Pneumatic Conveying Systems

Pneumatic Conveying SystemsPneumatic Conveying Systems Navigating Dynamics Comprehensive Analysis and Forecasts 2025-2033

Pneumatic Conveying Systems by Type (Transportation Systems, Positive Pressure Transportation Systems, Vacuum Transport System), by Application (Food And Beverage, Manufacturing, Metals, Minerals, And Ceramics, Petroleum Chemical, Plastic, Rubber, Pharmaceuticals, Pulp, Power Generation, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

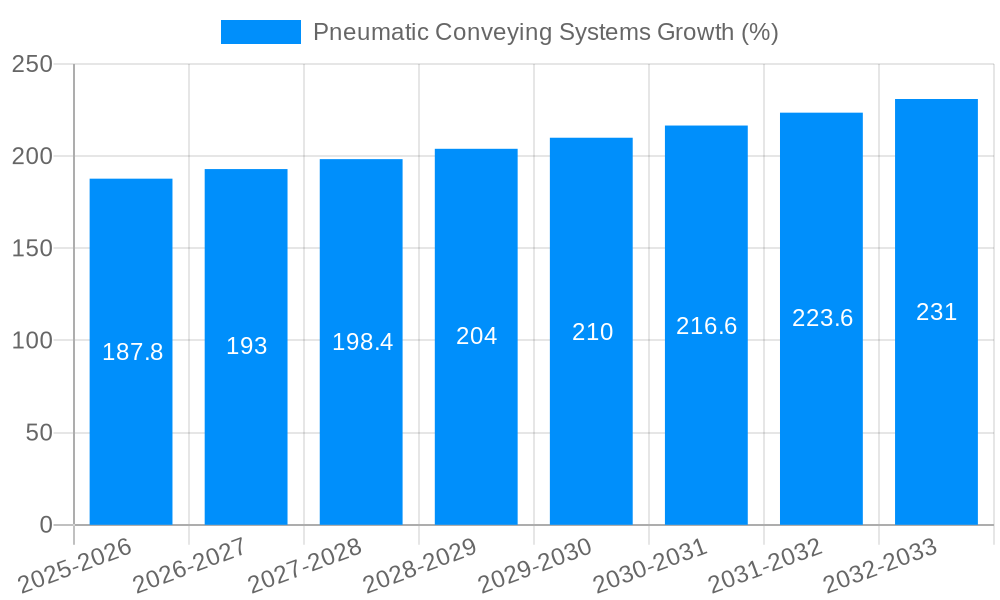

The global pneumatic conveying systems market, valued at $5402.8 million in 2025, is projected to experience steady growth, driven by increasing automation across various industries and a rising demand for efficient material handling solutions. The 3.4% CAGR indicates a consistent expansion, primarily fueled by the robust growth in sectors like food and beverage, pharmaceuticals, and manufacturing. These industries prioritize hygienic and efficient material transfer processes, making pneumatic conveying an attractive option. Furthermore, the ongoing trend toward miniaturization and increased precision in manufacturing processes enhances the demand for sophisticated pneumatic conveying systems capable of handling delicate and valuable materials. Technological advancements, such as the integration of advanced sensors and control systems, are improving the efficiency and reliability of these systems, driving further market expansion. The market is segmented by system type (positive pressure, vacuum, and transportation systems) and application, allowing companies to cater to specific industry needs. While challenges like high initial investment costs and the need for specialized maintenance might pose some restraint, the overall market outlook remains positive, propelled by the increasing adoption of automation and the need for efficient material handling solutions across multiple industries.

The market's regional distribution is likely to reflect established industrial hubs, with North America and Europe holding significant market shares. However, rapid industrialization in regions like Asia-Pacific, particularly in China and India, is expected to drive considerable growth in these markets over the forecast period (2025-2033). Companies like Atlas Copco, AZO GmbH & Co. KG, and others are actively involved in the market, competing through technological innovation and product diversification. The competitive landscape is expected to remain dynamic, with a focus on offering customized solutions and enhancing after-sales services to maintain a strong market position. The ongoing emphasis on sustainability and reduced energy consumption within industries will likely further shape the development of more energy-efficient pneumatic conveying systems in the coming years.

