Passive ETF

Passive ETFPassive ETF Unlocking Growth Opportunities: Analysis and Forecast 2025-2033

Passive ETF by Type (Bond ETFs, Stock ETFs, Industry/Sector ETFs, Commodity ETFs, Currency ETFs, Others), by Application (Direct Sales, Indirect Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

Market Analysis for Passive ETFs

The global passive ETF market is exhibiting significant growth, with a market size valued at XXX million in 2025 and projected to expand at a CAGR of XX% from 2025 to 2033. This growth is driven by factors such as increased demand for low-cost, diversified investment options, the rise of robo-advisors and digital platforms, and favorable regulatory policies. Key trends shaping the market include the shift towards ESG investing, the increasing popularity of thematic and sector-specific ETFs, and the emergence of actively managed ETFs.

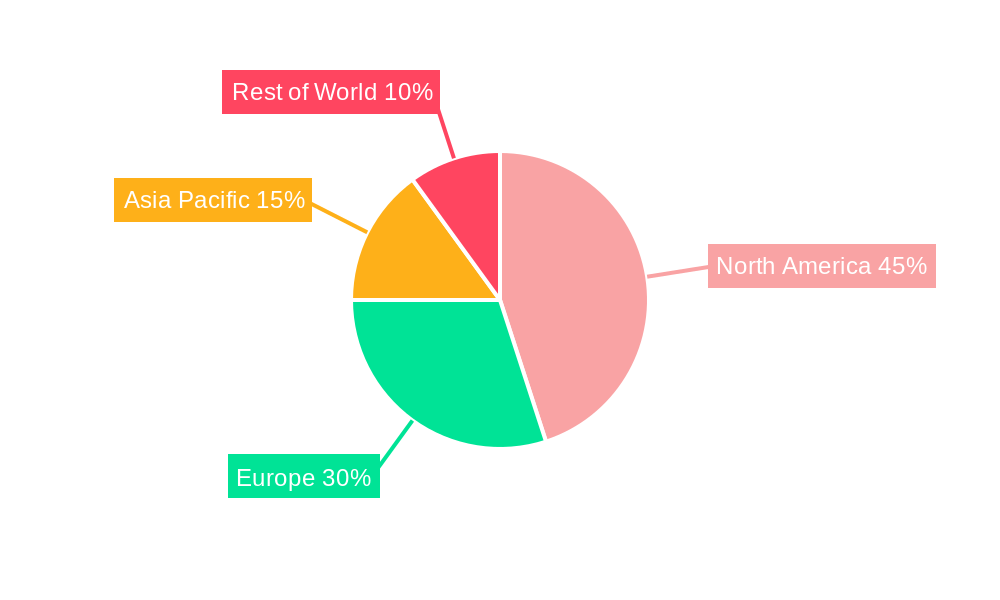

The market is highly competitive, with prominent players including BlackRock Fund, Vanguard, and UBS Group. The Asia Pacific region is expected to witness the highest growth in the coming years, driven by the region's rapidly developing economies and rising financial literacy. North America and Europe remain mature markets, while the Middle East and Africa present growth potential due to increasing investor sophistication and the development of local ETF exchanges. Overall, the passive ETF market is poised for continued expansion, offering investors cost-effective and accessible investment options that track various market segments and strategies.

Passive ETF Trends

The global passive ETF market has witnessed significant growth in recent years, driven by factors such as rising investor demand for low-cost, diversified investment options and the increasing popularity of index tracking strategies. As a result, the market size has expanded to reach $6.1 trillion in assets under management (AUM) in 2021. This trend is expected to continue in the coming years, with the market projected to reach $10.4 trillion by 2026, representing a CAGR of 10.3%.

The growth of passive ETFs is largely attributed to the increasing number of investors seeking cost-effective and efficient ways to gain exposure to various investment themes. Passive ETFs offer low expense ratios compared to actively managed funds, making them an attractive option for investors seeking long-term wealth creation. Additionally, the rise of self-directed investing and the growing availability of online trading platforms have made it easier for retail investors to access these ETFs.

