Parallel Artificial Membrane Permeability Assay

Parallel Artificial Membrane Permeability AssayParallel Artificial Membrane Permeability Assay Is Set To Reach XXX million By 2033, Growing At A CAGR Of XX

Parallel Artificial Membrane Permeability Assay by Type (Caco-2 Cultures, Gastrointestinal Tract, Blood–brain Barrier, Skin), by Application (Drug Discovery, Cosmetic Research, Toxicology Research, Drug Delivery Research), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The Parallel Artificial Membrane Permeability Assay (PAMPA) market is experiencing robust growth, driven by the increasing demand for efficient and cost-effective drug discovery and development tools. The market's expansion is fueled by several key factors: the rising prevalence of chronic diseases necessitating new drug development, the increasing adoption of high-throughput screening methods in pharmaceutical and cosmetic research, and the growing need for accurate prediction of drug absorption and permeability. The diverse applications of PAMPA across various research areas, including drug discovery, cosmetic research, toxicology studies, and drug delivery research, contribute significantly to its market size. Segments like Caco-2 cultures and the blood-brain barrier assays are particularly significant due to their relevance in assessing drug bioavailability and central nervous system penetration. While the exact market size for 2025 requires further investigation, considering the global scale of pharmaceutical and biotechnology research, a reasonable estimate based on typical market growth within this niche would place it in the range of $250-300 million. This estimation factors in the reported CAGR and the sustained high demand for reliable in-vitro permeability assays. The market is expected to show a steady growth trajectory over the next decade, driven primarily by technological advancements in assay design and the increasing integration of PAMPA within larger drug development pipelines.

Competition in the PAMPA market is relatively fragmented, with several key players offering a range of services and products. These companies are focused on providing high-quality assays, supporting services, and efficient data analysis tools. Continued technological advancements, such as improved membrane models and automated systems, are expected to drive innovation and market expansion. However, limitations such as the inability to fully replicate in-vivo conditions and the potential for inter-assay variability represent challenges. Overcoming these challenges through standardized protocols and enhanced experimental design will be crucial for maintaining the market's positive growth momentum. Geographic expansion, particularly in emerging markets with growing pharmaceutical industries, represents a significant growth opportunity for existing and new market entrants.

Parallel Artificial Membrane Permeability Assay Trends

The parallel artificial membrane permeability assay (PAMPA) market is experiencing robust growth, projected to reach USD 250 million by 2025 and exceeding USD 500 million by 2033. This significant expansion is driven by the increasing demand for efficient and high-throughput drug discovery and development tools. The pharmaceutical and cosmetic industries are increasingly adopting PAMPA as a crucial preliminary screening tool, enabling faster and cost-effective evaluation of drug candidates and cosmetic ingredients. The assay's ability to rapidly assess permeability across various biological barriers, including the gastrointestinal tract, blood-brain barrier, and skin, offers a significant advantage over traditional in vivo models. This is particularly important during the early stages of drug development where rapid screening of numerous compounds is vital to identify promising candidates. The historical period (2019-2024) witnessed a steady rise in PAMPA adoption, fueled by advancements in assay technology and a growing awareness of its benefits. This positive trend is expected to continue throughout the forecast period (2025-2033), with significant contributions from both established pharmaceutical giants and emerging biotech companies. The market is also witnessing increased interest in PAMPA applications beyond drug discovery, including cosmetic research, toxicology studies, and drug delivery research. This diversification of applications will further propel market growth and solidifies PAMPA's position as an indispensable tool in multiple sectors. The growing adoption of artificial intelligence and machine learning algorithms for data analysis in PAMPA assays is enhancing the efficiency and predictive power of the technology, contributing to its market expansion. Furthermore, the increasing outsourcing of preclinical research to contract research organizations (CROs) is further contributing to market growth.