Pneumatic Conveying Systems Trends

The global pneumatic conveying systems market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. Driven by increasing automation across diverse industries and a rising demand for efficient material handling solutions, the market demonstrates considerable potential. The historical period (2019-2024) witnessed steady expansion, with the base year (2025) showcasing a significant market size exceeding several hundred million units. The forecast period (2025-2033) anticipates continued growth, fueled by technological advancements and the expanding adoption of pneumatic conveying in sectors like food & beverage, pharmaceuticals, and plastics. Key market insights reveal a strong preference for energy-efficient systems, particularly vacuum transport systems, owing to their lower operational costs and reduced environmental impact. The positive pressure transportation systems segment also maintains a substantial market share, largely driven by its adaptability in high-throughput applications. Furthermore, the growing focus on improving hygiene and safety standards in industries like pharmaceuticals and food processing is shaping the demand for systems with advanced features such as dust control mechanisms and automated cleaning capabilities. The increasing adoption of Industry 4.0 principles is also influencing the market, with smart pneumatic conveying systems capable of data integration and remote monitoring becoming increasingly popular. Competition among established players like Atlas Copco and newcomers alike ensures continuous innovation, contributing to market expansion. This competitive landscape, combined with the diverse application range and ongoing technological advancements, makes pneumatic conveying a dynamic and promising market segment.

Driving Forces: What's Propelling the Pneumatic Conveying Systems

Several factors are driving the expansion of the pneumatic conveying systems market. Firstly, the escalating demand for automation in various industrial sectors is a key driver. Industries strive to enhance efficiency and productivity by replacing manual material handling with automated pneumatic conveying systems. This transition reduces labor costs, minimizes human error, and significantly improves overall operational efficiency. Secondly, the growing need for efficient and safe material handling is further propelling market growth. Pneumatic conveying offers a cleaner, dust-free, and safer alternative to traditional methods, particularly crucial for handling hazardous or sensitive materials. Thirdly, continuous technological advancements in pneumatic conveying technology, including the development of energy-efficient systems and advanced control systems, are attracting wider adoption. Features such as improved material flow control, precise delivery, and reduced energy consumption contribute to enhanced efficiency and cost savings. Finally, stringent environmental regulations concerning dust emissions and waste management are influencing the transition to cleaner pneumatic conveying systems, particularly in industries facing stricter environmental scrutiny. These factors cumulatively contribute to the sustained and robust growth of the pneumatic conveying systems market.

Challenges and Restraints in Pneumatic Conveying Systems

Despite the promising market outlook, several challenges and restraints hinder the widespread adoption of pneumatic conveying systems. High initial investment costs can be a significant barrier, particularly for small- and medium-sized enterprises (SMEs) with limited budgets. The complexity of system design and installation necessitates specialized expertise, leading to higher installation and maintenance costs. Furthermore, the potential for system blockages and wear and tear on components can necessitate frequent maintenance and repairs, adding to operational expenses. Energy consumption remains a concern, especially for larger-scale systems, although advancements in energy-efficient designs are mitigating this issue. The susceptibility of certain materials to degradation during pneumatic conveying can limit the applicability of this technology. Finally, potential safety concerns, such as the risk of explosions in applications handling flammable materials, require careful risk assessment and mitigation strategies. Addressing these challenges through cost-effective solutions, improved system designs, and enhanced operator training is crucial for broader market penetration.

Key Region or Country & Segment to Dominate the Market

The Manufacturing segment is poised to dominate the pneumatic conveying systems market throughout the forecast period. This dominance is driven by the extensive use of pneumatic conveying in various manufacturing processes, including the transportation of raw materials, intermediate products, and finished goods across diverse production lines. The widespread adoption of automation within the manufacturing sector fuels the high demand for these systems.

High Growth Potential in Asia-Pacific: The Asia-Pacific region is projected to exhibit substantial growth, driven by the rapid industrialization and expansion of manufacturing hubs in countries like China and India. The increasing investments in infrastructure and industrial automation within the region contribute significantly to this market expansion.

North America Remains a Significant Market: North America, with its well-established manufacturing base and robust adoption of advanced technologies, continues to hold a substantial market share. The region's focus on enhancing efficiency and productivity fuels consistent demand for high-performance pneumatic conveying solutions.

Europe’s Steady Growth: Europe shows steady growth driven by stringent environmental regulations and a focus on sustainable manufacturing practices, leading to increased demand for energy-efficient pneumatic conveying systems.

Positive Pressure Systems Market Share: Within the types of systems, Positive Pressure Transportation Systems hold a significant market share due to their suitability for various applications and capacities, particularly in bulk material handling across long distances.

Vacuum Transport System's Niche Markets: While Vacuum Transport Systems command a smaller market share compared to positive pressure systems, their increasing adoption in applications requiring gentler material handling (e.g., pharmaceuticals, food processing) showcases a robust niche market.

The interplay between the growing manufacturing sector in the Asia-Pacific region and the continued adoption of Positive Pressure Transportation Systems across all regions is expected to shape the dominant segment and region throughout the forecast period. The unique advantages of Vacuum Transport Systems in sensitive applications will further contribute to overall market expansion.

