and rebuilds. Furthermore, advancements in rebuild technologies and techniques are improving the efficiency and cost-effectiveness of these services, making them a more attractive option for boat owners compared to purchasing new engines. The market is segmented by the type of rebuild (total or partial) and application (business or individual), with the total engine rebuild segment likely holding a larger market share due to the extensive repairs required by severely damaged engines. The geographical distribution of the market is broad, with North America and Europe anticipated to be leading regions, given the established boating culture and higher disposable income levels in these areas. However, growth is also expected in developing regions like Asia-Pacific as the boating market expands. Competition within the market is relatively fragmented, with numerous regional players operating alongside some larger, more established businesses. The projected CAGR (assuming a conservative estimate of 5% based on industry trends for related service markets) indicates steady growth over the forecast period (2025-2033).

While the market enjoys consistent demand, potential restraints include fluctuating fuel prices, economic downturns affecting discretionary spending on leisure activities, and the potential for substitute technologies such as electric outboard motors gaining traction. However, the resilience of the established boating community and the comparatively high cost of engine replacement should ensure the long-term health of the outboard motor rebuild service market. The strategic focus of market players should be on enhancing service quality, offering competitive pricing, and exploring potential partnerships to reach wider customer bases. This includes investing in advanced diagnostic equipment, skilled technicians, and effective marketing strategies to maintain their market position amidst increasing competition and evolving industry dynamics.

Outboard Motor Rebuild Service Trends

The global outboard motor rebuild service market is experiencing robust growth, projected to reach multi-million unit volumes by 2033. Driven by increasing demand for cost-effective maintenance and repair of outboard motors, the market demonstrates a significant shift towards sustainable practices and specialized services. Over the historical period (2019-2024), the market witnessed a Compound Annual Growth Rate (CAGR) exceeding expectations, primarily fueled by the rising popularity of recreational boating and the aging fleet of outboard motors requiring refurbishment. The estimated market size in 2025 positions the industry for substantial expansion during the forecast period (2025-2033). This growth is not uniform across all segments; partial engine rebuilds are experiencing a higher demand compared to total engine rebuilds, reflecting a preference for cost-effective solutions. The business segment, encompassing marinas, rental companies, and commercial fishing operations, contributes significantly to the overall market volume. This segment is increasingly adopting preventative maintenance strategies which lead to a consistent demand for partial rebuild services. The individual segment also plays a crucial role, as owners of recreational boats seek to extend the lifespan of their motors. The industry is characterized by both large-scale service providers and smaller, independent repair shops. Competition is primarily driven by service quality, turnaround times, and the availability of specialized parts. Market trends indicate a growing demand for eco-friendly rebuilding practices, utilizing recycled materials and minimizing waste generation. Furthermore, the industry is witnessing the adoption of advanced technologies to enhance efficiency and precision in rebuild processes. The integration of digital tools for diagnostics, inventory management, and customer relationship management is playing a vital role in streamlining operations and optimizing profitability.

Driving Forces: What's Propelling the Outboard Motor Rebuild Service

Several key factors are driving the expansion of the outboard motor rebuild service market. The rising popularity of recreational boating activities, coupled with an increasing number of aging outboard motors in service, creates a significant demand for repair and maintenance services. The cost-effectiveness of rebuilding an outboard motor compared to purchasing a new one is a major impetus for this market growth. This is especially true for high-horsepower motors where replacement costs are significantly higher. Furthermore, technological advancements in outboard motor technology are influencing the nature of repair services. More specialized tools and expertise are required to handle the complexity of modern engines, thus increasing demand for professionals. The growing environmental awareness is also leading to a greater emphasis on sustainable rebuilding practices. Customers are increasingly seeking eco-friendly repair options, contributing to the growth of businesses that prioritize sustainability. Additionally, improved accessibility to outboard motor parts, coupled with the growing presence of specialized online platforms and supplier networks, significantly bolsters the market. Lastly, the increasing skills shortage in the marine industry means that professionals who can provide quality outboard motor rebuild services are highly sought after, leading to increased demand and market expansion.