Driving Forces: What's Propelling the Parallel Artificial Membrane Permeability Assay

The escalating demand for rapid and cost-effective drug discovery and development is the primary driver propelling the growth of the parallel artificial membrane permeability assay market. Traditional in vivo methods are time-consuming, expensive, and often require the use of animals. PAMPA offers a high-throughput alternative, allowing researchers to screen hundreds or even thousands of compounds in a significantly shorter time frame. This translates into reduced development costs and accelerated time-to-market for new drugs and cosmetic products. The increasing prevalence of chronic diseases globally is also fueling the demand for innovative drug therapies. The need to identify and develop effective drugs quickly necessitates the use of efficient screening technologies, with PAMPA emerging as a critical component. Moreover, the growing emphasis on regulatory compliance and the need for robust preclinical data to support drug approvals are driving the adoption of validated and reliable methods like PAMPA. Finally, continuous advancements in assay technology, including the development of more sophisticated artificial membranes that better mimic biological barriers, are improving the accuracy and predictive power of PAMPA. These ongoing technological advancements are ensuring that PAMPA remains a cutting-edge tool in drug discovery and development.

Challenges and Restraints in Parallel Artificial Membrane Permeability Assay

Despite the significant advantages of PAMPA, several challenges and restraints hinder its widespread adoption. One major challenge is the inherent limitations of artificial membranes in accurately mimicking the complex in vivo environment. While PAMPA provides a good approximation of permeability, it cannot fully capture the intricacies of biological barriers, such as the influence of transporters and metabolic enzymes. This limitation can affect the accuracy of permeability predictions, particularly for compounds that interact strongly with these biological factors. Another challenge is the lack of standardization across different PAMPA platforms and protocols. Variations in membrane composition, assay conditions, and data analysis methods can lead to discrepancies in permeability measurements between different laboratories, making comparisons difficult. The need for specialized equipment and expertise to perform PAMPA assays represents a significant barrier for smaller research groups and institutions with limited resources. The relatively high initial investment cost of purchasing equipment and setting up the assay can be prohibitive. Overcoming these challenges requires collaborative efforts to establish standardized protocols, develop more sophisticated artificial membranes, and make the technology more accessible to a broader range of researchers.

Key Region or Country & Segment to Dominate the Market

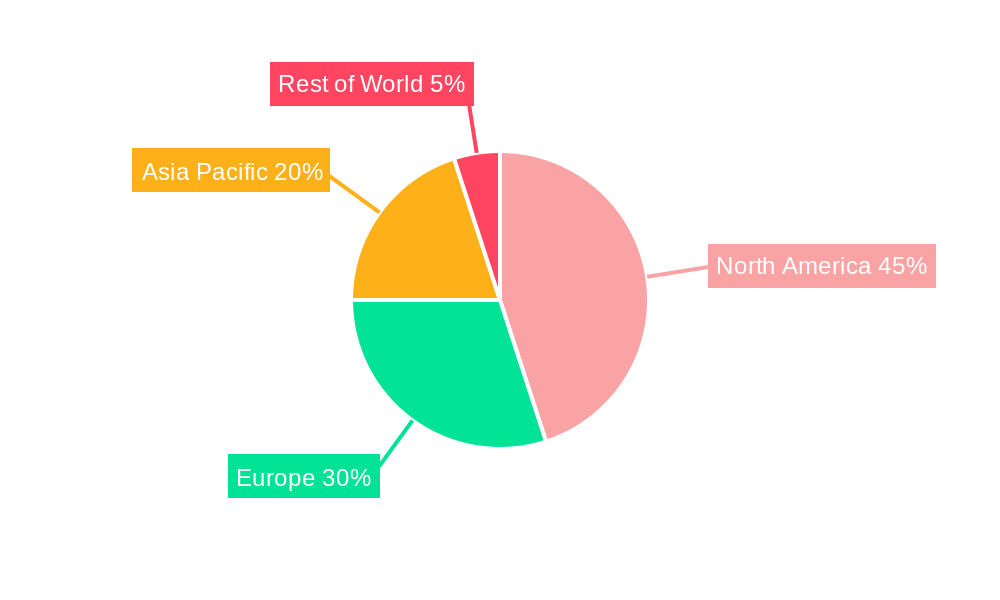

The North American market is projected to dominate the parallel artificial membrane permeability assay market during the forecast period (2025-2033), driven by a high concentration of pharmaceutical and biotechnology companies, robust research and development infrastructure, and significant investments in drug discovery and development. Europe is expected to follow closely, propelled by increasing pharmaceutical R&D investments and the presence of several leading CROs. The Asia-Pacific region is also anticipated to witness substantial growth, particularly in countries like China and India, owing to the rapidly expanding pharmaceutical and biotechnology industries and increasing outsourcing of drug development activities.