Growth Catalysts in Pneumatic Conveying Systems Industry

The pneumatic conveying systems market is experiencing accelerated growth driven by several factors. Increasing automation across industries, coupled with stringent regulations on dust and waste management, is pushing the adoption of efficient and eco-friendly pneumatic solutions. Advancements in system design, such as energy-efficient models and improved control systems, enhance operational efficiency and reduce maintenance costs, further driving market expansion. The rising demand for hygiene and safety in sectors like food and pharmaceuticals necessitates the use of systems with specialized features, providing lucrative growth opportunities. The expanding adoption of Industry 4.0 technologies is also contributing, as smart pneumatic systems capable of data integration and remote monitoring gain popularity.

Leading Players in the Pneumatic Conveying Systems

- Atlas Copco

- AZO GmbH & Co. KG

- Coperion K-Tron

- Cyclonaire Corporation

- DongYang P&F

- Dynamic Air

- Flexicon Corporation

- Hillenbrand

- Macawber Engineering

- Motan Colortronic

- Nilfisk Group

- Nol-Tec Systems

- Schenck Process LLC

- VAC-U-Max

- Wamgroup S.P.A

- Zeppelin Systems GmbH

Significant Developments in Pneumatic Conveying Systems Sector

- 2020: Introduction of a new range of energy-efficient pneumatic conveying systems by Atlas Copco.

- 2021: AZO GmbH & Co. KG launches a system with improved dust control capabilities for pharmaceutical applications.

- 2022: Coperion K-Tron introduces a smart pneumatic conveying system with advanced monitoring capabilities.

- 2023: Cyclonaire Corporation partners with a leading automation company to develop integrated solutions.

(Note: Specific development dates may require further research for accurate reporting.)

Comprehensive Coverage Pneumatic Conveying Systems Report

This report provides a comprehensive analysis of the pneumatic conveying systems market, covering market size, segmentation, trends, growth drivers, challenges, and leading players. The detailed insights presented offer a thorough understanding of the market dynamics, enabling informed decision-making for stakeholders. The report's projections for future growth offer valuable guidance for strategic planning and investment strategies within the industry. The in-depth analysis of regional and segmental variations ensures a complete picture of the market's current state and future trajectory.

Pneumatic Conveying Systems Segmentation

-

1. Type

- 1.1. Transportation Systems

- 1.2. Positive Pressure Transportation Systems

- 1.3. Vacuum Transport System

-

2. Application

- 2.1. Food And Beverage

- 2.2. Manufacturing

- 2.3. Metals, Minerals, And Ceramics

- 2.4. Petroleum Chemical

- 2.5. Plastic, Rubber

- 2.6. Pharmaceuticals

- 2.7. Pulp

- 2.8. Power Generation

- 2.9. Other

Pneumatic Conveying Systems Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pneumatic Conveying Systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.4% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pneumatic Conveying Systems Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Transportation Systems

- 5.1.2. Positive Pressure Transportation Systems

- 5.1.3. Vacuum Transport System

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food And Beverage

- 5.2.2. Manufacturing

- 5.2.3. Metals, Minerals, And Ceramics

- 5.2.4. Petroleum Chemical

- 5.2.5. Plastic, Rubber

- 5.2.6. Pharmaceuticals

- 5.2.7. Pulp

- 5.2.8. Power Generation

- 5.2.9. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Pneumatic Conveying Systems Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Transportation Systems

- 6.1.2. Positive Pressure Transportation Systems

- 6.1.3. Vacuum Transport System

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food And Beverage

- 6.2.2. Manufacturing

- 6.2.3. Metals, Minerals, And Ceramics

- 6.2.4. Petroleum Chemical

- 6.2.5. Plastic, Rubber

- 6.2.6. Pharmaceuticals

- 6.2.7. Pulp

- 6.2.8. Power Generation

- 6.2.9. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Pneumatic Conveying Systems Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Transportation Systems

- 7.1.2. Positive Pressure Transportation Systems

- 7.1.3. Vacuum Transport System

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food And Beverage

- 7.2.2. Manufacturing

- 7.2.3. Metals, Minerals, And Ceramics

- 7.2.4. Petroleum Chemical

- 7.2.5. Plastic, Rubber

- 7.2.6. Pharmaceuticals

- 7.2.7. Pulp

- 7.2.8. Power Generation

- 7.2.9. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Pneumatic Conveying Systems Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Transportation Systems

- 8.1.2. Positive Pressure Transportation Systems

- 8.1.3. Vacuum Transport System

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food And Beverage

- 8.2.2. Manufacturing

- 8.2.3. Metals, Minerals, And Ceramics

- 8.2.4. Petroleum Chemical

- 8.2.5. Plastic, Rubber

- 8.2.6. Pharmaceuticals

- 8.2.7. Pulp

- 8.2.8. Power Generation

- 8.2.9. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Pneumatic Conveying Systems Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Transportation Systems