Driving Forces: What's Propelling the Passive ETF Market

The growth of the passive ETF market is driven by several key factors, including:

- Low cost: Passive ETFs generally have lower expense ratios compared to actively managed funds, which can significantly reduce investment costs over time.

- Diversification: Passive ETFs provide instant diversification across a wide range of asset classes, sectors, and geographies, reducing overall portfolio risk.

- Transparency: The rules-based investment approach of passive ETFs ensures transparency and predictability, allowing investors to clearly understand the underlying investment strategy.

- Passive management: Passive ETFs track an underlying index or benchmark, eliminating the need for active management, which can result in lower turnover rates and reduced trading costs.

Challenges and Restraints in Passive ETF Market

Despite the significant growth potential, the passive ETF market faces certain challenges and restraints, including:

- Tracking error: Passive ETFs may exhibit tracking error, which is the deviation of the ETF's performance from the underlying index. This can occur due to various factors, such as sampling error, liquidity constraints, and trading costs.

- Limited alpha generation: Passive ETFs are designed to track an index, which means they do not actively seek to outperform the benchmark. This can limit their potential for alpha generation, which is the excess return above the benchmark.

- Market volatility: Passive ETFs are subject to market volatility, which can lead to significant fluctuations in their value. This can pose a challenge for investors seeking stable returns.

Key Region or Country & Segment to Dominate the Market

The United States is the dominant market for passive ETFs, accounting for over 70% of global AUM. This dominance is driven by the presence of a large and well-established ETF industry, as well as a sophisticated investor base that values cost-effective investment options. Other key regions include Europe and Asia-Pacific, which are experiencing growing demand for passive ETFs due to increasing investor awareness and the development of local ETF markets.

Within the different segments, stock ETFs are expected to continue dominating the market, driven by their ability to provide broad exposure to various equity markets. Bond ETFs are also gaining popularity as investors seek fixed income exposure with lower interest rate risk. Commodity ETFs and currency ETFs are niche segments that cater to specific investor needs for exposure to specific asset classes.

Growth Catalysts in Passive ETF Industry

The growth of the passive ETF industry is supported by several key catalysts, including:

- Technological advancements: The development of innovative technologies, such as robo-advisors and automated trading platforms, has made it easier for investors to access and manage passive ETFs.

- Increasing regulatory support: Governments and regulatory bodies are increasingly recognizing the benefits of passive ETFs and are implementing policies that support their growth.

- Rising demand from institutional investors: Institutional investors, such as pension funds and endowments, are increasingly allocating a portion of their portfolio to passive ETFs due to their cost-effectiveness and diversification benefits.

Leading Players in the Passive ETF Market

The passive ETF market is characterized by intense competition, with a large number of asset managers offering a wide range of ETFs. Some of the leading players in the industry include:

Significant Developments in Passive ETF Sector

The passive ETF industry is constantly evolving, with new developments emerging regularly. Some recent significant developments include:

- Thematic ETFs: Thematic ETFs have gained popularity, providing investors with exposure to specific investment themes, such as emerging markets, clean energy, and technology.

- ESG ETFs: ESG (environmental, social, and governance) ETFs have emerged as investors increasingly incorporate sustainability factors into their investment decisions.

- Fixed income ETFs: Fixed income ETFs have become more sophisticated, offering exposure to a wider range of bond markets, including high-yield and emerging market bonds.

Comprehensive Coverage Passive ETF Report

This report provides a comprehensive overview of the passive ETF market, covering key market trends, driving forces, challenges, growth catalysts, leading players, and significant developments. The report is designed to provide investors and industry professionals with valuable insights into the dynamics of this rapidly evolving market.

Passive ETF Segmentation

-

1. Type

- 1.1. Bond ETFs

- 1.2. Stock ETFs

- 1.3. Industry/Sector ETFs

- 1.4. Commodity ETFs

- 1.5. Currency ETFs

- 1.6. Others

-

2. Application

- 2.1. Direct Sales

- 2.2. Indirect Sales

Passive ETF Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Passive ETF REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Frequently Asked Questions

What are some drivers contributing to market growth?

.

Can you provide examples of recent developments in the market?

undefined

Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00 , USD 6720.00, and USD 8960.00 respectively.