- Drug Discovery Segment Dominance: The drug discovery segment will constitute the largest portion of the PAMPA market. The significant advantages offered by PAMPA in terms of speed, cost-effectiveness, and high throughput are making it an indispensable tool in the drug development pipeline. Early-stage drug screening is greatly facilitated by the assay, enabling quicker identification of lead compounds and improved efficiency in the overall drug discovery process. The increasing need for more effective and faster drug development methods is further strengthening the dominance of this segment. The demand for cost-effective solutions to speed up the drug discovery process and reduce overall development costs is driving the segment's growth.

- Caco-2 Cultures: The use of Caco-2 cell cultures in PAMPA assays is expected to witness high growth owing to their established role as a reliable model for assessing intestinal permeability. Caco-2 cells offer a more physiologically relevant model compared to simple artificial membranes, making them better suited for predicting in vivo absorption.

The growing adoption of PAMPA in drug delivery research is also significant, as the ability to accurately assess permeability is crucial for designing effective drug delivery systems. This includes targeted drug delivery systems and transdermal patches. Furthermore, the growing application of PAMPA in toxicology research, assessing the potential toxicity of compounds based on their ability to penetrate biological barriers, is expanding the assay’s market reach. The need for accurate, rapid, and cost-effective toxicity assessment fuels this segment.

Growth Catalysts in Parallel Artificial Membrane Permeability Assay Industry

The parallel artificial membrane permeability assay market is fueled by several catalysts, including the increasing demand for high-throughput screening in drug discovery, the development of advanced artificial membranes mimicking biological barriers more accurately, and the growing adoption of PAMPA in diverse applications beyond drug discovery, such as cosmetic and toxicology research. The rising prevalence of chronic diseases worldwide increases the urgency for developing new drug treatments, further driving market growth.

Leading Players in the Parallel Artificial Membrane Permeability Assay

- Cyprotex

- Creative Biolabs

- Admescope

- Creative Bioarray

- Enamine

- Sygnature Discovery

- Aurigene Pharmaceutical Services

Significant Developments in Parallel Artificial Membrane Permeability Assay Sector

- 2020: Development of a novel artificial membrane significantly improving the accuracy of PAMPA predictions for certain drug classes.

- 2021: Launch of a new high-throughput PAMPA platform by a leading CRO.

- 2022: Publication of several studies validating the use of PAMPA for predicting in vivo permeability across various biological barriers.

- 2023: Introduction of automated data analysis software for PAMPA assays, enhancing efficiency and accuracy.

Comprehensive Coverage Parallel Artificial Membrane Permeability Assay Report

The parallel artificial membrane permeability assay market is poised for significant growth, driven by the ongoing need for efficient drug discovery and development methods. Technological advancements and the increasing adoption of PAMPA across diverse sectors ensure continued market expansion in the coming years. This report provides a comprehensive overview of market trends, growth drivers, challenges, and key players, offering valuable insights for stakeholders involved in this dynamic sector.

Parallel Artificial Membrane Permeability Assay Segmentation

-

1. Type

- 1.1. Caco-2 Cultures

- 1.2. Gastrointestinal Tract

- 1.3. Blood–brain Barrier

- 1.4. Skin

-

2. Application

- 2.1. Drug Discovery

- 2.2. Cosmetic Research

- 2.3. Toxicology Research

- 2.4. Drug Delivery Research

Parallel Artificial Membrane Permeability Assay Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Parallel Artificial Membrane Permeability Assay REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) of the Parallel Artificial Membrane Permeability Assay ?

The projected CAGR is approximately XX%.

Which companies are prominent players in the Parallel Artificial Membrane Permeability Assay?