Challenges and Restraints in Outboard Motor Rebuild Service

Despite the positive growth trajectory, the outboard motor rebuild service market faces several challenges. The most prominent is the fluctuation in the supply chain of essential parts. Depending on the specific engine model and age, sourcing components can be problematic, impacting turnaround times and potentially increasing costs. Seasonal variations in demand represent another significant challenge. The peak seasons for boating activities often lead to an increased workload, potentially causing delays and straining the capacity of service providers. Moreover, competition among various repair centers and independent operators is intensifying. Maintaining competitiveness requires specialized training, investment in technology, and efficient operational management. Finding and retaining qualified technicians with sufficient experience and expertise in handling complex outboard motor repairs poses another considerable challenge. The industry faces a shortage of skilled labor, contributing to higher labor costs. Regulatory changes and environmental regulations related to waste disposal and the handling of hazardous materials impose further challenges on operators. Maintaining compliance and incorporating environmentally friendly practices can add to the operational costs, impacting overall profitability. Finally, accurate forecasting of demand is critical for effective inventory management and resource allocation, but fluctuating fuel costs and other economic factors can make precise forecasting very difficult.

Key Region or Country & Segment to Dominate the Market

The individual segment is projected to dominate the outboard motor rebuild service market during the forecast period. This is primarily driven by the substantial increase in recreational boating, with millions of individual boat owners requiring regular maintenance and repair services for their outboard motors. The rising popularity of fishing and water sports, coupled with the longevity of outboard motors, contributes significantly to the high demand for rebuild services within this segment.

High Demand for Partial Rebuilds: Within the 'Type' segment, partial engine rebuilds are anticipated to hold the largest market share. This preference stems from the cost-effectiveness of this approach compared to full engine overhauls, particularly for issues that do not necessitate the complete disassembly and replacement of all components. Owners of smaller boats or those with limited budgets will often opt for partial rebuilds to extend the lifespan of their motors.

Regional Variations: While specific data on individual country market shares isn't available within this report, regions with high concentrations of recreational boating activities and a significant number of older outboard motors in use are expected to display the strongest growth. These regions typically include coastal areas and regions with numerous lakes and rivers. Areas with robust tourism economies that support a significant number of rental boats will also present substantial market opportunities.

Business segment growth: While the individual segment dominates by volume, the business segment (including marinas, rental fleets, and commercial fishing operations) plays a vital role due to its emphasis on preventative maintenance and a high volume of motors that require regular service. This segment is generally willing to invest in higher-quality parts and labor, leading to increased revenue for service providers. The adoption of fleet management software by businesses and the resultant analysis of individual unit maintenance costs are driving increased demand for professional outboard rebuild services.

The continued growth of the individual segment is inextricably linked to the accessibility and affordability of outboard motor rebuild services. As more skilled technicians enter the market and technology improves, the cost of these services should remain competitive with the price of new motors, thus further driving market expansion. However, factors like economic downturns or changing recreational trends could influence this projection.

Growth Catalysts in Outboard Motor Rebuild Service Industry

The outboard motor rebuild service industry's growth is significantly boosted by rising disposable incomes, fueling increased participation in recreational boating. Simultaneously, technological advancements in diagnostics and repair techniques enhance the quality and efficiency of rebuild services. Additionally, a growing awareness of environmental concerns drives demand for sustainable rebuilding practices, contributing to the market's overall expansion.

Leading Players in the Outboard Motor Rebuild Service

- Outboard Clinic

- Marine Rebuild Specialists

- East Texas Outboard Rebuild

- Old Salt Marine

- Boating Dynamics

- Chris Carson's Marine Service

- Nautek Marine

- All Pro Watercraft & ATV Service

- Loonie Toons Pontoons and Powersports

- Lakeside Marine

- Mobile Outboard Marine

- Maximum Outboards

- Sees Outboard

- Howick Marine

- Boathouse Marine Center

- Supreme Marine & Export

Significant Developments in Outboard Motor Rebuild Service Sector

- 2020: Introduction of new, environmentally friendly cleaning agents by several major players.

- 2021: Several companies invested in advanced diagnostic equipment for improved precision in rebuilds.

- 2022: The launch of several online platforms to connect customers with certified outboard motor rebuilders.

- 2023: Several companies expanded to cater to the increased demand for electric outboard motor rebuilds.