What is the projected Compound Annual Growth Rate (CAGR) of the Passive ETF ?

The projected CAGR is approximately XX%.

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Passive ETF," which aids in identifying and referencing the specific market segment covered.

What are the main segments of the Passive ETF?

The market segments include

How can I stay updated on further developments or reports in the Passive ETF?

To stay informed about further developments, trends, and reports in the Passive ETF, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Passive ETF Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Bond ETFs

- 5.1.2. Stock ETFs

- 5.1.3. Industry/Sector ETFs

- 5.1.4. Commodity ETFs

- 5.1.5. Currency ETFs

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Direct Sales

- 5.2.2. Indirect Sales

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Passive ETF Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Bond ETFs

- 6.1.2. Stock ETFs

- 6.1.3. Industry/Sector ETFs

- 6.1.4. Commodity ETFs

- 6.1.5. Currency ETFs

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Direct Sales

- 6.2.2. Indirect Sales

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Passive ETF Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Bond ETFs

- 7.1.2. Stock ETFs

- 7.1.3. Industry/Sector ETFs

- 7.1.4. Commodity ETFs

- 7.1.5. Currency ETFs

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Direct Sales

- 7.2.2. Indirect Sales

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Passive ETF Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Bond ETFs

- 8.1.2. Stock ETFs

- 8.1.3. Industry/Sector ETFs

- 8.1.4. Commodity ETFs

- 8.1.5. Currency ETFs

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Direct Sales

- 8.2.2. Indirect Sales

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Passive ETF Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Bond ETFs

- 9.1.2. Stock ETFs

- 9.1.3. Industry/Sector ETFs

- 9.1.4. Commodity ETFs

- 9.1.5. Currency ETFs

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Direct Sales

- 9.2.2. Indirect Sales

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Passive ETF Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Bond ETFs

- 10.1.2. Stock ETFs

- 10.1.3. Industry/Sector ETFs

- 10.1.4. Commodity ETFs

- 10.1.5. Currency ETFs

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Direct Sales

- 10.2.2. Indirect Sales

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BlackRock Fund

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vanguard

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UBs Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fidelity Investments

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 State Street Global Advisors

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Morgan Stanley

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 JPMorgan Chase

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Allianz Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Capital Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Goldman Sachs

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bank of New York Mellon

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PIMCO

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Amundi

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Legal & General

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Credit Suisse

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Prudential Financial

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Edward Jones Investments

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Deutsche Bank

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 T.Rowe Price

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Bank of America

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Sumitomo Mitsui Trust Holdings

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 E Fund Management

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 China Asset Management

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Gf Fund Management

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 China Southern Asset Management

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Fullgoal Fund Management

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 China Universal Asset Management

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 China Merchants Fund Management

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.1 BlackRock Fund

- Figure 1: Global Passive ETF Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Passive ETF Revenue (million), by Type 2024 & 2032

- Figure 3: North America Passive ETF Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Passive ETF Revenue (million), by Application 2024 & 2032

- Figure 5: North America Passive ETF Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Passive ETF Revenue (million), by Country 2024 & 2032

- Figure 7: North America Passive ETF Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Passive ETF Revenue (million), by Type 2024 & 2032

- Figure 9: South America Passive ETF Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Passive ETF Revenue (million), by Application 2024 & 2032

- Figure 11: South America Passive ETF Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Passive ETF Revenue (million), by Country 2024 & 2032

- Figure 13: South America Passive ETF Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Passive ETF Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Passive ETF Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Passive ETF Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Passive ETF Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Passive ETF Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Passive ETF Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Passive ETF Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Passive ETF Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Passive ETF Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Passive ETF Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Passive ETF Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Passive ETF Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Passive ETF Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Passive ETF Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Passive ETF Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Passive ETF Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Passive ETF Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Passive ETF Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Passive ETF Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Passive ETF Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Passive ETF Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Passive ETF Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Passive ETF Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Passive ETF Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Passive ETF Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Passive ETF Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Passive ETF Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Passive ETF Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Passive ETF Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Passive ETF Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Passive ETF Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Passive ETF Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Passive ETF Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Passive ETF Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Passive ETF Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Passive ETF Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Passive ETF Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Passive ETF Revenue (million) Forecast, by Application 2019 & 2032

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.