Key companies in the market include Cyprotex,Creative Biolabs,Admescope,Creative Bioarray,Enamine,Sygnature Discovery,Aurigene Pharmaceutical Services,

What are the notable trends driving market growth?

.

What are the main segments of the Parallel Artificial Membrane Permeability Assay?

The market segments include

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

What are some drivers contributing to market growth?

.

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million .

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00 , USD 5220.00, and USD 6960.00 respectively.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Parallel Artificial Membrane Permeability Assay Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Caco-2 Cultures

- 5.1.2. Gastrointestinal Tract

- 5.1.3. Blood–brain Barrier

- 5.1.4. Skin

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Drug Discovery

- 5.2.2. Cosmetic Research

- 5.2.3. Toxicology Research

- 5.2.4. Drug Delivery Research

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Parallel Artificial Membrane Permeability Assay Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Caco-2 Cultures

- 6.1.2. Gastrointestinal Tract

- 6.1.3. Blood–brain Barrier

- 6.1.4. Skin

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Drug Discovery

- 6.2.2. Cosmetic Research

- 6.2.3. Toxicology Research

- 6.2.4. Drug Delivery Research

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Parallel Artificial Membrane Permeability Assay Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Caco-2 Cultures

- 7.1.2. Gastrointestinal Tract

- 7.1.3. Blood–brain Barrier

- 7.1.4. Skin

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Drug Discovery

- 7.2.2. Cosmetic Research

- 7.2.3. Toxicology Research

- 7.2.4. Drug Delivery Research

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Parallel Artificial Membrane Permeability Assay Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Caco-2 Cultures

- 8.1.2. Gastrointestinal Tract

- 8.1.3. Blood–brain Barrier

- 8.1.4. Skin

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Drug Discovery

- 8.2.2. Cosmetic Research

- 8.2.3. Toxicology Research

- 8.2.4. Drug Delivery Research

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Parallel Artificial Membrane Permeability Assay Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Caco-2 Cultures

- 9.1.2. Gastrointestinal Tract

- 9.1.3. Blood–brain Barrier

- 9.1.4. Skin

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Drug Discovery

- 9.2.2. Cosmetic Research

- 9.2.3. Toxicology Research

- 9.2.4. Drug Delivery Research

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Parallel Artificial Membrane Permeability Assay Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Caco-2 Cultures

- 10.1.2. Gastrointestinal Tract

- 10.1.3. Blood–brain Barrier

- 10.1.4. Skin

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Drug Discovery

- 10.2.2. Cosmetic Research

- 10.2.3. Toxicology Research

- 10.2.4. Drug Delivery Research

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cyprotex

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Creative Biolabs

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Admescope

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Creative Bioarray

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Enamine

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sygnature Discovery

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aurigene Pharmaceutical Services

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Cyprotex

- Figure 1: Global Parallel Artificial Membrane Permeability Assay Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Parallel Artificial Membrane Permeability Assay Revenue (million), by Type 2024 & 2032

- Figure 3: North America Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Parallel Artificial Membrane Permeability Assay Revenue (million), by Application 2024 & 2032

- Figure 5: North America Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Parallel Artificial Membrane Permeability Assay Revenue (million), by Country 2024 & 2032

- Figure 7: North America Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Parallel Artificial Membrane Permeability Assay Revenue (million), by Type 2024 & 2032

- Figure 9: South America Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Parallel Artificial Membrane Permeability Assay Revenue (million), by Application 2024 & 2032

- Figure 11: South America Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Parallel Artificial Membrane Permeability Assay Revenue (million), by Country 2024 & 2032

- Figure 13: South America Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Parallel Artificial Membrane Permeability Assay Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Parallel Artificial Membrane Permeability Assay Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Parallel Artificial Membrane Permeability Assay Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Parallel Artificial Membrane Permeability Assay Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Parallel Artificial Membrane Permeability Assay Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Parallel Artificial Membrane Permeability Assay Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Parallel Artificial Membrane Permeability Assay Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Parallel Artificial Membrane Permeability Assay Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Parallel Artificial Membrane Permeability Assay Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Parallel Artificial Membrane Permeability Assay Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Parallel Artificial Membrane Permeability Assay Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Parallel Artificial Membrane Permeability Assay Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.