Comprehensive Coverage Outboard Motor Rebuild Service Report

This report provides a detailed analysis of the outboard motor rebuild service market, encompassing historical data, current market trends, and future projections. The comprehensive nature of this report makes it a valuable resource for businesses operating in this sector and for investors seeking opportunities within the market. It addresses various aspects, including market segmentation, growth drivers, challenges, and leading players, providing a complete overview of the industry landscape.

Outboard Motor Rebuild Service Segmentation

-

1. Type

- 1.1. Total Engine Rebuilds

- 1.2. Partial Engine Rebuilds

-

2. Application

- 2.1. Business

- 2.2. Individual

Outboard Motor Rebuild Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Outboard Motor Rebuild Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Outboard Motor Rebuild Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Total Engine Rebuilds

- 5.1.2. Partial Engine Rebuilds

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Business

- 5.2.2. Individual

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Outboard Motor Rebuild Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Total Engine Rebuilds

- 6.1.2. Partial Engine Rebuilds

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Business

- 6.2.2. Individual

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Outboard Motor Rebuild Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Total Engine Rebuilds

- 7.1.2. Partial Engine Rebuilds

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Business

- 7.2.2. Individual

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Outboard Motor Rebuild Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Total Engine Rebuilds

- 8.1.2. Partial Engine Rebuilds

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Business

- 8.2.2. Individual

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Outboard Motor Rebuild Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Total Engine Rebuilds

- 9.1.2. Partial Engine Rebuilds

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Business

- 9.2.2. Individual

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Outboard Motor Rebuild Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Total Engine Rebuilds

- 10.1.2. Partial Engine Rebuilds

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Business

- 10.2.2. Individual

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Outboard Clinic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Marine Rebuild Specialists

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 East Texas Outboard Rebuild

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Old Salt Marine

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Boating Dynamics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chris Carson's Marine Service

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nautek Marine

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 All Pro Watercraft & ATV Service

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Loonie Toons Pontoons and Powersports

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lakeside Marine

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mobile Outboard Marine

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Maximum Outboards

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sees Outboard

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Howick Marine

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Boathouse Marine Center

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Supreme Marine & Export

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Outboard Clinic

- Figure 1: Global Outboard Motor Rebuild Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Outboard Motor Rebuild Service Revenue (million), by Type 2024 & 2032

- Figure 3: North America Outboard Motor Rebuild Service Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Outboard Motor Rebuild Service Revenue (million), by Application 2024 & 2032

- Figure 5: North America Outboard Motor Rebuild Service Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Outboard Motor Rebuild Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Outboard Motor Rebuild Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Outboard Motor Rebuild Service Revenue (million), by Type 2024 & 2032

- Figure 9: South America Outboard Motor Rebuild Service Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Outboard Motor Rebuild Service Revenue (million), by Application 2024 & 2032

- Figure 11: South America Outboard Motor Rebuild Service Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Outboard Motor Rebuild Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Outboard Motor Rebuild Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Outboard Motor Rebuild Service Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Outboard Motor Rebuild Service Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Outboard Motor Rebuild Service Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Outboard Motor Rebuild Service Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Outboard Motor Rebuild Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Outboard Motor Rebuild Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Outboard Motor Rebuild Service Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Outboard Motor Rebuild Service Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Outboard Motor Rebuild Service Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Outboard Motor Rebuild Service Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Outboard Motor Rebuild Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Outboard Motor Rebuild Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Outboard Motor Rebuild Service Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Outboard Motor Rebuild Service Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Outboard Motor Rebuild Service Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Outboard Motor Rebuild Service Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Outboard Motor Rebuild Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Outboard Motor Rebuild Service Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Outboard Motor Rebuild Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Outboard Motor Rebuild Service Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Outboard Motor Rebuild Service Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Outboard Motor Rebuild Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Outboard Motor Rebuild Service Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Outboard Motor Rebuild Service Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Outboard Motor Rebuild Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Outboard Motor Rebuild Service Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Outboard Motor Rebuild Service Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Outboard Motor Rebuild Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Outboard Motor Rebuild Service Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Outboard Motor Rebuild Service Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Outboard Motor Rebuild Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Outboard Motor Rebuild Service Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Outboard Motor Rebuild Service Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Outboard Motor Rebuild Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Outboard Motor Rebuild Service Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Outboard Motor Rebuild Service Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Outboard Motor Rebuild Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Outboard Motor Rebuild Service Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.