- 9.1.2. Positive Pressure Transportation Systems

- 9.1.3. Vacuum Transport System

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food And Beverage

- 9.2.2. Manufacturing

- 9.2.3. Metals, Minerals, And Ceramics

- 9.2.4. Petroleum Chemical

- 9.2.5. Plastic, Rubber

- 9.2.6. Pharmaceuticals

- 9.2.7. Pulp

- 9.2.8. Power Generation

- 9.2.9. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Pneumatic Conveying Systems Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Transportation Systems

- 10.1.2. Positive Pressure Transportation Systems

- 10.1.3. Vacuum Transport System

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food And Beverage

- 10.2.2. Manufacturing

- 10.2.3. Metals, Minerals, And Ceramics

- 10.2.4. Petroleum Chemical

- 10.2.5. Plastic, Rubber

- 10.2.6. Pharmaceuticals

- 10.2.7. Pulp

- 10.2.8. Power Generation

- 10.2.9. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Atlas Copco

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AZO GmbH & Co. KG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Coperion K-Tron

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cyclonaire Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DongYang P&F

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dynamic Air

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Flexicon Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hillenbrand

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Macawber Engineering

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Motan Colortronic

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nilfisk Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nol-Tec Systems

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Schenck Process LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 VAC-U-Max

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Wamgroup S.P.A

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Zeppelin Systems GmbH

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Atlas Copco

- Figure 1: Global Pneumatic Conveying Systems Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Pneumatic Conveying Systems Revenue (million), by Type 2024 & 2032

- Figure 3: North America Pneumatic Conveying Systems Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Pneumatic Conveying Systems Revenue (million), by Application 2024 & 2032

- Figure 5: North America Pneumatic Conveying Systems Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Pneumatic Conveying Systems Revenue (million), by Country 2024 & 2032

- Figure 7: North America Pneumatic Conveying Systems Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Pneumatic Conveying Systems Revenue (million), by Type 2024 & 2032

- Figure 9: South America Pneumatic Conveying Systems Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Pneumatic Conveying Systems Revenue (million), by Application 2024 & 2032

- Figure 11: South America Pneumatic Conveying Systems Revenue Share (%), by Application 2024 & 2032

- Figure 12: South America Pneumatic Conveying Systems Revenue (million), by Country 2024 & 2032

- Figure 13: South America Pneumatic Conveying Systems Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pneumatic Conveying Systems Revenue (million), by Type 2024 & 2032

- Figure 15: Europe Pneumatic Conveying Systems Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Pneumatic Conveying Systems Revenue (million), by Application 2024 & 2032

- Figure 17: Europe Pneumatic Conveying Systems Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Pneumatic Conveying Systems Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Pneumatic Conveying Systems Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Pneumatic Conveying Systems Revenue (million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Pneumatic Conveying Systems Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Pneumatic Conveying Systems Revenue (million), by Application 2024 & 2032

- Figure 23: Middle East & Africa Pneumatic Conveying Systems Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East & Africa Pneumatic Conveying Systems Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Pneumatic Conveying Systems Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Pneumatic Conveying Systems Revenue (million), by Type 2024 & 2032

- Figure 27: Asia Pacific Pneumatic Conveying Systems Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Pneumatic Conveying Systems Revenue (million), by Application 2024 & 2032

- Figure 29: Asia Pacific Pneumatic Conveying Systems Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Pneumatic Conveying Systems Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Pneumatic Conveying Systems Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Pneumatic Conveying Systems Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pneumatic Conveying Systems Revenue million Forecast, by Type 2019 & 2032

- Table 3: Global Pneumatic Conveying Systems Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Pneumatic Conveying Systems Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Pneumatic Conveying Systems Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Pneumatic Conveying Systems Revenue million Forecast, by Application 2019 & 2032

- Table 7: Global Pneumatic Conveying Systems Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Pneumatic Conveying Systems Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Pneumatic Conveying Systems Revenue million Forecast, by Application 2019 & 2032

- Table 13: Global Pneumatic Conveying Systems Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Pneumatic Conveying Systems Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Pneumatic Conveying Systems Revenue million Forecast, by Application 2019 & 2032

- Table 19: Global Pneumatic Conveying Systems Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Pneumatic Conveying Systems Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Pneumatic Conveying Systems Revenue million Forecast, by Application 2019 & 2032

- Table 31: Global Pneumatic Conveying Systems Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Pneumatic Conveying Systems Revenue million Forecast, by Type 2019 & 2032

- Table 39: Global Pneumatic Conveying Systems Revenue million Forecast, by Application 2019 & 2032

- Table 40: Global Pneumatic Conveying Systems Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Pneumatic Conveying Systems Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

About Market Research Forecast

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.